Light commercial vehicles (LCV) remain the "workhorse" of the Ukrainian car market. The secret of their stable popularity lies in their perfect balance. Unlike large trucks, LCVs do not ruin their owners with fuel and service costs. And their compact dimensions allow them to maneuver freely in tight city yards, where a truck simply cannot fit.

For small and medium-sized businesses, this is an alternative income-generating tool. In addition, cargo-passenger versions meet two needs at once: during the day it is a delivery vehicle, and in the evening or on weekends — a comfortable car for family trips.

- Check the history of a car by VIN code before buying using the CEBIA service!

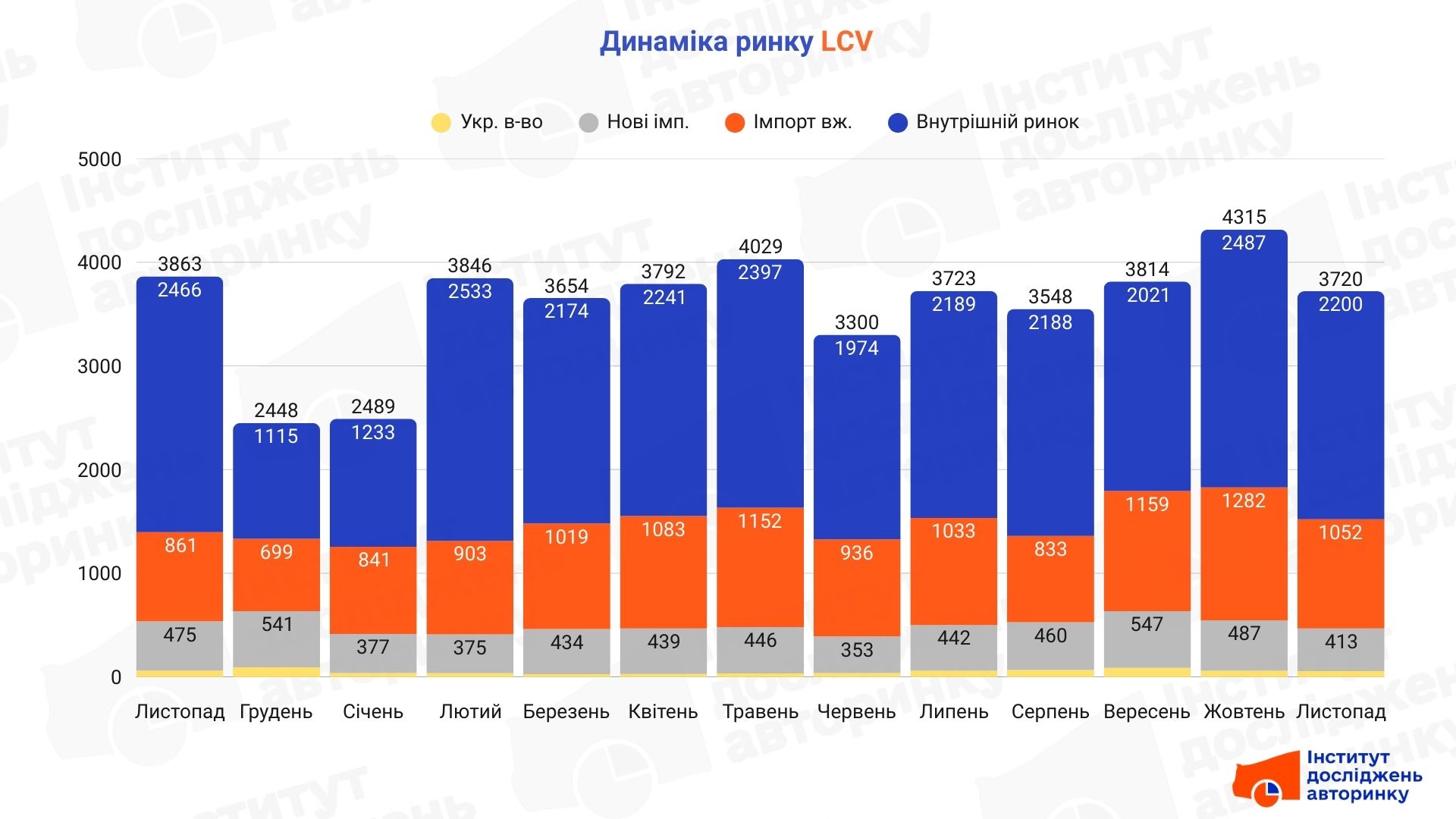

However, November brought a certain cooling to the market. The total volume of trades, determined by specialists of the Institute of Auto Market Research, amounted to 3,720 units, which is 13.8% less than in October. If compared to last year, trades are also in a slight "minus" (-3.7%), although individual subsegments demonstrate interesting dynamics:

- Domestic resales: −11.5% MM, −10.8% YY

- Used imports: −17.9% MM, 22.2% YY

- New imports: −15.2% MM, −13.1% YY

- Made in Ukraine: −6.8% MM, −9.8% YY

The segment structure is as follows: the largest share, 59.1% — in domestic resales; 28.3% were imported used light trucks, 11.1% — new imported, 1.5% — produced or re-equipped in Ukraine. The total share of new cars — 12.6%. Based on the size of the share of each of the subsegments, we will consider them in more detail in the same order.

