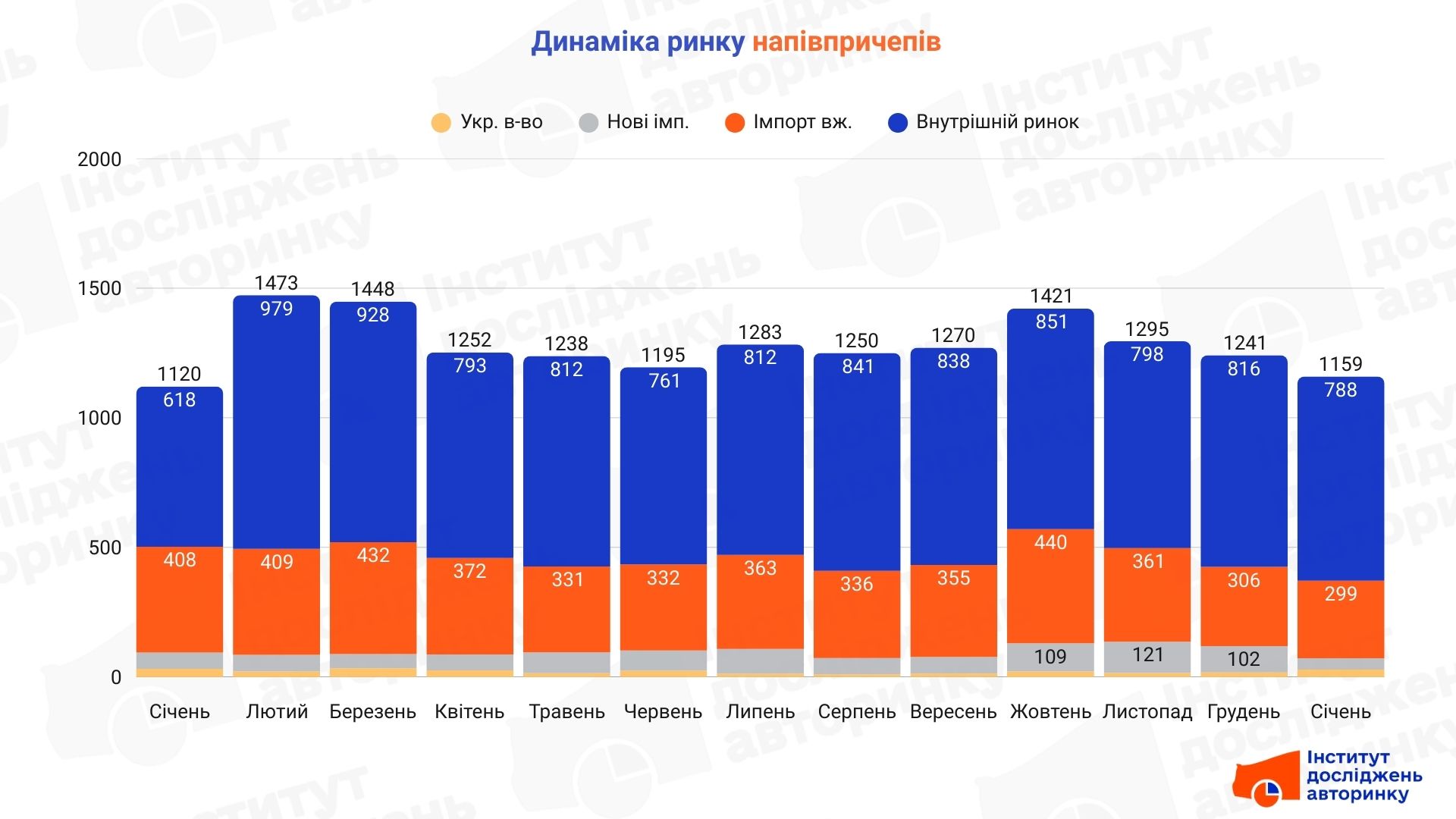

The 2025 semi-trailer market outlook shows the same trend as in tractors: a major “reload.” The logistics boom of previous years has been replaced by rational consumption. Companies are no longer grabbing “everything with wheels,” but are focusing on updating their fleets for specific tasks.

