Currently, the Ukrainian car market is witnessing the so-called “second wave of Chinese cars.” The first one was around 2005-2008, when individual importers imported brands that were new to our motorists, such as Chery, Geely, Lifan, and the like. At that time, these were mostly gasoline versions, the main advantages of which were relatively low prices, a wide range of options from basic trim levels, and sometimes automatic transmissions and all-wheel drive.

However, over time, and not too long, it turned out that these cars have a low resource, reliability, corrosion resistance of the body, sometimes problems with spare parts. Therefore, they did not gain global favor among Ukrainian motorists. Of all the variants sold before the 2008 crisis, only a few copies remain on the secondary market to this day, and for these reasons we will not review the domestic market.

And what does the “second wave” mean? This is a different set of brands and models, consisting not only of purely local brands, but also of contract relocated cars of European, Japanese or American manufacturers, among which electric cars predominate. If during the first attempt the Chinese relied on low prices, now they are trying to compete with other means: advanced traction batteries that provide a fairly solid range, modern multimedia systems, a wide range of driver assistants and passenger comfort features. In addition, some specimens have a progressive design and very competitive characteristics.

Ultimately, how all this will again show itself in time, which is very important for the Ukrainian buyer, we will see later, when sufficient operational experience is gathered. Now letʼs look at which new and used passenger cars manufactured in China passed their first registration in the 12 months of 2024.

The trading volumes for such cars were not entirely uniform throughout the year, here is the dynamics of trading and first registrations over the past year:

