The following calculations are based on an analysis of the real sector of the car market. The team analyzed almost 3 million records of the Automoto.ua aggregator about the announcement of the sale of cars from all (about 100) car websites of Ukraine.

Given the fact that prices in advertisements are directly dependent on the principle of market equilibrium (that is, when the sellerʼs request must meet the buyerʼs expectations, so that the goods are sold in a reasonable time), as well as the fact that these same prices are formed under the influence of a number of external factors, they can to be used for market analysis as indicator values that demonstrate or explain the state of affairs at a certain moment, or explain the influence of external factors on the market. Possession of such information allows business analysts to determine tendencies (trends) and forecast the state of the market for the future, to plan activities taking into account historical and current information for future periods.

Online Used Car Market: Sellers Are Back

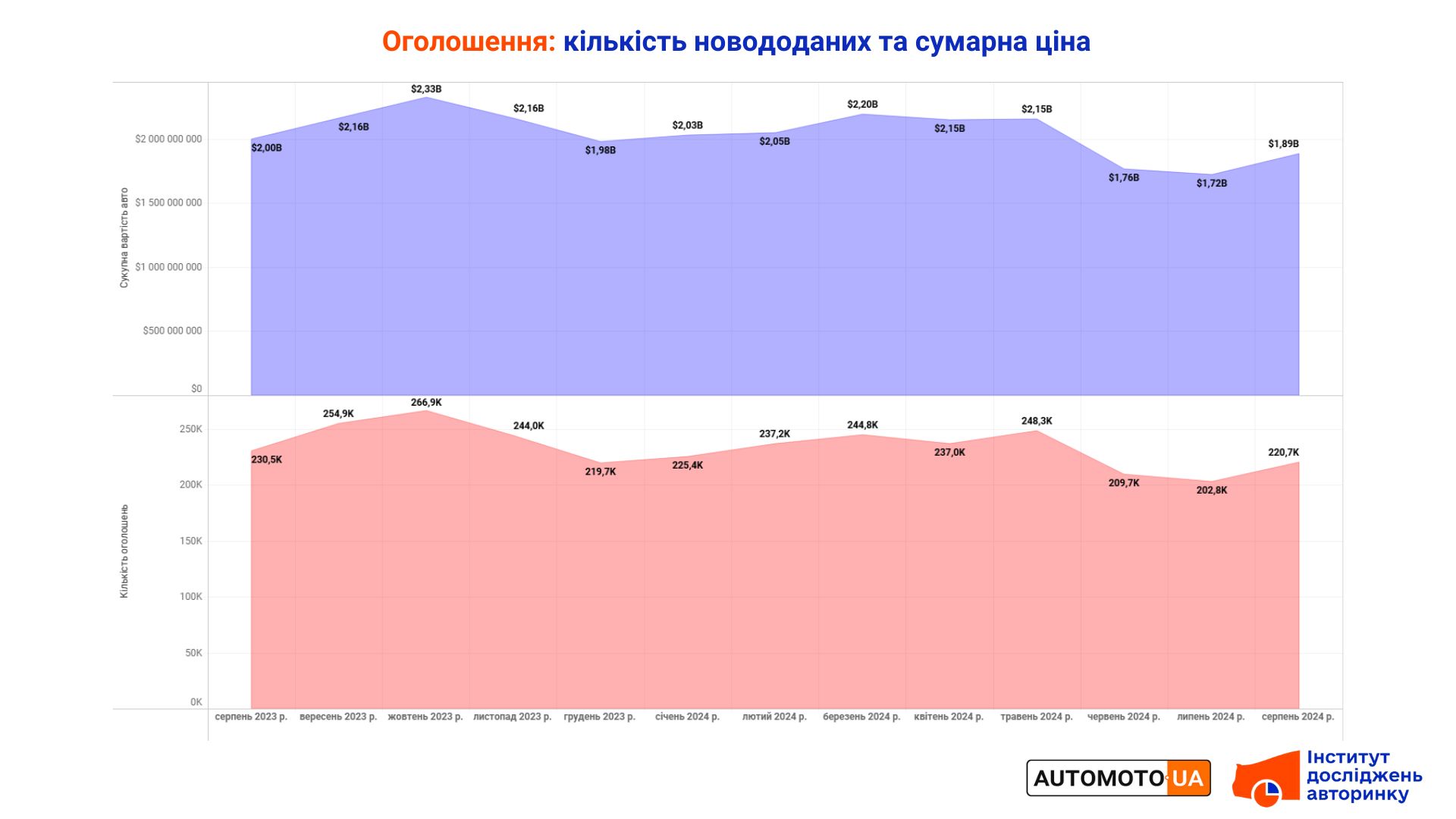

Over the past 12 months , 2.76 million offers for the sale of used cars were placed on Ukrainian online sites for posting advertisements for the sale of motor vehicles. This number includes only newly added ads, excluding duplicates that may occur on multiple bulletin boards.

The highest activity of sellers during the mentioned period was observed in October 2023, when 266.8 thousand ads were placed. The lowest activity was recorded in June and July 2024, 209.7 thousand and 202.8 thousand ads, respectively.

In August, contrary to the usual seasonal pattern, the number of ads increased to 220.7 thousand. Usually, the end of summer has the least business activity, which also applies to private sales of motor vehicles. However, this time, we probably have another consequence of the information wave about the introduction of a 15% tax on the first registration of cars — a certain part of the owners postponed the sale, anticipating a general increase in the price of the market (if the tax is introduced) and fearing to reduce the price by selling cars before the changes in the legislation. However, the tax is not implemented, so those who kept their cars decided to go back to selling them, as can be seen in the chart.

The potential financial value of all cars offered (or offered) for sale in the past 12 months was almost $26.6 billion. The maximum and minimum bid saturation in monetary terms is fully correlated with the number of ads mentioned above, which is also visible in the chart. On average, Ukrainians offer $2.1 billion worth of used cars for sale on the Internet every month.

