The following calculations are based on an analysis of the real sector of the car market. The IDA team analyzed almost 3 million records of the Automoto.ua aggregator about the announcement of the sale of cars from all (about 100) car websites of Ukraine.

Given the fact that prices in advertisements are directly dependent on the principle of market equilibrium (that is, when the sellerʼs request must meet the buyerʼs expectations, so that the goods are sold in a reasonable time), as well as the fact that these same prices are formed under the influence of a number of external factors, they can to be used for market analysis as indicator values that demonstrate or explain the state of affairs at a certain moment, or explain the influence of external factors on the market. Possession of such information allows business analysts to determine tendencies (trends) and forecast the state of the market for the future, to plan activities taking into account historical and current information for future periods.

Internet market of passenger cars with mileage: we continue to lose momentum

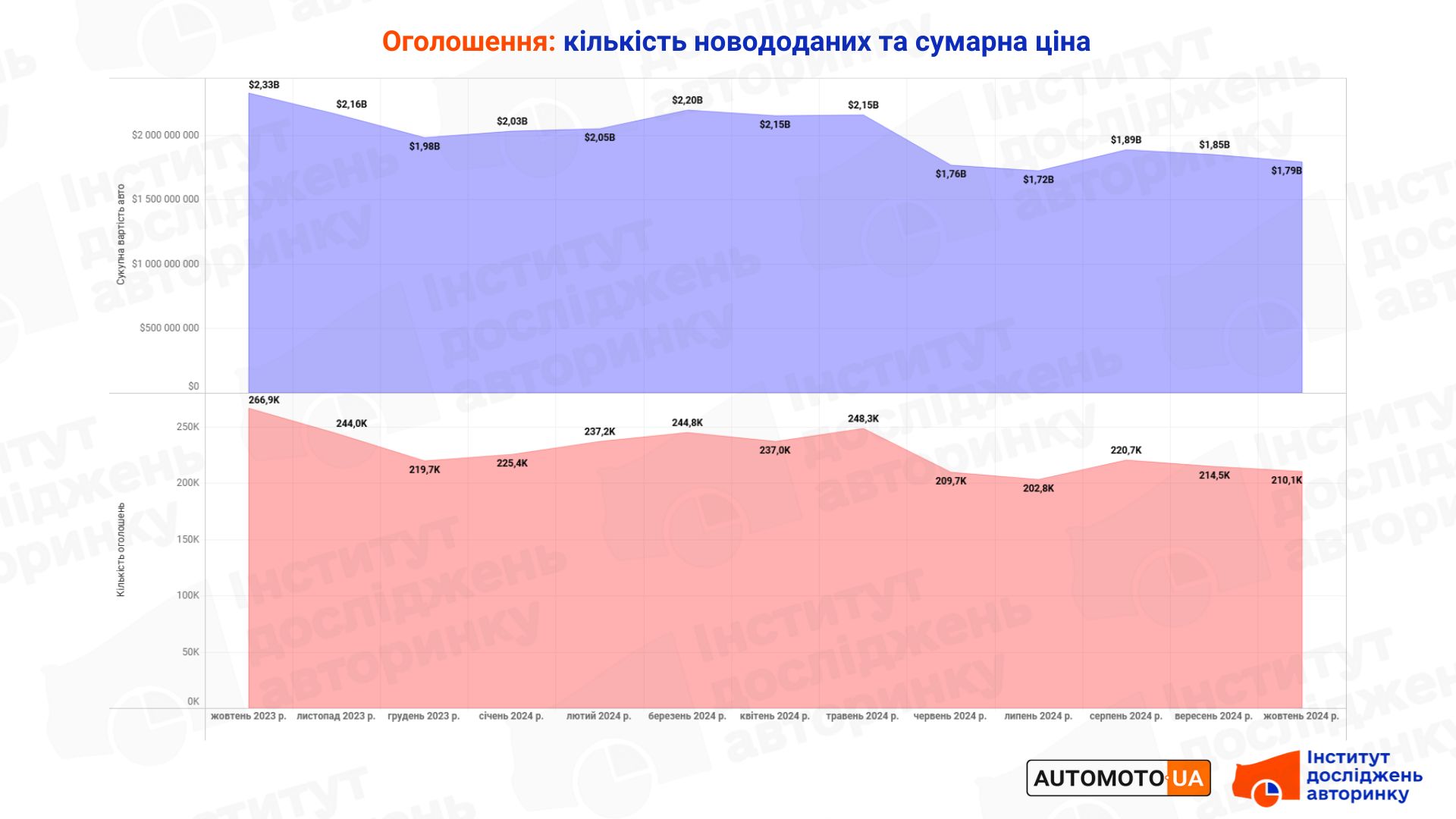

Over the past 12 months, 2.7 million offers for the sale of used cars were placed on Ukrainian online sites for posting advertisements for the sale of motor vehicles. This number includes only newly added ads, excluding duplicates that may occur on multiple bulletin boards.

The highest activity of sellers for the mentioned period was recorded in May 2024, when 248,300 ads were posted. The lowest activity was recorded in July of the same year, 202.8 thousand ads.

