Experts from the Institute of Auto Market Research analyzed vehicle registration statistics in Ukraine and identified the most popular models in three segments of trucks weighing over 3.5 tons (except for tractor units) : used imports, domestic resales, and purchases of new cars, including those converted in Ukraine.

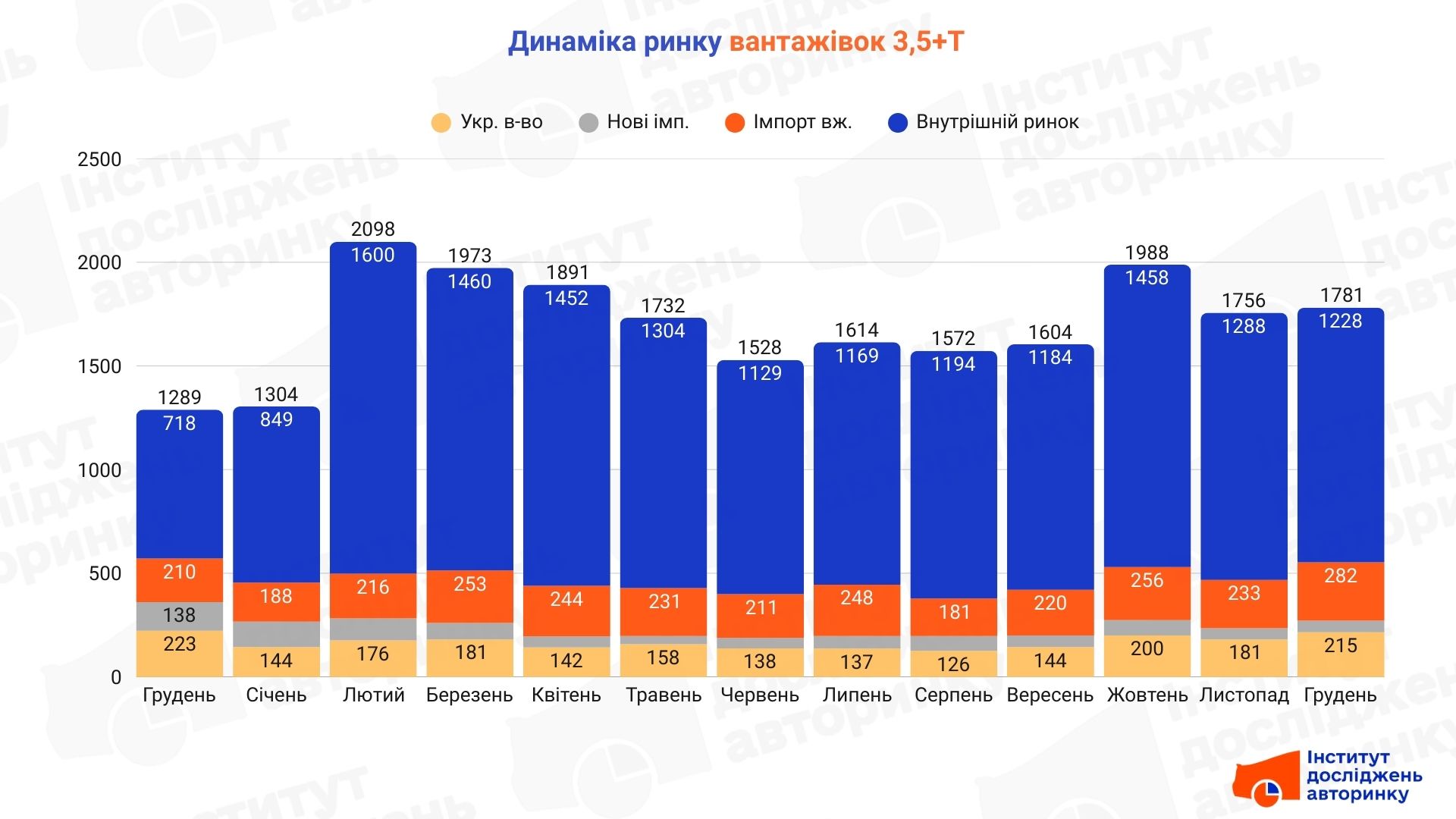

Truck market dynamics

The overall results of the year indicate stable but specific development of the truck chassis and onboard vehicles segment.

