In this article, we will look at two related segments that cover used passenger electric vehicles — imports (first registrations, an indicator of fleet replenishment), and domestic resales (“secondary”, an indicator of the turnover of such cars within the country). Letʼs start with the first registrations of “freshly driven” cars.

Electric vehicles — import

The share of "freshly driven" cars among all electric cars on the market as of September 2025 was 53.4%, that is, more than half, and, accordingly, more than the other two segments combined — sales of new and domestic resales of used electric cars. More about this in a separate review.

In total, over the past month, the Ukrainian car fleet was replenished with 6,473 BEV (Battery Electric Vehicle) passenger cars with mileage.

- Order turnkey electric cars from West Auto Hub

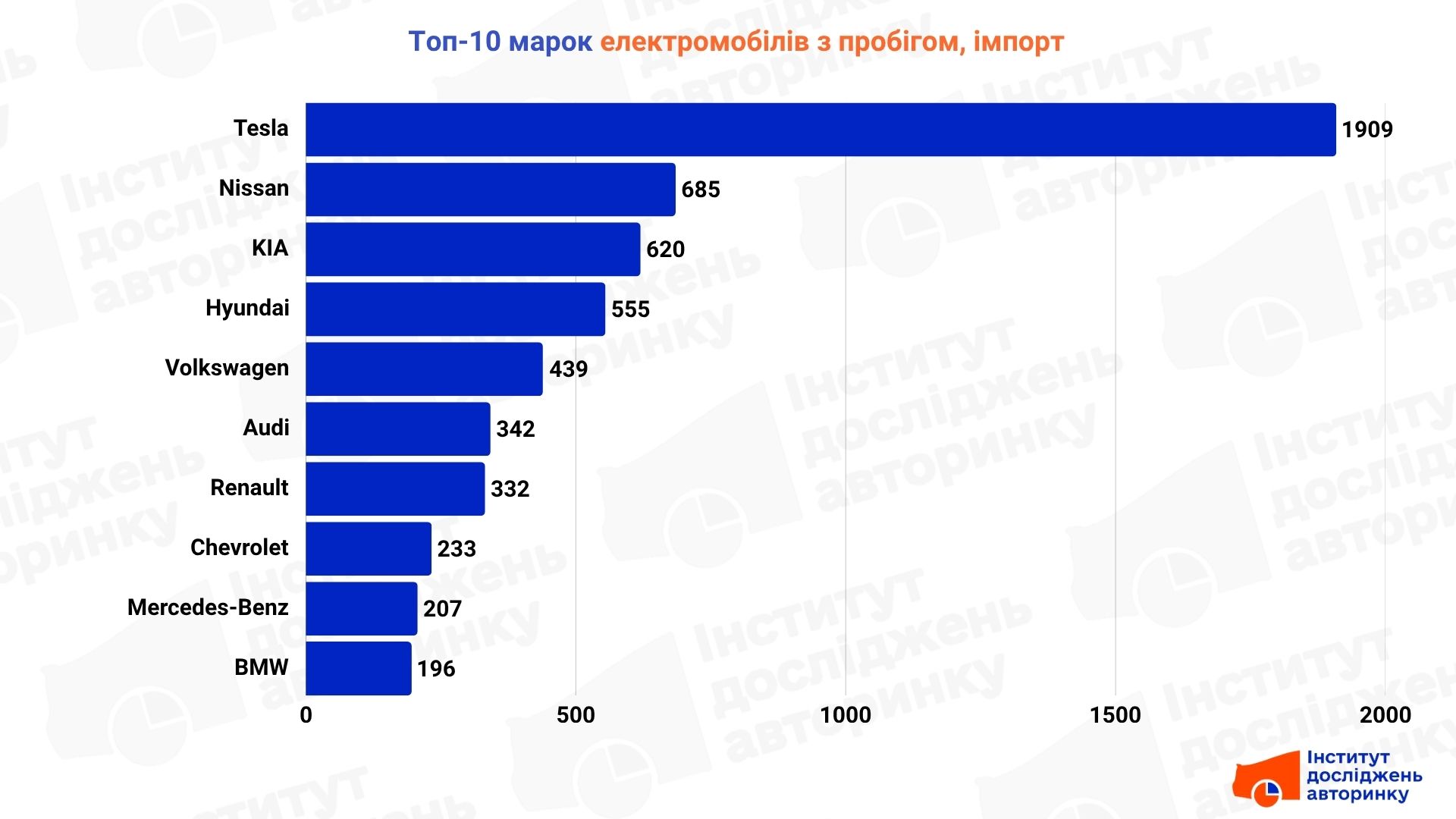

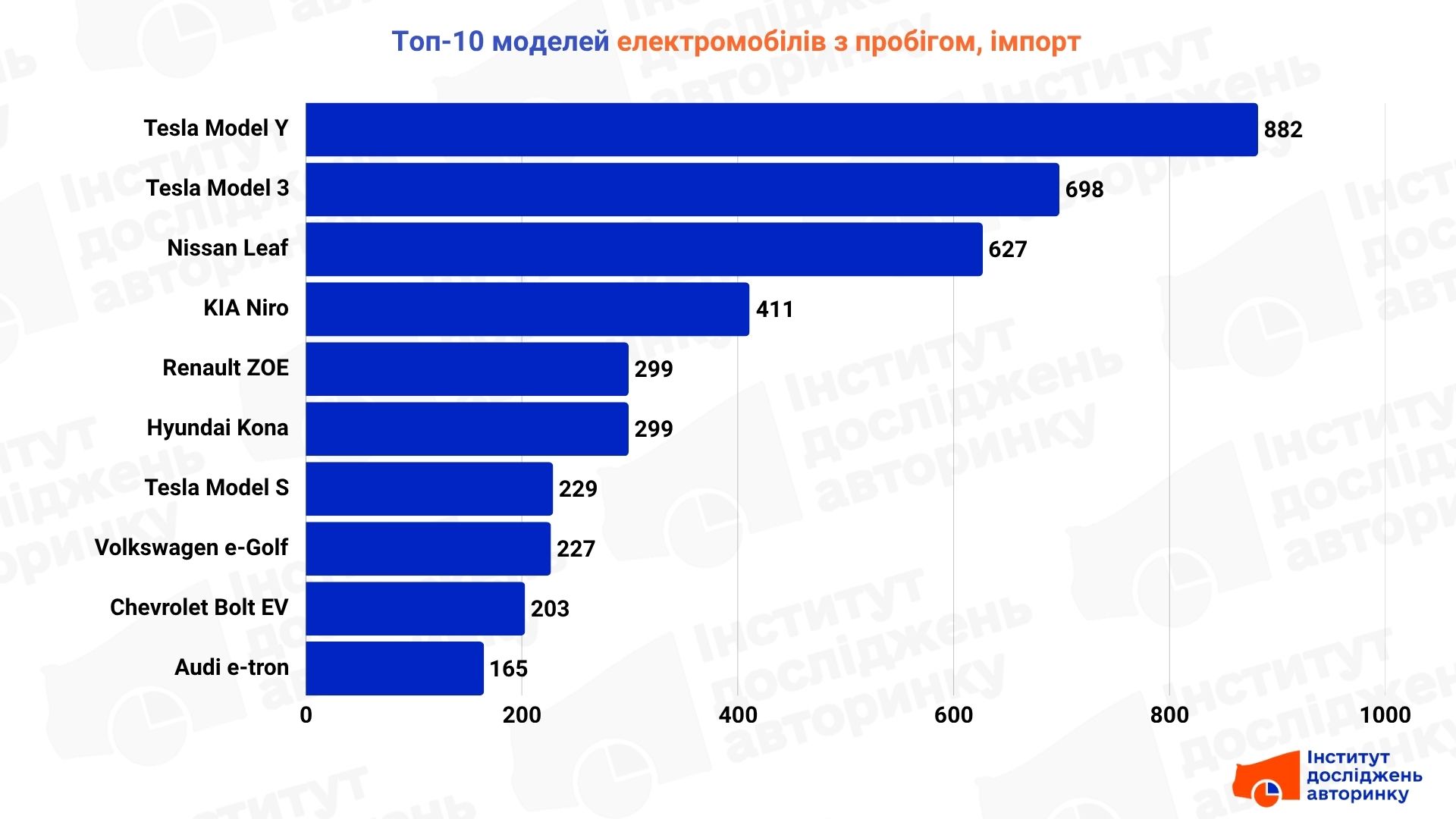

September in the market of used cars that replenished the Ukrainian car fleet demonstrated the steady dominance of traditional import leaders, but with a clear emphasis on the