Fuel and power plants: what is the priority in the market now? Comparing 2024 and 2025

The market distribution by fuel type in 2025 is the best illustration of how tax changes and new technologies are "breaking" even the most conservative habits of Ukrainians. If diesel previously seemed like an unshakable rock, now it is rapidly losing ground under the pressure of electric and hybrids.

- Check the history of a car by VIN code before buying with CEBIA!

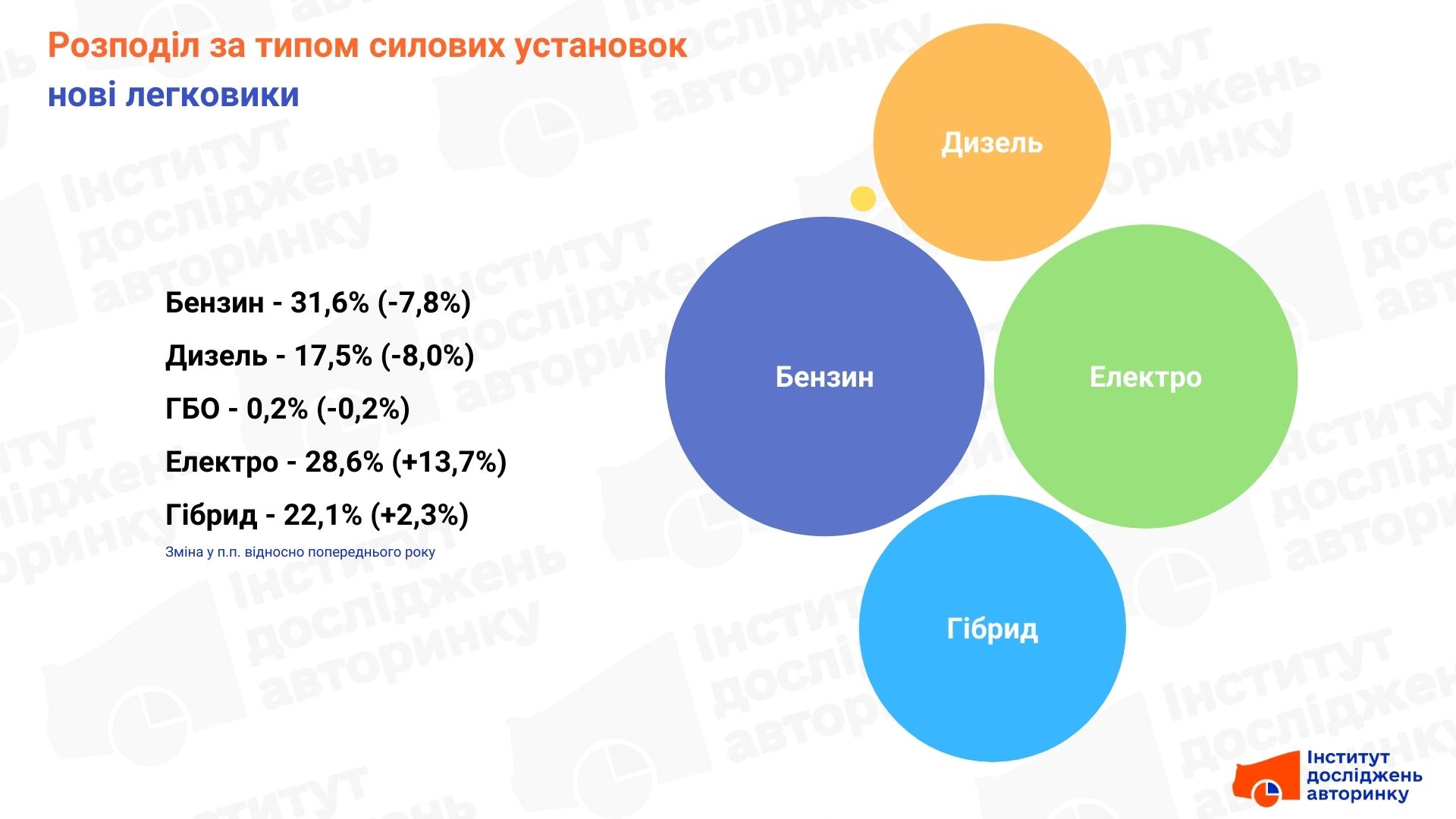

New cars: Electric-hybrid majority

The new car segment is always the vanguard of the market, and here in 2025 the picture of buyer preferences changed noticeably.