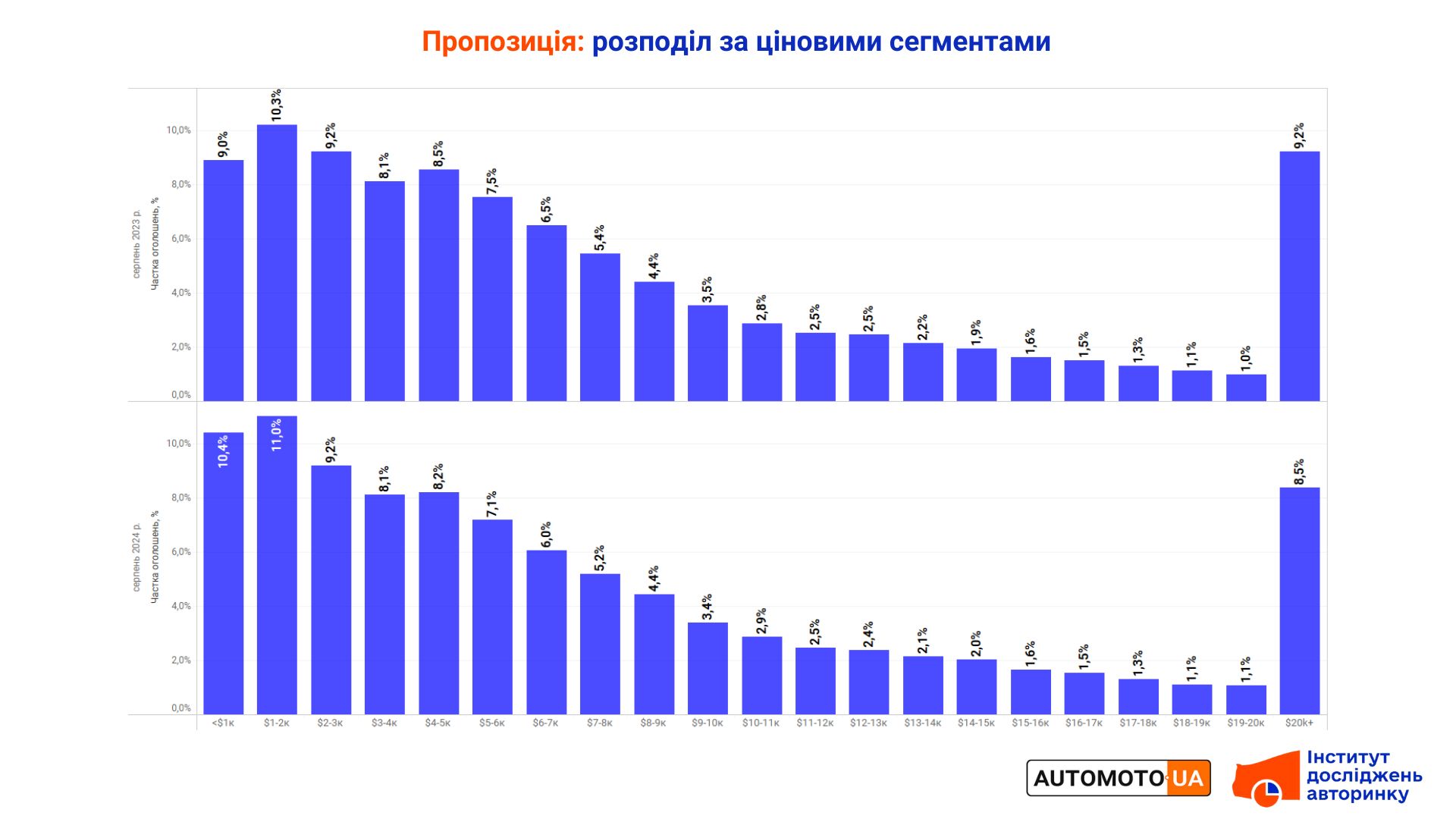

Price structure: cheaper ones are offered more, more expensive ones are offered less

During the year, the following changes took place on the diagram, which shows the saturation of the market with offers of various price groups. The share of the most affordable cars, which makes up the mass market of the Ukrainian "secondary" (offered price up to $8 thousand), changed (increased) from 64.5% to 65.2%.

On the other hand, the share of expensive (for the Ukrainian market) cars with a price of more than $20,000 has decreased: now 8.5% of them are offered, despite the fact that last year their share was 9.2%.

That is, the offer of cheaper cars continues to increase on the market, and the offer of more expensive cars decreases. It is worth noting that this trend has become, and is observed much further than within a few months or a year.

