The following calculations are based on an analysis of the real sector of the car market. The IDA team analyzed almost 3 million records of the aggregator Automoto.ua about the announcement of the sale of cars from all (about 100) car websites of Ukraine.

Considering the fact that prices in advertisements are directly dependent on the principle of market equilibrium (that is, when the sellerʼs request must meet the buyerʼs expectations so that the goods are sold in a reasonable time), as well as the fact that these prices are formed under the influence of a number of external factors, they can to be used for market analysis as indicator values that demonstrate or explain the state of affairs at a certain moment, or explain the influence of external factors on the market. Possession of such information allows business analysts to determine tendencies (trends) and forecast the state of the market for the future, to plan activities taking into account historical and current information for future periods.

Online used car market: Hello, stagnation

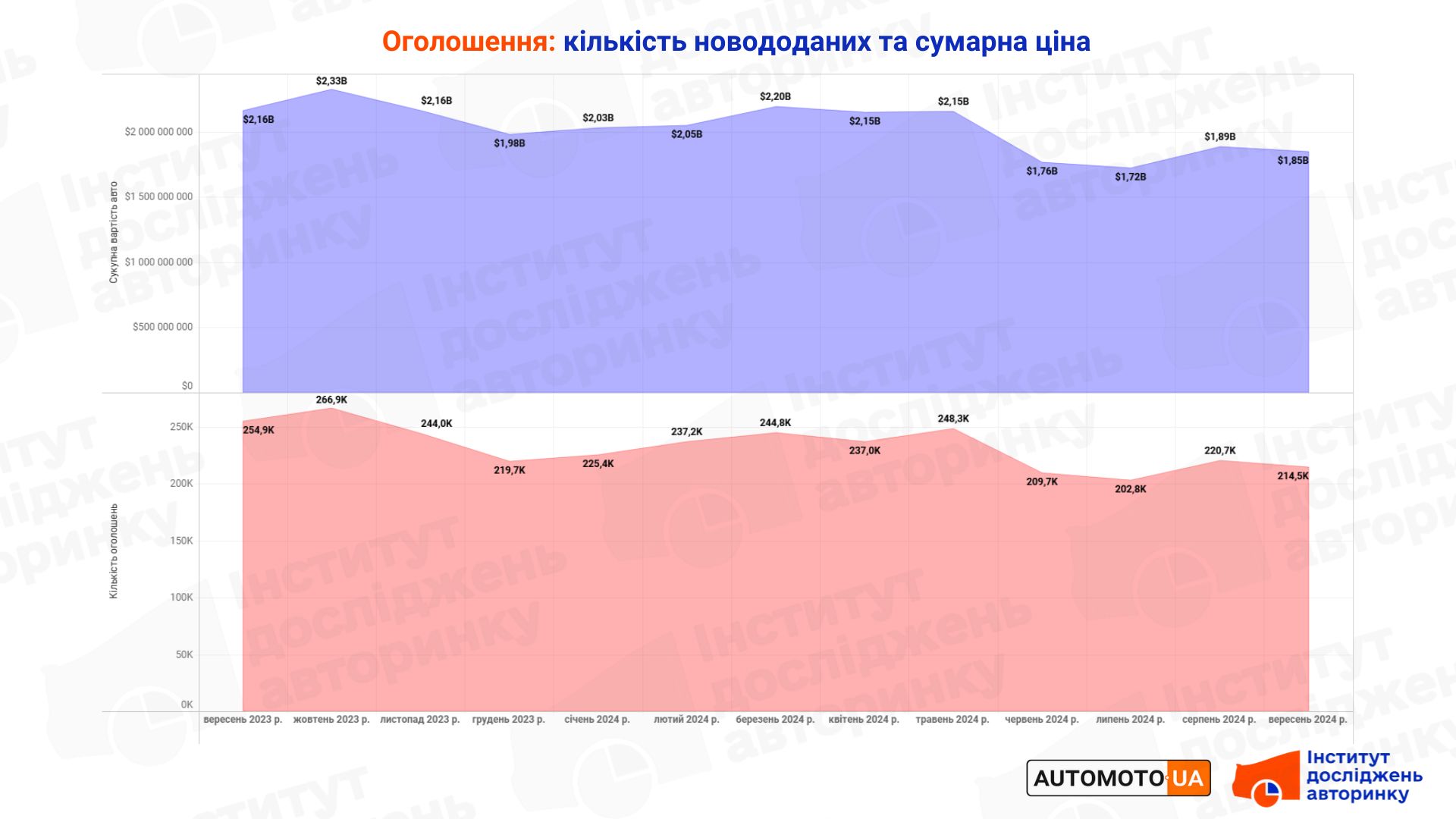

Over the past 12 months, 2.77 million offers for the sale of used passenger cars were placed on Ukrainian Internet sites for posting advertisements for the sale of motor vehicles. This number includes only newly added ads, excluding duplicates that may occur on multiple bulletin boards.

The highest activity of sellers for the mentioned period remains in October 2023, when 266.8 thousand ads were placed. The lowest activity was recorded in June and July 2024, 209.7 thousand and 202.8 thousand ads, respectively.

In September, contrary to the usual seasonal pattern, the number of ads decreased from 220.7 to 214.5 thousand. Usually after the summer vacation season, September, which is still a warm and dry month in terms of climate, followed by a cold winter that is not very convenient for buying and selling cars, business activity in the market increased. At that time, more cars were sold, which were used for a long trip to one of the sea coasts, and to replace them they looked for other options, often crossovers, because there was still snow and ice ahead. But this time, the war made its corrections — for the third year in a row, the boundaries not only between vacation seasons and business periods, but also between weekdays and weekends in general, have been blurred. In addition, the information wave about the introduction of a 15% tax on the first registration of cars, which artificially slightly accelerated the market in August, which was completely predicted by the analysts of the Institute of Car Market Research, turned into a "statistical pit" in September, the size of which was precisely predicted by them: 30%

The potential financial value of all cars offered (or offered) for sale in the past 12 months decreased slightly to $24.3 billion. The maximum and minimum bid saturation in monetary terms is fully correlated with the number of ads mentioned above, which is also visible in the chart. On average, Ukrainians offer $2 billion worth of used cars for sale on the Internet every month.

