Experts from the Institute of Auto Market Research analyzed vehicle registration statistics in Ukraine and identified the most popular models in three segments of trucks weighing over 3.5 tons (except for tractor units) : used imports, domestic resales, and purchases of new cars, including those converted in Ukraine.

Truck market dynamics

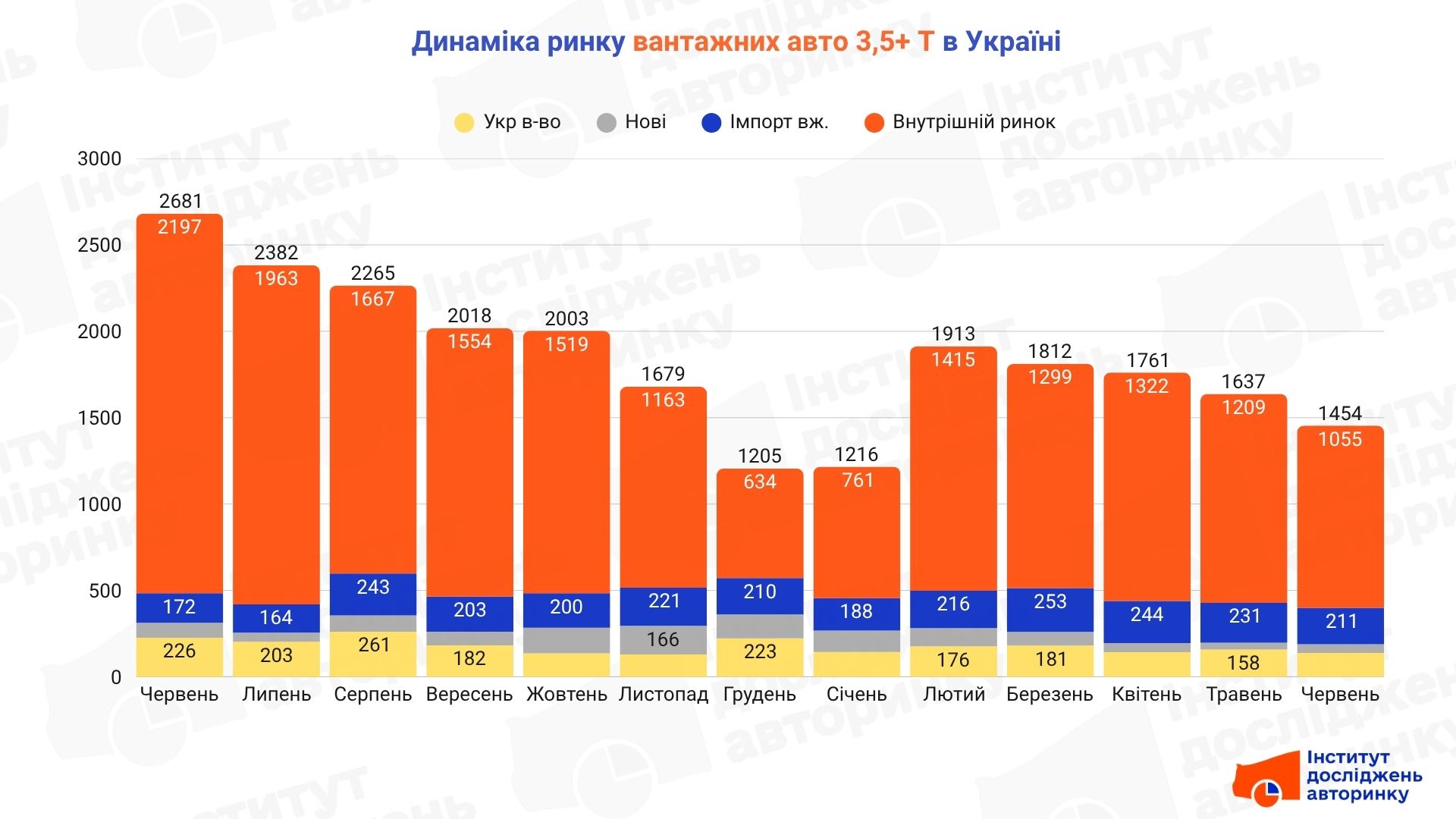

The market volume of trucks with a gross vehicle weight of over 3,500 kg as of June 2025 amounted to 1,500 units. Compared to May of the same year, this is 11.2% less, and also 45.8% less compared to June 2024. Monthly dynamics can be seen in the diagram.

The structure of this segment is as follows: 72.6% (1055 units) — domestic resales, 14.5% (211 units) — imports of used trucks; 3.4% (50 units) — imports of new trucks, 9.5% (138 units) — sales of trucks manufactured (or converted in the factory) in Ukraine. The total share of new vehicles in this group was 12.9%.

The dynamics by individual subsegments, the shares of which were just given, are as follows:

