The light commercial vehicle (LCV) segment remains a key component of the Ukrainian car market due to its combination of practicality and economy. Compared to heavy-duty vehicles, such cars are cheaper to maintain and consume less fuel. Compact dimensions allow them to work confidently in urban conditions, and their cargo capacity makes them popular among small and medium-sized businesses. Cargo-passenger versions add versatility, allowing you to combine business trips with personal needs.

- Check the history of a car by VIN code before buying using the CEBIA service!

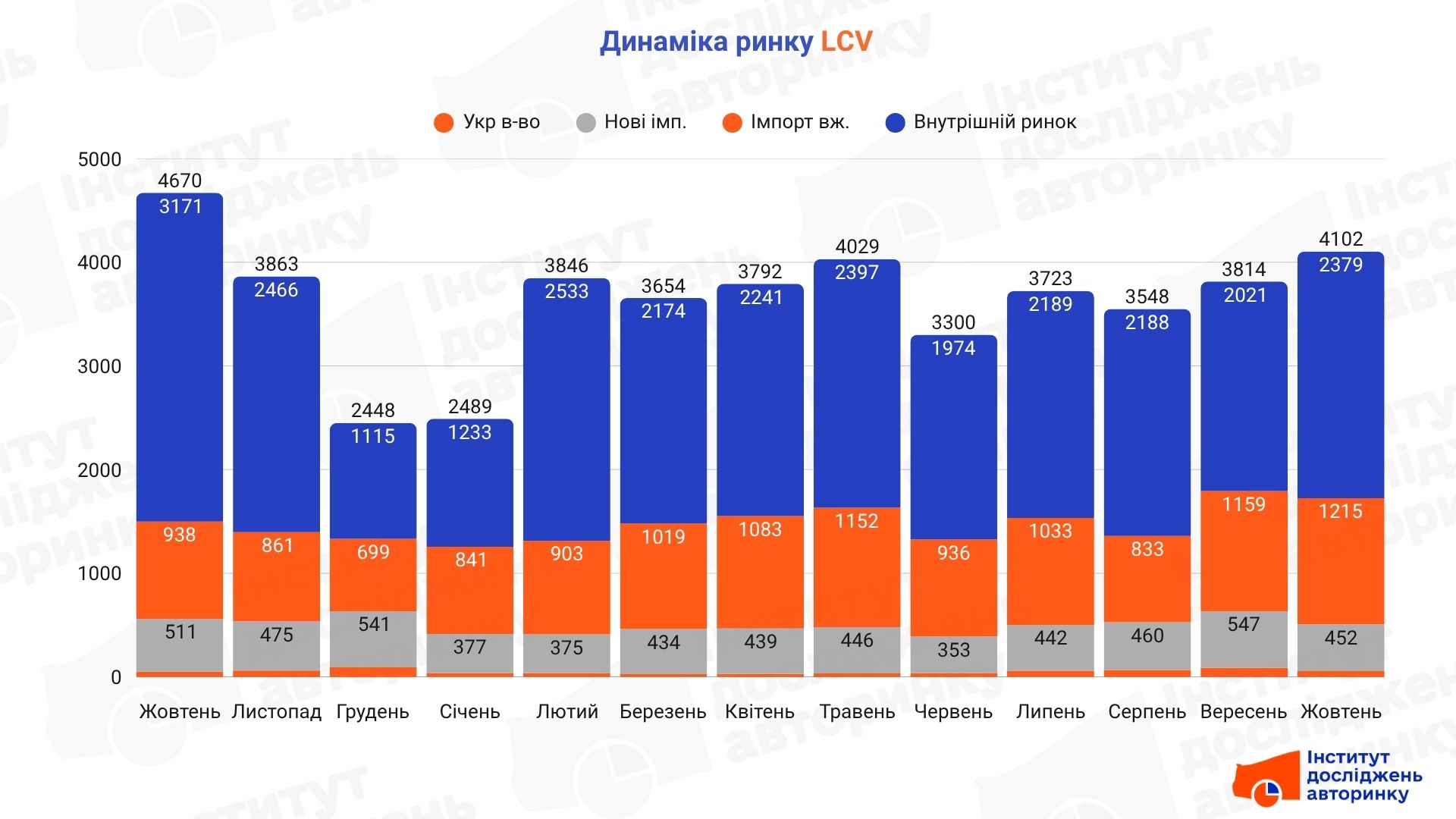

Specialists of the Institute of Car Market Research have determined the dynamics of trade in this segment, as well as the most popular types and models for each of the groups. Letʼs start with the total trade volumes. During October 2025, a total of 4.1 thousand cars of the LCV group were purchased. Compared to September of this year, this is 7.6% more. Compared to October 2024, we have a decrease in volumes of 12.2%.