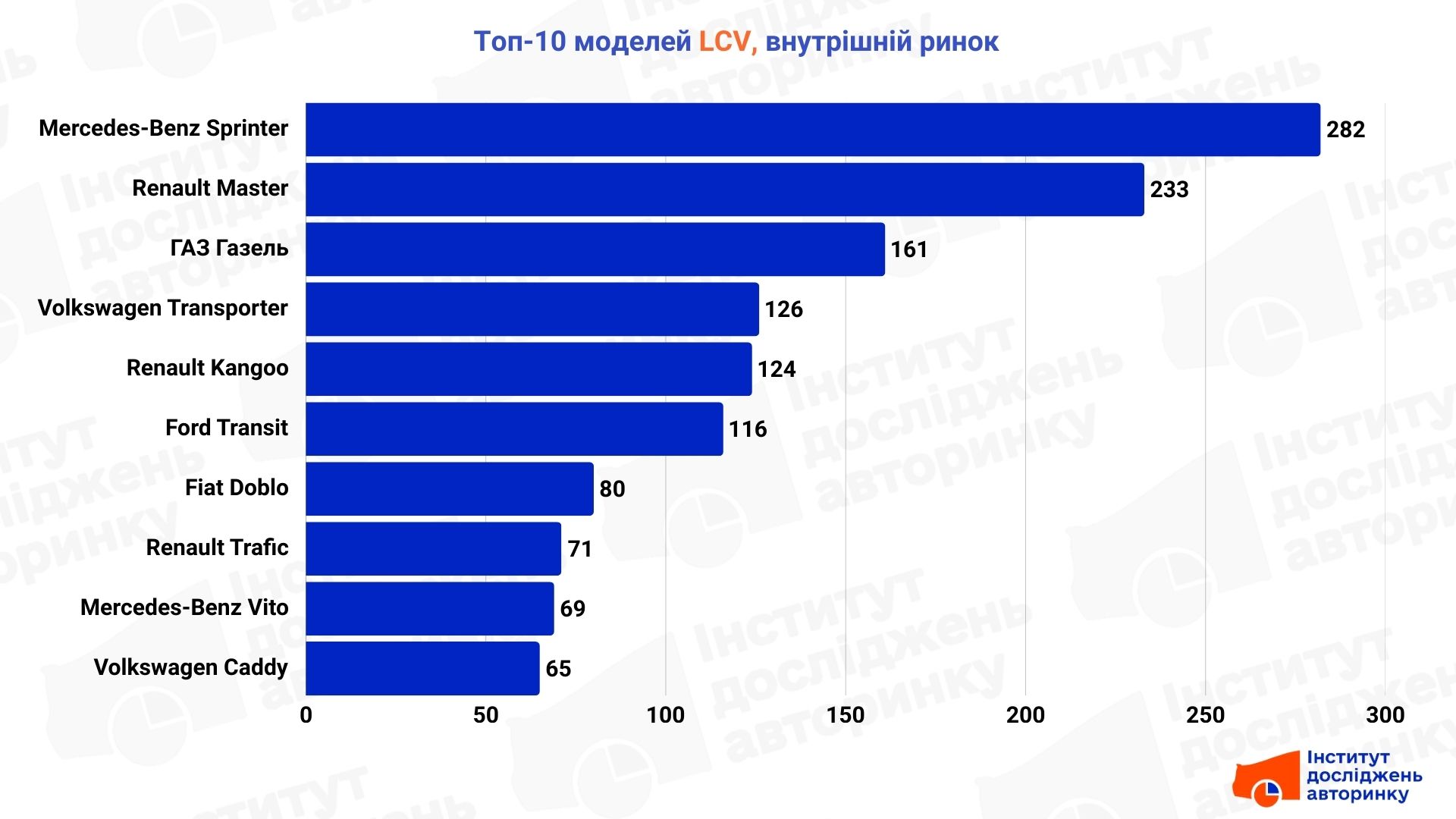

LCV — domestic market

The largest segment of the market — domestic resales — showed a decline of 11.5% by October. Here, Ukrainian businesses choose time-tested solutions: vans, pickup trucks, and universal cargo-passenger vehicles.

The eternal duel between two giants is unfolding in the top of sales. The first place is held by the Mercedes-Benz Sprinter, which is valued for its reliability and status. It is closely followed by the French competitor Renault Master, a favorite of logisticians for its endurance and moderate maintenance costs.

And in third place, like a ghost from the past, the Russian-Soviet Gazelle still holds on. Despite its age, rust, and moral obsolescence, this car remains on the market thanks to two factors: it costs a "penny" and can be repaired with a hammer and a strong word in any garage. Although with each passing month, fewer and fewer people want to buy this designer. Also in the top ten are the "popular" Volkswagen Transporter and the compact Renault Kangoo.