Semi-trailer market dynamics

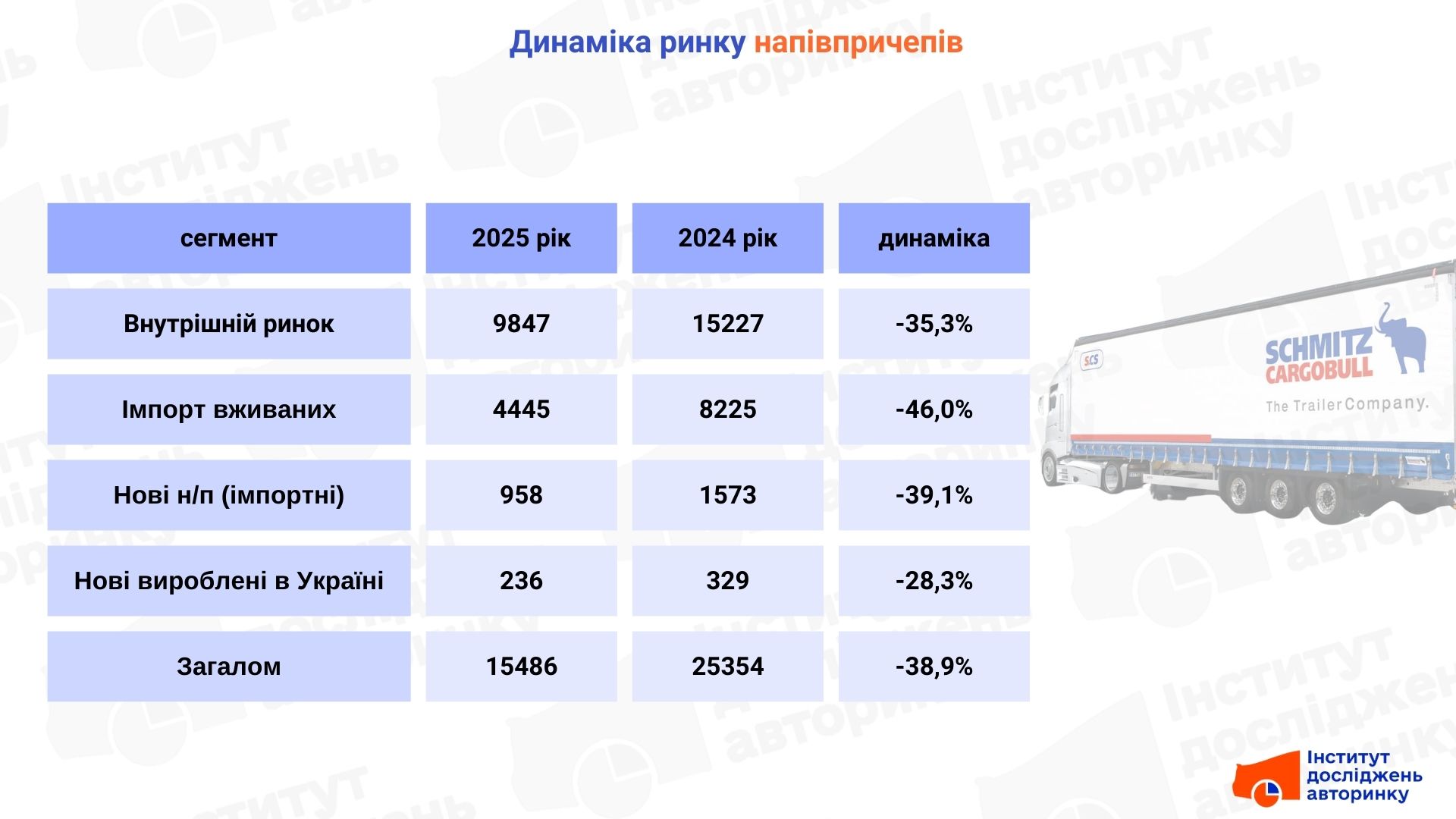

The total volume of the segment in 2025 amounted to 15,486 units, which is 38.9% less than in 2024. The largest decline was recorded in the used import segment — the market was actually saturated with European "second-hand".