- Domestic market: This is the foundation of the segment. 15,314 purchase and sale transactions were recorded during the year. These are "workhorses" that were already in the country and simply changed owners for local business or utility needs.

- Statistical phenomenon: In 2025, the used truck import and new car sales sectors showed an identical result — 2,763 units each.

- New cars and the “Ukrainian footprint”: If we analyze the segment of new trucks in more detail, the role of domestic enterprises becomes clear. Of the 2,763 new cars, only 821 units were imported as a finished product. The remaining 1,942 units are vehicles manufactured, retrofitted or re-equipped directly in Ukraine. Most often, this is the installation of special bodies (garbage trucks, towers, refrigerators, fire engines) on imported chassis.

December 2025: The last month of the year brought dynamics that clearly divided the market into "ours" and "othersʼ."

- Domestic resales: 1,228 transactions were recorded in December. This is a slight decrease compared to November ( -4.7% MM ), but a real breakthrough compared to last year — an increase of 71.0% YY. But this does not indicate a significant activation of the secondary market compared to the end of 2024, since then the TSCs did not register used vehicles due to an information system failure.

- Used imports: The segment showed solid growth in December — 282 cars ( +21.0% MM and +34.3% YY ). The business tried to cover the needs for equipment before the start of the new tax period.

- New trucks: the contrast of imports and localization. 271 new trucks were registered in December.

- Imports of new (56 units): showed symbolic growth over the month ( +3.7% ), but fell by 59.4% compared to last December.

- Ukrainian production/assembly (215 units): on the contrary, showed activity ( +18.8% MM ), almost equaling last yearʼs performance ( -3.6% YY ).

This dynamics is explained by the structure of delayed budget tenders and the specifics of reconstruction. New ready-made trucks from abroad are becoming more and more expensive, so customers choose the path of purchasing a bare chassis with subsequent installation of equipment at Ukrainian factories. This is not only cheaper, but also allows you to get a machine that is maximally adapted to specific local tasks.

- Check the history of a car by VIN code before buying using the CEBIA service!

