Experts from the Institute of Auto Market Research analyzed vehicle registration statistics in Ukraine and identified the most popular models in three segments of trucks weighing over 3.5 tons (except for tractor units) : used imports, domestic resales, and purchases of new cars, including those converted in Ukraine.

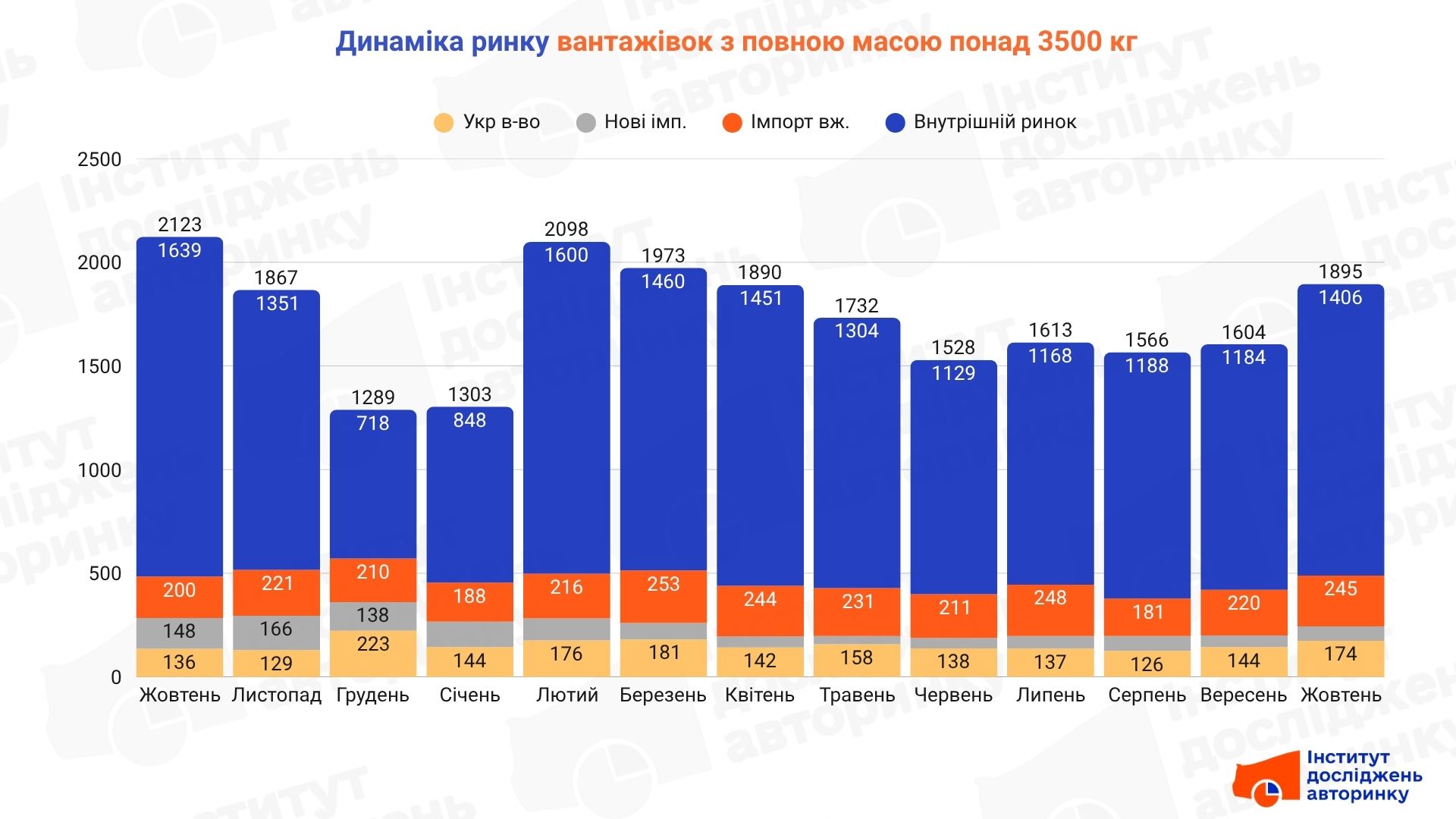

Truck market dynamics

The market volume of trucks with a gross weight of over 3,500 kg as of October 2025 amounted to 1,895 units. Compared to September of the same year, this is 18.1% more, but 10.7% less compared to the results of October 2024. Monthly volumes are shown in the diagram.

