The Institute for Automotive Market Research analyzed vehicle registration statistics in Ukraine for October 2025. The study focuses on the distribution of market shares of cars with different types of powertrains in three key segments: domestic resales, imports of used cars, and the new passenger car market.

Data shows that the preferences of Ukrainians differ significantly depending on the market in which the car is purchased.

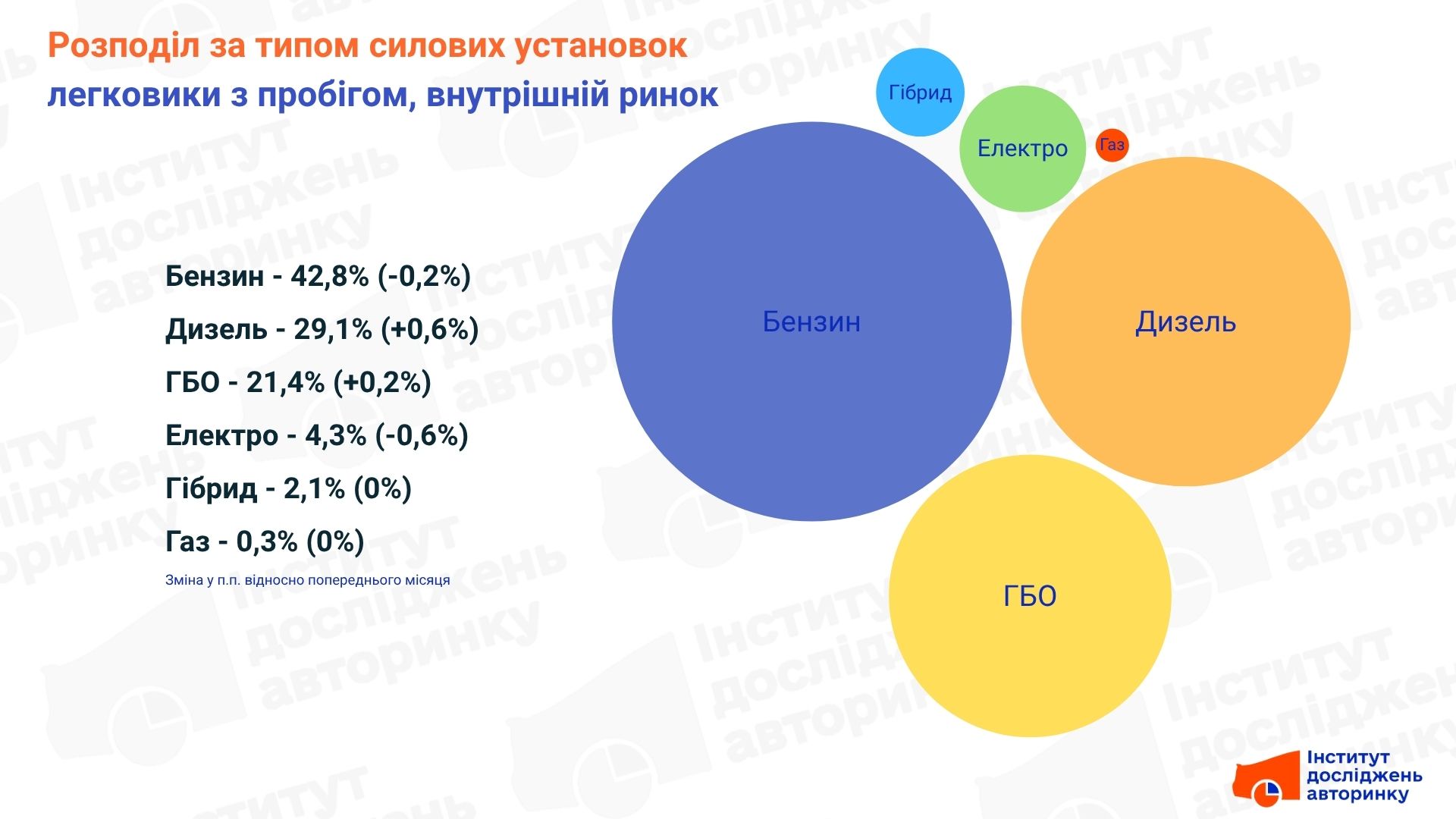

Domestic market

The domestic resale market is dominated by cars with traditional internal combustion engines. Gasoline cars account for over 42% of the market. Diesel showed the greatest growth in October. At the same time, the share of electric cars, which are mainly represented by older models, has decreased slightly.