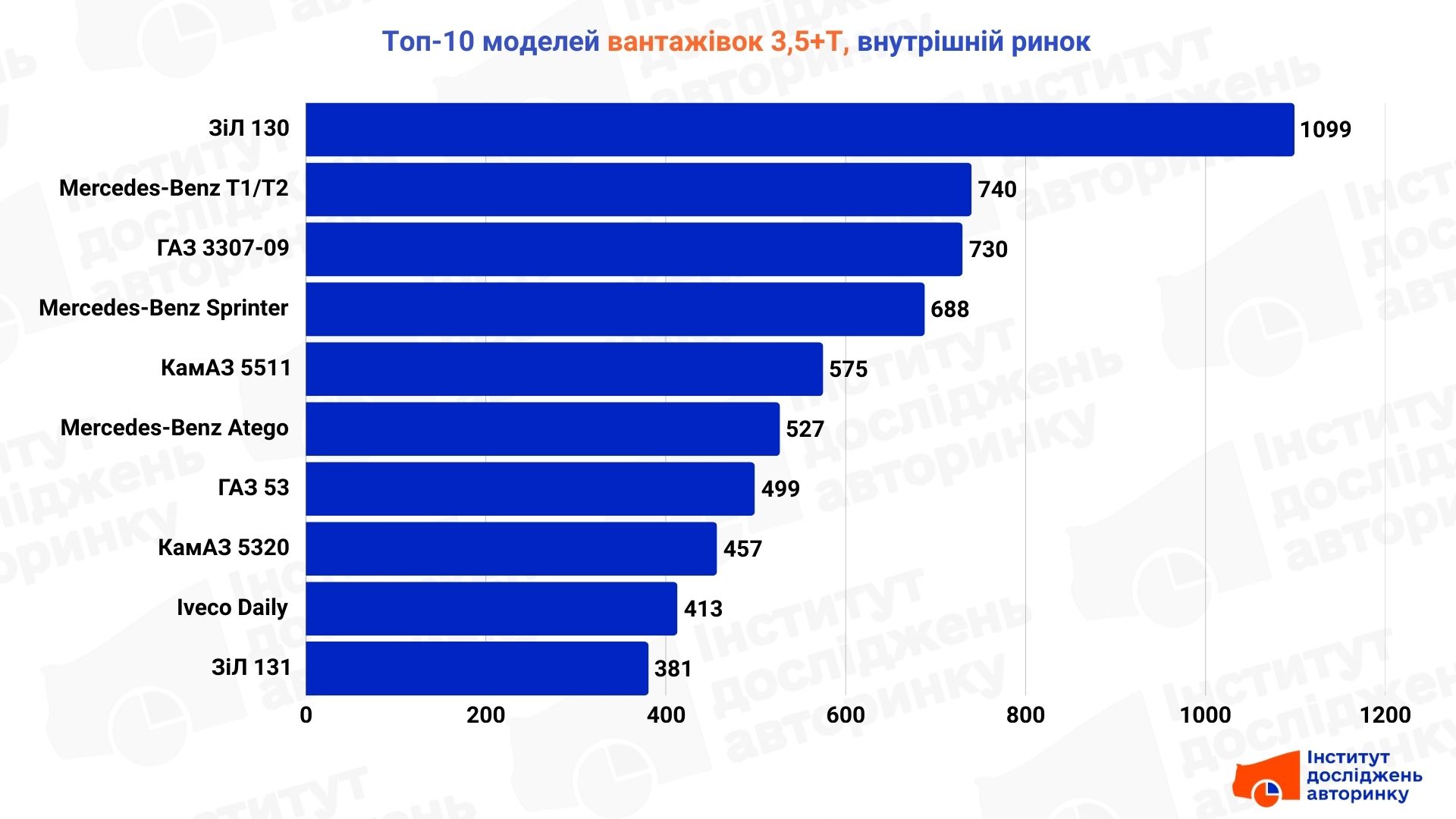

Top 10 trucks in the domestic market

The most popular type in this subsegment was dump trucks, with stable demand for vans and flatbed versions.

Regarding the sales structure, the domestic truck market in 2025 is a territory of paradoxes.

ZiL-130: The absolute leader of the rating. The truck, which began to be designed during the Khrushchev era, still remains the most popular in the secondary market. The secret is simple: it is the cheapest entry ticket to freight transportation. It is bought for short arms in agriculture, for construction or as a base for barrels and sewage trucks. Fuel consumption there is "cosmic", but the ability to repair a car with a sledgehammer outweighs any economy.

German old school: Second place after the "immortal" Mercedes-Benz T1 and T2. These cars should have been scrapped a long time ago, but in Ukraine they have received the status of "eternal". Together with the Atego and heavy versions of the Sprinter, they form the backbone of small and medium-sized businesses, where the reliability of the units is more important than the year of manufacture in the technical passport.

Soviet heritage: The presence of the GAZ-3307, GAZ-53 and ZIL-131 all-terrain vehicles in the top shows that a significant part of our internal logistics (especially in the hinterland and forestry) still relies on Soviet archives. KamAZ 5511 (dump truck) and 5320 remain the main players on local construction sites, where it is simply a pity to "kill" expensive European equipment.

European pragmatists: Only the Iveco Daily and the already mentioned Mercedes-Benz models are trying to bring at least a little bit of European comfort and fuel efficiency to this hit parade.

Paradox of the Year: We live in the age of artificial intelligence and electric vehicles, but the most popular truck for resale remains a gasoline-steel “hybrid” from the 1960s. It’s a market where the cost of owning “yesterday” is still more important than the cost of operating “tomorrow.”