New cars from China

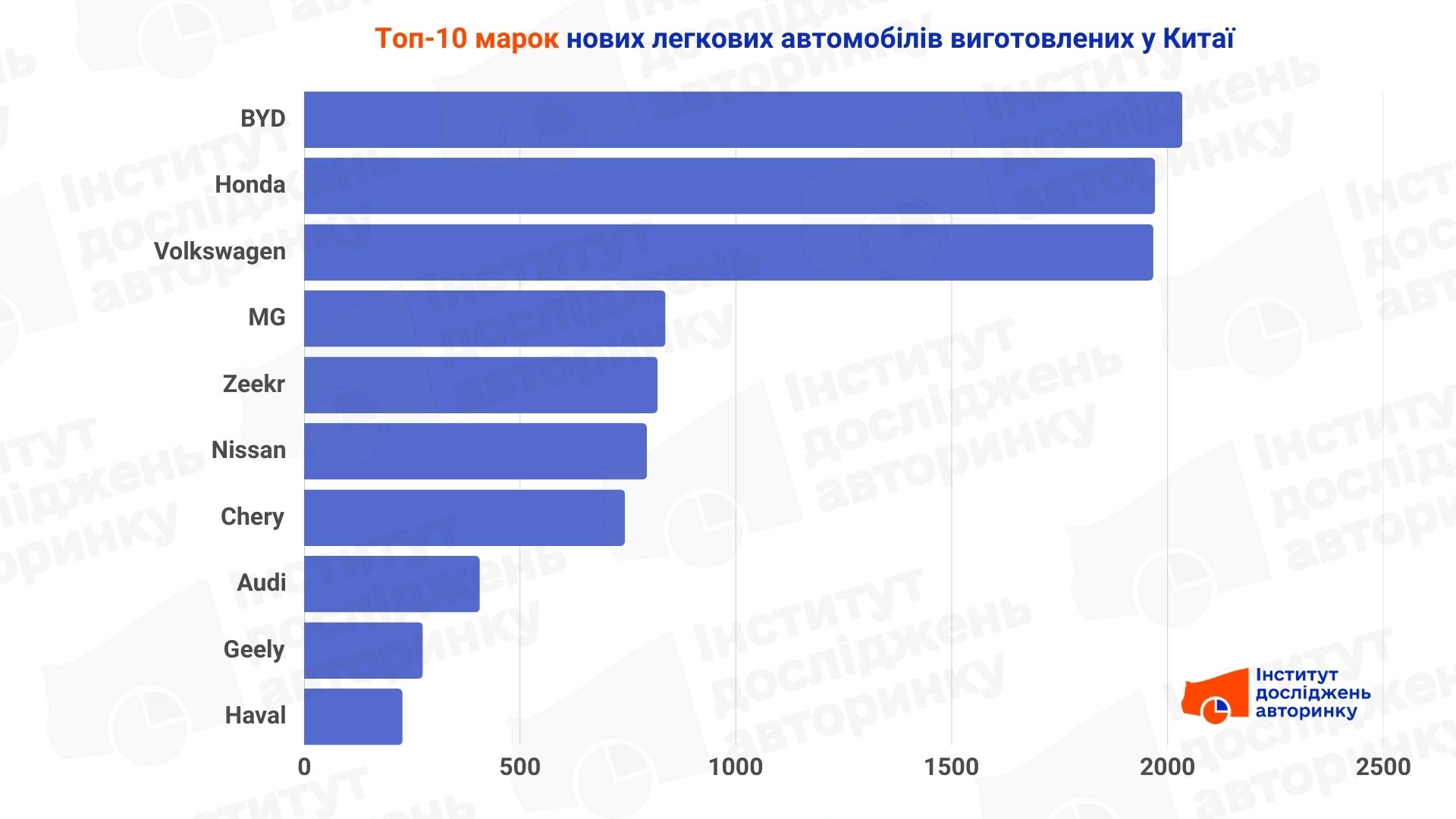

Last year, the Ukrainian car fleet was replenished with 10,974 cars with the “Made in China” plate. This is a share (if we take into account only general-purpose cars, without specialized ones) of 16.7%. And this is a significant figure, because there are many import directions. What brands were imported most often?

The top three are clearly visible in the diagram: the leader was the local brand BYD, with 2,034 cars. Second place was taken by contract products, which are sold here with the Honda logo — 1,971 such cars were purchased. Third in the standings is Volkswagen, which is mostly imported by independent dealers, with a total of 1,967 cars.

Regarding individual models, the picture is as follows:

The most popular in our market in the segment of new passenger cars according to the results of 2024 was the Volkswagen ID.4. All variations of this crossover were registered as new 1601 units. The second position is held by the Honda M-NV, 1294 units. The third is the BYD Song Plus, a stylish crossover with an “adult” battery of as much as 87 kWh, and a starting price of $26,000.

