During 2023, Ukrainians sold used cars on the Internet with a total value of more than 25.5 billion US dollars. There was an increase in average prices in some market segments. The Automoto.ua aggregator collects ads for the sale of all cars from 100 auto sites in Ukraine. Based on these data, the experts of the Institute of Car Market Research determined the price picture of online sales of used cars in Ukraine.

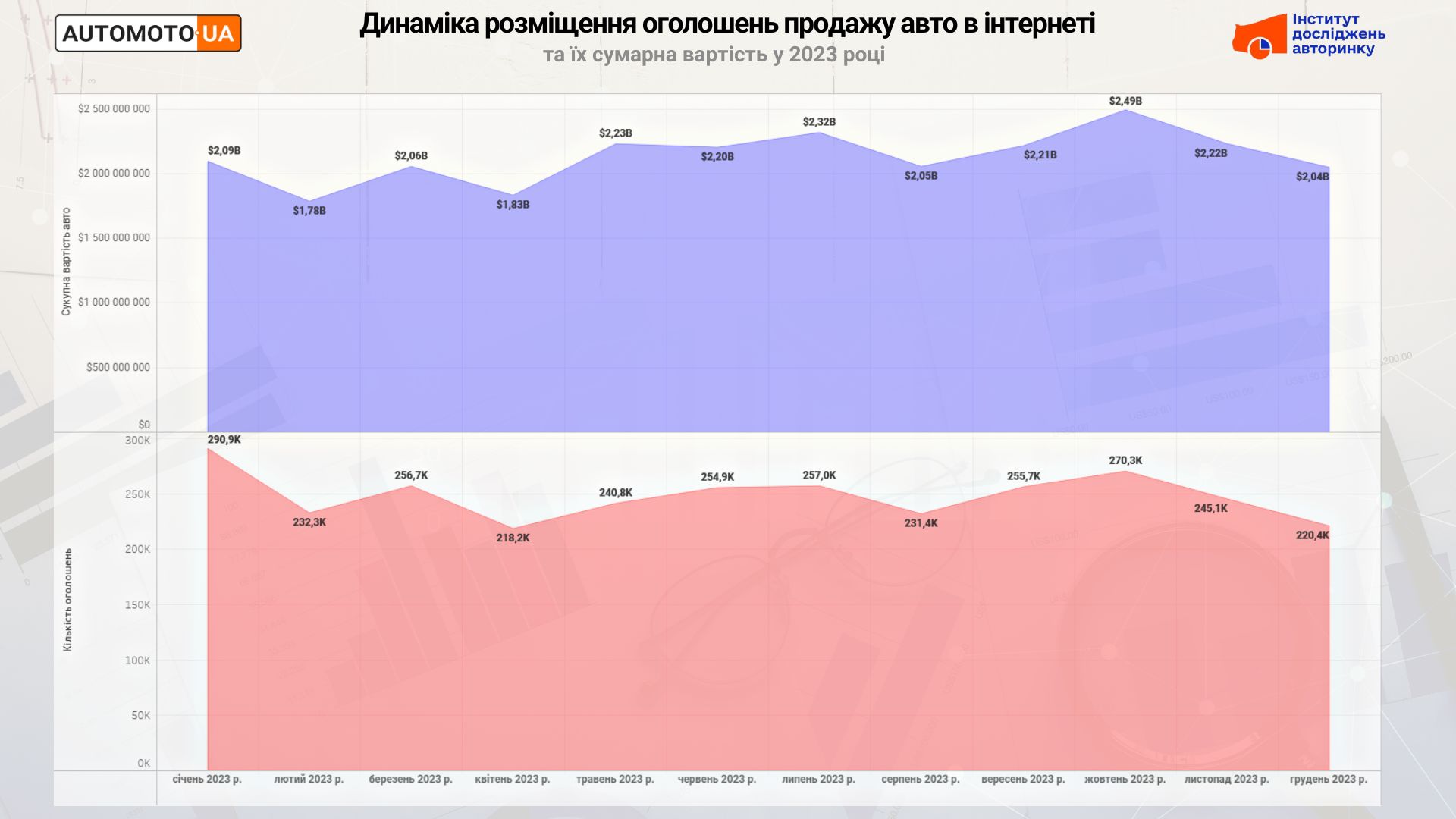

Last year, Ukrainians placed almost 3 million ads (2 million 974 thousand) for the sale of cars on the Internet. Of them, 290,000 were published in January, which remained last yearʼs record. April was the least active (as in 2022 ) — 218.2 thousand ads. The year ended with a total of 220.4 thousand. of active ads in December, which is 24% less than at the beginning — in January.

The total value of cars placed in advertisements in 2023 amounted to $25.5 billion. The largest array of ads by total value was observed in October, when cars were offered for almost $2.5 billion. The lowest saturation of the market with offers last year was in February (1.8 billion). In general, on average, Ukrainians offer for sale used cars worth more than $2.1 billion every month.