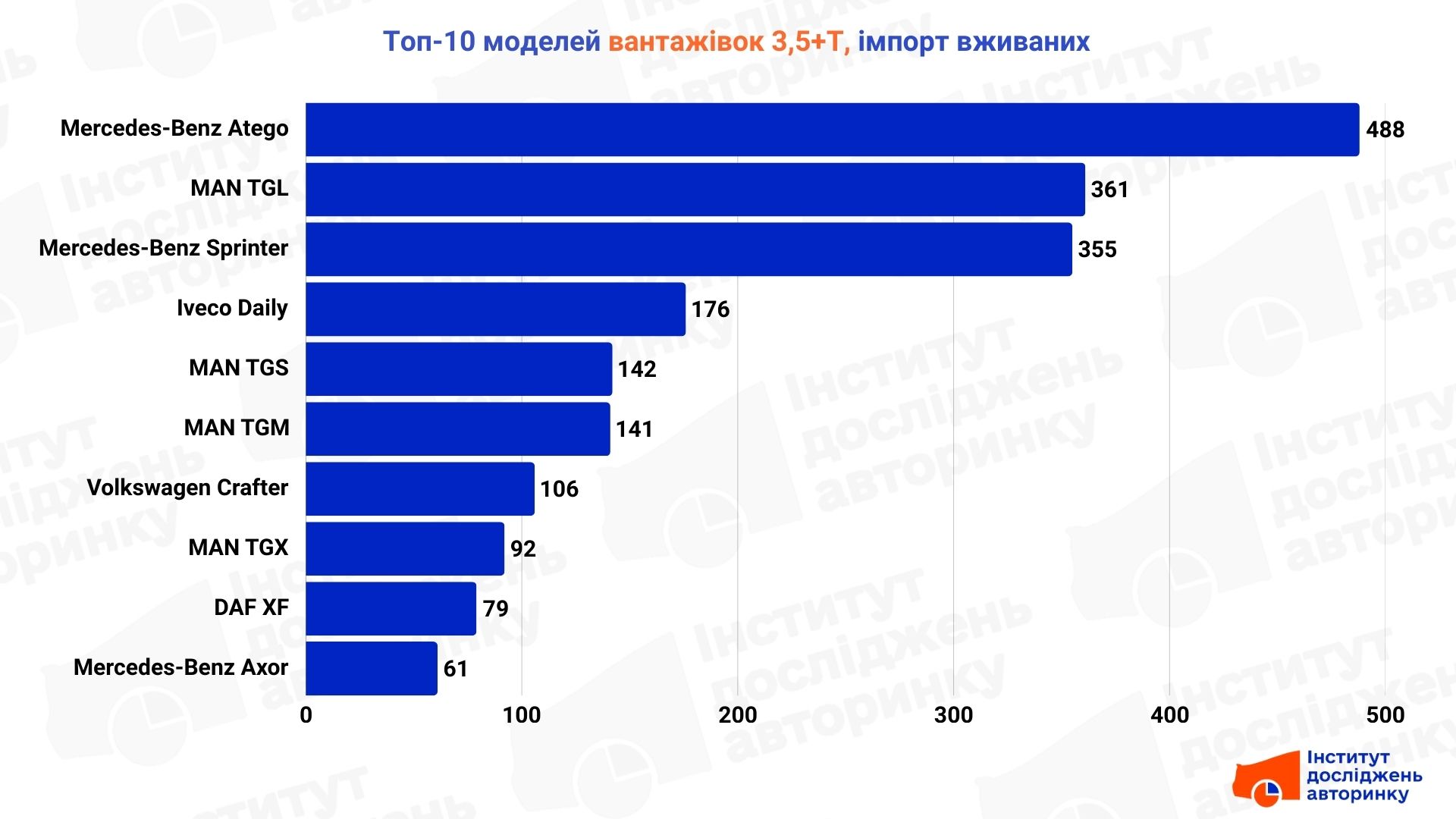

Top 10 imported trucks with mileage

Pure European pragmatism reigned in the used truck import segment in 2025. Here, the choice of model is dictated not only by the purchase price, but primarily by the cost of ownership, fuel efficiency, and residual value on the market.

Most often, the Ukrainian fleet was replenished last year with tail lift vans, regular vans, and refrigerated vans.

The undisputed leader in imports remains the Mercedes-Benz Atego. For the Ukrainian carrier, this model has become the “gold standard” of medium-duty trucks. It is valued for the extraordinary durability of the suspension and engines, as well as for the modular chassis design, which allows you to easily adapt the car to any needs — from a regular isothermal van to a manipulator or tow truck. This is a car that almost does not lose value over the years, which makes it a safe investment for small businesses.

