The distribution of fuel types in the Ukrainian passenger car market shows noticeable changes. While gasoline previously remained the undisputed leader, now more and more drivers are paying attention to electric cars and hybrids. An analysis of three segments — the domestic market, used car imports, and new car sales — shows different rates and nature of changes.

Domestic market

In the domestic market, the structure remains quite conservative, demonstrating high stability. Gasoline maintains its leadership with a share of 43.0% unchanged. Diesel ranks second ( 28.5% ), showing a slight decrease (-0.6 pp). The most important shift here is in favor of alternative options: LPG continues its slow but steady growth ( 21.2%, +0.3 pp), and the share of electric vehicles has increased to 4.9% (+0.2 pp). This indicates a gradual but continuous saturation of the market with used electric vehicles.

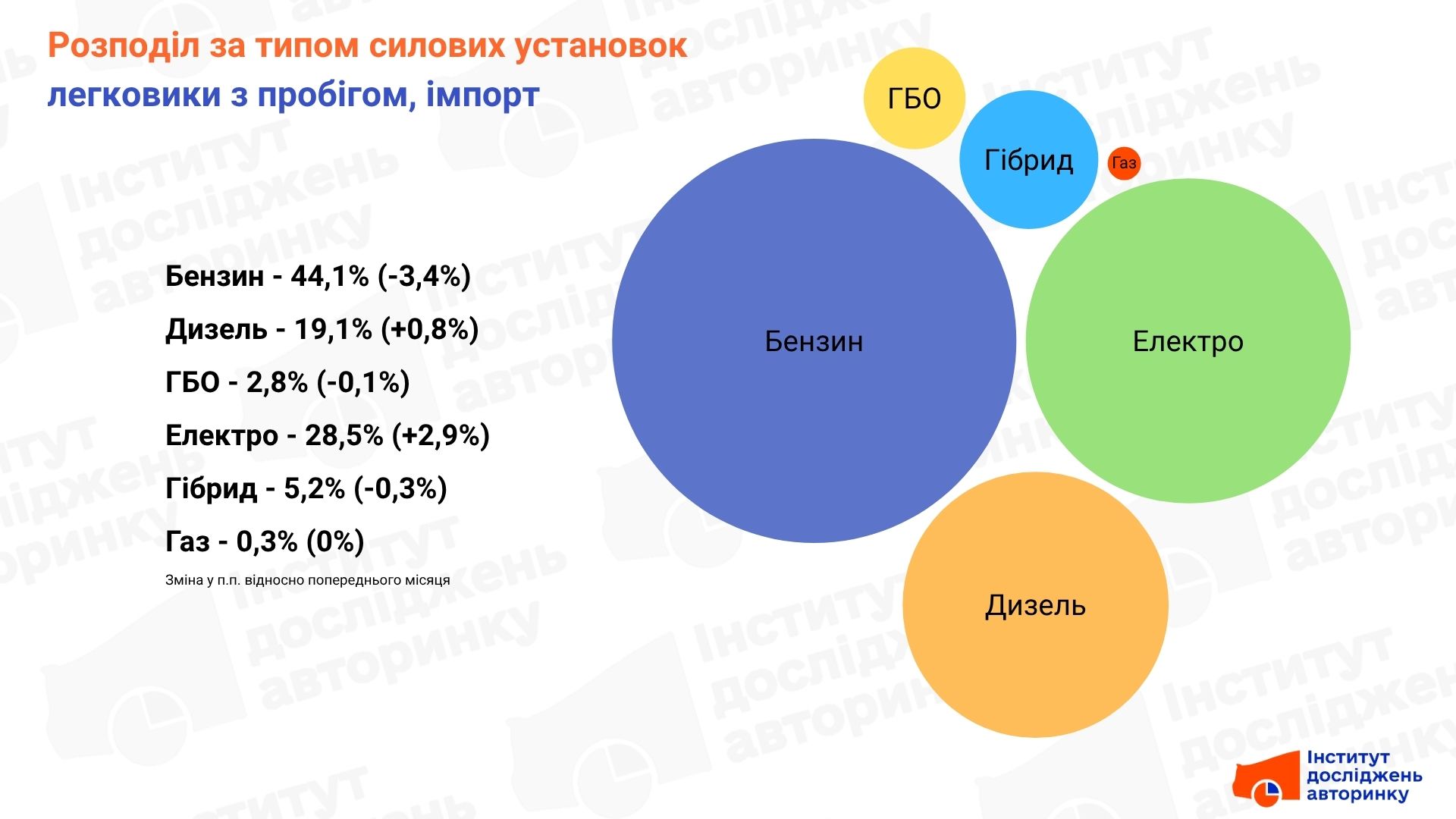

Import of used

This segment is the main driver of changes in the countryʼs fuel picture. The share of gasoline cars, although remaining the largest ( 44.1% ), showed a significant drop (-3.4 pp). Instead, there was a sharp jump in the popularity of electric cars, whose share reached 28.5% (+2.9 pp). This is an absolute maximum, which confirms that electric models are the main target for newly purchased cars — at least while the approaching VAT clearance stimulates buyers. Diesel stabilized at 19.1% (+0.8 pp), and hybrids ( 5.2% ) slightly lost their positions, which is a consequence of direct competition with full-fledged electric cars.

