This segment is the “big league” of our car market. If cars are about comfort and emotions, then tractor units are pure mathematics of profit. The 2025 analysis shows that after two years of anomalous demand, the logistics market has finally hit the brakes and gone into pragmatic cooling mode.

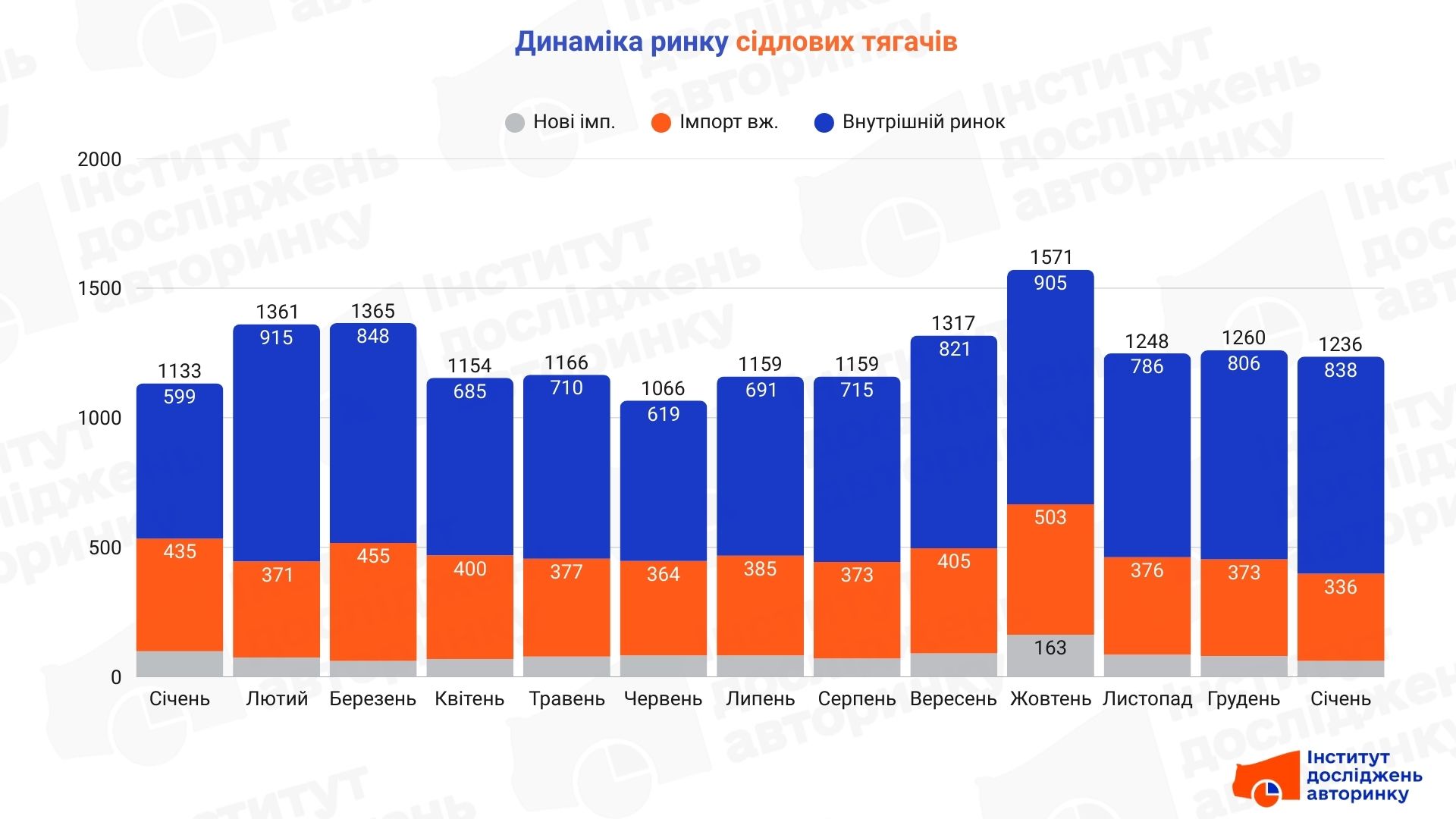

Tractor unit market dynamics

The total volume of the segment in 2025 was 14,159 units. If we compare it with 2024 ( 24,407 units), we see a drop of 42%. This is not a crisis, but rather a return to real needs after carriers massively updated their fleets in 2023–2024 against the backdrop of logistical challenges.