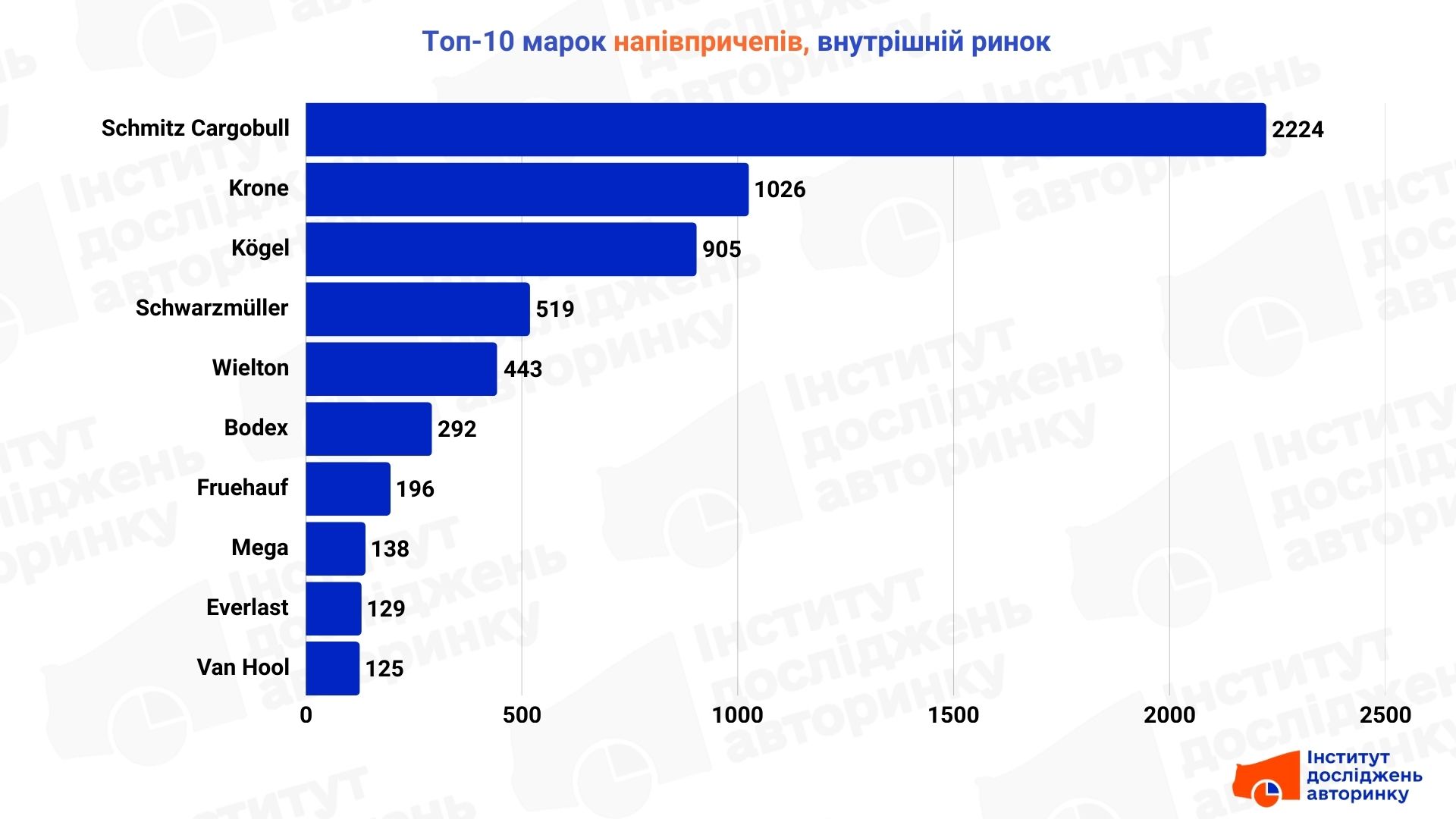

The most popular semi-trailers on the domestic market

The secondary market is dominated by German giants. Popular types are flatbed and tilt trailers, which are the basis for any transportation. Tankers also hold a significant share, which is critical for the fuel and agricultural sectors.

- Leaders: Schmitz Cargobull (2,224 units) remains out of reach. Krone (1,026 units) and Kögel (905 units) share the rest of the pie.

- Interesting point: Ukrainian Everlast (129 units) confidently holds its position in the Top 10 of the domestic market, which indicates the high liquidity of domestic tanks in the secondary market.