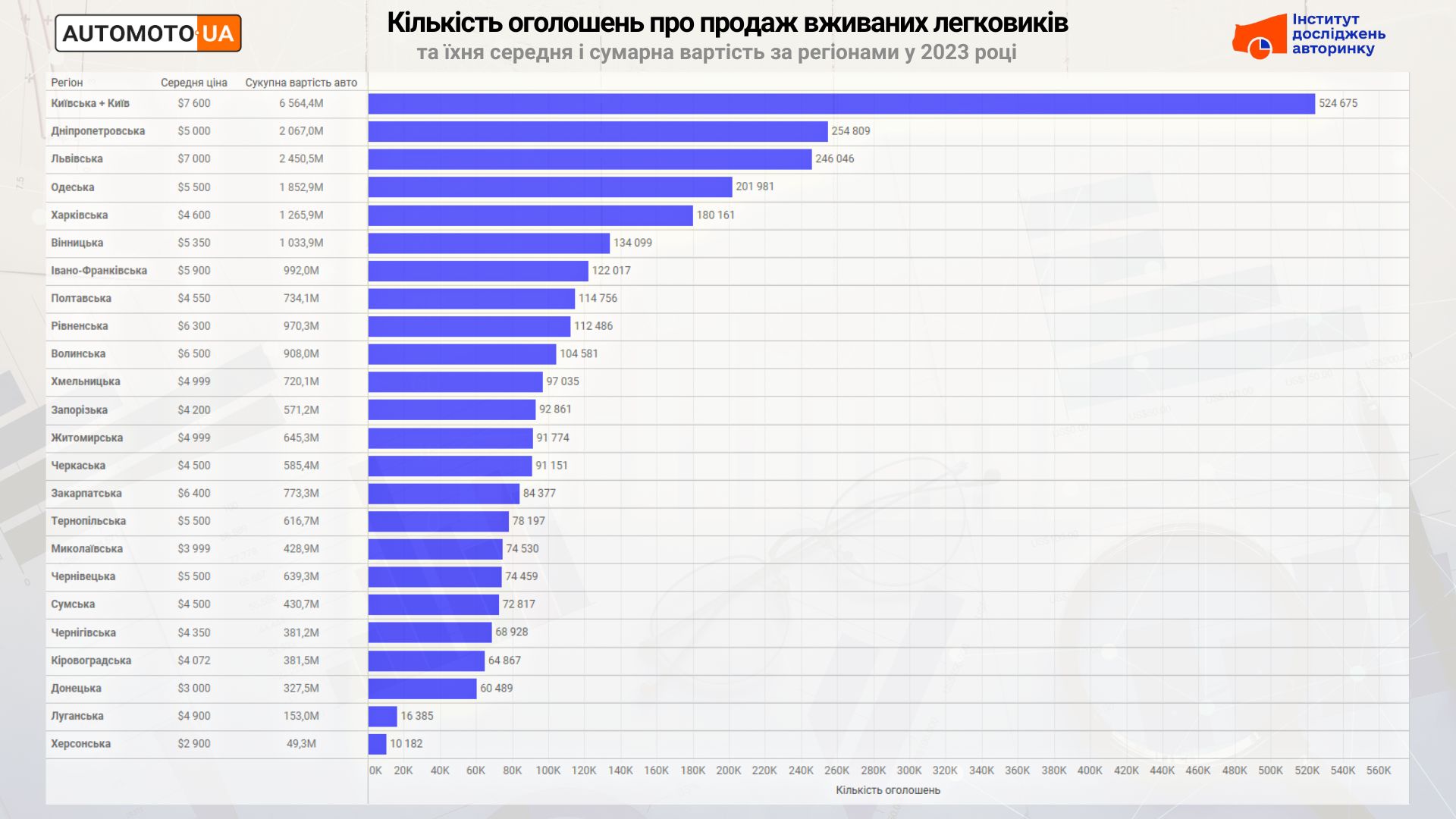

The largest number of ads in 2023 were placed in Kyiv region and Kyiv city (a total of 524.6 thousand), Dnipropetrovsk (254.8 thousand) and Lviv (246 thousand) regions. The least — in Kherson (10.2 thousand), Luhansk (16.4 thousand) and Donetsk (60.5 thousand) regions.

The cheapest (by average cost) cars were in Kherson ($2,900), Donetsk ($3,000), and Mykolaiv ($4,000) regions, the most expensive — in Kyiv and Kyiv Oblast ($7,600), Lviv ($7,000), and Volyn ($6,500) ) regions.

The total value of cars was also the highest in the capital and Kyiv region ($6.56 billion), Lviv ($2.45 billion), and Dnipropetrovsk ($2.07 billion) regions, the lowest — in Kherson ($49 million), Luhansk ($153 million) and Donetsk ($327 million).

The average price of cars offered for sale on the Internet in 2023 was $5,700. The chart shows that this indicator was $4800 at the beginning of the year and $6000 at the end. The total growth for 12 months was 9.1%, which is quite significant. However, when we consider the price pictures for individual sub-segments, rather than the generalized schedule, it becomes clear that not all passenger cars have risen in price at the same rate.

There is a direct dependence on age — cars older than 15 years have not actually changed their prices. On the contrary, the younger the age of the car, the faster the average price for it grew. This is explained by the lack of new cars, which should later replenish the secondary market, and the small volume of imports of passenger cars from abroad, which are at least twice (or even three times) behind the demand. Average prices for used crossovers have also increased, thanks to a general increase in demand for this type of passenger car, and cars from the US, which are now in short supply, and mostly without the most affordable options, which are unprofitable to import due to the increase in the cost of delivery of such cars.