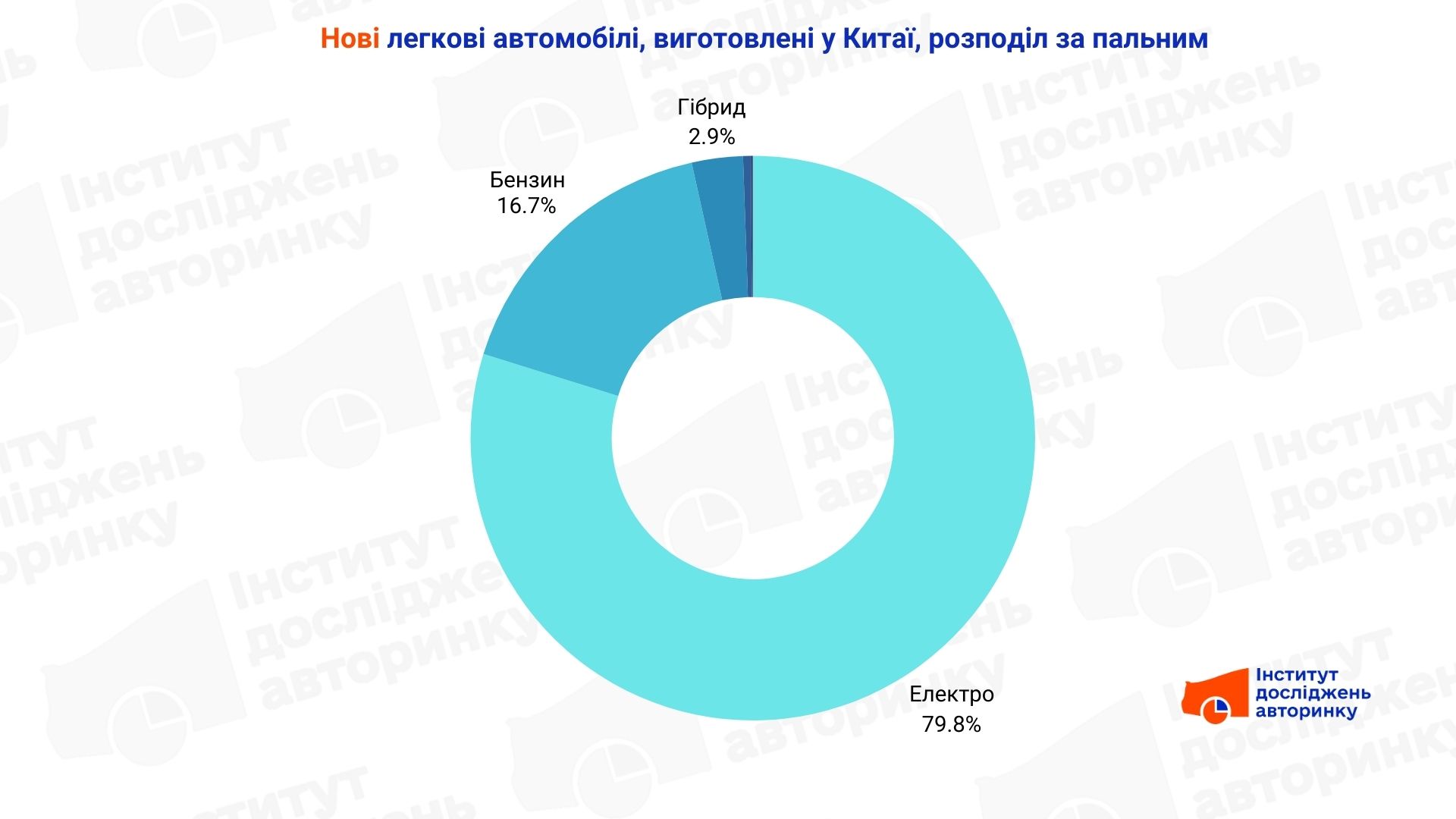

Next, letʼs look at the picture by fuel — which new cars made in China were most often purchased new in Ukraine last year.

Almost 80% here are electric cars, there were also a few gasoline cars (16.7%), the remaining small shares were divided between versions with hybrid power plants, diesel and equipped with LPG.