The second powerful import pole is the MAN line, which is represented by four series at once. The most popular among them, the MAN TGL, is chosen for urban and regional distribution for its best-in-class turning radius and comfortable cabin. The TGM and TGS models are more often used as specialized solutions: heavy chassis for concrete mixers or construction dump trucks, where engine power and the ability to work in difficult conditions are critical. Even the MAN TGX mainline rigid frame format finds its buyer for long-distance bulk transportation.

- Looking for a way to "drive" a truck from Europe? — West Auto Hub will help you get it turnkey!

An interesting trend is observed in the “heavy” versions of popular light-duty vehicles, such as the Mercedes-Benz Sprinter, Iveco Daily and Volkswagen Crafter. In this rating, they are represented by modifications with a gross weight of more than 3.5 tons (usually 5 and 7-ton versions). Carriers choose them as an effective “last mile” tool: they allow you to transport significantly more cargo than conventional vans of category “B”, while maintaining the maneuverability and speed of a passenger car. The Iveco Daily, in particular, is valued for its strong frame structure, which allows for significant loads without compromising its resource.

The top ten import leaders are the heavy chassis DAF XF and Mercedes-Benz Axor. These vehicles are purchased for specific tasks, such as grain trucks or large refrigerators for interregional flights. DAF traditionally wins due to its spacious cabin and fuel efficiency, while the Axor is perceived as a simpler and cheaper to maintain alternative to the flagship Actros. In general, the import structure of 2025 shows that Ukrainian business has finally reoriented to proven European equipment, where each kilometer of mileage has a clearly calculated cost.