Here are the dynamics by subsegments of the LCV market:

- Domestic resales: +17.7% MM, −25.0% YY

- Used imports: +4.8% MM, +29.5% YY

- New imports: −17.4% MM, −11.5% YY

- Made in Ukraine: −35.6% MM, +12.0% YY

The segment structure is as follows: the largest share, 58% — in domestic resales; 29.6% were taken by imported used light trucks, 11% — new imported, 1.4% — produced or re-equipped in Ukraine. The total share of new cars — 12.4%. Based on the size of the share of each of the subsegments, we will consider them in more detail in the same order.

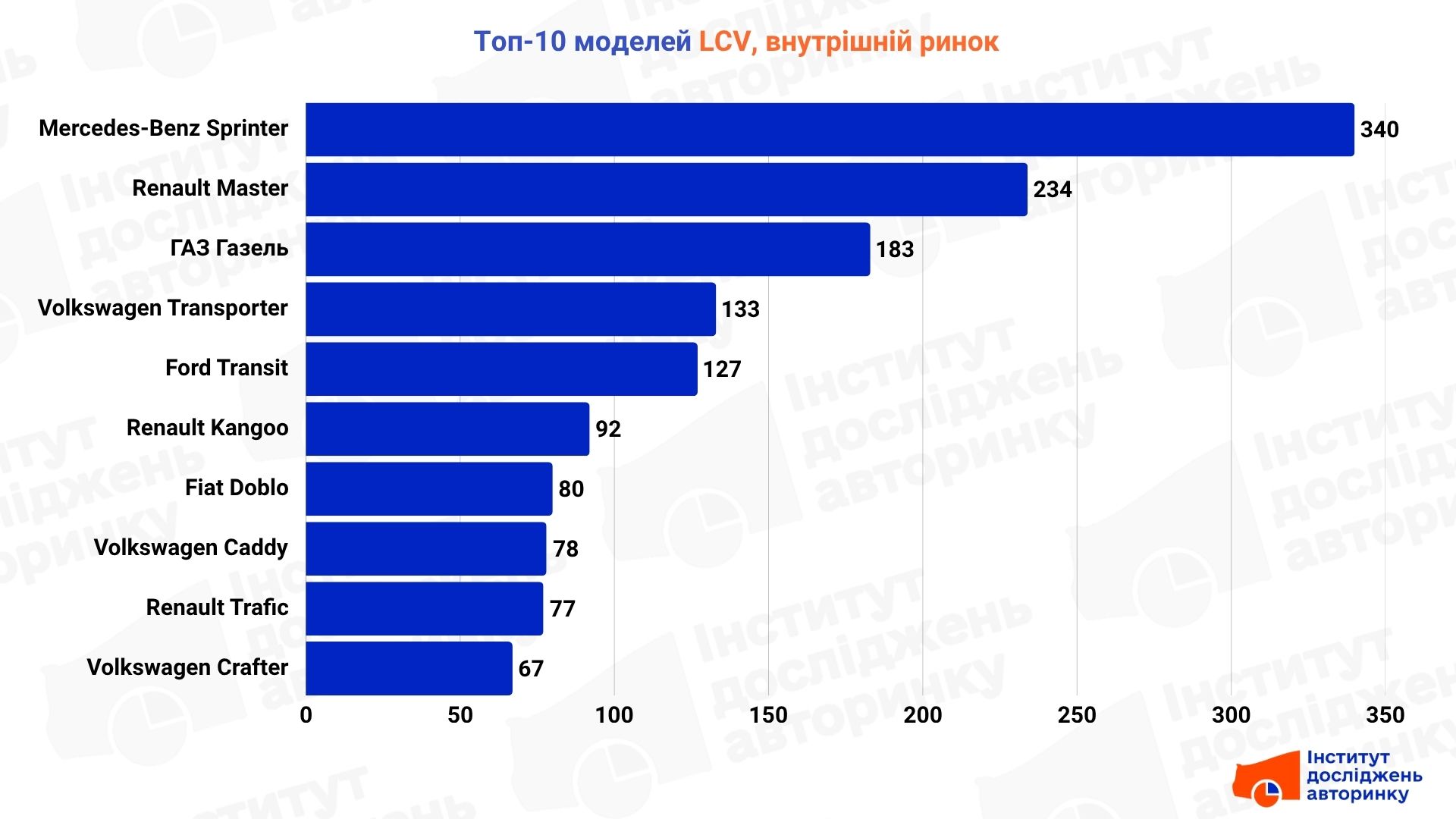

LCV — domestic market

In this part, cargo vans, which form the basis of the segment, were the most popular. Pickup trucks and flatbed versions were purchased less frequently.

A total of 2,379 purchase and sale agreements were concluded for vehicles in this segment.

In the domestic market, the leader remains the Mercedes-Benz Sprinter — a universal van with an impeccable reputation among carriers. In second place is the Renault Master, which in recent years has become a favorite of small businesses due to a successful combination of price, volume and costs. Third place is taken by the GAZ Gazelle — a kind of compromise among trucks: inexpensive at the entrance, but unpredictable in daily maintenance.

Next in the ranking are the tried-and-tested Volkswagen Transporter and Ford Transit, which remain classics for those who value a balance between resource and comfort. And in the more compact category, the consistently popular Renault Kangoo, Fiat Doblo, and Volkswagen Caddy are practical, economical, and designed for the city.

