If we were to set the task of describing the results of the car market in 2025 as concisely as possible, it would probably be “in search of mobility.” Despite all the difficult circumstances, and perhaps under their influence, Ukrainians bought new and “freshly driven” passenger cars more often, significantly (setting several records) increased the pace of buying electric cars, and even “pumped up” the motorcycle segment. Not for fun — but to get from point A to point B. Cheap and really angry.

- Check the history of your car by VIN code on CEBIA!

But the segments of commercial transport, in particular trucks (with a gross weight of over 3500 kg, including tractor units), and LCVs (buses and vans) have sagged. And this is a bad sign, indicating a decrease in the interest of carriers in this type of transport, which arises as a result of a decrease in the volume of transportation orders, which causes a general slowdown in the economy in the country. Also, despite the presence of a trend to renew the fleet, the total volume of bus trade has fallen.

Letʼs consider each of the segments according to three main indicators — the volume of first registrations of new vehicles, the number of registrations of imported used vehicles, and the result of purchase and sale transactions officially registered in the domestic market.

Passenger cars, market 2025

In this largest part of the Ukrainian car market, new car sales and import volumes are in the positive. The number of transactions on the domestic market has decreased. However, there has actually been some balancing between these subsegments, due to the hype about electric cars, which was growing rapidly until the end of last year, and it is thanks to this that the picture we see on the slide emerged.

As for the electric vehicles themselves, which were talked about so much last year and the volumes of which are included in the slide above, there are several records here. The total replenishment of the fleet in 2025 is more than in any of the previous years, for the first time it crossed the mark of 100 thousand vehicles per year, and there is still a lot to be said about these volumes, for example, that in December alone 31 thousand electric vehicles arrived, which is more than from 2012 to 2022 combined.

- Order turnkey cars from West Auto Hub

But the most important thing is that these records will most likely gather dust on the stands with cups for a long time now, because VAT on their import has returned, the situation with electricity supply is not easy, prices per kW at public EV charging stations have increased, and the dollar/euro exchange rate is also slowly creeping up. So now we are talking about records, because there are reasons, and then — probably only in a few years will we be able to write again "the record of December 2025 was broken, over 31 thousand electric cars were imported"...

Motorcycle market

A segment that may not seem very noticeable, but the only one where new cars prevail (if we talk only about motor vehicles, without trailers), and which is steadily growing from year to year. If we were to show these numbers to one of our colleagues, Western auto journalists, or ask even the best of LLM (a large language machine, "artificial intelligence") to comment on these statistics, most likely we would get a summary that Ukrainians have become interested in motorcycles, probably due to the improvement of the condition of the roads, climate change, which has more days a year with dry weather, safe for two-wheelers, and similar conclusions.

However, the truth is different — if we examine the picture in more detail, we see that people buy motor vehicles as a means of transport, not a bike for the weekend. These are Chinese or Indian products, with engines of 125-250 cc, purely to replace "minibuses" for short distances. There are also bikes for fun, but they are few, the need for mobility prevails, not for entertainment or sports.

LCV Market 2025

In the van and light commercial vehicle (LCV) segment, we have a noticeable decrease in interest in new cars, by 10%, an increase in used imports by 18%, and a significant decrease in volumes on the domestic market — by as much as 52%. That is, vehicles that have already been used as commercial vehicles in Ukraine are not in a hurry to sell, and are not very willing to buy. And this is also a sign that the overall demand for LCV cars from carriers and small businesses has decreased.

Truck market

In this section, we will summarize the results for all trucks with a gross weight of over 3.5 tons, including tractor units, which we usually review separately (as well as semi-trailers for them). And here we have a set of three minuses: all subsegments of this part of the car market have taken root. Fewer, by 23% (compared to 2024), new trucks were purchased, by 31% "freshly driven", and by 42% fewer purchase and sale agreements were concluded on the "secondary" market. The segment is confidently stagnating, and this, let us recall, is not a cause, but a consequence.