premium segment. Tesla absolutely dominates, leading the rating of brands (1909 units) and models. Two models — Model Y (882 units) and Model 3 (698 units) — account for almost all imports of the American brand. This pair of models became the main driving force in replenishing the car fleet with used cars. The Top 10 models also include Model S (229 units), confirming that buyers are now choosing not only mass, but also flagship models.

Behind the leader, a familiar picture is observed. The mass segment is represented by three unchanged favorites. Nissan (685 units) and its legendary Leaf (627 units) once again confirm their position as the most affordable and popular newly launched cars for the mass consumer. KIA (620 units) with the Niro model (411 units) and Hyundai (555 units) with the Kona crossover (299 units) demonstrate stable demand for high-quality, but more modern cars. This also includes Renault ZOE (299 units) and Volkswagen e-Golf (227 units), which remain popular due to their compactness and simplicity.

Special attention is paid to the premium quartet in the second half of the brand ranking: Audi (342 units), Mercedes-Benz (207 units), BMW (196 units) and Chevrolet (233 units). These brands provide a significant volume of imports, offering used cars with high residual value. In the Top 10 models, this segment is represented by the Audi e-tron crossover (165 units) and the already mentioned Tesla models.

The general trend for September is clear: the used car market is divided between Teslaʼs absolute leadership in the premium segment and steady demand for affordable Asian and European models, traditionally imported from America and Europe.

The average age of electric cars arriving in our country last month was 4.7 years — the lowest value among all segments of our used car market.

Electric vehicles — domestic market

As of September 2025, the share of domestic resales in the passenger electric vehicle segment was 29.3%, and the total number of passenger cars of the BEV group that became the subjects of purchase and sale agreements in the domestic market was 3,552 units.

- Check the history of a car by VIN code before buying using the CEBIA service!