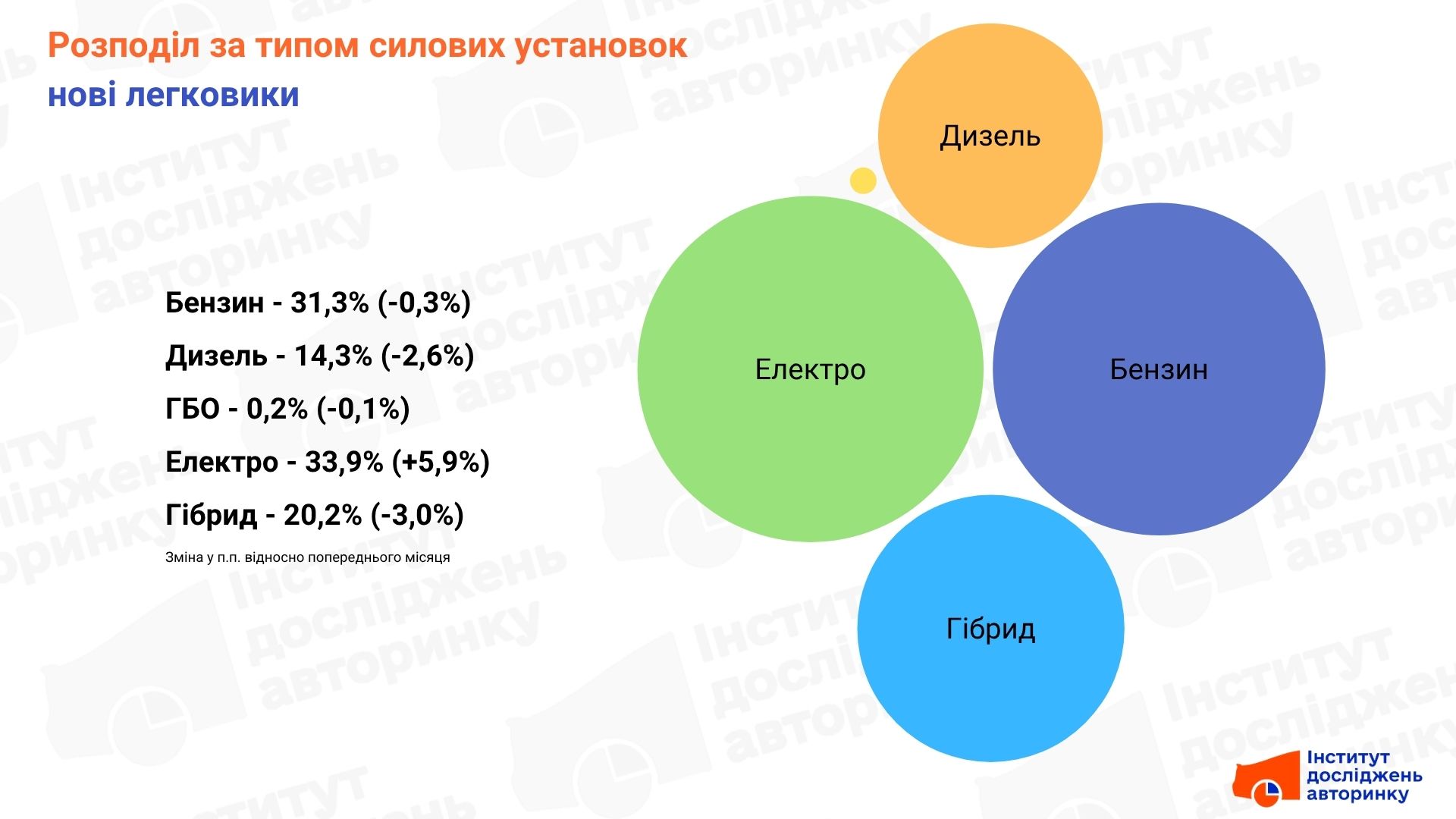

New passenger car segment

Here the most dramatic changes took place: for the first time in history , electric vehicles (33.9%) gained absolute leadership, demonstrating phenomenal growth (+5.9 pp!). This is a direct consequence of the aggressive expansion of Chinese manufacturers, which we saw in the Top 10 brands of new electric vehicles, and, of course, the approaching date from which VAT on EA customs clearance will be refunded. Against this background, the share of traditional gasoline ( 31.3% ) and hybrids ( 20.2% ) decreased, and diesel suffered the greatest blow, sinking to 14.3% (-2.6 pp).

September was the month of triumph for electric vehicles in the new car segment, where they first took the leading position, and their further consolidation in the used car import segment. These trends indicate an irreversible reformatting of the fuel structure of the Ukrainian car fleet towards electrification.

However, this hype has a clearly defined expiration date. The rapid growth, especially in imports, is largely stimulated by the expiration of tax benefits. From January 1, 2026, VAT on customs clearance is expected to be refunded, which will automatically increase the final price of these cars by at least 20%, and in fact more, taking into account the supply chain.

Thus, Septemberʼs records are not only confirmation of high demand, but also the marketʼs reaction to the upcoming price increase. There is an active desire of buyers and importers to take advantage of the last window of opportunity while the import of electric vehicles remains as profitable as possible. This is the key driver that dictates the market dynamics in the last quarter of this year.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.