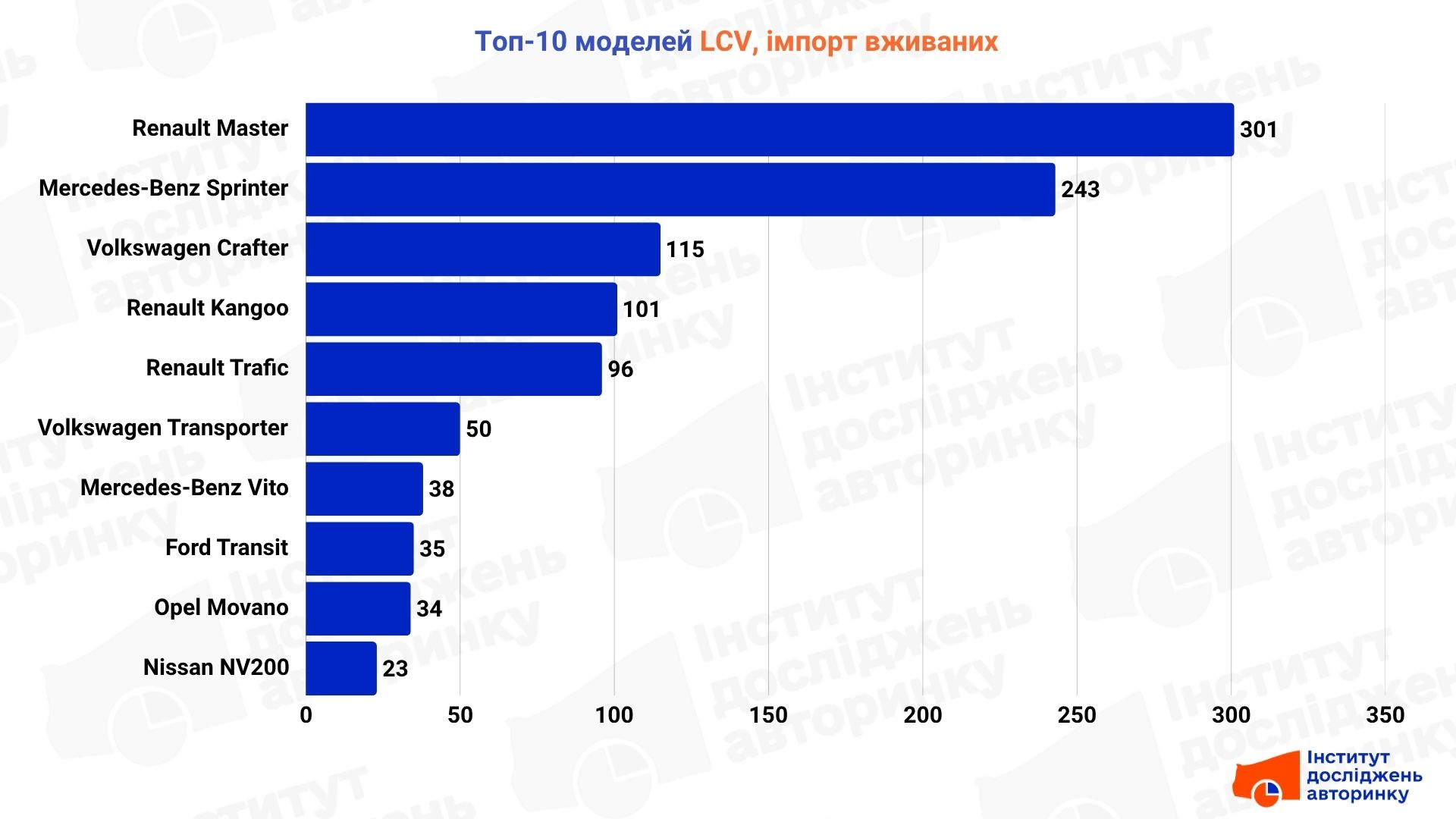

LCV — used import

In October 2025, our fleet was replenished with 1,215 LCV vehicles. Here, buyers most often chose "fitted" cargo vans, somewhat less often flatbed awning versions and refrigerated vans.

The situation on the used LCV import market is as follows: the leader remains the Renault Master — a practical and hardy van that is well adapted to Ukrainian realities. The second place is taken by the Mercedes-Benz Sprinter — more expensive, but in demand among carriers looking for a resource and brand reputation. Next is the Volkswagen Crafter, as an alternative to the German school with lower costs.

In the more compact class, Renault Kangoo and Trafic are consistently popular, which, due to their reliability and ease of operation, often become an "entry ticket" to business. In the second half of the rating are the Volkswagen Transporter, Mercedes-Benz Vito, Ford Transit, Opel Movano and Nissan NV200: proven, but less popular participants in the segment, which are often chosen on a residual basis or for a specific task.

