Last year, the European new passenger car market grew by 0.9%. According to JATO , this translates into 12,909,740 first registrations of new passenger cars in Europe-28.

The list of EU-28 countries includes Belgium, Denmark, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, the United Kingdom, Austria, Finland, Sweden, Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, Slovenia, Bulgaria, Romania and Croatia.

Despite a slight increase in registrations, 2024 marked the fifth year of relatively lower first registrations compared to the level recorded before the COVID-19 pandemic. The European automotive market has shrunk by almost 2.9 million units since the start of the pandemic in 2020.

Products from China are the sixth largest in terms of volume

According to JATO estimates, almost 21% of the total number of new passenger vehicles registered in the EU-28 in 2024 will come from plants in Germany. However, the country has lost market share in this respect to the Czech Republic, the third largest country of origin of vehicles in Europe after Spain. France is in fourth position, despite a 3% drop in volumes at French plants. Romania rounds out the top five.

The most interesting trend is that China has become the sixth largest country of origin of new vehicles registered in Europe. In the period from 2023 to 2024, it surpassed the UK, Turkey, Japan and South Korea. Industry experts believe that Chinaʼs influence in Europe is growing and strengthening. This is noticeable both in the field of supply of complete equipment and in the field of production of finished vehicles. Chinese products are highly competitive, but in practice they will have to face new increased tariffs, which will obviously have a noticeable impact on the further position of products made in China in Europe.

Crossovers are becoming increasingly popular

Despite the fact that European drivers do not have such a high demand for cars with increased ground clearance, all-wheel drive and certain SUV features as Ukrainian drivers do due to the condition of certain roads, European buyers are increasingly leaning towards SUVs. This is confirmed by statistical data: 54% of the total number of registrations in Europe in 2024 were crossovers and SUVs — this is a record market share for this segment. In total, consumers in Europe bought 6.92 million SUVs, which is 4% more than in 2023.