- Gasoline and diesel are at a low. The share of gasoline cars fell to 31.6% (minus 7.8% ), and diesel cars to 17.5% (minus 8.0% ). In total, they lost almost 16 percentage points of the market in just one year.

- Triumph of the “greens.” Instead, electric cars ( 28.6% ) and hybrids ( 22.1% ) now collectively account for more than half of the new car market ( 50.7% ). Electric cars showed the strongest growth — up 13.7%.

The buyer of a new car today is a person who considers not only the cost of fuel, but also the cost of ownership, at least when it comes to popular Japanese hybrids. In a few years, because it is still a mystery, we will find out whether Ukrainian buyers will learn to determine the liquidity and price on the secondary market, in particular for Chinese electric cars, which were bought in large numbers in the wake of the "VAT is returning" hype. And this is not about sarcasm — it is still really unknown how attractive (or vice versa) the same BYD will become in 3-5 years, when the time comes for their sale by the first owners.

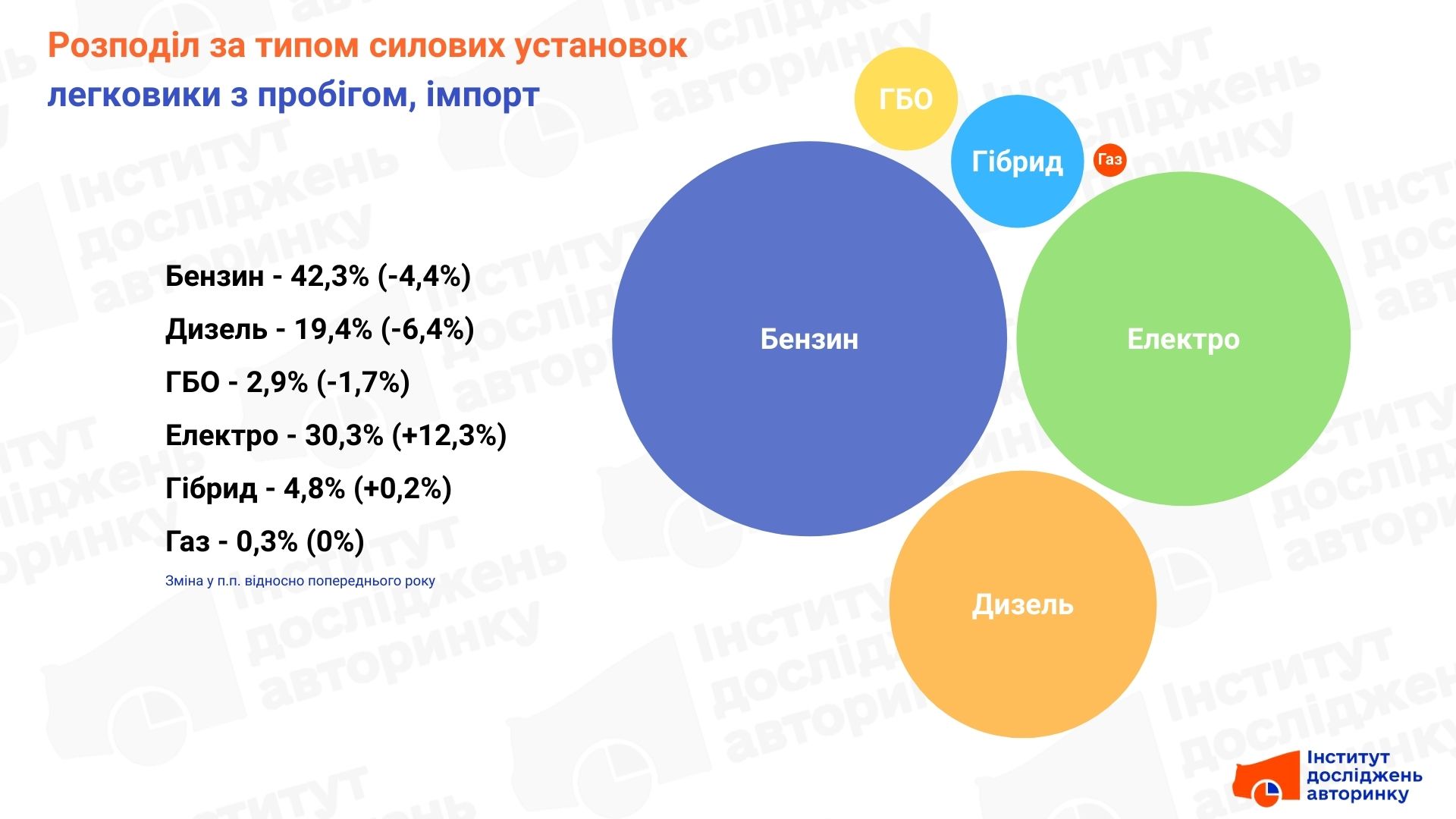

Import of used cars: The hype for electric cars

The situation is even more radical in the import of used cars, and here the main driver was fiscal policy.

- Diesel on the "parking lot". The share of diesel in imports fell to 19.4% (minus 6.4% ). Gasoline also dropped to 42.3% (minus 4.4% ).

- Electric boom. The share of electric cars has soared to 30.3%, adding an incredible 12.3% in a year. Now every third used car entering Ukraine is battery-powered.

The whole of 2025 passed under the banner of "making time for VAT". Buyers and dealers massively brought Tesla, Nissan and other used "electric cars" while the benefits were in effect. This literally washed out the share of traditional fuel from the import flow. And whether the same trend will continue this year is unlikely, because the supply of BEVs is now in excess.