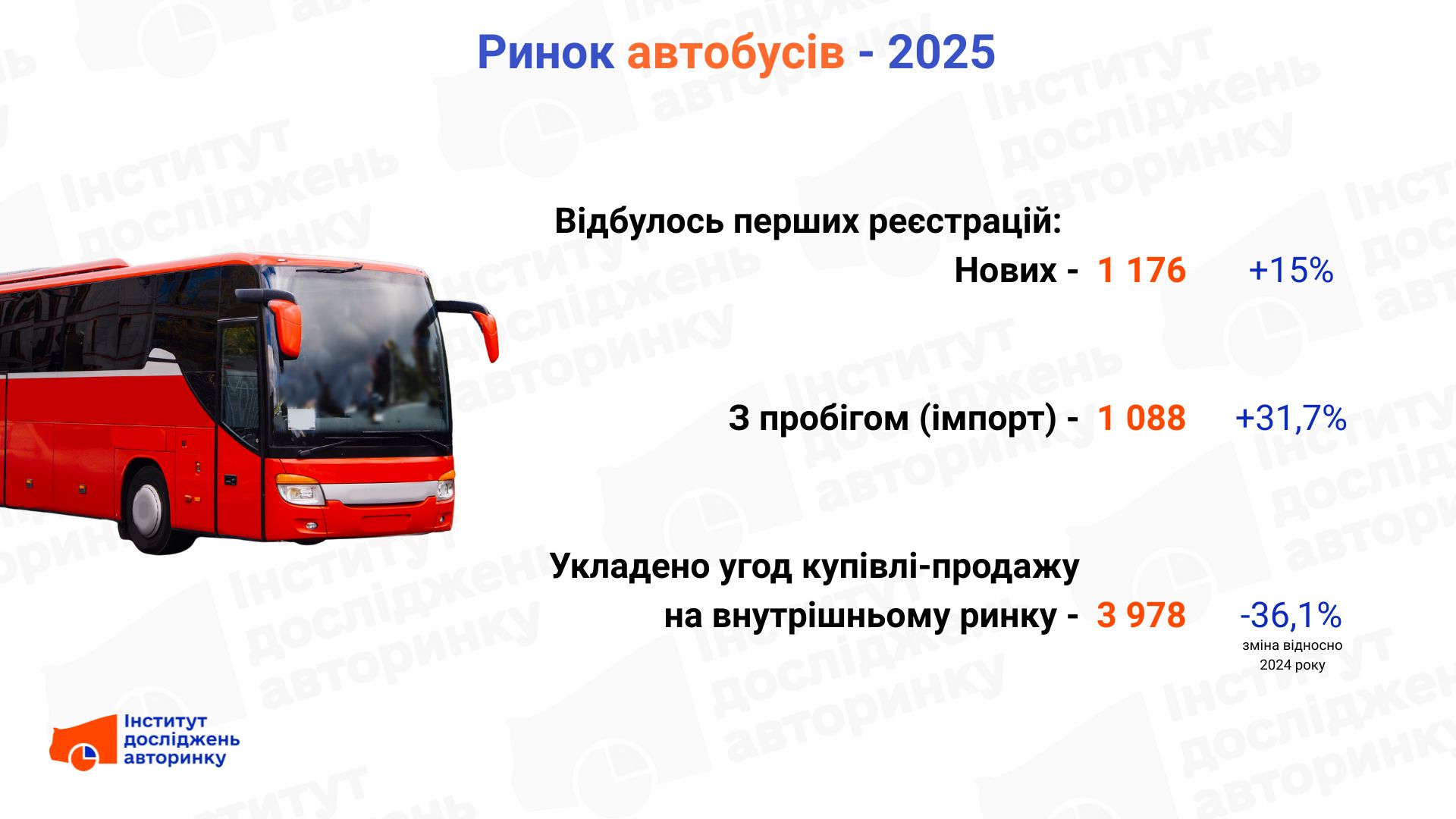

Bus market

In this segment, we see an increase in carriersʼ interest in new vehicles (by 15%) — here the purchase of locally produced vehicles for urban or intercity transportation has its influence, less often — the purchase of new buses by international carriers. Imports of used buses increased by 32%, while domestic resales decreased by 36%. So we have a trend towards updating the fleet of passenger vehicles, but stagnation with sales of those already registered in Ukraine. In total, 1,833 fewer buses were purchased than in 2024. That is, another part of commercial transport with a minus sign.

In the following articles, the Institute for Automotive Market Research will examine in detail each segment of the Ukrainian market, with ratings of brands and models and other important information.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.