- Check the history of a car by VIN code before buying using the CEBIA service!

The structure of this segment is as follows: 74.2% (1406 units) — domestic resales, 12.9% (245 units) — imports of used trucks; 3.7% (70 units) — imports of new trucks, 9.2% (174 units) — sales of trucks manufactured (or converted in the factory) in Ukraine. The total share of new vehicles in this group was 12.9%.

The dynamics by individual subsegments, the shares of which were just given, are as follows:

- Domestic resales: +18.8% MM, −14.2% YY

- Used imports: +11.4% MM, +22.5% YY

- New imports: +25.0% MM, −52.7% YY

- Made in Ukraine: +20.8% MM, +27.9% YY

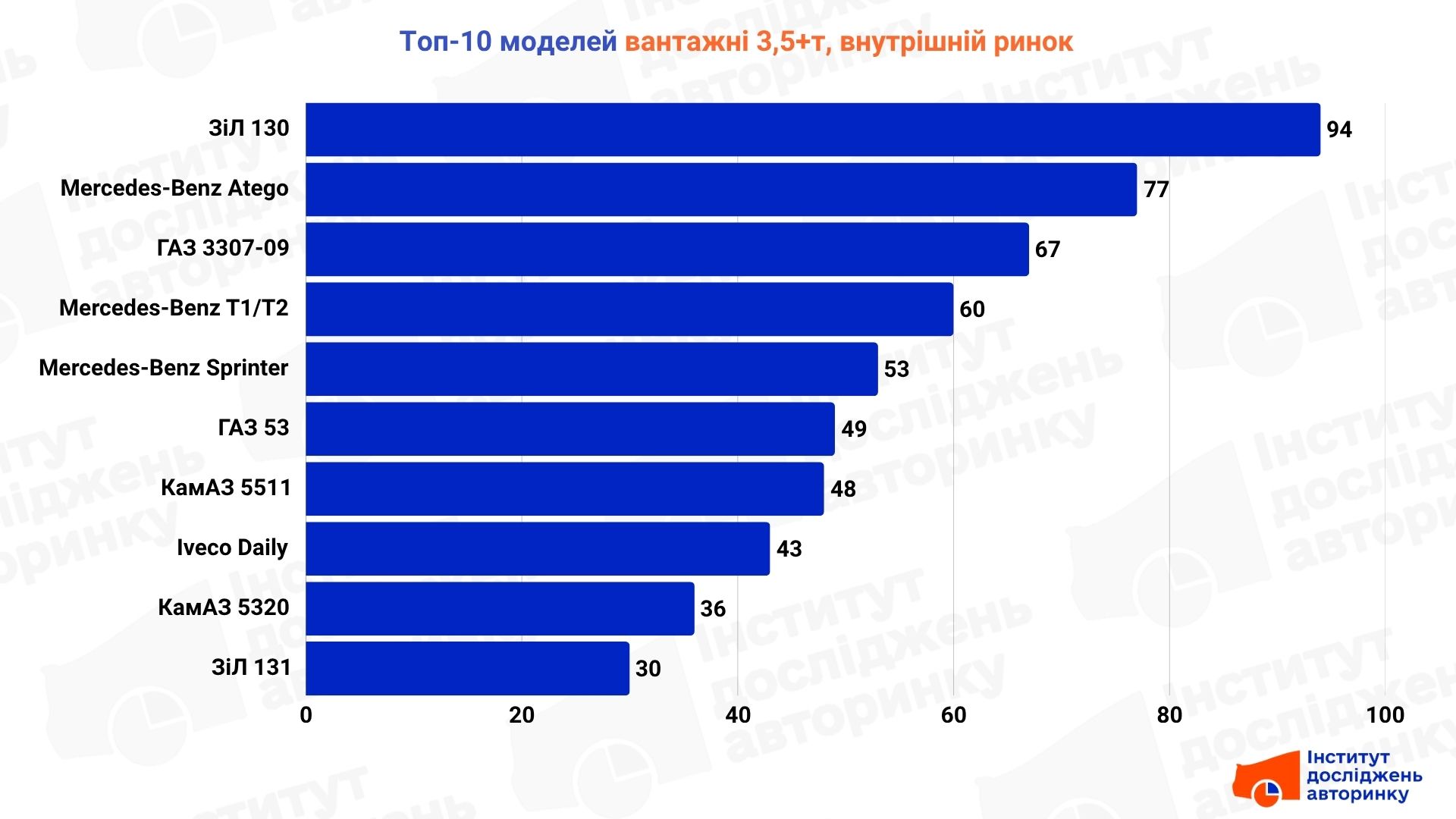

Top 10 trucks in the domestic market

The most popular type in this subsegment was dump trucks, with stable demand for vans and flatbed versions.

In the domestic market of trucks with a gross weight of over 3.5 tons, the usual contrast reigns again in October. The leadership was taken by the equipment that is a direct legacy of Soviet times: the first place was taken by the ZIL-130 (94 resales) and its numerous modifications. It is accompanied by the GAZ-3307-09 (67 units), the classic GAZ-53 (49 units), as well as the KAMAZ-5511 dump trucks (48 units) and the KAMAZ-5320 flatbed (36 units).

This picture is diluted by representatives of the German auto industry. High positions are held by the Mercedes-Benz Atego (77 units), the veteran Mercedes-Benz T1/T2 (60 units), the production of which ceased in the mid-90s, and the more modern Sprinter (53 units) and Iveco Daily (43 units).

Unfortunately, this market structure, dominated by cars aged 25-40+ years, will not change in the near future.

Comment: As expert Stanislav Buchatsky notes, the reason is the current rules for calculating excise duty. For trucks older than 5 and 8 years, the rates become, in fact, prohibitive. Because of this, carriers simply cannot update their fleets of old ZiLs and KamAZs with something newer — the price gap becomes unbearable. The market is forced to "preserve" itself in its current state, operating the equipment to the last.