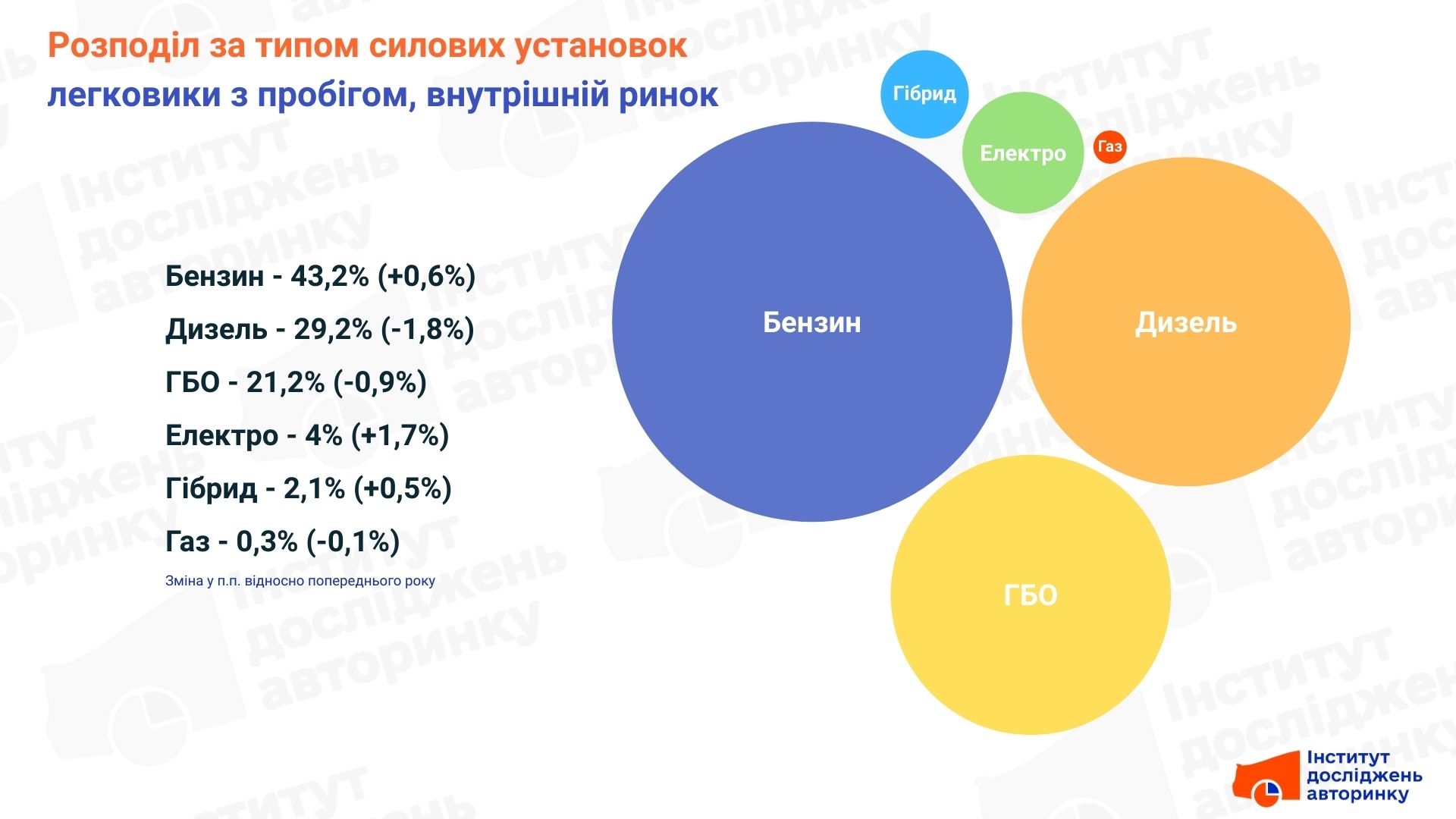

Domestic market: Everything is stable

Domestic resales change the slowest, as what circulates here is what was purchased 5, 10 or even 20 years ago.

- Gasoline stability. The share of gasoline here even increased slightly — to 43.2% (+ 0.6% ). This is explained by the fact that gasoline cars are easier and cheaper to maintain in the "secondary" market than old, complicated diesels.

- Diesel and LPG are losing weight. Diesel fell to 29.2% (minus 1.8% ), and LPG to 21.2% (minus 0.9% ). The era of "gas-petrol" as the main way to save is gradually becoming a thing of the past.

- Electricity is in the "pluses". Even here, the share of electricity has begun to grow noticeably — up to 4% (+ 1.7% ). These are the same "first swallows" of imports of past years, which began to massively change owners within the country.

Analystʼs view: Results of fuel redistribution

"We see two parallel processes. In new cars and imports, it is a rapid adaptation to new technologies and tax breaks. People massively switched to electricity, because it is profitable "here and now", and power outages did not become a more important factor than the VAT refund on imports of electric cars. However, the domestic market resembles a large inertial flywheel. Gasoline remains number one here, because it is understandable and cheap at the entrance. But look at new cars: gasoline and diesel together are already losing to electricity and hybrids. This means that in 3-5 years, when these cars enter the domestic market, the fuel structure in Ukraine will change forever. Even if we discard tax aspects, it is clear that diesel is gradually being pushed into the niche of commercial vehicles and heavy SUVs, due to the complication of engine designs ("hanging" them with "ecology"), which eliminates fuel savings at the first turn on of Check Engine."

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.