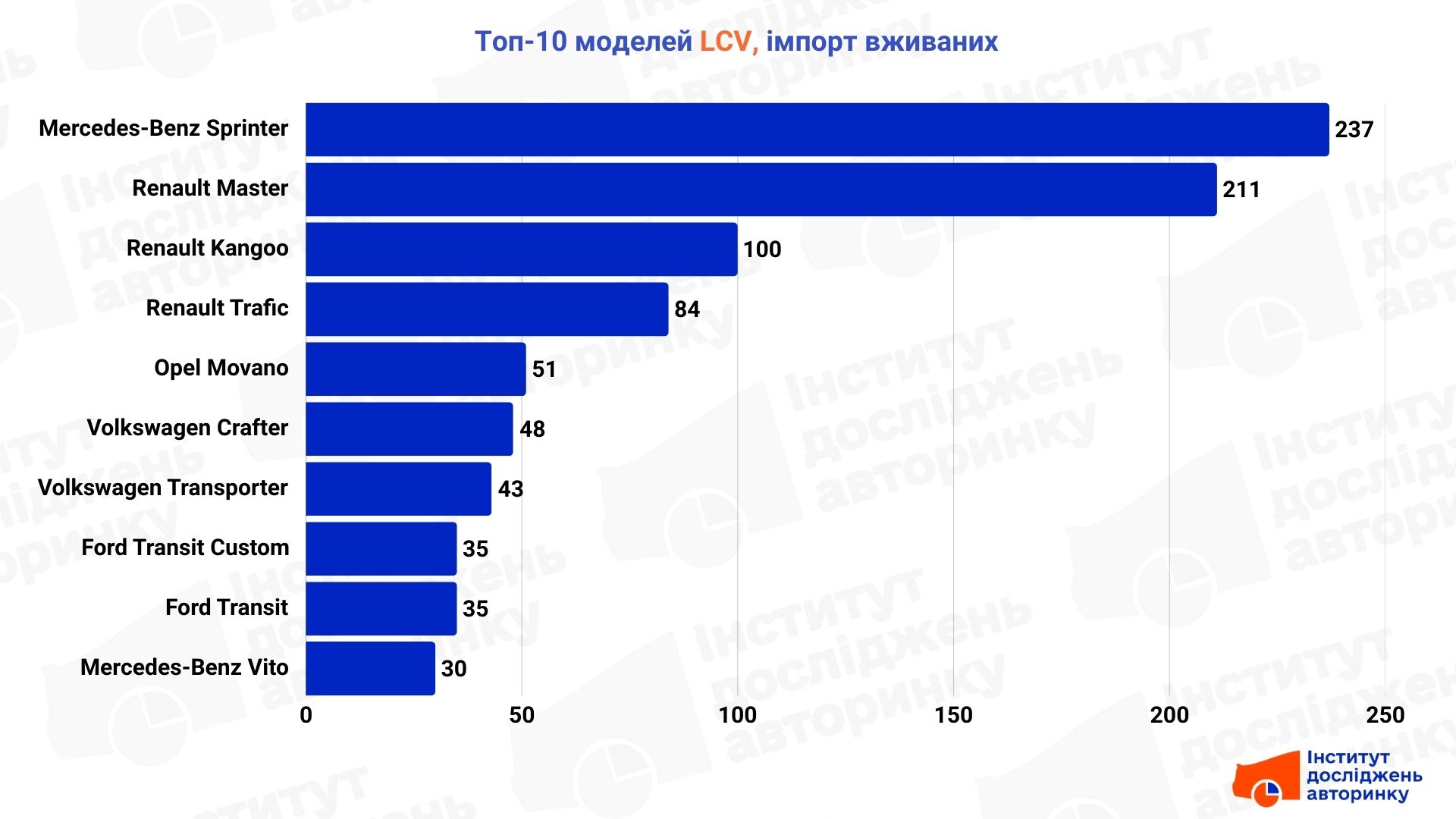

LCV — used import

The segment of "freshly driven" cars also experienced a seasonal decline (-17.9% by October). But if we look at the annual distance, we have an optimistic +22.2% compared to November 2024. This means that the demand for updating the fleet with high-quality cars from Europe remains high.

The tastes of importers are unchanged: they mainly transport vans, tilt platforms and refrigerators. Mercedes-Benz Sprinter and Renault Master also dominate here. Their gap from their pursuers is simply enormous. For smaller transportations, businesses choose Renault Kangoo and Trafic. But there are, of course, no Gazelles here — they only bring from Europe what is economically profitable to operate.

