November statistics clearly delineated Ukraineʼs automotive map into three different worlds. The domestic market is increasingly going online, imports are held back at the western borders, and the new car market demonstrates the centralization of money in the capital.

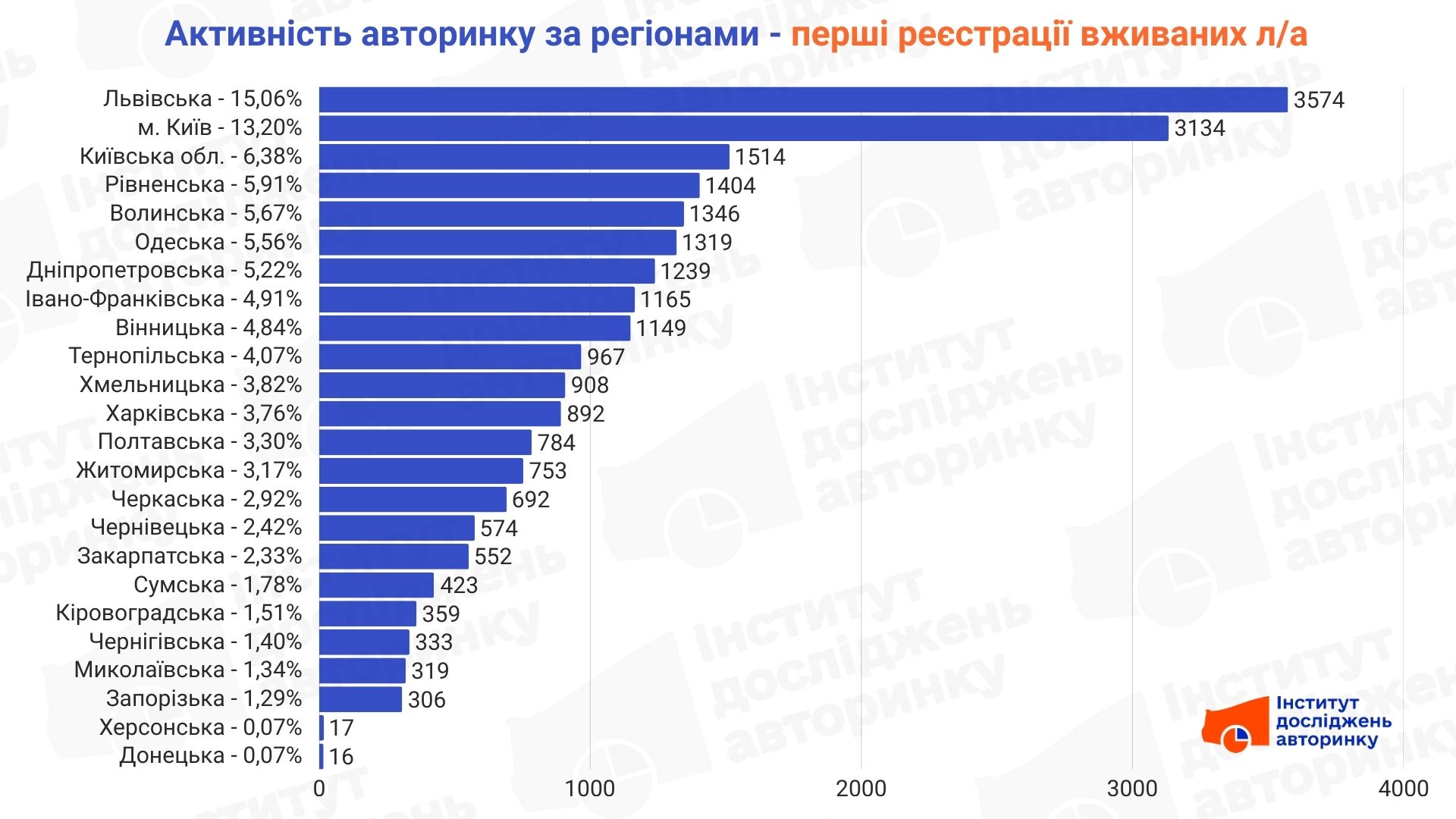

Hereʼs what the activity of Ukrainians looks like by region.

Domestic market: Diya is the largest region of Ukraine

The most interesting phenomenon of the domestic market is the leadership of a region that does not exist on the map. The re-registration service in the Diya application continues to capture the market. A quarter of all used car purchase and sale transactions are concluded online. This means that the “digital region” is now twice as large as physical Kyiv! Ukrainians vote with their smartphones for speed and no queues.

- Buying a car? Check it by VIN code now on CEBIA !

If we take into account the classic service centers of the Ministry of Internal Affairs, then the leadership is traditionally held by Kyiv. It is followed by the Dnipro region, Odessa region and Kyiv region with a solid margin. The western regions (Lviv region) close the top five, which indicates that the center of business activity of the secondary market is closer to the center of the country.

Import of used cars: Western Gate

In the segment of "driving" geography is changing dramatically. Here logistics plays the first violin. The undisputed leader is Lviv region. This is the main gateway for European and American (through the ports of Europe) imports. It is here that the lionʼs share of "freshly driven" cars is cleared and registered.

- Order turnkey cars from Europe from West Auto Hub

Kyiv ranks second, acting as the main consumer of these cars. And then we see a clear dominance of border and logistics hubs: Kyiv, Rivne and Volyn regions. It is through these regions that the main routes for the supply of used foreign cars pass, and local businesses actively earn on this. The South (Odessa) and the East (Dnipro) are inferior to their western neighbors here.

New cars: Kyiv and all others

The map of new car sales is the most accurate indicator of the populationʼs solvency. And here we see a colossal gap. The city of Kyiv takes up almost 40% of the entire new car market! That is, almost every second new car in the country is purchased in the capital. This demonstrates a significant concentration of capital in one city. The statistics also add to the fact that many leasing companies are also located in the capital and register cars at their place of residence, even if they actually drive to another region with an AA license plate.

The remaining regions lag significantly behind. Dnipropetrovsk region, Kyiv region, Lviv region, and Odessa region show stable results, but even taken together, they can barely compete with the capital in terms of car sales from the showroom.

Ostap Novitsky, a car market expert, comments:

"The regional statistics for November highlight three key trends. First, digitalization is defeating bureaucracy. The fact that Diya has covered 25% of the domestic market is a signal that finally usersʼ trust in digital services has stabilized and continues to grow. People choose comfort, and this trend will only intensify. Second, the logistical division of labor. The West of Ukraine (Lviv, Volyn, Rivne) works as a large hub for the entry of imported cars, providing them to the rest of the country. Third, financial centralization. Statistics of new cars show that "money" lives in Kyiv. The gap between the capital and the regions here is simply enormous. If the activity in the secondary market is distributed more or less evenly, then sedan cars remain the privilege of residents of megacities, primarily Kyiv, even taking into account leasing and state institutions."

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.