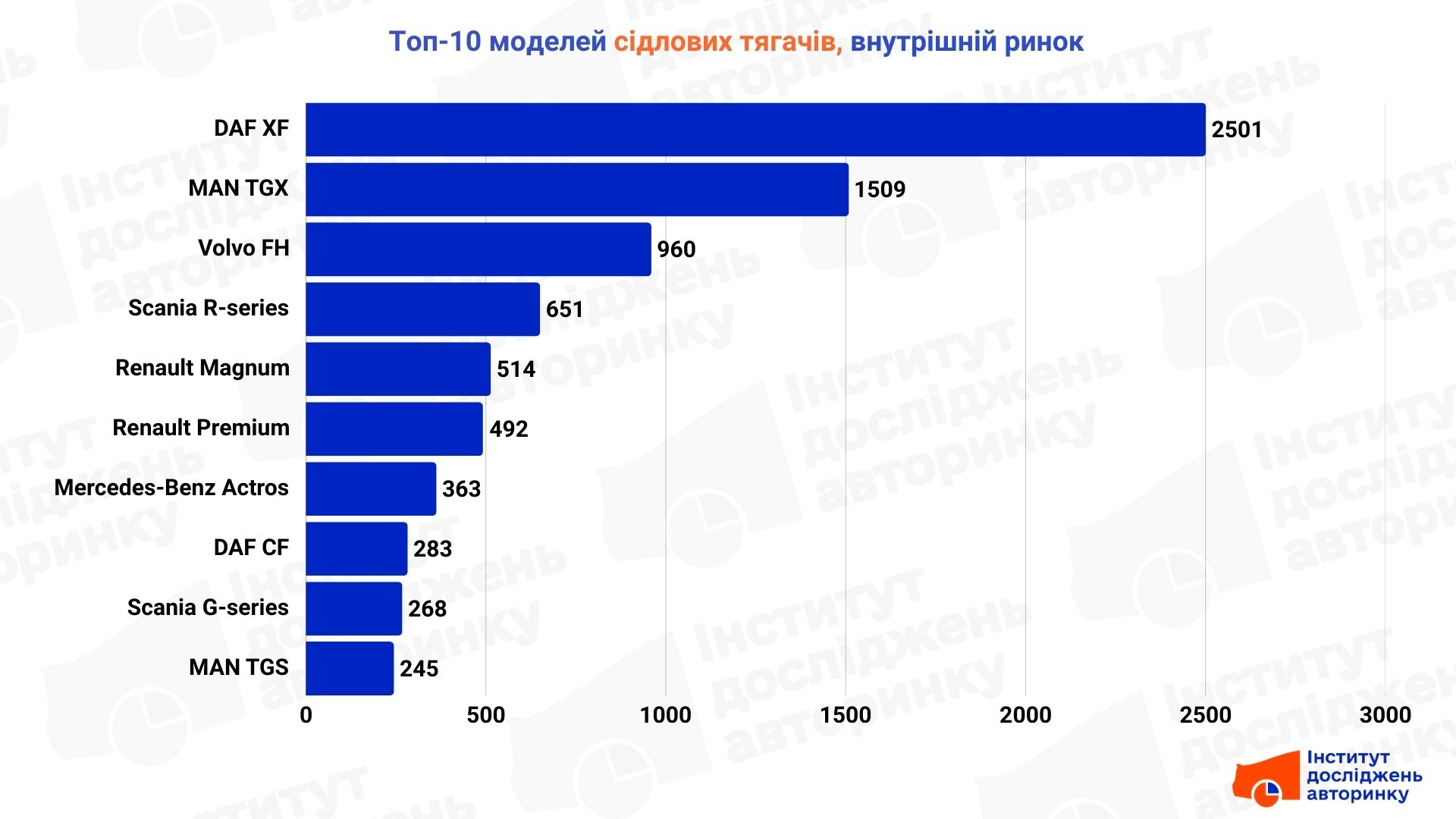

The most popular tractors on the domestic market

The DAF XF dominates the secondary market of Ukraine. This model has become a standard for Ukrainian carriers due to its balance of price, resource, and availability of service. It is followed by the MAN TGX, the main competitor for driversʼ sympathy.

- Check the history of a car by VIN code before buying using the CEBIA service!

Interestingly, Renault Magnum and Renault Premium are still in the Top 10 of the domestic market. These cars have not been produced for a long time, but their presence in the registers indicates that the "old school" with its simplicity is still in demand in local transportation.