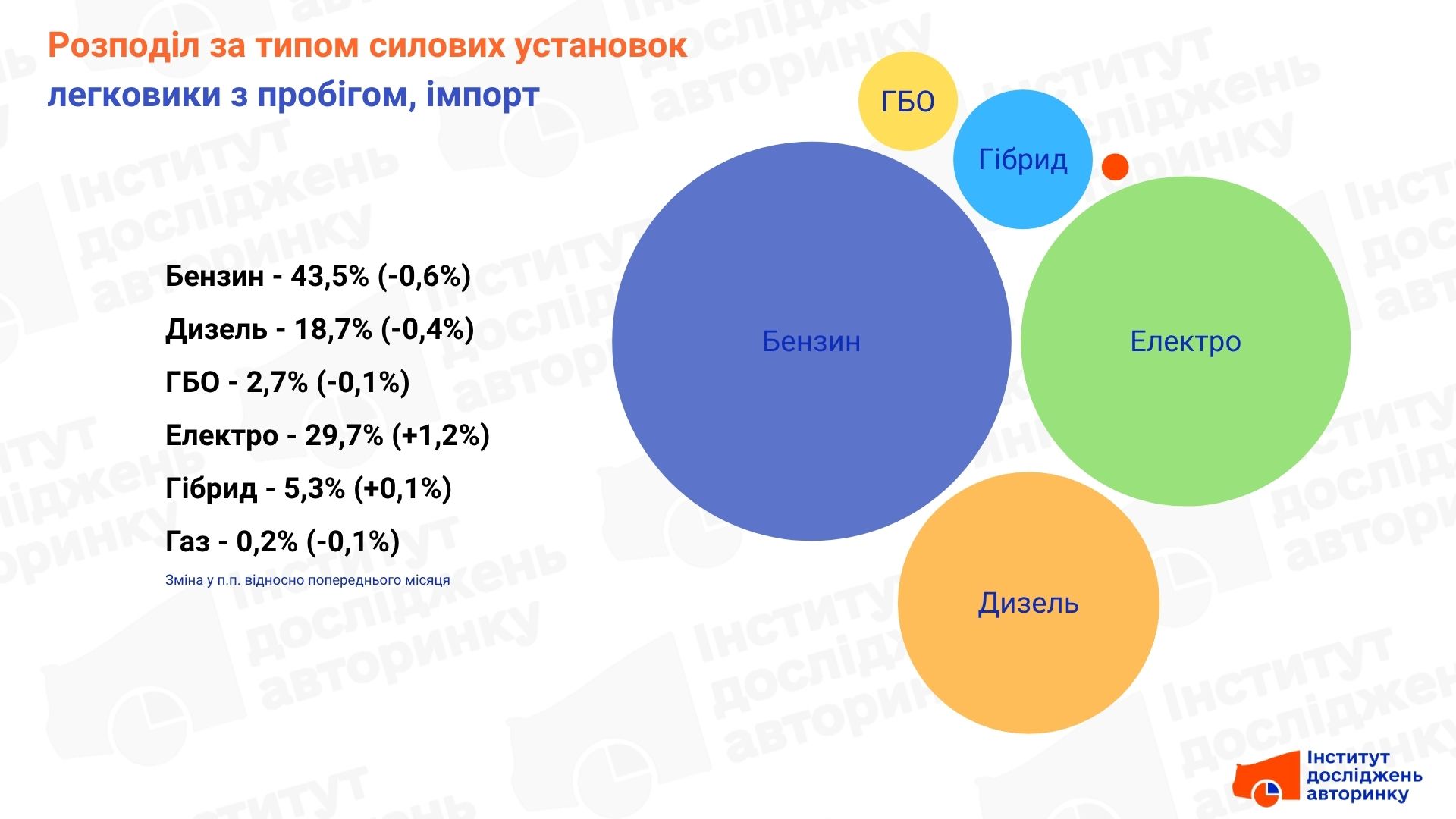

Import of used

The used car import segment remains the main channel for the arrival of electric vehicles in Ukraine. Their share increased again in October, approaching 30% of all imports. Gasoline cars, mainly imported from the USA and Europe, still hold the lead, although their shares are gradually decreasing.

New passenger car segment

The new car market is showing the greatest volatility and focus on modern technologies. In October, the share of electric cars and gasoline cars decreased significantly. Instead, there was an unexpected surge in demand for diesel cars (+3.3%) and a steady growth in the popularity of hybrids, which already occupy over 20% of the market.

Ostap Novitsky, expert at the Institute for Car Market Research:

“October data clearly illustrates that in Ukraine there are actually three parallel automobile markets with completely different demand structures.

The domestic market is the "old" car fleet of the country. It remains conservative and financially oriented. The dominance of gasoline, diesel versions and LPG (over 93% in total) is logical. Buyers here are looking for proven, often cheaper to maintain options. A slight drop in the share of electric cars (-0.6%) is expected here, since it is now strongly attracted by the segment of newly driven cars.

The import market is the main supplier of affordable "green" cars. The trend is obvious: the share of used electric cars (almost 30%) continues to grow (+1.2% per month). Ukrainians are actively importing EVs from abroad as a profitable alternative — and the VAT refund on their customs clearance is not far off.

The new car market is the most unpredictable. The rapid growth of diesel (+3.3%) and the simultaneous decline of electric and gasoline (−2.0%) are unlikely to be a change in consumer sentiment. This is most likely a logistical factor: now dealers, especially official ones, often have to trade what they were given, and buyers, in turn, buy it, because the choice is sometimes limited. Or even simpler — sometimes this picture occurs when a large order for several hundred cars is placed by one buyer (company), after which, the next month, the indicators return to their previous, familiar values.

The main trend in the new car market is the steady growth of hybrids (+0.7%). They have occupied the niche of the "golden mean" for those who want a technological and economical car, but are not yet ready for a fully electric one. If we look more broadly, in total, electric cars (31.9%) and hybrids (20.9%) have already covered more than 52% of the new car market. This indicates a clear vector for electrification.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.