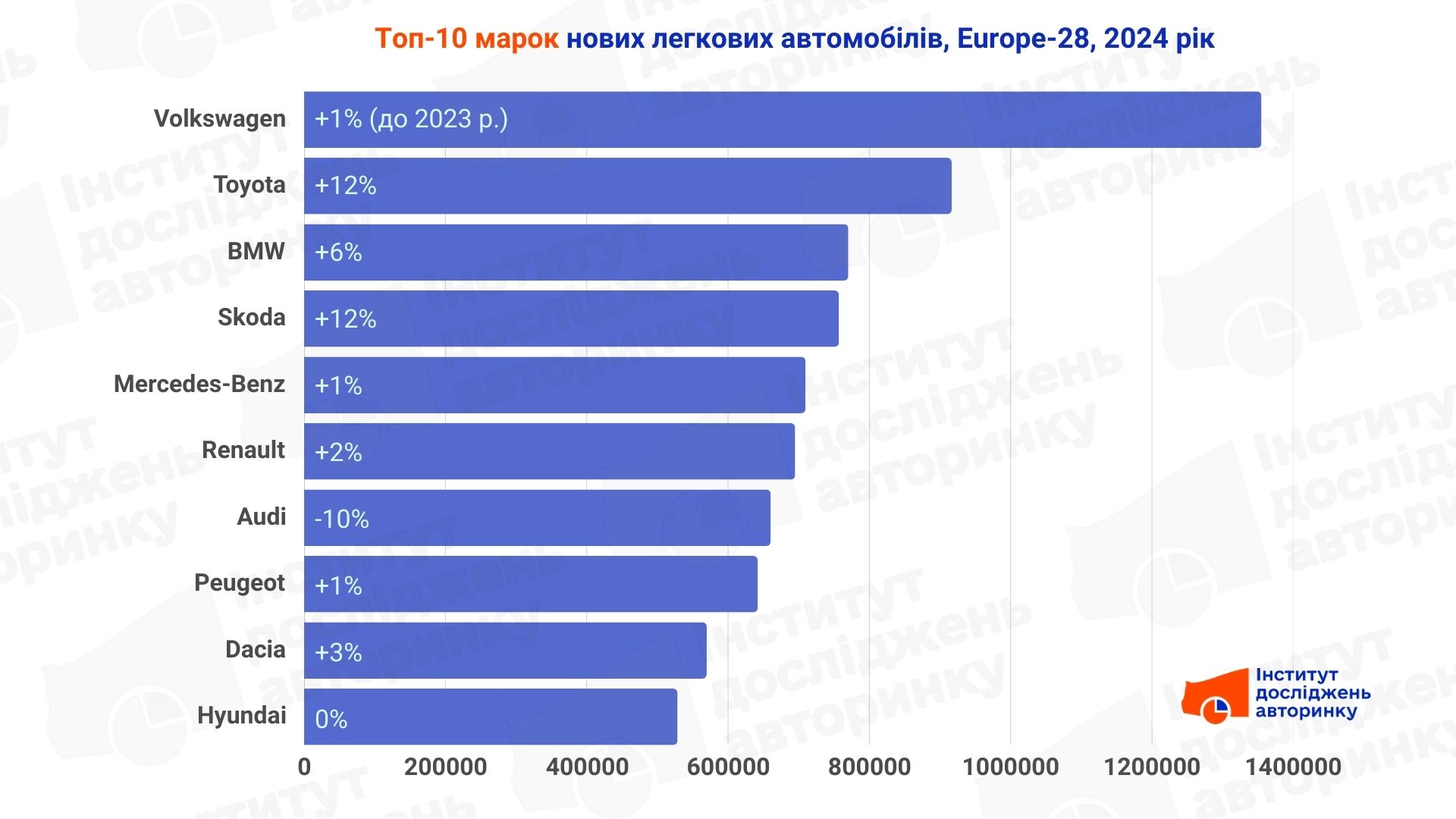

The most popular brands of new cars in Europe

The leader among manufacturers was the German brand Volkswagen, which took 10.5% of the market with a solid figure of over 1.3 million cars sold, increasing by 1 percent compared to 2023. Second place went to Toyota, with a share of 7% and 917 thousand cars sold, while it is worth noting the significant growth of this Japanese brand — plus 12 percent per year. Third place in terms of sales volumes in Europe (within the 28 countries listed above) was taken by BMW plants (6%, 770 thousand, improvement +6%).

