Used truck market in Ukraine: a precarious balance between supply and demand

Having processed data from the Automoto.ua aggregator, which collects information from all vehicle sales ad sites in Ukraine, specialists from the Auto Market Research Institute determined the dynamics of the truck market in terms of supply.

Before moving on to the market review from the supply side, it is worth recalling what the statistics of truck sales looked like, at least in general terms. Last year, since the summer, the volumes of actually purchased trucks have been decreasing every month. And at the end of the year they reached record low volumes. Analysts believe that the reason for this decrease in the interest of carriers in commercial transport is the general decrease in the activity of business processes in the country due to the long war, the decrease in the flow of goods, the shortage of drivers and auto mechanics. The factors that could potentially contribute to the development of road transport (the cessation of civil aviation, the suspension of seaports, the incompatibility of the railway track with the European one) as statistics show no longer affect the car market, the interest of carriers in replenishing their fleets is decreasing, currently we are recording half the volume of trades than at the beginning of 2024.

Suggestion: Ads are also getting fewer

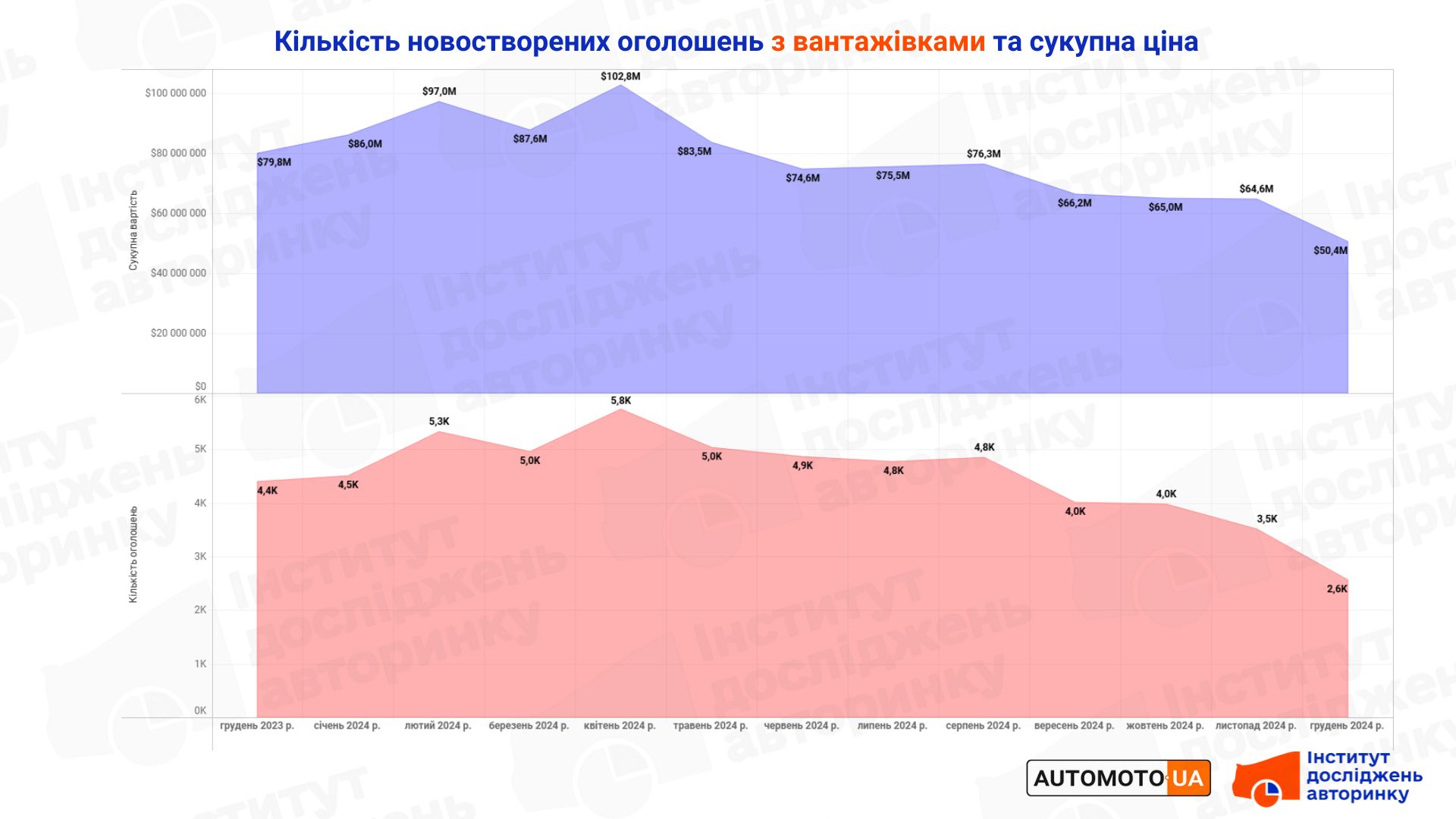

A logical continuation of the previous section could be a proportional increase in the number of ads — they say, there is less work for trucks, they sell them more often. However, in practice we have a different picture: the number of ads, and at the same time the total cost of all trucks in offers on online bulletin boards, is also decreasing.

The number of newly created ads in December 2024 was the lowest for the period — 2.6 thousand, which is 26% less than in November and 41% less than in December 2023.

The total cost of all freight vehicles offered for sale also decreased: synchronously with the number, we have the lowest figure in December 2024, $50.4 million, which is 22% less than the results of November, and 37% less than in December 2023.

Key observations

- Spring peak of activity: April 2024 was the most active month, which may be due to seasonal demand for trucks, particularly in the agricultural sector.

- Stability in the first half of the year: Between February and June, the number of listings remained at 4.8–5.8 thousand, and the total value remained around $80–100 million.

- Decrease in the second half of the year: Since August, there has been a sharp drop in both indicators.

Why is the truck market shrinking?

Most likely, the current state of affairs is temporary — a balance has been established between the needs/capabilities of carriers and the volume of orders in the markets where trucks are involved. There is currently no need to expand fleets, and there is also no motivation to reduce them. However, as practice shows, such an equilibrium does not last long — it is too dependent on external influences, and small changes can be enough to disrupt it (the so-called "butterfly effect").

What are the prospects?

The truck market in Ukraine, based on supply, showed mixed dynamics in 2024. Although there was an increase in activity at the beginning of the year and in the spring, the second half of the year was marked by a significant reduction in the number of ads and the total value. This indicates the marketʼs dependence on various external factors. In the current state of affairs, it is the supply that can grow — if the transportation business does not increase turnover. Which will lead to increased competition between sellers, a decrease in average prices and an increase in sales time. To prevent this from happening, it is necessary to intensify activities involving trucks, in simple words — an increase in demand and transportation tariffs.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.