This year, the market for installations of gas cylinder equipment is showing low but stable rates, staying at the level of 1000–1200 installations per month. If earlier the main driver here was the opportunity to almost halve fuel costs, and this was of interest to both owners of "small cars" and "bulky" cars, now the difference in monetary terms is not so significant. At current prices for gasoline and propane-butane mixture, 100 kilometers of travel at a consumption of 10 l/100 km will cost about 580 UAH on gasoline, and 450 UAH (with a consumption of 13 l/100 km of LPG) on a gas mixture. In categories, the difference is two coffees at a network gas station.

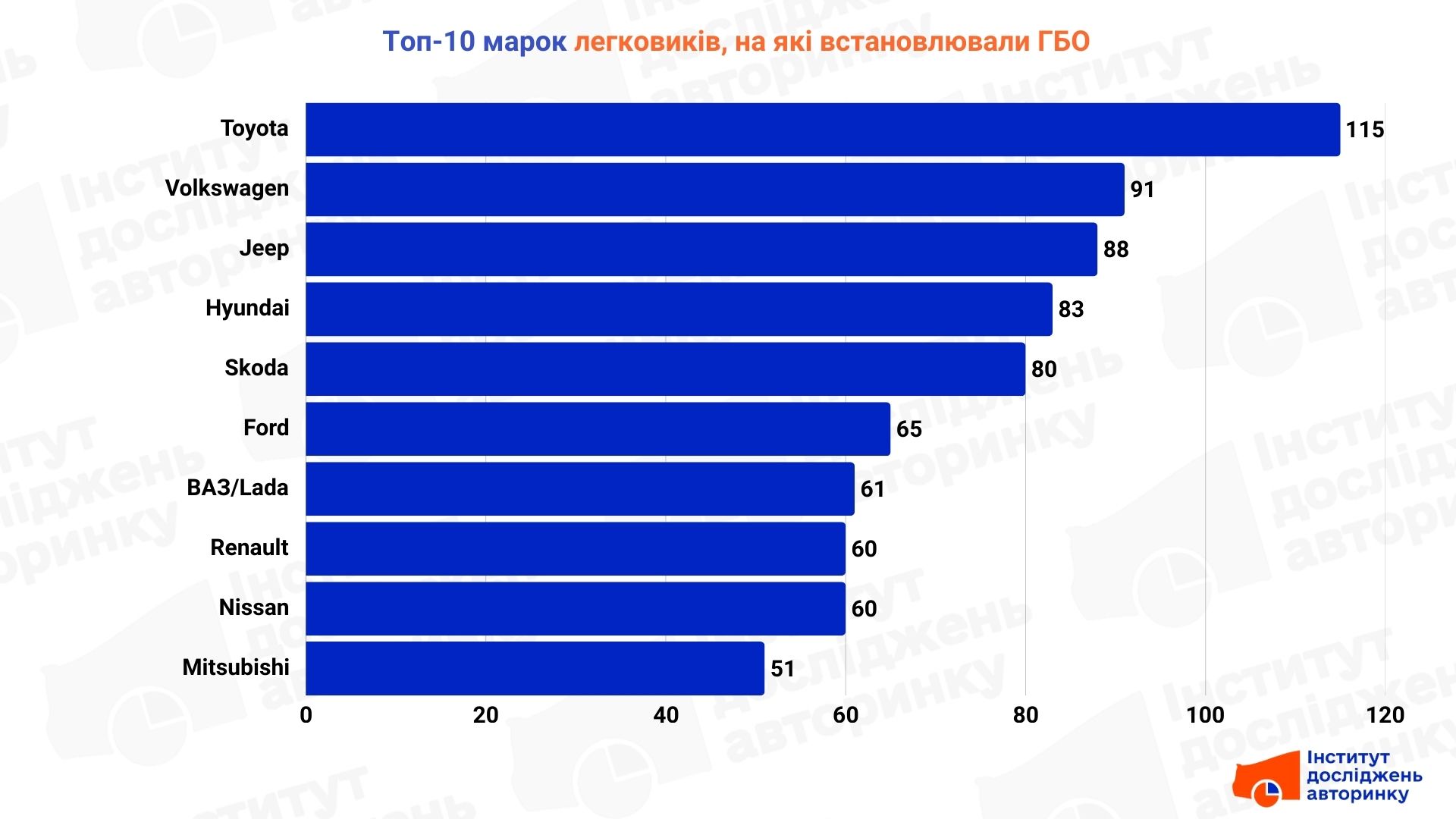

The ratings of brands that were most often re-equipped in October 2025 to work on two types of fuel, including a liquefied propane-butane mixture, demonstrate the usual mix of old Europeans and cars from the American market, where you can still find "atmospheric" engines in some places, for which HBO in our realities is not just a means of saving, but the only opportunity to have fuel costs within reasonable limits. Because otherwise, even despite electric cars, the operation of a gasoline engine with a volume of more than 2.5...3 liters becomes economically inexpedient. Among the "Americans" (which includes some cars from Toyota, Volkswagen, Ford, Nissan, Jeep, Hyundai and Mitsuishi), there are several European brands — Skoda of early releases, before the TSI era, and Renault, before the saturation of the line with TCE engines.