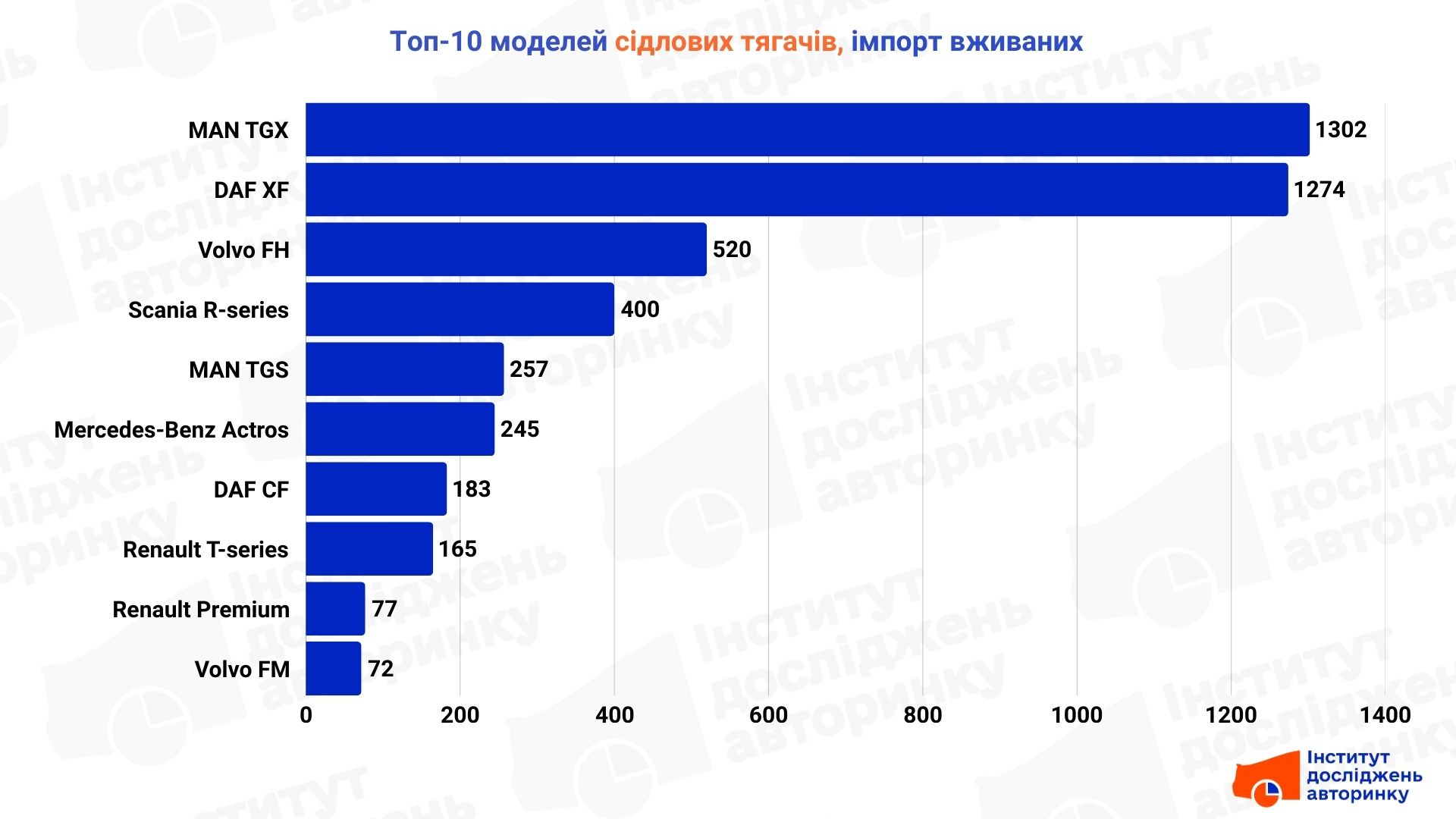

The most popular used tractor units imported from abroad

In the segment of "drive-in" from Europe, the main struggle unfolded between MAN TGX and DAF XF. These two models account for more than 50% of all imports of used equipment.

- Order turnkey tractor units from Europe from West Auto Hub .

Buyers are choosing proven European leasing vehicles with a transparent history, with the Volvo FH and Scania R-series closing the group of leaders, offering a higher level of comfort and fuel efficiency.