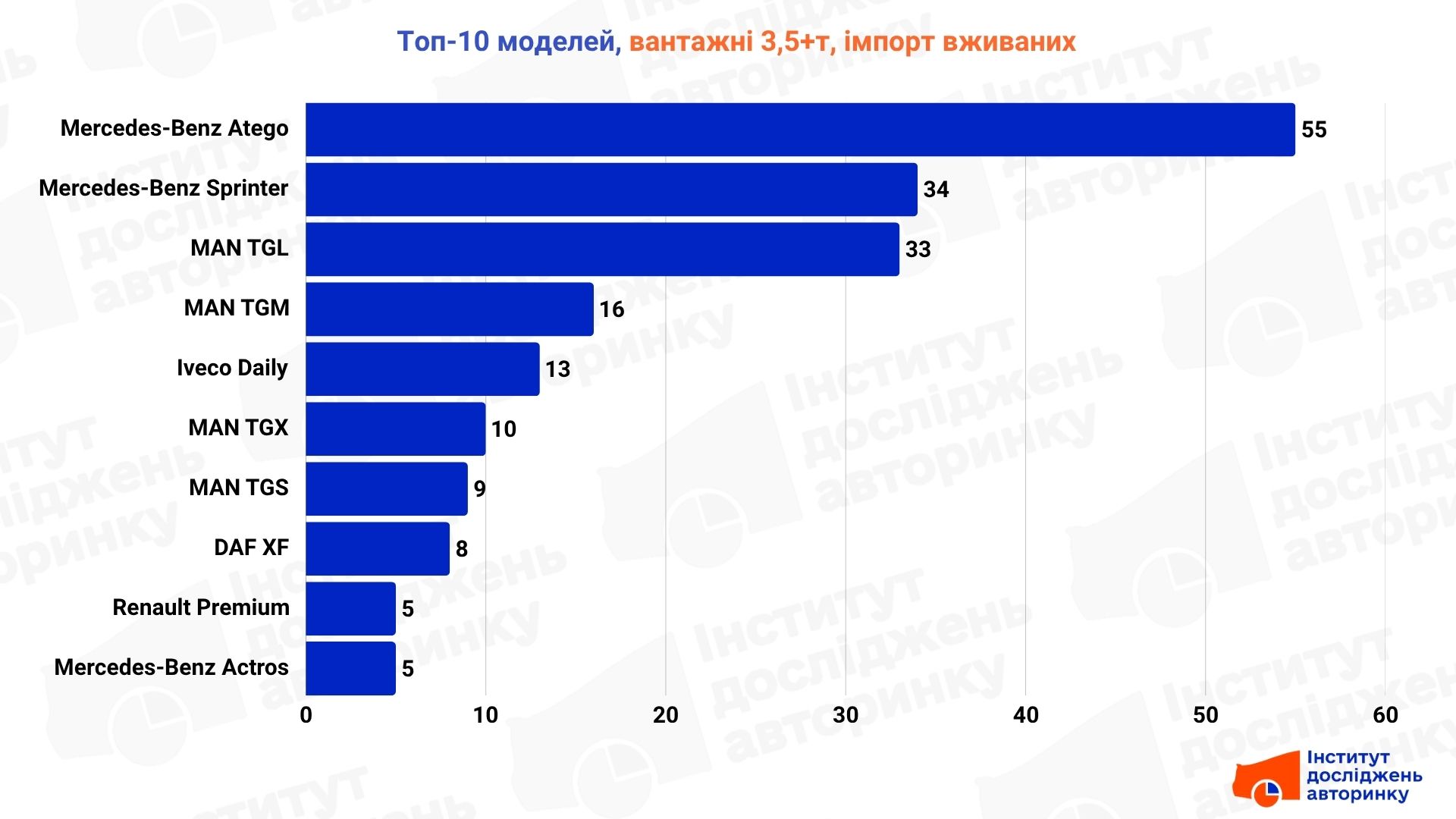

Top 10 imported trucks with mileage

Most often, the Ukrainian fleet last month was replenished with tail lift vans, regular vans, and container trucks.

- Looking for a way to "drive" a truck from Europe? — West Auto Hub will help you get it turnkey!

The used equipment import segment shows a completely different picture. European brands dominate here, which form the countryʼs modern commercial fleet.

The greatest demand in October was for Mercedes-Benz: the leadership is held by the Mercedes-Benz Atego (55 units), followed by the Sprinter (34 units). MANʼs positions look strong: the TGL model (33 units) took third place, complemented by the TGM (16 units), as well as the TGX container trucks (10 units) and the construction TGS (9 units).

Also in the top 10 were Iveco Daily (13 units), DAF XF (8 units) and the “heavyweights” Renault Premium and Mercedes-Benz Actros (5 units each). It is this segment, although “used”, that provides a real renewal of commercial transport in Ukraine — but in too small quantities.

