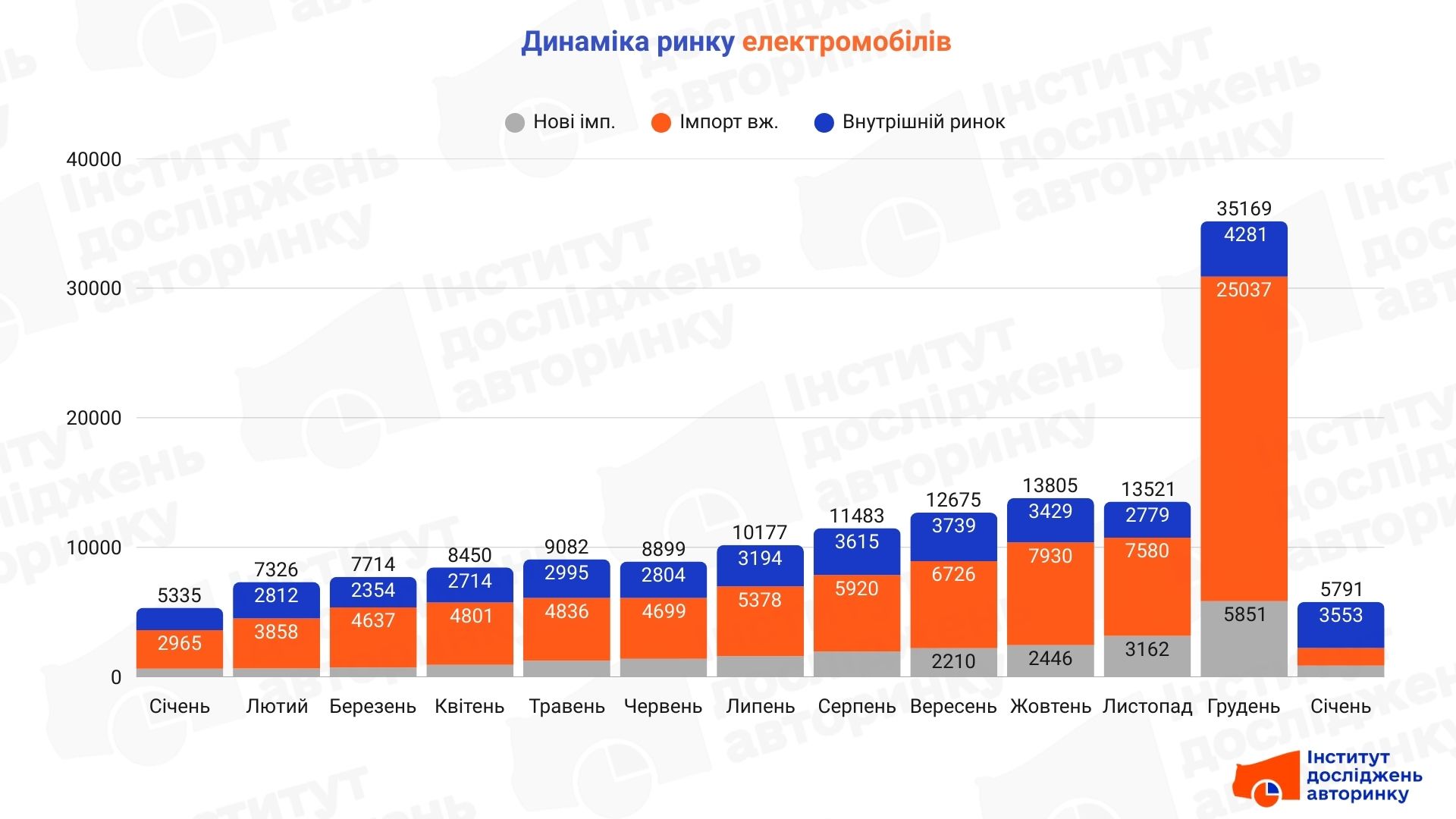

VAT shock: January showed the true cost of ending benefits. Imports of electric cars dropped 14 times.

January 2026 was a moment of truth for the Ukrainian electric vehicle market. After the December “storm” of customs caused by the return of VAT on imports of electric cars, the figures for the first month of the year demonstrate the expected, but still impressive, collapse in import volumes.