Price structure: the market is stabilizing

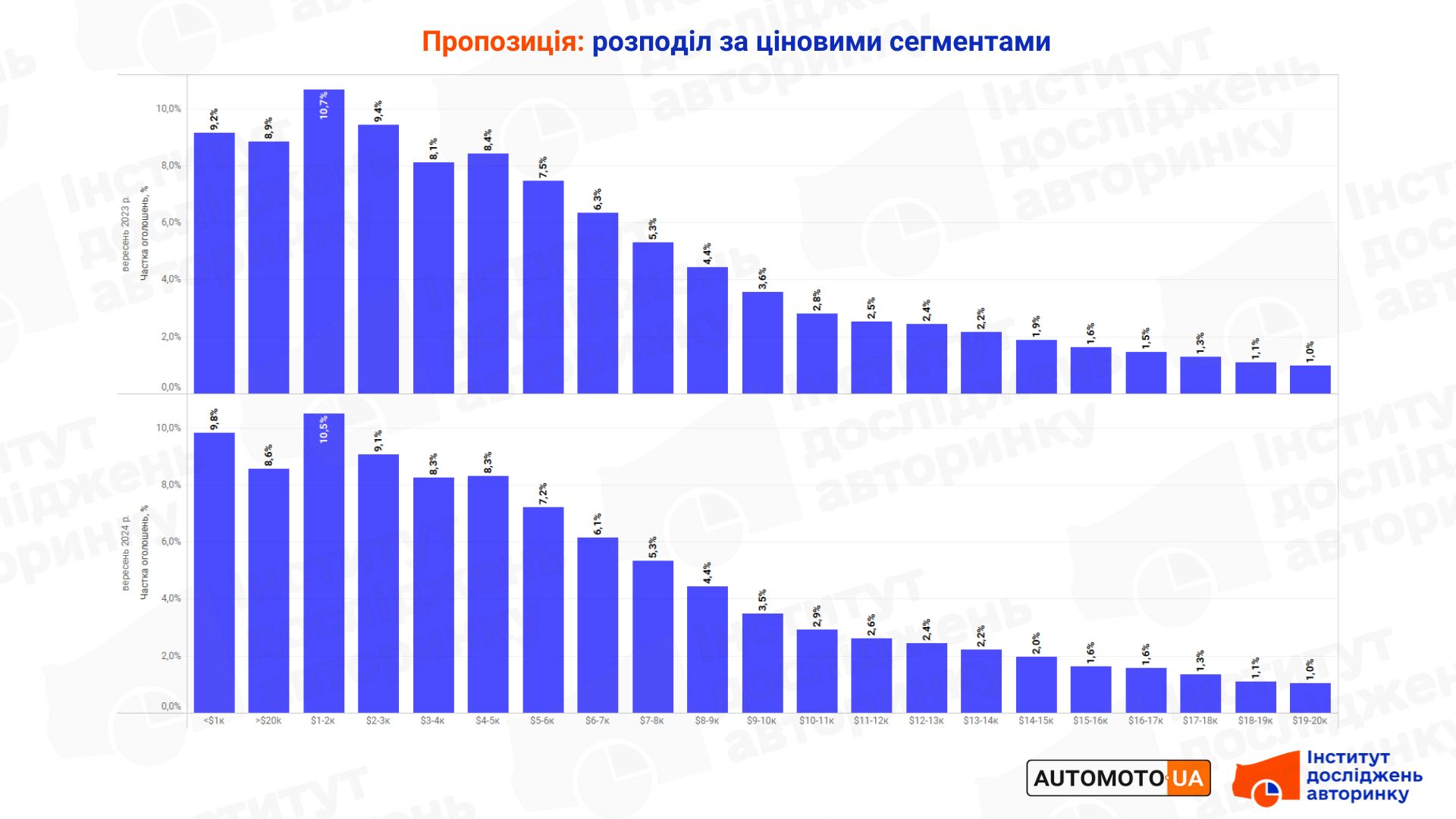

For a year, i.e., comparing September-2024 with September last year, no radical changes are observed on the diagram, which shows the saturation of the market with offers of various price groups. Despite the fact that in the past months there were a lot of external factors that had an impact on the car market and, accordingly, the formation of the quantitative-price picture, the exit to an almost repetition of last yearʼs appearance of this diagram indicates a decrease in external influences on the market and its stabilization.

At the same time, similar phenomena (if repeated over a long period of time, for example, several months), can also indicate stagnation in the market, too low movement of goods. However, it is too early to talk about the transition to a "pause" in relation to the car market.