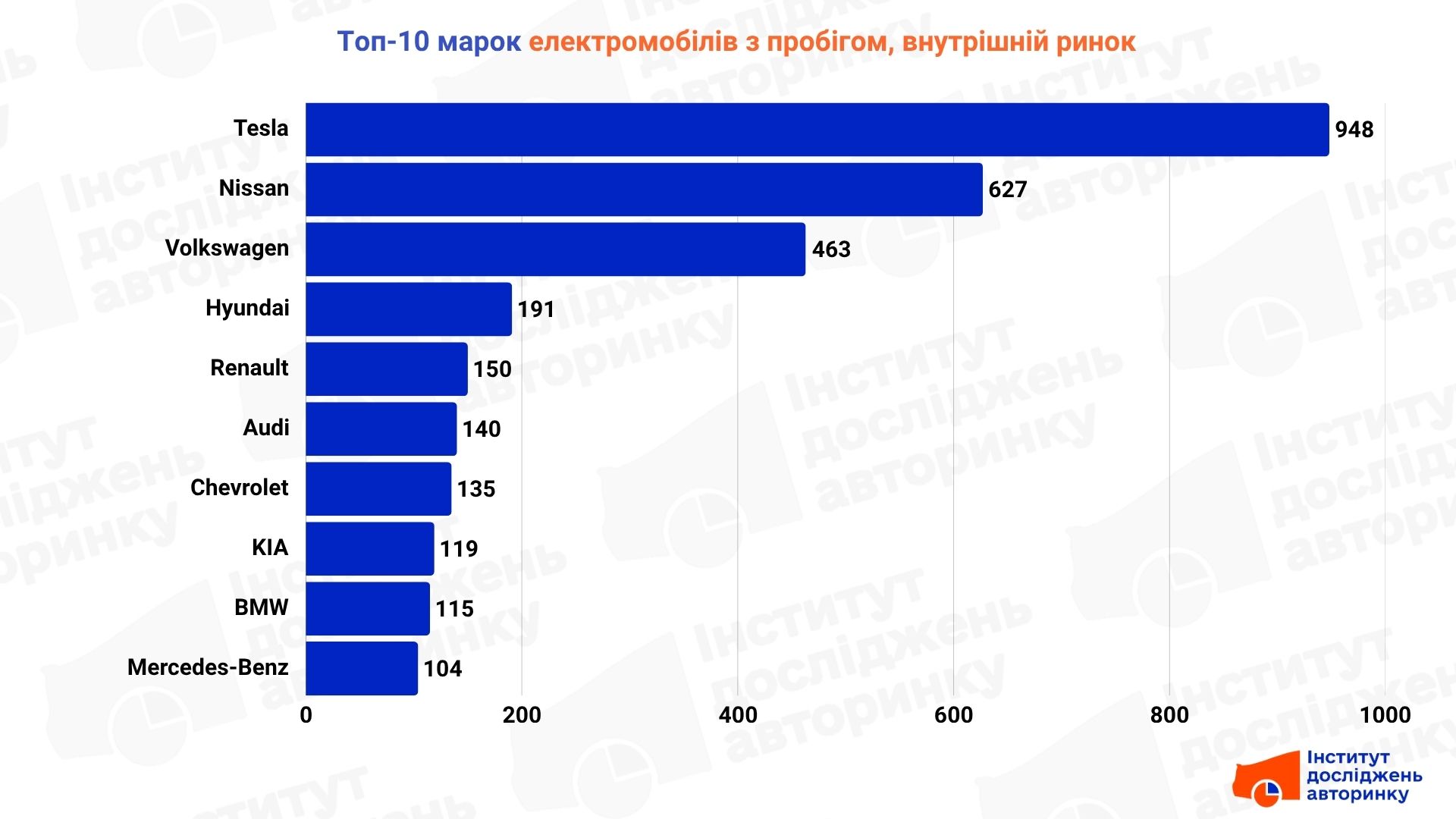

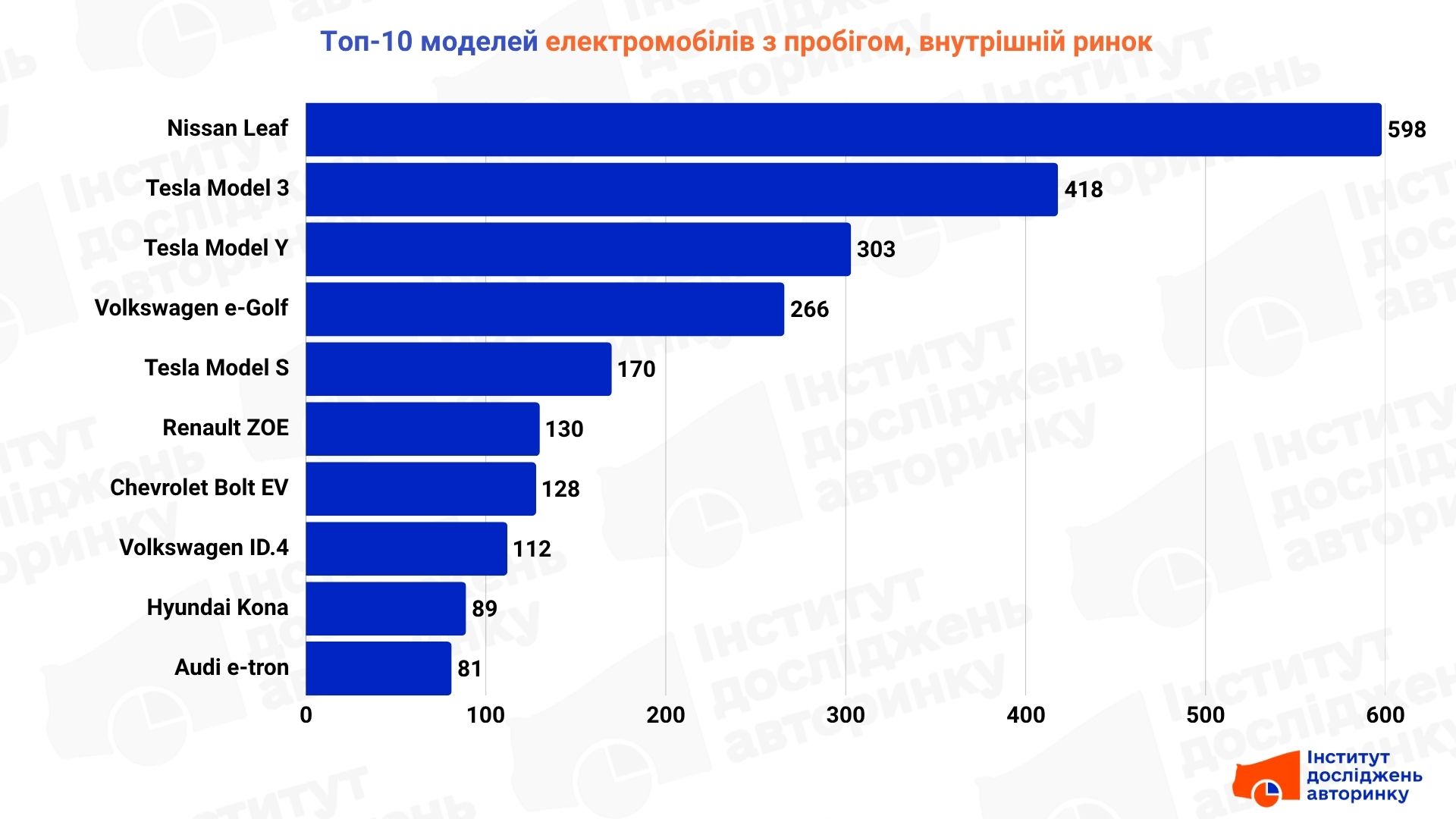

Analysis of the domestic resale market for used pure electric vehicles in September shows that leadership and stability are the main values for owners. Tesla leads the brand rating (948 units) due to high liquidity and stable demand. The Model 3 sedan (418 units) turned out to be the most popular of the family for domestic resales, while the Model Y (303 units) and Model S (170 units) also provided a significant volume of transactions. This confirms that the American brand has the highest liquidity and is most actively “flowing” among Ukrainian owners.

In the mass segment , Nissan (627 units) and its unchanged Leaf (598 units) remain the absolute champions of domestic resales. This car, most likely, acts as a “first step” into the world of electric cars, which most often changes owners.

In the middle of the ranking, key positions are occupied by reliable European and Korean brands. Volkswagen (463 units) has gained ground thanks to the e-Golf model (266 units), which remains popular in domestic circulation due to its simplicity. The Volkswagen ID.4 crossover (112 units) is also present in the Top 10 models, which indicates the beginning of an active exchange with newer models imported earlier. Renault (150 units) with the ZOE model (130 units) and Chevrolet (135 units) with the Bolt EV (128 units) demonstrate stable, albeit moderate, demand.

The premium segment is very active: Audi (140 units), BMW (115 units) and Mercedes-Benz (104 units) are confidently included in the Top 10 brands in terms of resale. This indicates that owners of expensive electric cars are actively updating their fleets or that these cars are quickly finding new connoisseurs in the domestic market, maintaining high investment attractiveness. In the model rating, the Audi e-tron (81 units) confirms this trend.

In general, the domestic resale market demonstrates high liquidity for Tesla and Nissan, as well as growing activity in the exchange of newer and premium cars that have already become popular in Ukraine.

Finally, we would like to add that the electric vehicle segment remains the youngest in the secondary market as well — the average age of cars resold last month was 6 years. This is significantly less than the overall used car market, which is currently around 16 years old.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.