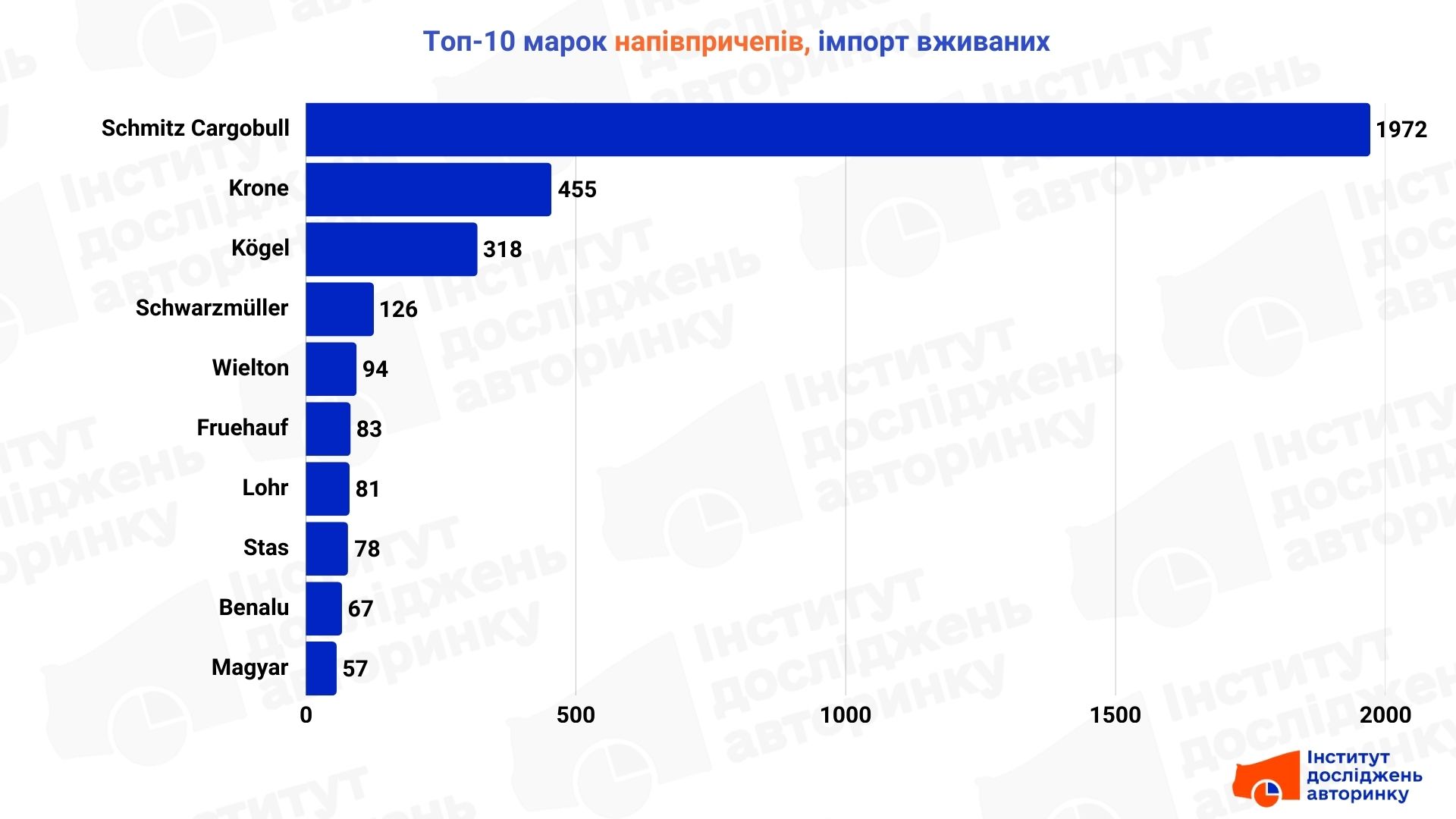

The most popular used semi-trailers imported from abroad

Here, demand is clearly structured for international flights. In addition to standard awnings, much attention is paid to refrigerated vans — without them, food export is impossible.

- West Auto Hub will help you select and deliver a semi-trailer from Europe .

Here, among the imported ones, the presence of Schmitz Cargobull is felt even more sharply — the brand occupies the lionʼs share of the market. Krone and Kögel act here more as catch-ups, satisfying the demand of those looking for specific models or a slightly lower price.

Brands: Schmitz Cargobull is a real monopolist here — almost 2,000 trailers (almost half of all used imports).

- Check vehicle history by VIN code with CEBIA!

Special equipment: The appearance on the list of brands such as Lohr (road trucks) and Magyar (chemical/food tankers) reminds us that Ukrainian business is increasingly specializing in niche transportation.

