2024 was not a record year for electric vehicle (EV) sales in Europe, as the slowdown in sales that the industry began to experience in 2022 led to a decline in sales last year. Sales increased by +107% year-on-year between 2019 and 2020, +63% between 2020 and 2021, +29% between 2021 and 2022 and +28% between 2022 and 2023. However, 1,985,996 new passenger electric vehicles were registered in the EU-28 in 2024, an annual decline of 1.2%, according to JATO.

The decline in registrations has also had an impact on the BEV market share in Europe, which has fallen slightly from 15.7% in 2023 to 15.4% last year. Lack of clarity on BEV incentives, high average retail prices of new models and low residual values, as well as concerns about charging infrastructure across the continent, are among the reasons for the decline in volumes. Despite the decline recorded last year, the situation is expected to improve during 2025 as the average price of BEVs in Europe continues to fall, mainly due to the emergence of more affordable model offerings from major automakers.

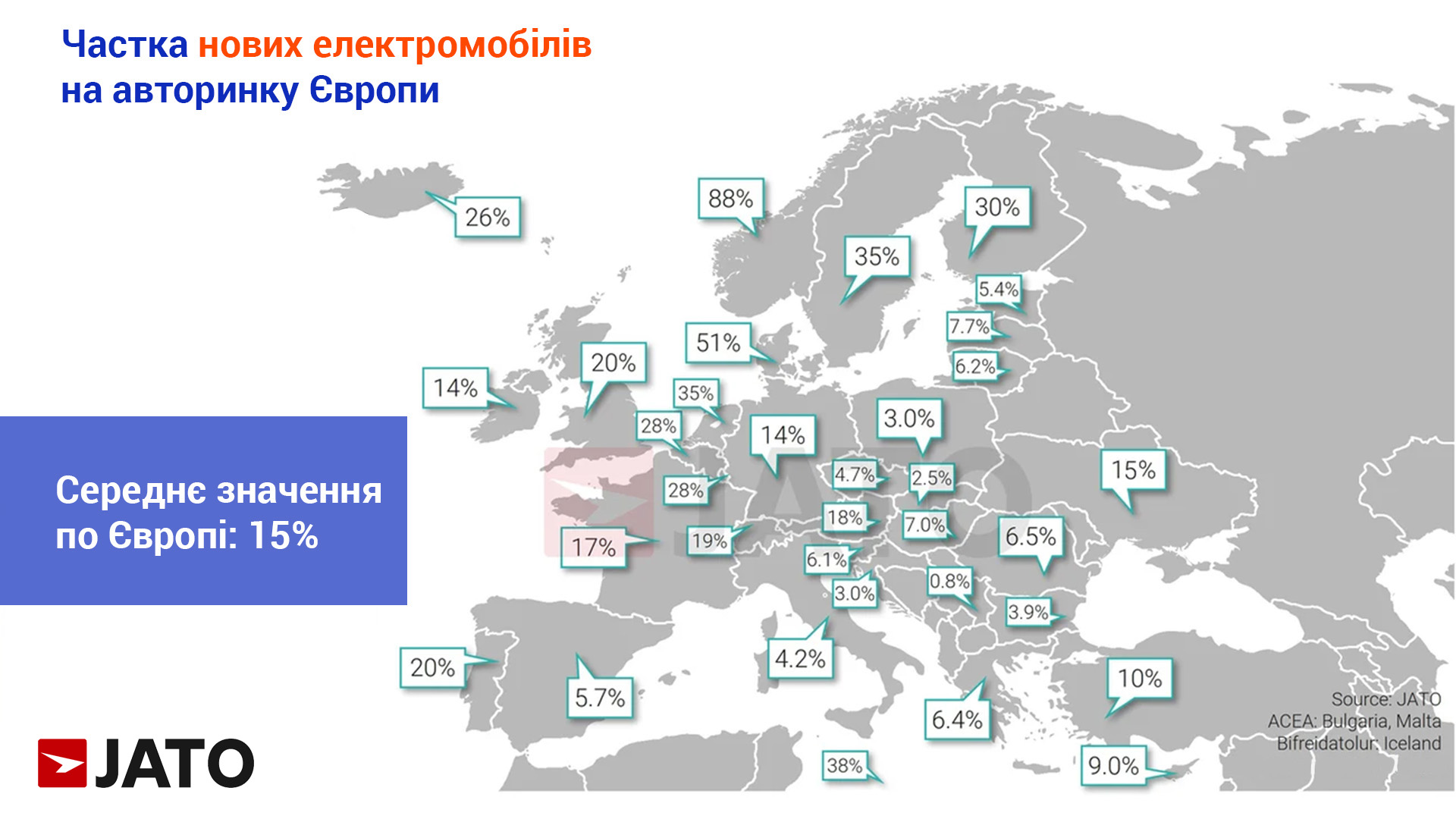

What market share did new electric vehicles take in each European country?

Norway maintained its lead in 2024, with BEVs holding the largest market share (88%). It was followed by Denmark (51%), Sweden (35%) and the Netherlands (34.7%). Denmark, Belgium, Norway, Luxembourg and the Netherlands were the five European countries where electric vehicles gained the largest market share year-on-year, while Germany, Ireland, Finland, Romania and Sweden did the opposite.

In terms of manufacturer rankings, the BEV market did not change significantly in 2024. Volkswagen Group remained the sales leader, with over 427,000 units of its electric models registered in 2024. At the same time, VW Group’s share of the BEV market fell slightly from 22.2% in 2023 to 21.5% last year and remains lower than its share in the broader new passenger car market, which was 26.1% in 2024. 2024. Tesla took second place — increased competition from other players and the long wait for the new Model Y did not allow the American brand to compensate for its decline in the European market. In third place was the products of the Stellantis group, which remained in the top three BEV manufacturers, despite a 10% drop in volumes. In other countries, electric cars from BMW Group and Geely prevailed.

In Ukraine, the share of new battery-powered cars was 15.1% — almost the same as the average value in Europe. In the secondary market, if we determine the share of electric cars among those that were first registered last year, we will get an even higher value — 17.9%. It is worth noting that with different assessment methods, taking into account the specifics of the Ukrainian market, these numbers may be different if those that, for example, were up to 1 year old but were registered as used according to the documents are included in new cars. Then the share will change in favor of new cars, taking a certain part from the first registrations of used electric cars.

Just like in Europe, Ukraine is expected to see an increase in electric vehicle sales. However, the basis for these processes is different — while in the EU this will occur mainly due to financial incentives — tax cuts, grants, and the appearance of more affordable models on the market, in Ukraine the "bullwhip method" will likely be used — since from 2026 the full format of taxation of electric vehicle imports will return, which will one way or another stimulate many to switch to electricity this year.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.