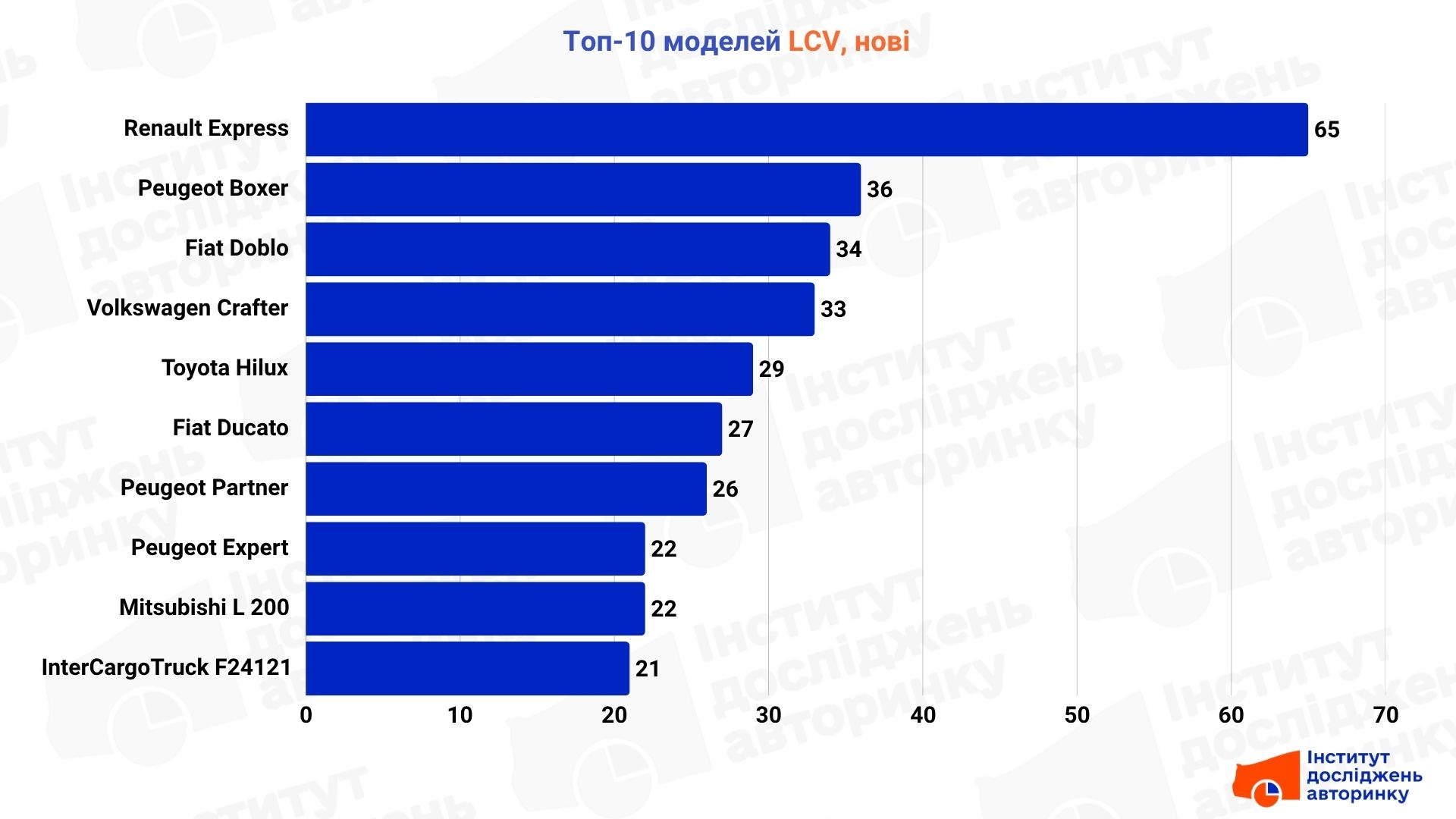

LCV — new sales

Last month, 508 new light trucks hit Ukrainian roads for the first time. Of these, 452 were imported, 56 were registered as manufactured (or converted in a factory) in Ukraine.

Among the types, vans dominate here, followed by pickup trucks and refrigerated vans.

In the segment of new light commercial vehicles, the leadership is held by Renault Express — a simple and affordable work tool, which has displaced the former Dokker from its niche. Next are Peugeot Boxer, Fiat Doblo and Volkswagen Crafter — popular among corporate clients who appreciate proven solutions from European manufacturers. Also in the top five is Toyota Hilux — a pickup for those who need endurance and all-wheel drive. However, it is only a few cars behind another pickup, also tested by time and off-road — Mitsubishi L200.

Fiat Ducato, Peugeot Partner and Expert complete the middle part of the rating, demonstrating stable demand for the "French-Italian" school of commercial vehicles. And the locally produced InterCargoTruck F24121 shows that in the new LCV segment, buyers are looking for a variety of vehicles, including those converted by local companies.

Summing up this review, it is worth paying attention to an interesting point, which will be commented on by automotive expert Ostap Novytsky: “ A stable demand for electric vehicles in the LCV segment is beginning to emerge. If in previous months we saw literally units of this group of electric vehicles in statistical sections, then in October their number became quite noticeable: 132 units among the first registrations of used ones, and 37 new trucks of the LCV family.

Among the "freshly imported" ones, the most frequently imported were Renault Kangoo ZE and Nissan eNV200 — models that have been on the market for a relatively long time and their prices have "matured" to a level that suits buyers. Larger models such as the MB e-Sprinter are also appearing, although still in small numbers, but at one time the import of a Tesla sedan was also an event that almost all automotive publications in Ukraine wrote about. Among the new electric vans, the most frequently purchased were the Peugeot E-Expert and E-partner, and the Maxus E-Deliver van can also be included in the top three. So in the near future, as the prices for electric trucks become more affordable, more and more of them will be purchased — in particular, those businesses that use them for the so-called "last mile delivery", where there is no need for long distances and diesel loses its advantages.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.