This is a classic "electricity hangover": the market is trying to digest the reserves accumulated in the last weeks of 2025.

The situation by segment looks as follows:

- Domestic resales (3,553 transactions): This is the only segment that has maintained relative stability. Despite a decrease of -17.0% MM (relative to December), in annual terms we see significant growth — +105.0% YY. This means that the secondary market is already formed and lives its own life, regardless of customs vicissitudes.

- Import of used electric cars (1,374 units): A real “fall into the abyss” was recorded here — -94.5% MM. For comparison: in December, the number of imported cars was measured in tens of thousands, and in January the flow practically stopped. Even compared to last January, the drop was -53.7% YY.

- Imports of new electric vehicles (864 units): The new car segment also reacted painfully — a decrease of -85.2% MM. However, unlike used cars, new cars still show positive dynamics compared to last year ( +35.6% YY ), which indicates the inertia of official dealers and large corporate orders.

The main and only factor in such an anomaly is VAT refunds.

- December hype: Everyone who planned to buy an electric car in 2026 did so in December 2025 to make it before the tax was introduced. This drained both buyersʼ money and logistics capacity.

- Inflated price expectations: Now imported cars are becoming at least 20% more expensive (VAT amount). The market is frozen in anticipation: carriers are looking closely at the new rules of the game, and buyers are getting used to the new price tags.

- The domestic market as a lifeline: Since cars already in Ukraine are not subject to the new tax burden, activity has shifted here. The +105% YY indicator clearly indicates that demand has not disappeared, it has simply reoriented to the domestic resource.

Whatʼs next?

January is just the beginning of the adaptation. We expect February-March to also be depressing for imports until the warehouse stocks of "non-roadworthy" cars at dealers and second-hand dealers start to run out.

We will see the true price of the "new life" with VAT closer to mid-spring, when the market will have to buy according to the new rules.

Expert opinion

Stanislav Buchatsky, Head of the Institute for Car Market Research:

"The collapse in imports in January was quite predictable: we are observing a natural "electrical hangover" after the December hype. Most buyers tried to close deals by the end of 2025 in order to have time for VAT refunds. Those 1,374 used cars that still crossed the border in January are mostly "tails": cars that did not physically have time to arrive or be registered by New Yearʼs Eve. The situation will stabilize closer to the middle of the year, when the market will accept the new rules of the game.

An important indicator is the new car segment. Although we see a decline relative to the "peak" December, the figure of +35.6% compared to January last year indicates that systemic demand has not disappeared. But the real phenomenon is the domestic market. Despite the expected January lull and holiday seasonality, the number of resales has doubled compared to last year (+105%).

This confirms our thesis: the abolition of tax breaks did not kill interest in "electric cars", but simply changed the vector. Now buyers are looking for profit within the country, washing out stocks of cars that were imported at zero VAT. In essence, the domestic market has become a temporary damper that restrains the general decline in interest in the segment."

Ostap Novitsky, automotive expert:

"VAT refund is a significant factor, but far from the only one. The electric vehicle market in January fell into a "perfect storm", where several anti-incentives worked simultaneously:

- Energy exam: Power supply problems have once again made many think about autonomy. When the stability of the grid is in question, the electric car in the garage becomes a less predictable asset.

- Climatic factor: Abnormal frosts are the moment of truth for batteries. While modern models still hold up, electric cars from early years of production noticeably lose in range and economy. You canʼt fool physics: at -20°C, an electric car consumes resources not only for movement, but also for survival.

- Economic absurdity: This is perhaps the most painful blow. After the charging station networks increased tariffs to 30-32 UAH per kWh, the savings factor can officially be put out of the question. If you charge exclusively at public EV charging stations, a kilometer of mileage now costs more than on gasoline or diesel.

The conclusion is simple: the game of "saving on electricity" currently works only for those who have their own outlet with a night tariff. For everyone else, itʼs mathematics with many unknowns. To return the market to the activity of 2025, at least one of these factors must lose its sharpness, otherwise the "electricity boom" risks turning into a niche story for private homeowners.