Import of used cars from China

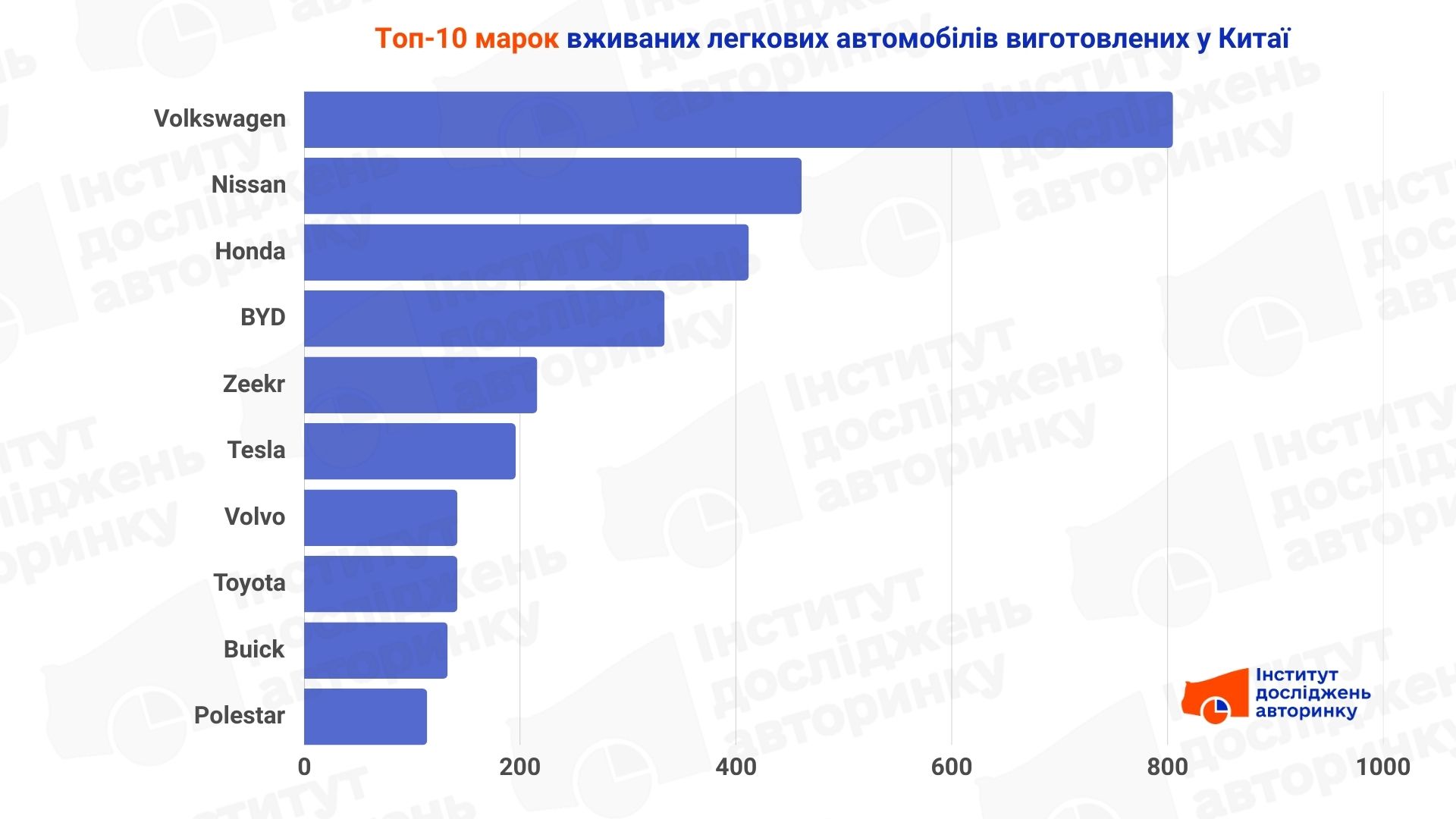

Among used cars, the popularity of "Chinese" cars is much lower than in the primary market. Here are the results of last year: in total, 3,638 such cars were first registered, which gives a share of 1.6% of all new arrivals in 2024. And here it is important to make a remark about their "usefulness" — if the average age of imported cars is 10 years, then those from China are only 3.3 years old.

In the same sequence as we examined new cars, letʼs look at the picture of used car imports. Letʼs start with the brands:

Here, Volkswagen is in first place, with 805 units submitted for first registration. With a significant gap from it, Nissan is in second place with a result of 461 cars. Honda is in third place, with a result of 421 first registrations of cars with mileage.