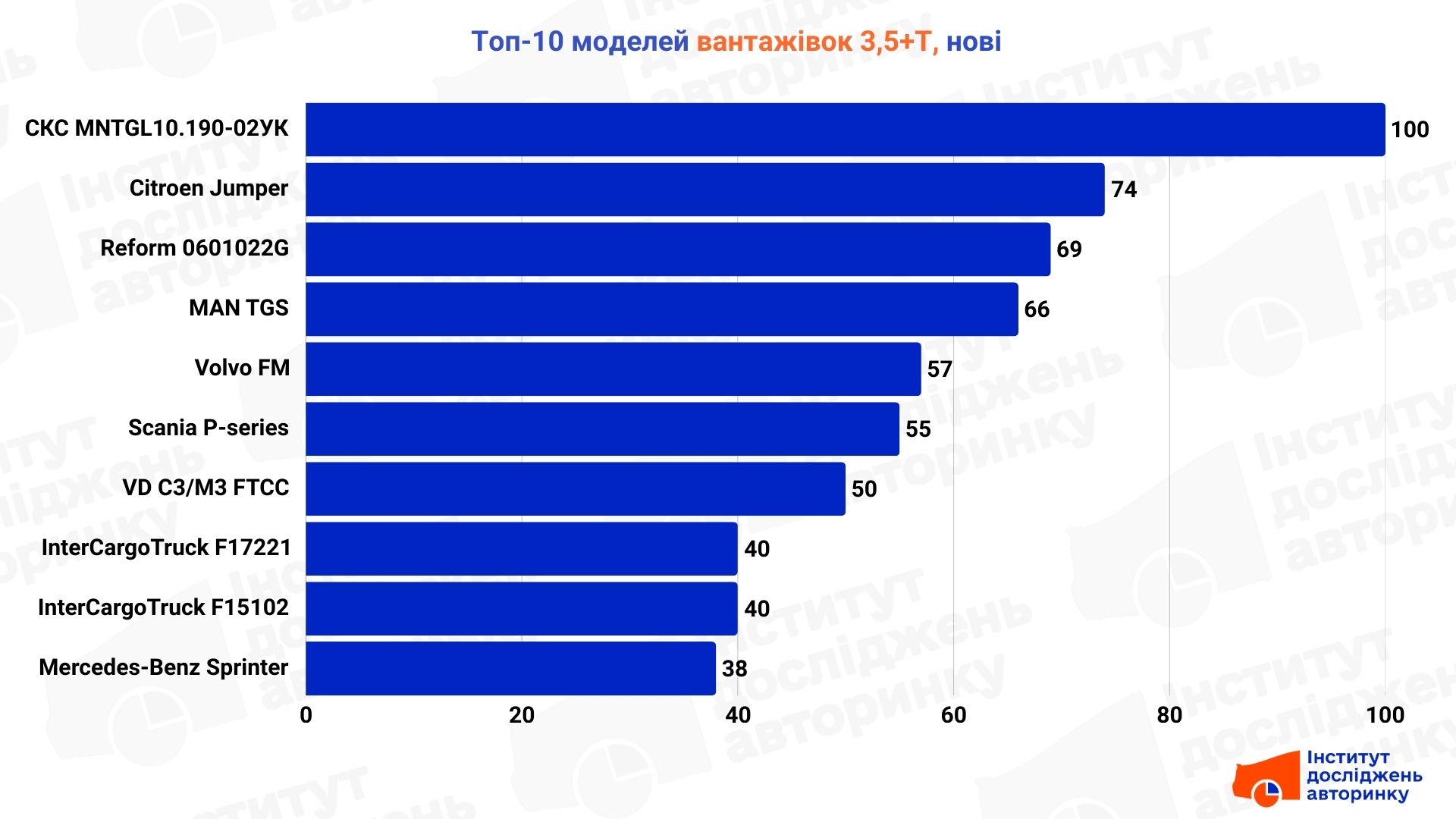

Top 10 new trucks

In this subsegment, the greatest demand was for dump trucks, classic vans, and tail lift vans.

As always, due to the superiority of equipment from local enterprises, long encrypted model codes are more common here than the more familiar and easier to understand format — brand-model (or series). The rating is headed by SKS MNTGL10.190-02UK (100 pcs.). This name hides the products of the company "Spets-Kom-Service" based on the MAN TGL chassis. This is a classic example of how a European base is transformed into Ukrainian special equipment — most likely, emergency repair vehicles for energy or utility workers. It is such large corporate or government orders that form the leaders of the segment.

A similar story with other "local" brands:

- Reform 0601022G (69 pcs.): This is a product of the Reform company, which specializes in armored collection vehicles and special vehicles.

- InterCargoTruck (80 units in total across two models): Cherkasy-based manufacturer that creates vans and flatbeds.

- VD (Valdis) : Another player supplying the market with municipal and special equipment.

These are the same 1,942 vehicles that we mentioned as “produced or re-equipped in Ukraine.” For businesses or state or municipal enterprises, this is an ideal scheme: you get a reliable chassis (MAN, Volvo or Scania) with equipment already installed and certified in Ukraine.

Among those who retained the original name in the technical passport, three groups stand out:

- Logistics "heavyweights": MAN TGS, Volvo FM and Scania P-series. These are vehicles for large construction and long-distance transportation, which are often purchased in standard version or with minimal modifications.

- Heavy vans: Citroen Jumper and Mercedes-Benz Sprinter. In the “over 3.5 t” category, they usually act as reinforced chassis for compact refrigerators or express delivery.

- Special orders: High figures for the Citroen Jumper (74 units) often indicate purchases for medical services or social needs.

Expertʼs comment

Stanislav Buchatsky, Head of the Institute for Car Market Research:

“The truck segment with a gross vehicle weight of over 3.5 tons in 2025 has demonstrated a strong adaptability to new economic realities. We see three completely different strategies for fleet renewal:

- The domestic market remains a "reserve" of affordability. Despite the dominance of obsolete ZiLs and KamAZs, it is a critically important resource for small businesses and rural communities, where the key factor is the low cost of entry and maintainability "in the field". The abnormal growth of resales in December ( +71% ) should not be misleading — this is primarily a technical compensation for the blackout in the registers of the Ministry of Internal Affairs at the end of 2024.

- Import of used equipment has finally moved to the language of numbers. Carriers are no longer buying "just a truck", they are buying a resource. The leadership of the Mercedes-Benz Atego and the MAN line indicates that businesses are willing to overpay for the brand at the purchase stage in order to save on every kilometer and minimize downtime.