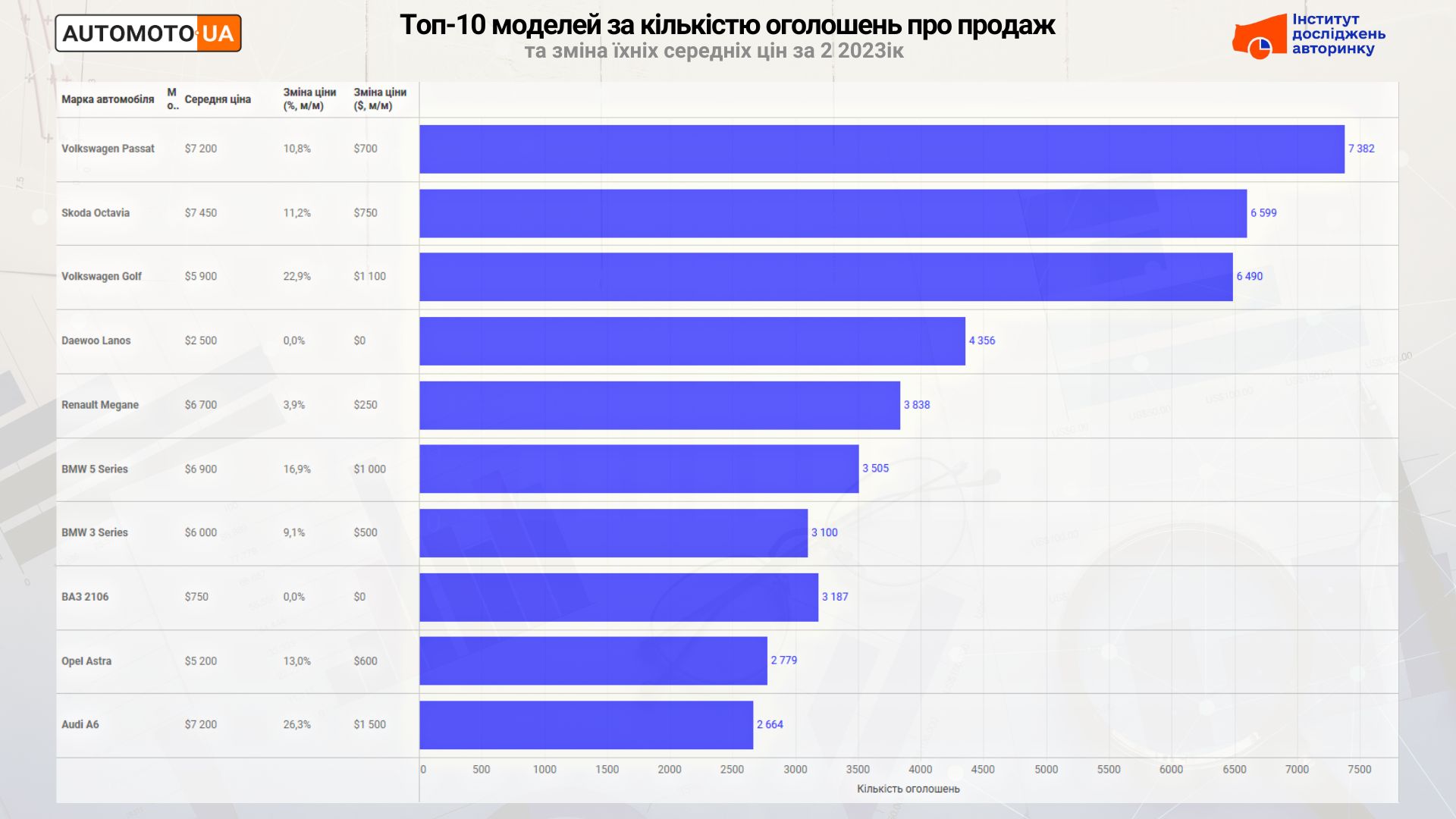

Among the 10 most popular car models in Ukraine since the beginning of the year , the Audi A6, Volkswagen Golf and BMW 5 Series have risen in price the most. In percentage terms, their prices increased by 26.3%, 22.9% and 16.9%, respectively. In monetary terms, the average price of these cars increased by more than $1,000.

None of the models on this list have become cheaper. On the contrary, the prices of the VAZ-2106 and Daewoo Lanos remained unchanged, although they should have decreased due to the increasing age of these models.

- Volkswagen Passat : $7,200, +10.8%, +$700

- Skoda Octavia : $7,450, +11.2%, +$750

- Volkswagen Golf : $5,900, +22.9%, +$1,100

- Daewoo Lanos : $2500, 0%, $0

- Renault Megane : $6,700, +3.9%, +$250

- BMW 5 Series : $6,900, +16.9%, +$1,000

- BMW 3 Series : $6,000, +9.1%, +$500

- VAZ-2106 : $750, 0%, $0

- Opel Astra : $5,200, +13%, +$600

- Audi A6 : $7,200, +26.3%, +$1,500

Fixation, and even more so the growth of average prices, is an abnormal phenomenon for open markets. However, since our market is in partial isolation (limited imports, low volumes of new car sales), processes characteristic of closed markets are emerging, such as Cuba, where 40-50-year-old passenger cars are forced to be maintained on the road, while the demand for scarce personal transport leads to to the inappropriate characteristics and quality of these cars, the increase in prices for it, which can many times exceed the cost of similar models in other countries.

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without advertising or spam.