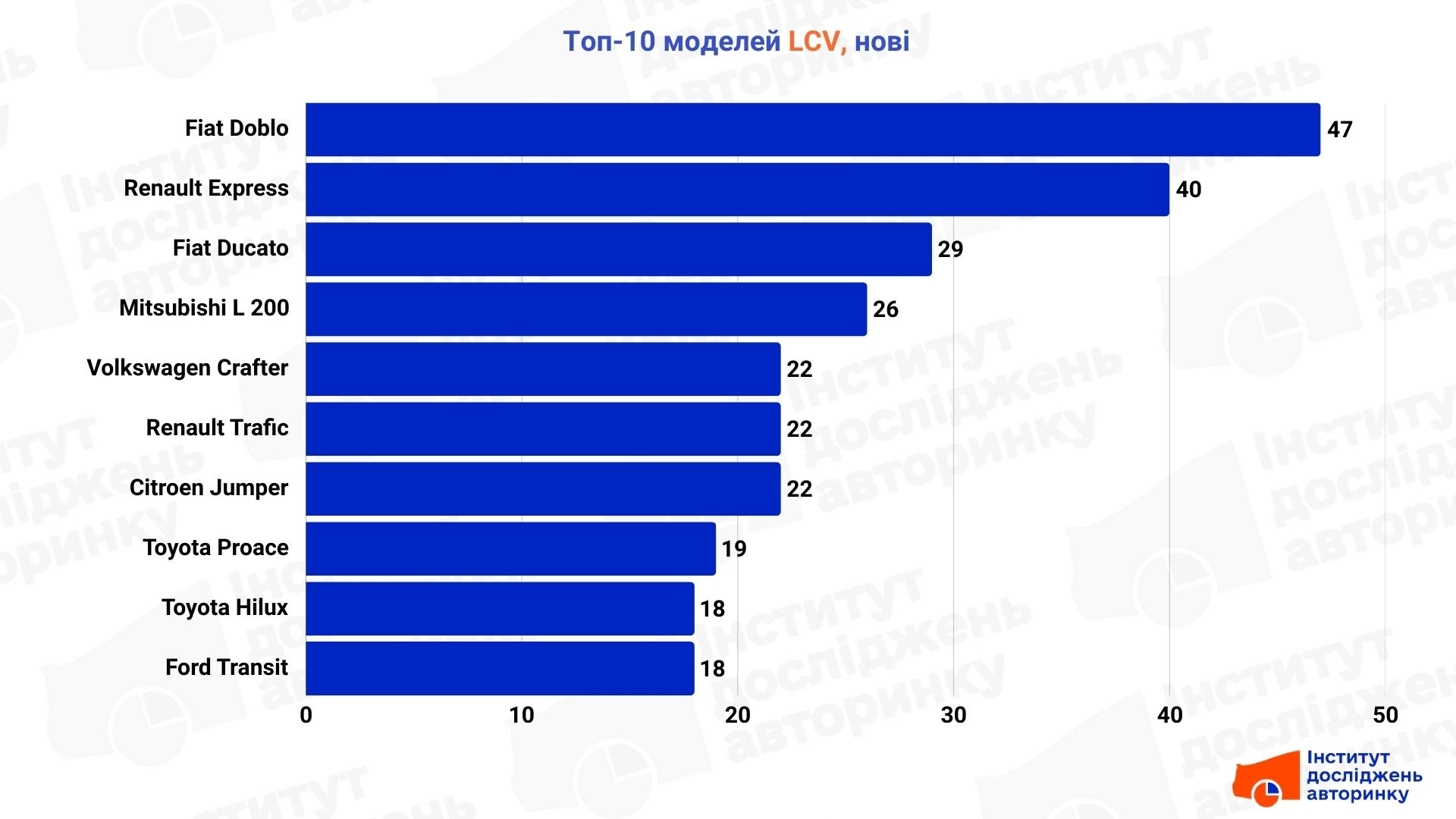

LCV — new sales

The market for new commercial vehicles (both imported and produced in Ukraine) has also declined. The leaders here are completely different from those in the secondary market. When buying new, businesses vote for compactness and economy.

The rating is headed by the Italian "pie" Fiat Doblo. It is followed by the similar class Renault Express. Large vans, such as Fiat Ducato, are also in the top, but are inferior to compact models in quantity. It is interesting to note the presence of Mitsubishi L200 and Toyota Hilux pickup trucks in the list — this is a specific segment that has stable demand from both farmers and energy and technical services.

As for types, vans, pickup trucks, and cargo-passenger variants predominate.

Expert comment: Stanislav Buchatsky, Head of the Institute for Car Market Research:

"The November slump in the commercial vehicle market by 13% looks like a typical seasonal pause. Businesses are summing up the results of the year and are less willing to invest in fleet renewal before the holidays. However, the annual growth in imports of used LCVs by over 20% is indicative. This is an indicator that small and medium-sized businesses are alive and planning their activities for the future, replacing old worn-out cars with more efficient European counterparts. But the new car segment is still suffering from general economic uncertainty, showing a decline both by the month and by the year."

Oldest Light Truck of the Month: The Favorite Van of British Robbers

The oldest commercial vehicle sold in November was a 1977 Ford Transit flatbed. It is a true legend. Firstly, it is petrol (1.7-litre engine), which is exotic in todayʼs world of diesel vans. Secondly, it is a representative of the generation that made the Transit iconic.

Historical fact: in the 1970s in Britain, the police stated that 95% of bank robberies were carried out in Ford Transits. Why? Because at that time it was the fastest van, which was driven like a passenger car, but could carry one and a half tons of... "cargo". In total, more than 8 million Transits were produced in the world, but finding a live copy of 1977 in working condition is a real luck. Perhaps this gray grandfather will still work on Ukrainian roads.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.