- The new car segment has become a platform for Ukrainian engineering. The fact that in the top of registrations we see the names of Ukrainian building plants more often than world giants is the main trend of the year. We do not produce trucks "from scratch", but we have become a powerful hub for converting imported chassis into complex specialized solutions.

In general, the truck market has become more mature: it is clearly divided between cheap "classics" for simple tasks and high-tech solutions of Ukrainian assembly for the professional sector."

Garage artifacts

Auto expert Ostap Novytskyʼs column

While we are discussing the new Mercedes and MAN, several interesting trucks have "lit up" in the registers of 2025. First of all, because they "saw" both the launch of the first satellite and the collapse of empires, were created in a time when motor oil was not yet divided into synthetic and mineral, the term computer diagnostics had not yet been invented, and the driver was often both a mechanic and a loader, and, probably, a bit of a romantic — because without a spark of enthusiasm in the soul, it was hardly possible to operate a vehicle that you serve, and not from you.

- GAZ-51 (1954)

On-board, green, 3.5 l

GAZ-51 is a truck created for life after the war. For reconstruction, transportation, agriculture, for everything that had to be done every day and a lot. It appeared at a time when technology had to be simple, understandable and maintainable — without complex solutions and unnecessary details.

The frame was straight and strong. The engine was an inline six that didn’t require high-quality fuel and ran on whatever was available. The gearbox without synchronizers forced the driver to feel the car with literally every movement, but in return allowed it to work for years without serious intervention.

It was a truck that didnʼt promise comfort, but it guaranteed results. It was used to transport grain, building materials, firewood, people — often without a clear division of roles. The driver was simultaneously a mechanic, a loader, and responsible for ensuring that the car got home on its own.

In 1954, the world was already changing, but behind the Iron Curtain these changes came slowly. Radios were not installed in such cars, and if they were installed, they caught a few state waves. But the GAZ-51 knew its business: to drive, transport and work as much as needed. That is why it has survived to this day — not as a museum exhibit, but as a living part of transport history.

- MAZ‑500A (1966)

On-board, blue, 14.8 l

This is a different civilization. The MAZ-500A was the moment when the Soviet auto industry suddenly took a step into the future. The cab above the engine, the diesel engine, the normal carrying capacity — all of this looked almost European.

The YaMZ engine was huge, loud, and had character. It was not in a hurry, but it pulled so hard that it seemed like it didnʼt care what it was hauling — concrete, wood, or half of a collective farm.

The cabin is ascetic, but with the feeling that the driver is not just an “operator”, but a person.

- IFA W50 (1966)

Dump truck, blue, 6.6 l

East Germany, but on Ukrainian roads — as its own. The IFA W50 is a case where the socialist camp suddenly did something very successful.

Simple, but well thought out. A diesel that would start in the cold. A cabin that you could sit in, not survive in. A dump truck that actually worked, not "was registered."

It was a car without pathos, but with a reputation. Drivers loved it because it didnʼt require daily heroism. It just got the job done.

These trucks appeared in a world that was changing rapidly. While the first intercontinental rockets were being launched in the USA, rock and roll was being born in Britain, and people were watching television broadcasts from another continent for the first time, for these machines and their drivers everything was much simpler and more down-to-earth. Their universe consisted of roads without asphalt, warehouses, elevators and construction sites. Of bricks, bags of cement, apples in wooden boxes and people, who were then transported quite normally in the back — without belts, airbags and even without a roof. That was how it was done, and no one questioned it.

It is difficult for modern buzzers to imagine that the driver of that era almost always had greasy hands and smelled of a mixture of gasoline, oil and tobacco smoke. He knew his car down to the smallest detail: piston diameters, crank stroke, tolerances for adjusting the main pair in the differential. Not out of curiosity — out of necessity. Because this truck gave him work, and he, in return, kept it running. There were no service centers and diagnostic scanners here — only experience, hearing and the feel of metal.

Today, these machines seem slow, noisy, and primitive. But they were the ones who carried the post-war reconstruction, industrialization, and everyday life of several generations. And the fact that they reappear in the registers in 2025 is not a curiosity, but a reminder: sometimes technology outlives the eras in which it was created. And while the world was counting satellites in orbit, these hard workers simply did their job — day after day, kilometer after kilometer.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.