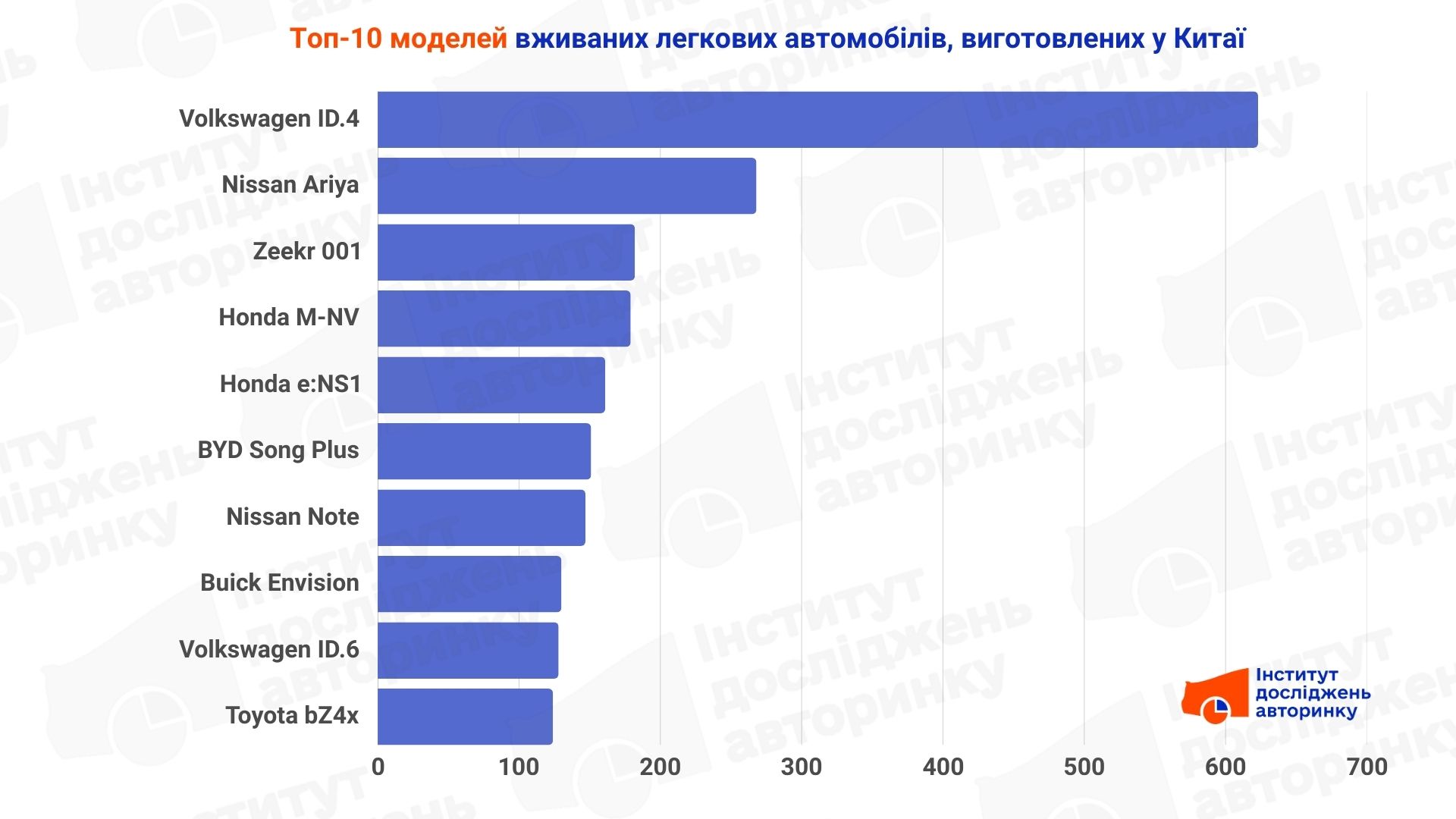

The next step is to review the ten most popular models in the segment.

Here the absolute champion is the Volkswagen ID.4 with 623 cars. Both among new and used cars, no one managed to come close to it at a competitive distance. The Nissan Ariya has a much more modest result — 268 crossovers, and second place. The third is the Zeekr 001, a fairly recent model that went on sale in 2022, with an average price on our "secondary" market of about $40,000 now, and 182 of which were purchased last year.

Regarding fuel, the following diagram is quite similar to the one in the previous section with new cars:

Electric vehicles have a clear advantage here, with a share of 86%. There is no point in commenting on the others — the trend towards an increase in the share of electric cars is obvious, and every year the segment marked "electric" will occupy an increasing area on the diagram.

So, this is the picture of replenishing our car fleet with cars made in China by the end of 2024.

- In order not to miss the release of other interesting market reviews, subscribe to the Telegram channel of the Auto Market Research Institute and be the first to receive important information!