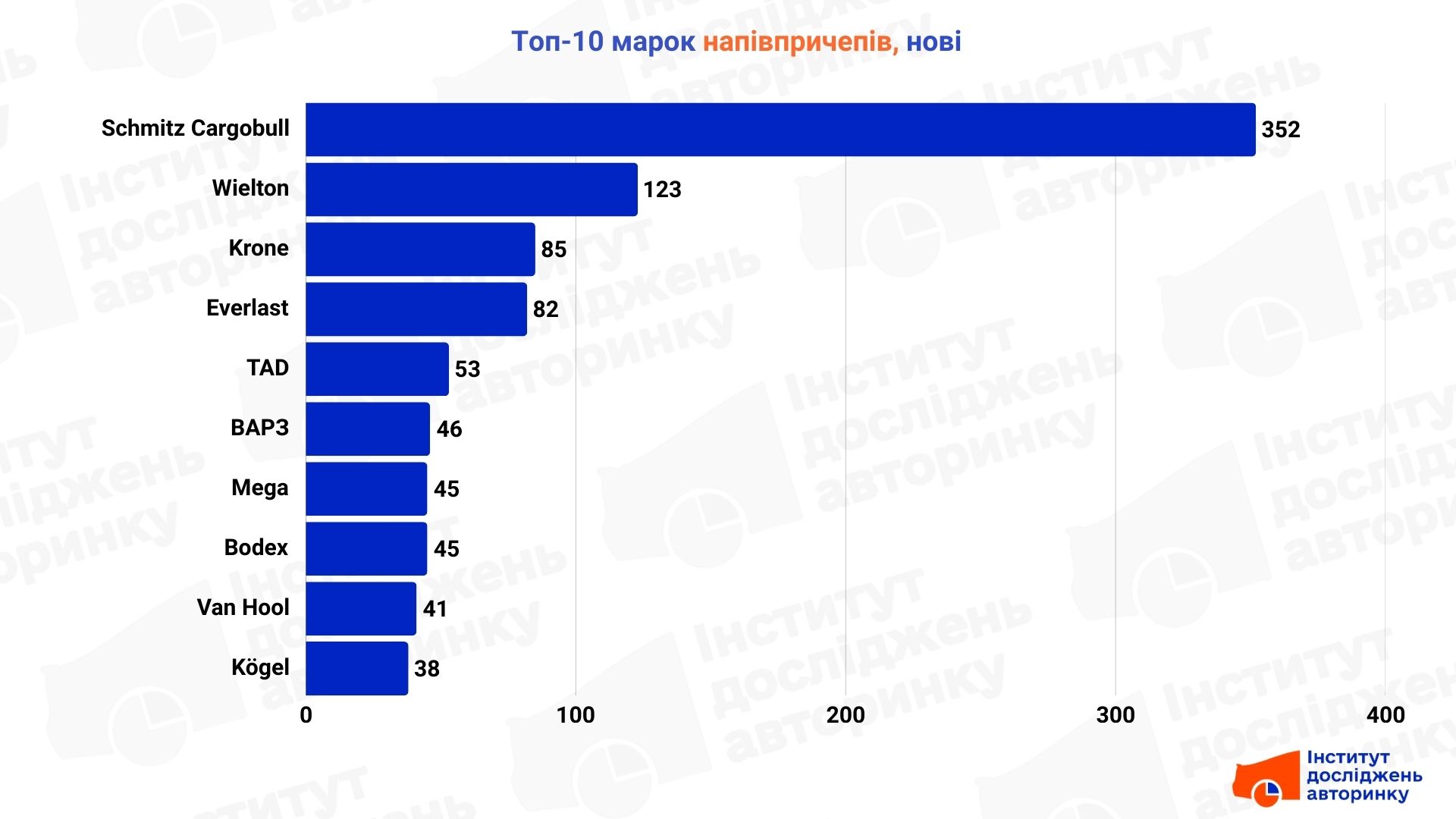

Most popular new semi-trailers

In the new equipment segment, dump trucks (construction and agriculture), refrigerators, and tilt trailers are popular.

- Brands: Schmitz Cargobull (352 units) and Wielton (123 units) lead in imports.

- Ukrainian breakthrough: The presence of our manufacturers in the top looks very cool. Everlast (82 units), TAD (53 units) and VARZ (46 units) successfully compete with European brands. When it comes to complex special equipment (trawls or tanks), Ukrainian carriers are increasingly choosing a local manufacturer due to better service and adaptation to our conditions.

Expert opinion

Stanislav Buchatsky, Head of the Institute for Car Market Research:

"The trailer market in 2025 finally got rid of feverish demand. We see that the number of new Ukrainian-made trailers fell significantly less (-28.3%) than the import of new ones (-39.1%). This is an important signal: Ukrainian factories have learned to make a product that businesses are ready to buy even in difficult times. The general decline in the market is not a sign of a crisis, but a stage of stabilization. The fleets are equipped, the logistics chains are built. Now the market is moving to a planned renewal, where the main factors are not the availability of "yesterdayʼs" equipment, but its fuel efficiency, weight and maintenance cost."

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.