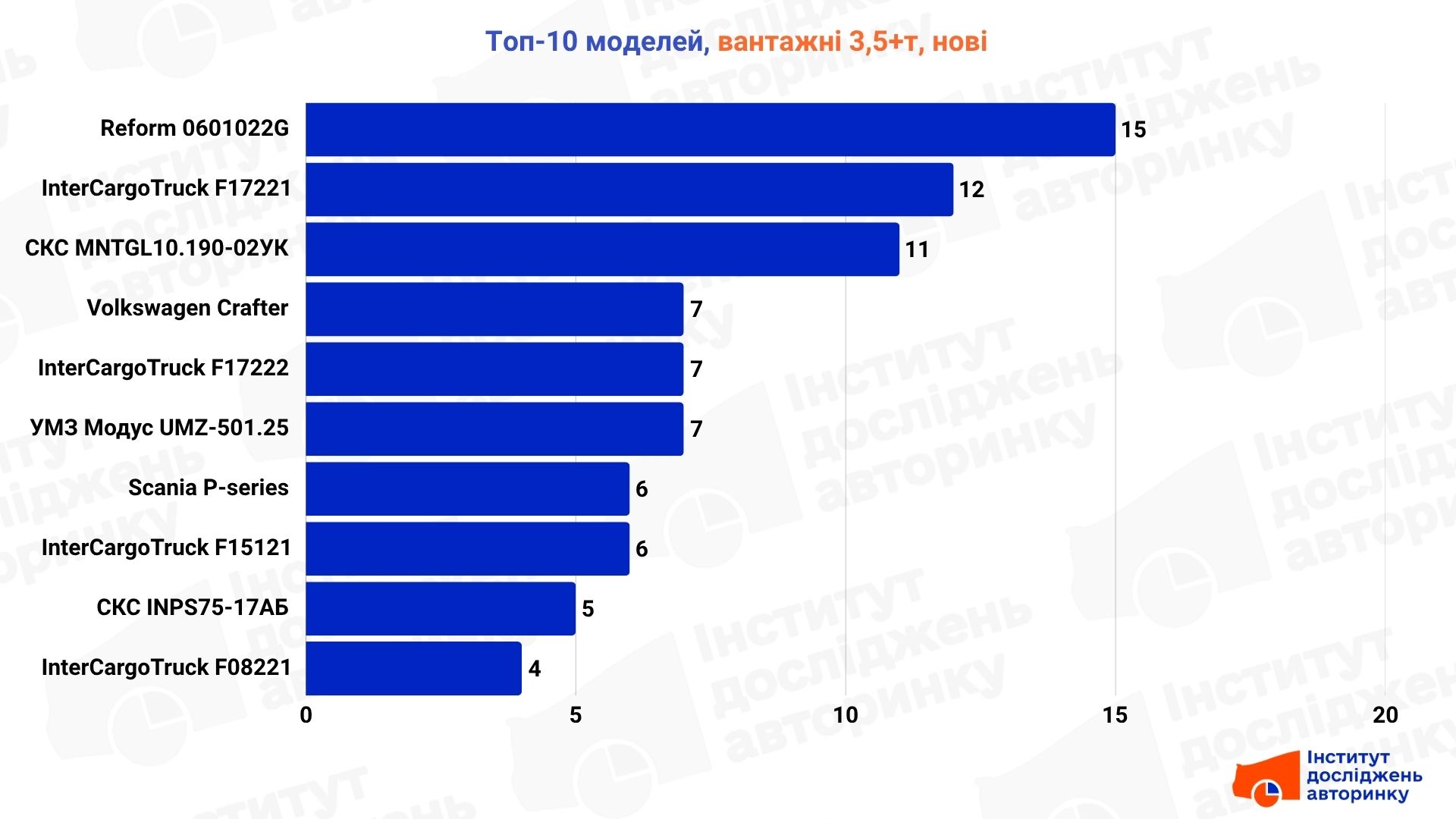

Top 10 new trucks

In this subsegment, the greatest demand was for dump trucks, vans, and refrigerated vans.

The new truck market in October has a distinct Ukrainian specificity. Most of the positions in the top 10 are not factory models of the "Big Seven", but products of Ukrainian companies specializing in superstructures.

These are vans, refrigerators or special equipment installed on imported chassis. That is why we see such names as Reform 0601022G (15 units) and InterCargoTruck in the leaders, which took four positions in the ranking (F17221, F17222, F15121, F08221).

This is also evidenced by the code names: for example, SKS MNTGL... (11 units) is a vehicle built on the MAN TGL chassis, and SKS INPS... (5 units) is probably based on Iveco. Among the "pure" imported models registered "from scratch", the Volkswagen Crafter (7 units) and Scania P-series (6 units) were notable in October.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.