The market for passenger trailers (with a gross weight of up to 750 kg) demonstrated stable growth in the third quarter of 2025. In total, 5,644 new trailers manufactured by local enterprises were registered, which is 5.7% more than in the same period in 2024, when this figure was 5,339 units. The key feature of this segment remains the almost complete dominance of Ukrainian-made products, which makes it unique in the domestic automotive market.

Market dynamics

During the third quarter, sales peaked in July, when 1,998 trailers were sold. In August, the figure decreased slightly to 1,894 units, and in September the market recorded 1,752 registrations. Despite a slight decrease in activity at the end of the quarter, the overall figure indicates stable demand.

Market structure: focus on Ukrainian production

Unlike other segments of our car market, the trailer segment is almost entirely supplied by domestic production. In the market structure for the third quarter of 2025, 86.7% were new trailers manufactured in Ukraine.

The share of imports is minimal: both new and used imported trailers accounted for only 0.2% of the market each. The remaining 13.9% is accounted for by domestic resales of used trailers. This structure explains why the analysis of used equipment imports for this segment is not representative — the market is almost completely self-sufficient.

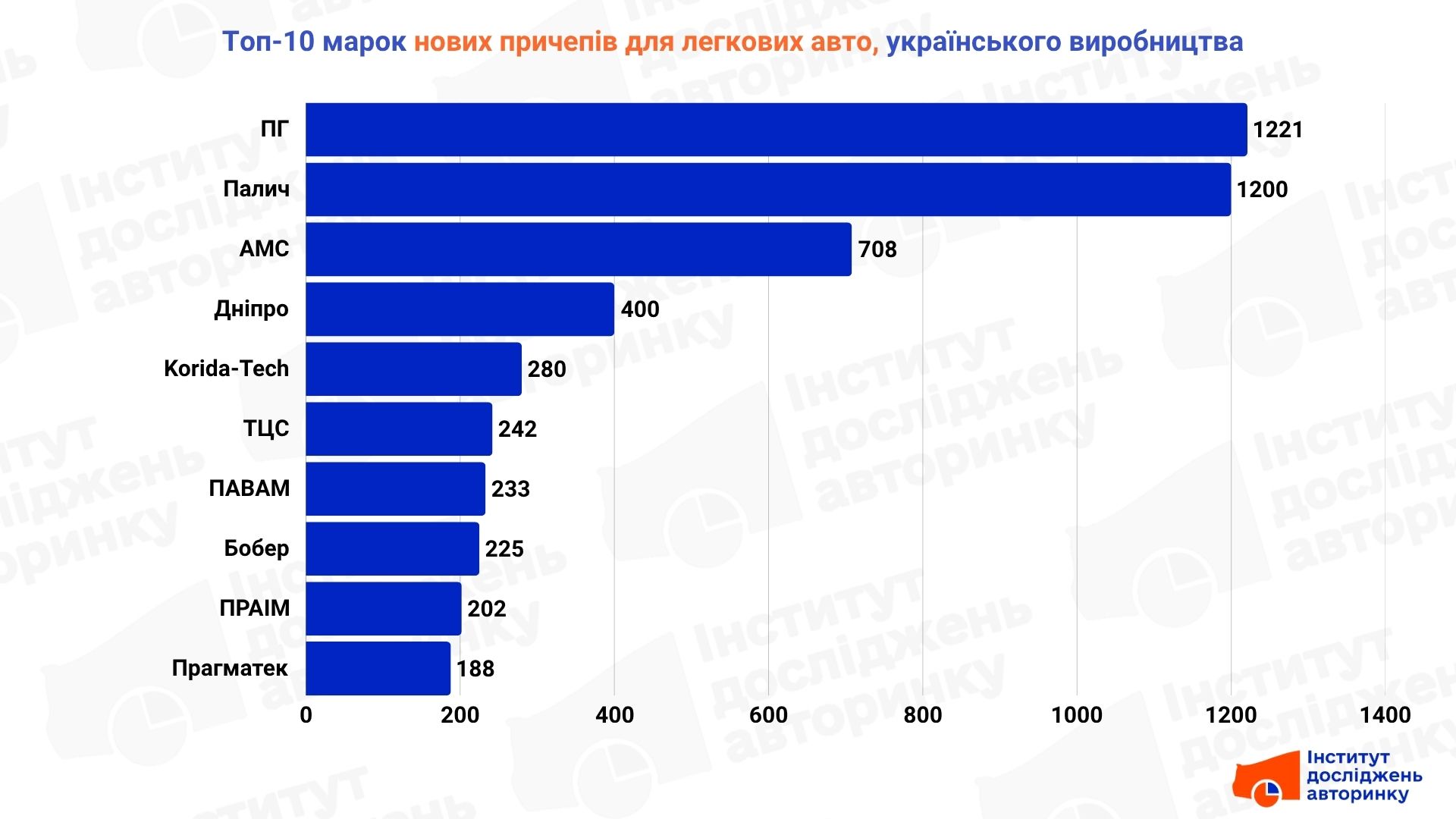

Competition among Ukrainian manufacturers remains high. The market leaders in the third quarter were two brands, which are almost on par:

- PG (LLC «MP Trailer Plant», Glukhiv) — 1221 pcs.

- Palych (LLC «NVP-Palych», Kyiv) — 1200 pcs.

Other brands that made it into the Top 10:

- AMS (Agromotorservice LLC, Starokostyantyniv) — 708 pcs.

- Dnipro (Cortes-2015 LLC, Kremenchuk) — 400 pcs.

- Korida-Tech (LLC «Korida-Tech», Vlasivka village, Kirovohrad region) — 280 pcs.

- TSC (LLC «T-Center Service», Tyvriv town, Vinnytsia region) — 242 pcs.

- PAVAM (LLC SPE «PAVAM», Irpin) — 233 pcs.

- Beaver (Avtotorg LLC, Kremenchuk) — 225 pcs.

- PRIME (Prime-Trailer LLC, Kyiv) — 202 pcs.

- Pragmatek (PP «Pragmatek», Lutsk) — 188 pcs.

The most popular types of trailers

Market demand is concentrated mainly on universal models. The «On-board» type leads by a large margin, accounting for 4,803 registrations, which is about 85% of the total.

The rest of the segment is represented by highly specialized types:

- For transporting boats — 415 pcs.

- Platform — 204 pcs.

- Van — 101 pcs.

- Trading — 59 pcs.

- For the transportation of motor vehicles — 46 pcs.

- Others (flatbed-tilted, rolling cart) — 16 pcs.

Conclusion

The Ukrainian car trailer market showed positive dynamics in Q3 2025, confirming its stability and focus on the domestic manufacturer. Demand remains stable, adjusted for seasonality, and the market structure demonstrates minimal dependence on imports, which is an exceptional phenomenon for the Ukrainian car market.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.