- Domestic resales: −12.7% MM, −52.0% YY

- Used imports: −8.7% MM, +22.7% YY

- New imports: +28.2% MM, −41.9% YY

- Made in Ukraine: −12.7% MM, −38.9% YY

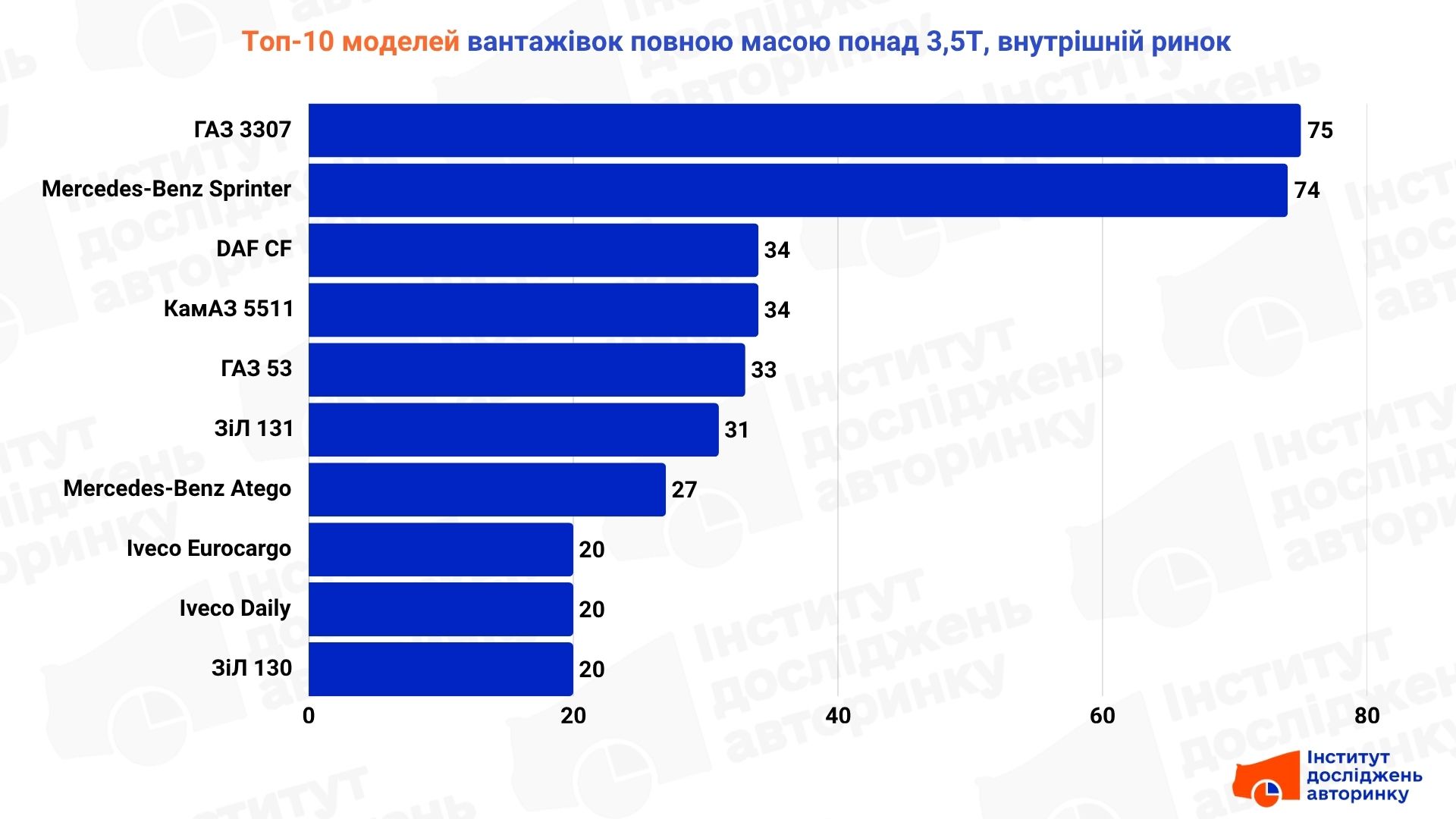

Top 10 trucks in the domestic market

The most popular type in this subsegment was dump trucks, with stable demand for vans and flatbed versions.

The situation with the models is consistently contrasting: on the one hand, modern cars of European brands, on the other, equipment from Soviet times, which, despite its age, is still in circulation. The leader this time is the GAZ-3307 — a typical example of the “legacy of the Union” that is still trying to stay in service. Next to it is the Mercedes-Benz Sprinter, which, although lighter, is actively used in freight transportation due to its versatility. DAF CF and KamAZ 5511 are more “serious” trucks that continue to serve construction sites and regional transportation. And ZiLs and GAZ-53 are equipment that symbolizes efforts to survive in conditions of lack of resources rather than commercial efficiency.

Top 10 imported trucks with mileage

The Ukrainian fleet was most often replenished last month with tail lift vans, regular vans, and refrigerated vans.

- Looking for a way to "drive" a truck from Europe? — West Auto Hub will help you get it turnkey!

In the segment of heavy and medium-duty truck imports, the leadership is confidently held by the Mercedes-Benz Atego — a universal option for both city deliveries and regional routes. It is followed by the MAN TGL — another popular representative in the “melee” class. Interestingly, even the Sprinter continues to make it to this list, although it is more often classified as an LCV. The top also features the heavier MAN TGS/TGM/TGX, DAF CF and Iveco Eurocargo — vehicles chosen for serious work when reliability and load capacity are required without unnecessary glamour.

By the way, this time the Tesla Cybertruck pickup truck fell into the 3,500+ kg group — which means that a regular category "B" in your driverʼs license will not be enough to legally drive this "electric vehicle."

Top 10 new trucks

Among new trucks with a gross vehicle weight of over 3.5 tons, the greatest demand was observed for vans, refrigerated vans, and garbage trucks.

Among the new trucks registered in June, brands that are not familiar to the general public dominate, but mainly chassis of foreign origin, which after retrofitting in Ukraine receive completely different names. In the top are Reform, Intercargotruck, Everlast, VKK Spetsmash and other representatives of the market of special equipment and superstructures.

These cars may look like cash collectors, fuel tankers, utility vehicles, or hydraulic lift trucks, but in statistics they go by separate local names. However, in the background are still the familiar Sprinter, Crafter, Sinotruk, and Dongfeng, which also form the pool of the new Ukrainian car fleet.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.