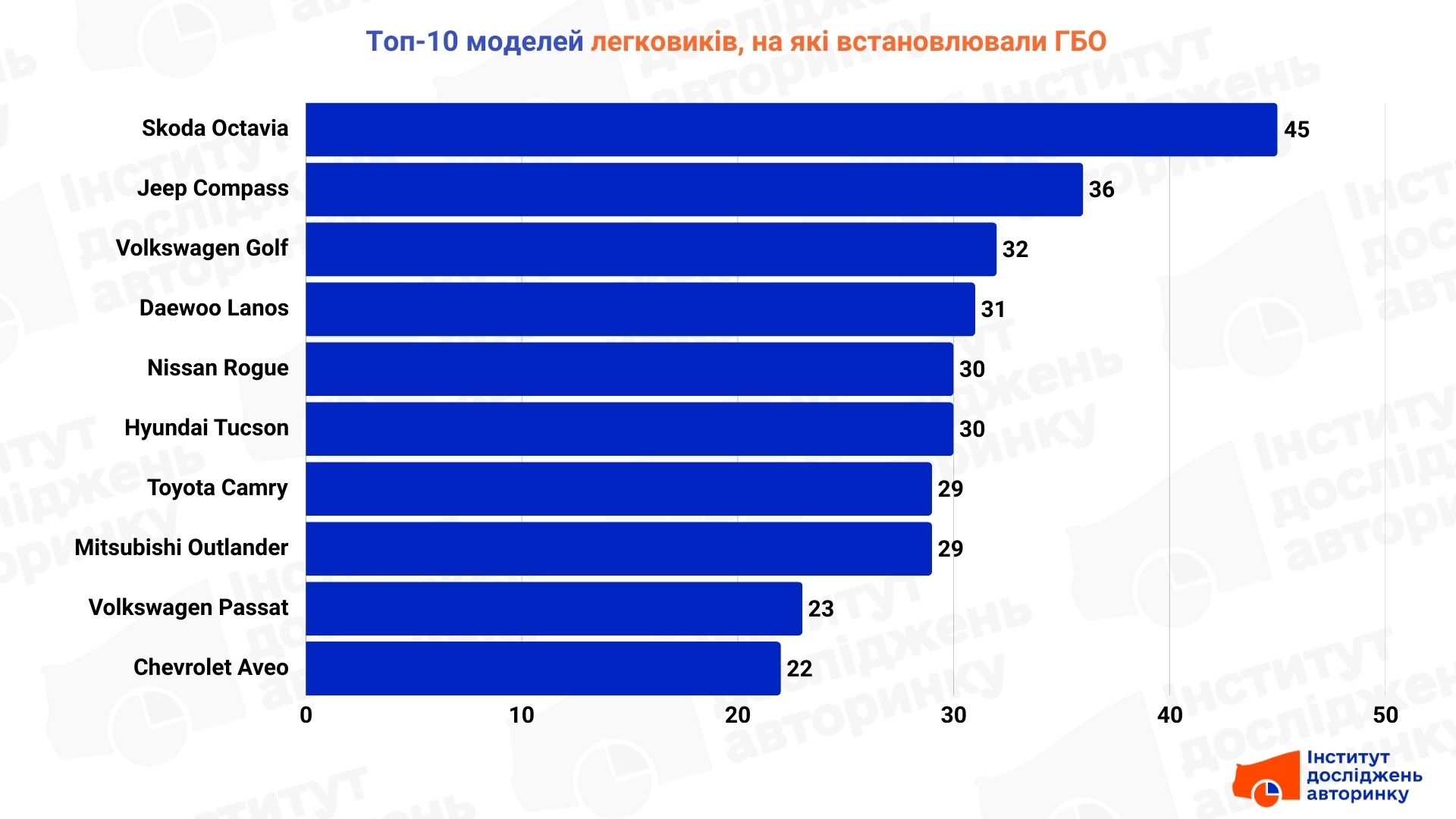

The top 10 models confirm that the SUV market is divided between two categories: mass crossovers and sedans from overseas and "workhorses" proven over the years.

The leadership of the Skoda Octavia (45 conversions) and the high positions of the Volkswagen Golf and Passat indicate that owners of European classics with simpler engines consider LPG as a reliable investment in long-term operation. Daewoo Lanos and Chevrolet Aveo are traditionally close to them — models for which LPG is a key factor, making their operation the cheapest possible.

- Check the history of a car by VIN code before buying using the CEBIA service!

However, almost half of the ranking is a direct result of imports: Jeep Compass (36 units) is an unexpected leader, which, like Nissan Rogue, Hyundai Tucson and Mitsubishi Outlander, has relatively large atmospheric engines. It is their economic inexpediency on gasoline that forces owners to seek a quick payback through gas en masse. The presence of Toyota Camry in this list reminds us that this manufacturer prefers old, but time-tested technologies, which, without LPG, can be quite expensive in practice.

The HBO installation sector today is a place of confrontation between old habits and new technologies. The market lives on imports from America, which supplies large naturally aspirated engines (the main HBO customer), and the remnants of old, easily convertible European cars.

The small difference between the price of LPG and gasoline no longer makes the idea of conversion as popular as before. Added to this is the increasing saturation of the market with the latest direct injection engines, on which LPG is either impractical or extremely expensive to install. And on the horizon appears the segment of electric vehicles, which offers savings without compromise.

Consequently, HBO is quickly turning into a highly specialized, pragmatic niche, serving a clearly defined group of cars whose engine design allows for a quick and inexpensive return on this investment.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.