Migration of passenger cars in the domestic market of Ukraine: where do cars go after resale?

This is the first time such a study has been published - the migration of cars between regions. It is not about border crossing or import — but about how cars already registered in Ukraine pass from one owner to another with re-registration within their region or with movement to another.

Such processes are a kind of internal logistics of the market. They reflect not only consumer activity, but also deeper trends: the level of demand, the saturation of the car fleet, the availability of services, and even the socio-economic mobility of residents of the regions.

The sample, which covers the period from the beginning of 2025 to mid-June, only considered used passenger cars that changed ownership in Ukraine. Each such case was recorded by the place of new registration, as well as with a comparison to the previous place of registration.

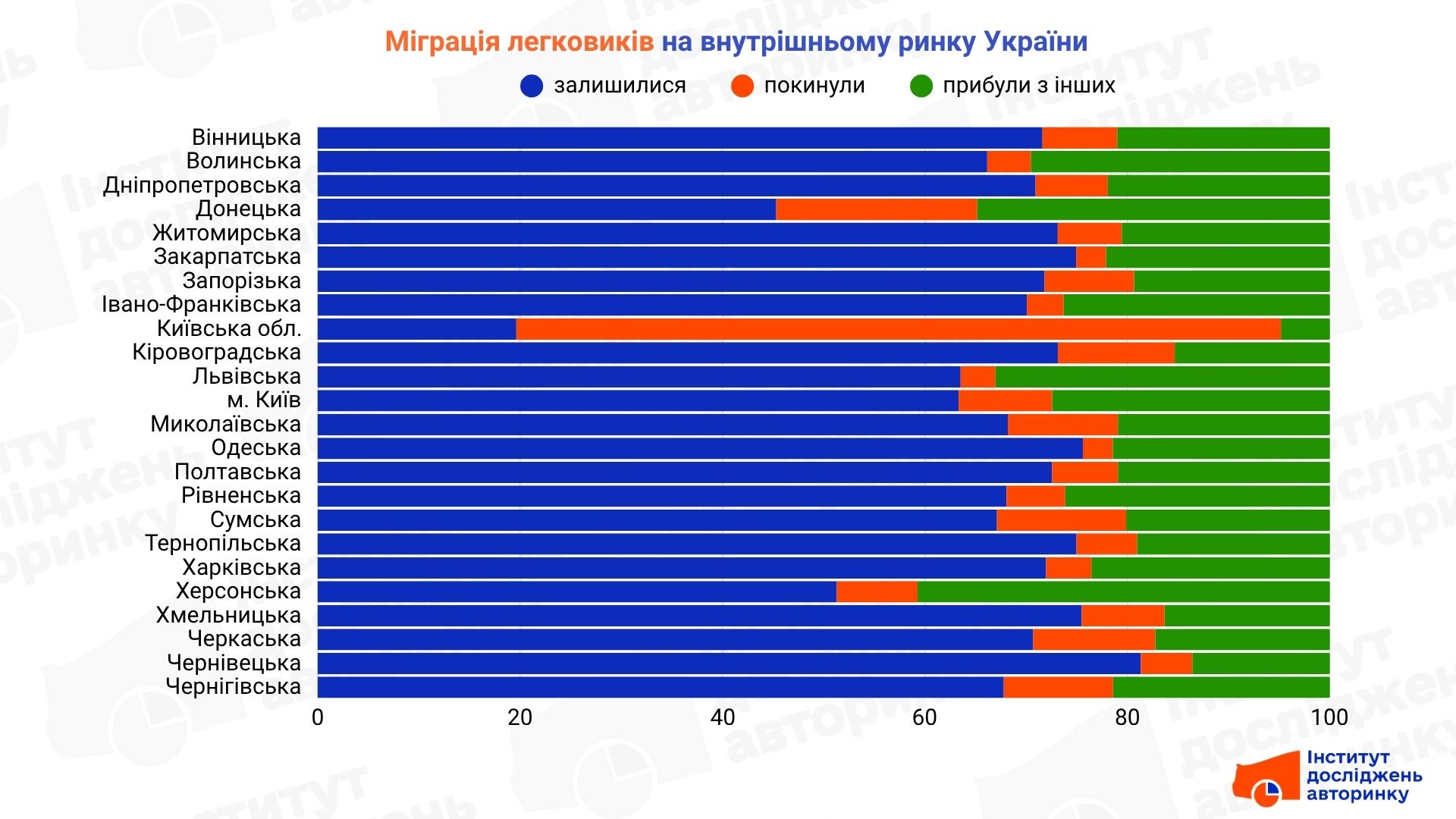

The visualization below shows the distribution by region : what percentage of cars remained within the region (i.e., sold within the region), what percentage left for other regions, and how many arrived.

In general, about 70% of cars in the country remain within the region, that is, they are purchased by new owners in the same region. Another 10% leave for other regions, and about 20% arrive from outside. This is a conditional average that masks the deep asymmetry between regions.

Thus, Kyiv region turned out to be the largest “donor” of the domestic market : more than 75% of all cars sold in the region went to other regions. This is a unique situation that may indicate that the region plays the role of a logistics or wholesale hub. This is partly explained by the high concentration of dealers, a large volume of commercial imports and proximity to the capital.

The other extreme is Chernivtsi region, where over 81% of cars remained within the region. There is a fairly closed domestic market here, with a low level of "outflow". A similar situation is in Ternopil, Khmelnytskyi, Odessa and Zakarpattia regions.

Interestingly, Kyiv and Lviv region, which traditionally have high traffic volumes, demonstrate moderate migration activity: 63% of cars remain in Kyiv, and slightly more than 63% in Lviv. This confirms the high demand in these regions, as well as the stability of traffic.

- Order turnkey electric cars from West Auto Hub

Donetsk and Kherson regions are among those with a particularly high share of “arrived” cars. In Kherson, for example, over 40% of all transactions are cars that arrived from other regions. This may be a result of pent-up demand, changes in population structure, or the loss of part of the local car fleet as a result of the war.

It is also worth noting Dnipropetrovsk, Kharkiv, Zhytomyr, and Poltava regions, where the internal turnover of cars is quite stable, with a dominance of "local" transactions, and the share of arriving and departing cars is closer to the national average.

Conclusions

Internal migration of used cars is no less important than imports. It allows us to see the dynamics of consumer demand, population mobility, regional imbalances and points of concentration of activity. Despite the stable picture in general, there are magnet regions and donor regions within the country, as well as areas with an almost hermetic domestic market.

This analysis is only a superficial assessment of the data. For more detailed information or to order a full sample by region (including an interactive map of migration routes), please contact the Auto Market Research Institute.