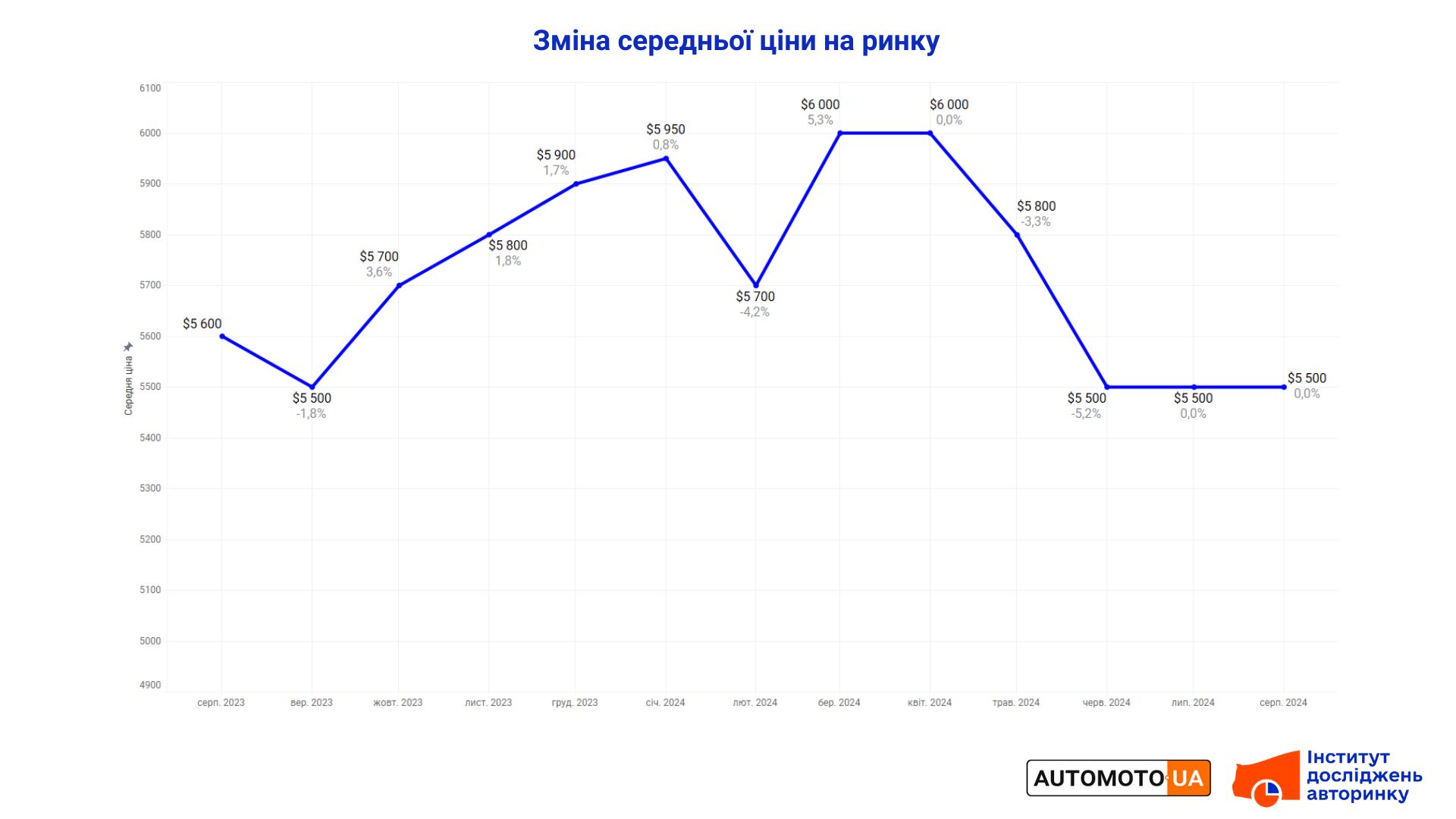

The average price of offers

Despite the influence of a number of external factors on the car market, the average price on it remains unchanged for the third month, at the level of $5,500. Actually returning to the values observed a year ago.