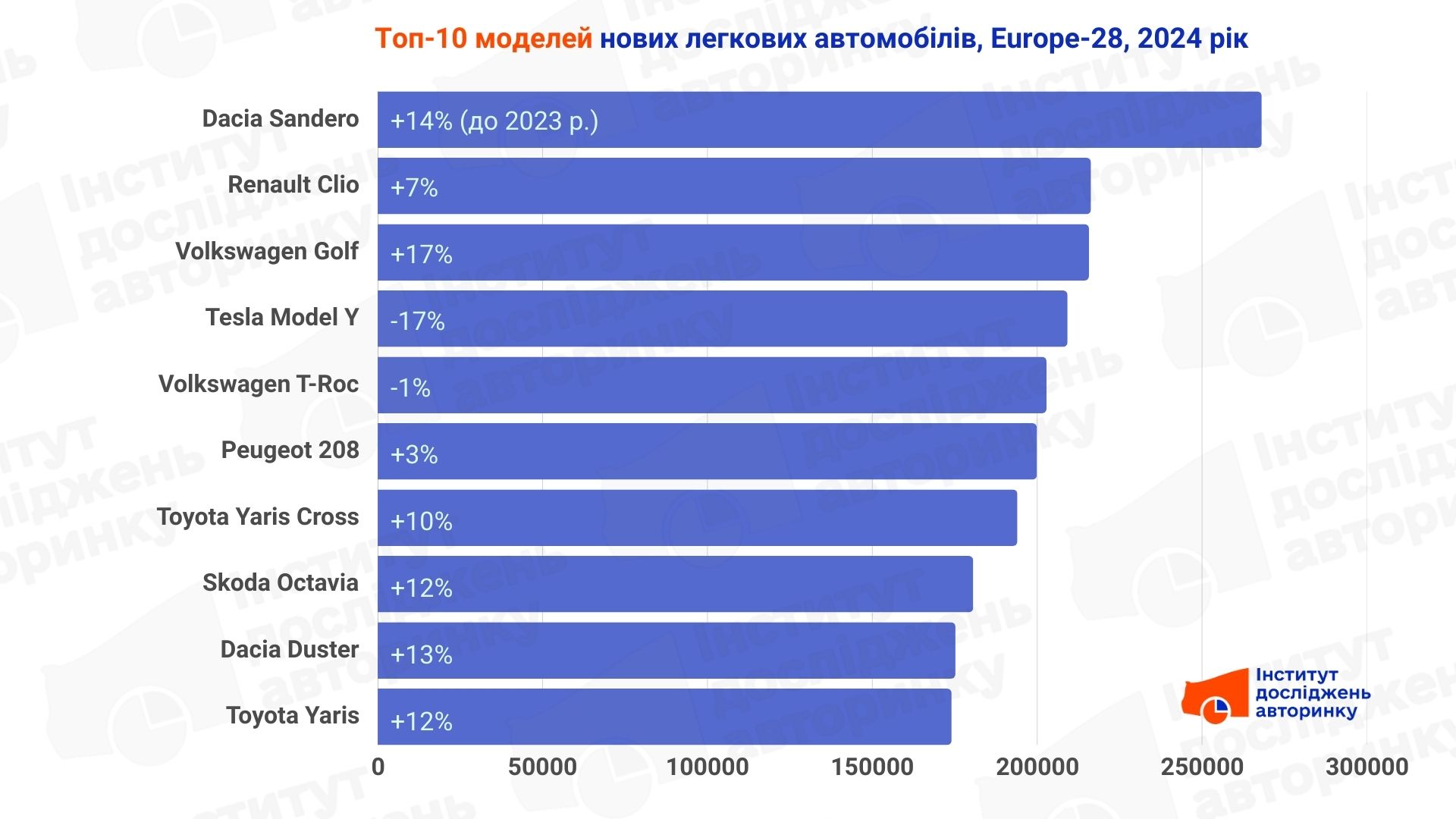

Top 10 new passenger car models in Europe

As soon as the Volkswagen Golf left the top spot it had held for many years in a row, the “battles for the throne” began in Europe: in 2022, the Peugeot 208 took the crown; in 2023, it was the Tesla Model Y; and the Dacia Sandero, which has been in the top three best-selling models since 2021, took first place according to last year’s sales results.

The Sanderoʼs popularity is largely due to its status as one of the most affordable car models in Europe. The carʼs price has allowed it to top the model rankings in two markets — Spain and Portugal, while the same advantage has helped it enter the top five most sold models in France, Italy, Belgium, Austria and Romania.

Tesla Model Y registrations fell 17% in 2024, the steepest decline among the top 36, as the crossover dropped to fourth place in the model rankings and lost the top spot it had held in Europe in 2023. The decline can be partly explained by the reduced impact of Tesla’s price cuts last year compared to 2023, a factor that helped propel the model to the top spot. Despite its overall decline, the Model Y retained its top spot in the Netherlands, Sweden, Switzerland, Denmark and Norway last year.

The Volkswagen Golf has regained some popularity thanks to better-than-expected results in markets such as Germany, Italy, Austria and Spain. However, the 215,700 units registered last year are a bit of a stretch compared to the 445,600 and 410,300 units registered in 2018 and 2019 respectively. The Golf and Tiguan showed the highest volume gains among the top 20 models.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.