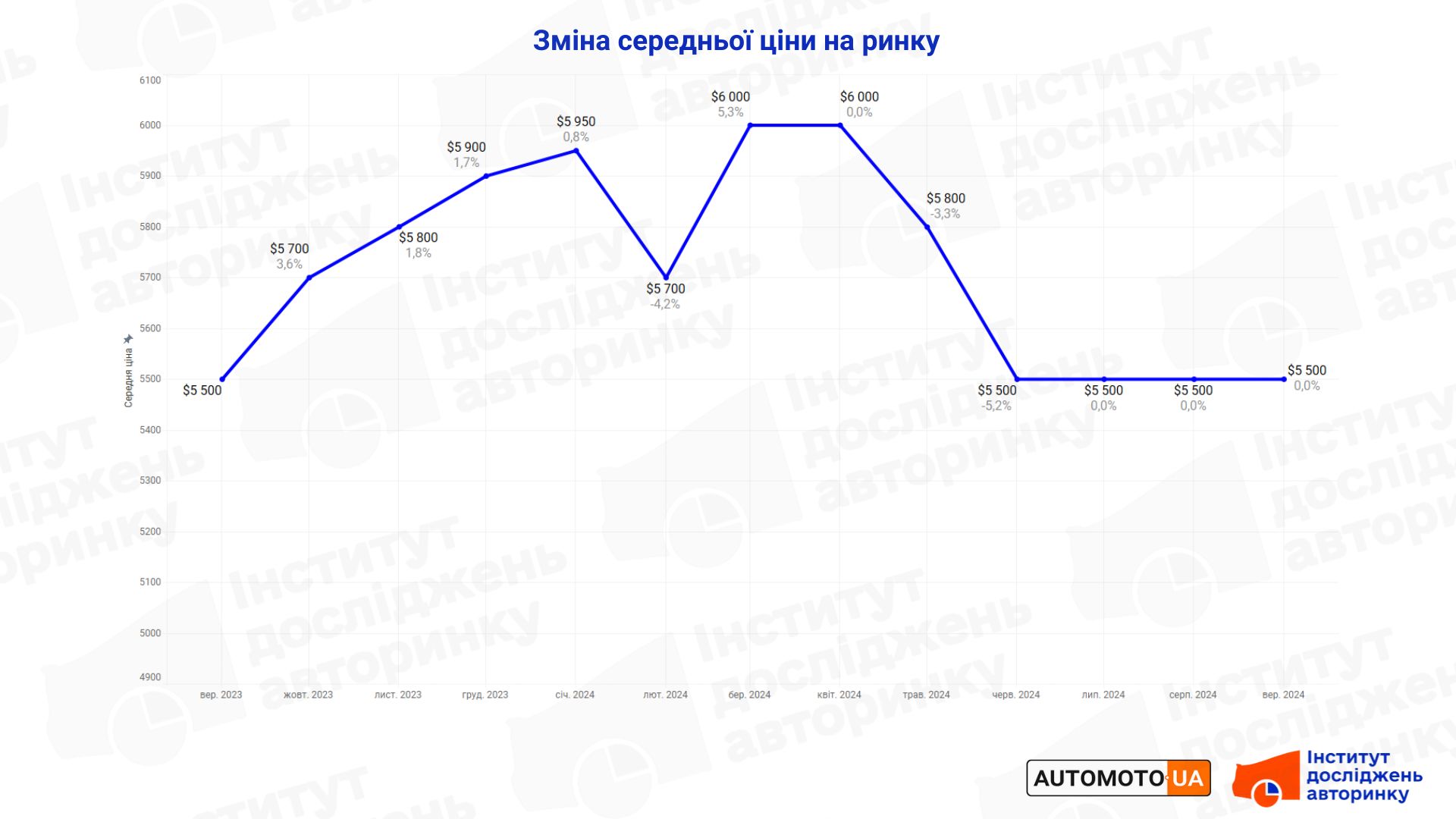

Average bid price: no movement

Despite the repeatedly mentioned influence of a number of external factors on the car market in previous periods, the average price on it remains unchanged for the fourth month, at the level of $5,500. Actually returning to the values observed a year ago.