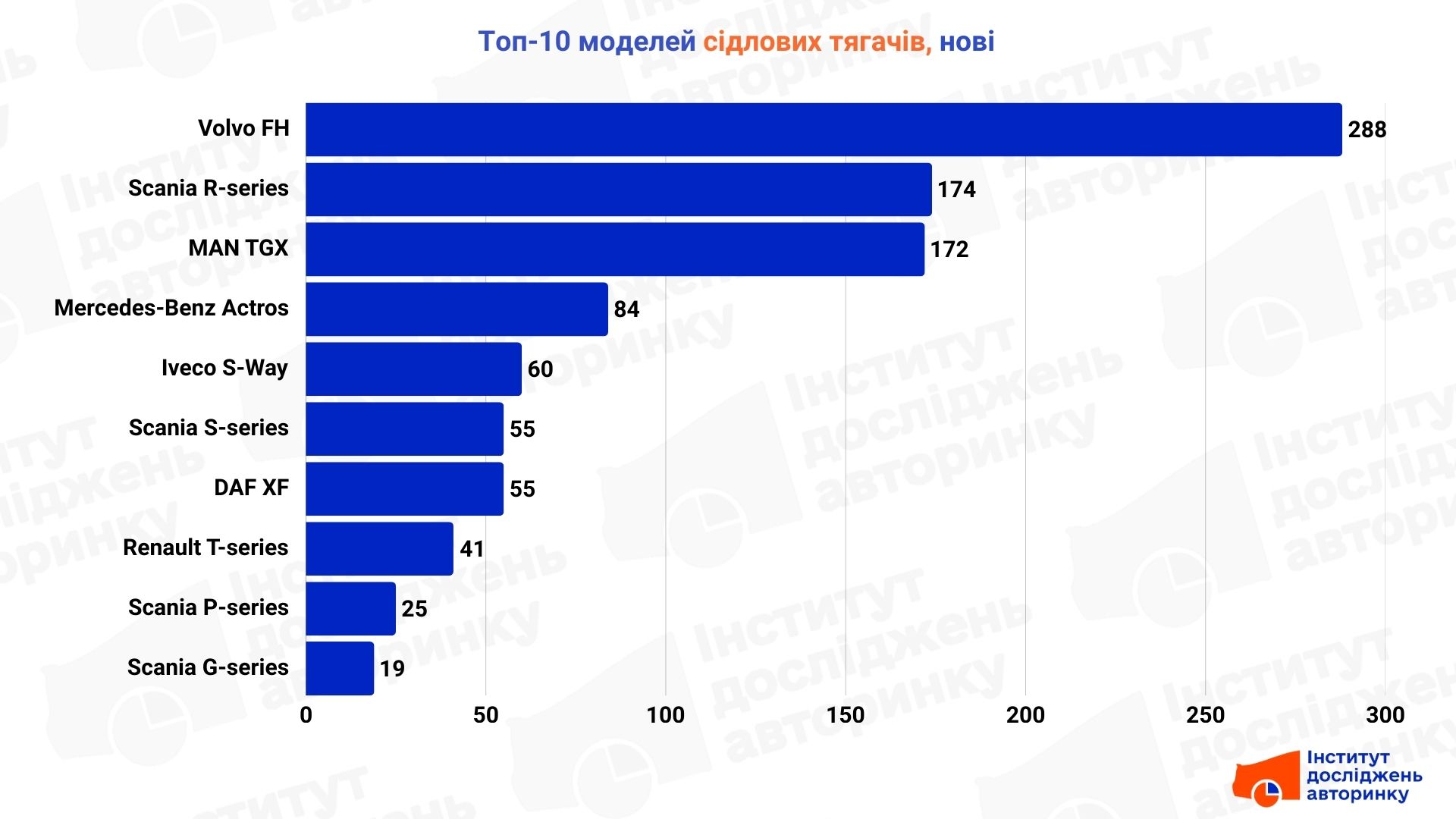

The most popular new tractor units

Here the picture is completely different. When it comes to large investments in new equipment, Ukrainian business chooses technological sophistication:

- The Volvo FH is the absolute leader. It is the choice of large fleets operating on European routes where every liter of fuel counts.

- Scania (R, S, P, G series) — overall, this brand demonstrates the widest presence, offering individual solutions for any task.

- The MAN TGX holds firm in third place, confirming its status as a versatile business tool.

Auto market expert Ostap Novitsky comments on the statistical overview for 2025:

"Last year, we watched as the tractor market finally "breathed a sigh of relief." Those for whom it was critically important to get on the road were hoarding back in 2024. In 2025, carriers switched from the "buy at least something" strategy to the "count every kilometer" strategy.

The domestic market has shown that the DAF XF has become for truckers what Lanos once was for taxi drivers — a reliable foundation that is understandable to every mechanic. But the most interesting thing is the new car segment. Despite the general decline, Volvo and Scania continue to compete on the level of technology, not price. This is a sign that large logistics in Ukraine is becoming more professional. Carriers are now buying not just iron, but service contracts and fuel economy.

Although the numbers have dropped, the quality of the fleet on the roads is increasing. We are getting rid of random players, leaving in the business those who know how to turn ton-kilometers into a stable profit .

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.