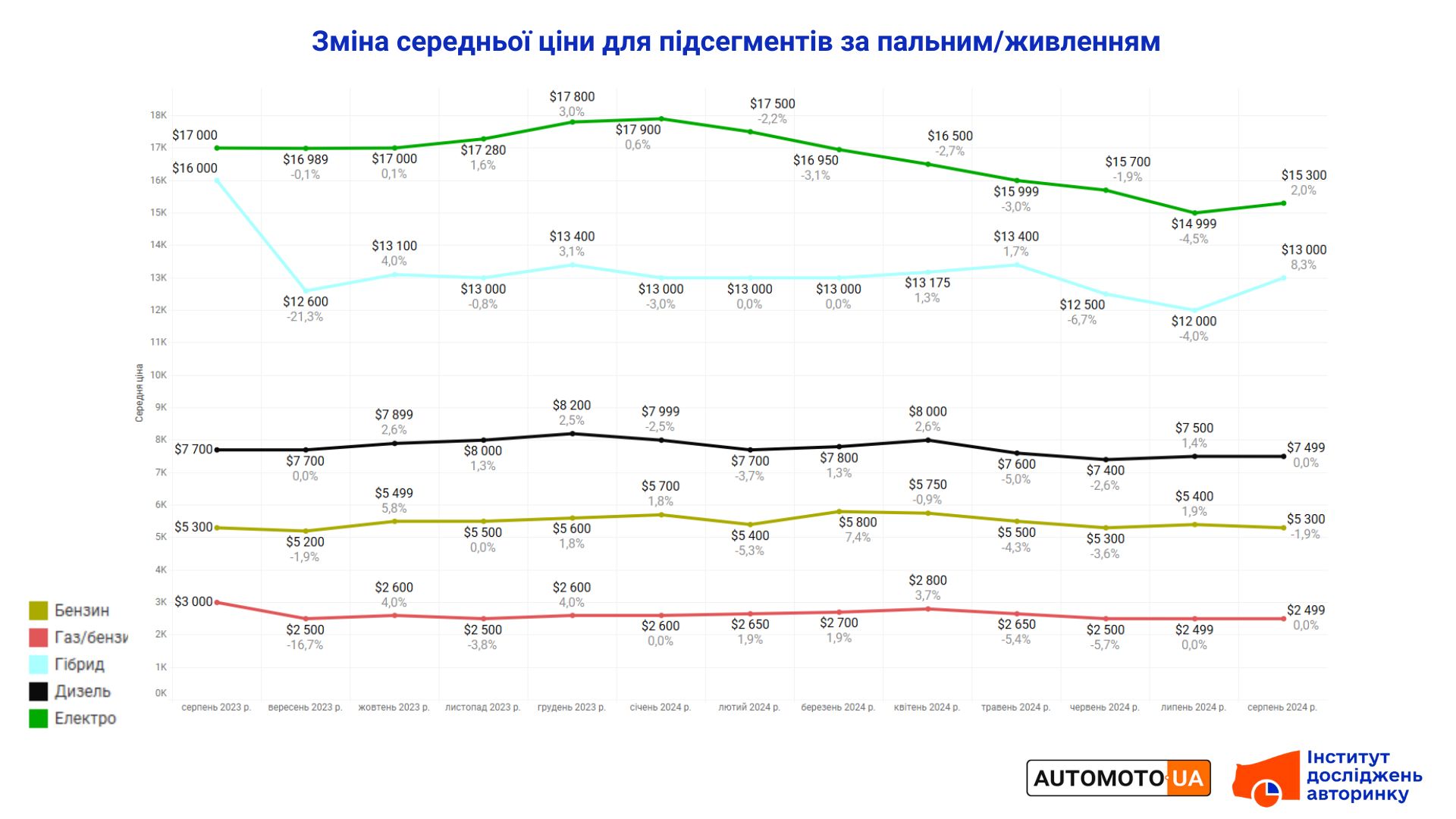

Changes in prices by segment (based on fuel/power)

In the section of individual segments, with distribution by type of power plant, the lowest average price, which according to the results of August is $2,500, is for passenger cars with gas cylinder equipment. It is worth noting that this segment may soon undergo significant changes — more details on this in a separate article related to the fuel market. Over the year, the average price in this segment decreased by $500.

The most popular segment on the market is gasoline cars, occupying an intermediate position between the just described cars with HBO and diesel cars. The current average price for all listings here is $5,300, down $100 from a month ago, but overall, despite slight fluctuations over past periods, the average price here remains stable.

Diesel passenger cars with mileage are now asking $7,500 on average, down slightly from $7,700 a year ago. All three segments just described (which at the same time are the most massive in the secondary market) were quite stable in terms of the average price from August 2023 to August of the current year.

The small segment of cars with hybrid powertrains (all subtypes like MHEV/HEV/PHEV in total) showed an increase in the average price, which is now $13,000, which is a whole thousand more than a month ago, but a considerable $4,000 less than a year ago ago. The small number of "hybrid" cars on sale is the main reason for such significant jumps in the average price in this segment.

And about the segment of electric cars: the long-term decrease in the average price, the level of which is now $15,300, has changed to its increase. A month earlier, this value was $300 less. It will be possible to say for sure whether this is already a way out of the "price hole" for the segment, or just a consequence of increased demand (in light of information about the probable introduction of a 15% tax) in a few months, when it becomes clear what shape the curve takes electric car prices in this chart.

- Need more information? Send us a request , and the IDA team will make every effort to provide you with all the necessary data that will help your business grow!

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without advertising or spam.