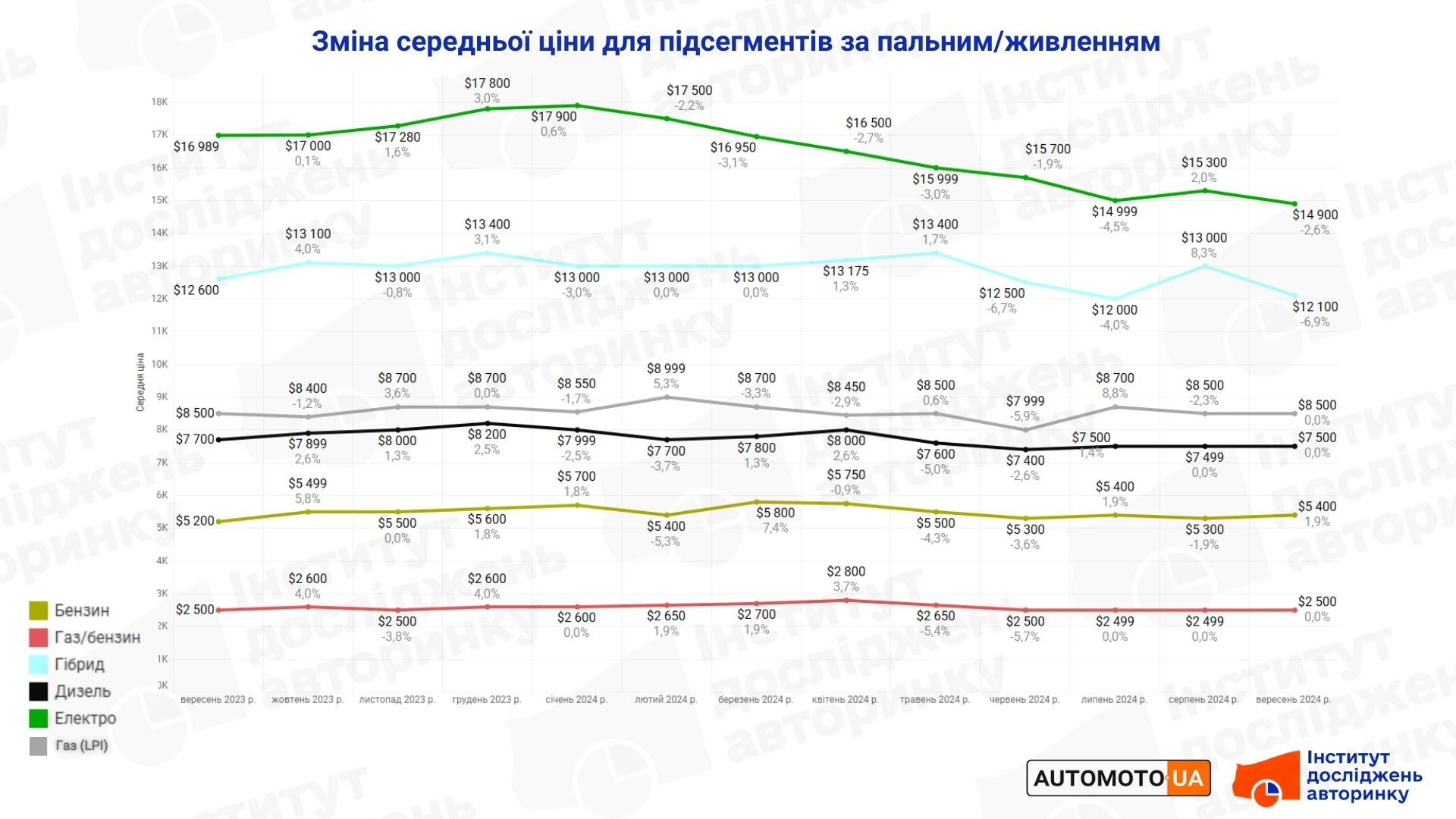

Changes in prices by segment (based on fuel/power)

In the section of separate segments, with distribution by type of power plant, the lowest average price, which according to the results of September is $2,500, is for passenger cars with gas cylinder equipment. It is worth noting that this segment may soon undergo significant changes — more details on this in a separate article related to the fuel market. Over the past 12 months, the average price in this segment has not changed, although there have been some fluctuations.

The most popular segment on the market is gasoline cars, occupying an intermediate position between the just described cars with HBO and diesel cars. The current average price of all listings here is $5,400, up $100 from a month ago, but overall, despite the slight fluctuations over the past periods, the average price here remains relatively stable.

Diesel passenger cars with mileage are currently asking $7,500 on average, about the same as in the previous 12 months included in this review. All three segments just described (which at the same time are the most massive in the secondary market) were quite stable in terms of average prices from September 2023 to September of this year.

The hybrid segment (all subtypes such as MHEV/HEV/PHEV) showed a decrease in average price, which is now $12,100, which is $900 less than a month ago and $500 less than in September 2023. A small number of "hybrid" cars on sale is the main reason for such jumps in the average price in this segment.

And about the segment of electric cars: the long-term decrease in the average price, the level of which is now $14,900, changed to its increase in August, which even gave hope for a certain fixation of it, or even an increase in the future. But no: we again record a decrease in the average level of asking prices of sellers for electric cars, by $400. And this despite the fact that the 15% tax on the first registration will not be introduced, as well as taking into account the rather long time of operation of the energy system of Ukraine without the introduction of hourly schedules of "light" outages.

- Need more information? Send us a request , and the IDA team will make every effort to provide you with all the necessary data that will help your business grow!

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without ads or spam.