The number of ads continued to decrease:from 214.5 thousand in September to 210.1 thousand in October (-2.1%). In a year-to-year comparison, the contrast is even greater: in October 2023, online marketplaces contained 266.9 thousand offers, which is 21.3% more than now.

That is, we have a sure trend of slow fading of the volumes of the Internet author market itself (which should be understood as the environment of large classifieds sites), which can be seen in the following diagram. However, this does not mean that the market is stagnating in general — the share of offers that are placed not on the usual classifieds, but on alternative platforms — in social networks, messengers (which should not be confused with "Instagram advertisers", who are actually unable to sell cars) is increasing every time. or dealersʼ own websites. Many dealers consider this format of communication with potential buyers to be more promising, since the audience is smaller, but of better quality because it consists of interested people; the opportunity to buy or reserve a car under special conditions (which are often offered by dealers) attracts many, and there is less competition with similar offers that is present on large bulletin boards.

The potential financial value of all cars offered (or offered) for sale over the past 12 months decreased slightly to $23.7 billion (vs. $24.3 billion).The maximum and minimum bid saturation in monetary terms correlates with the number of ads mentioned above, which is also visible in the chart. On average, Ukrainians offer $1.7 billion worth of used cars for sale on the Internet every month.

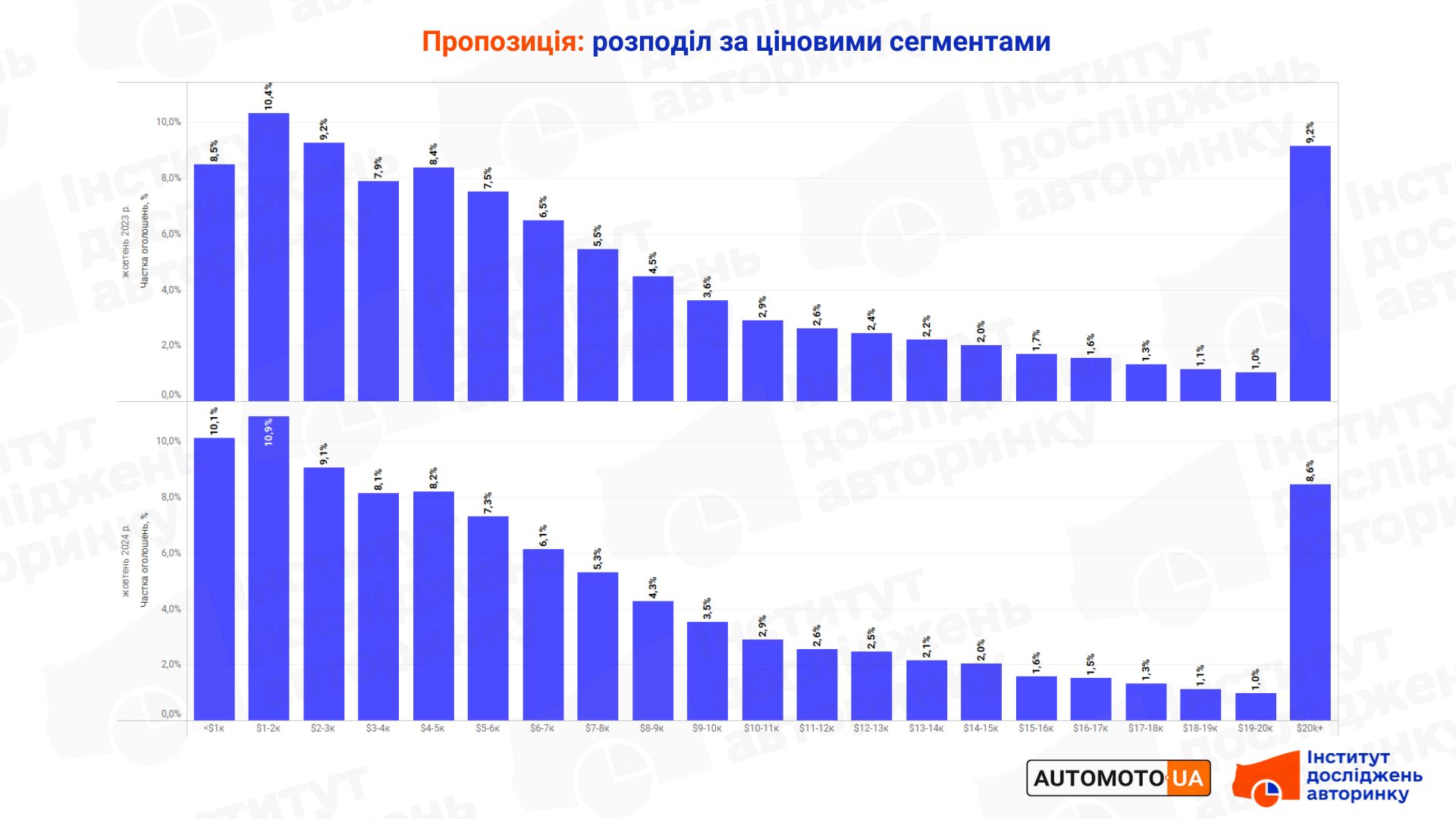

Price structure: cheaper cars dominate

For a year, i.e., comparing October 2024 to October last year, the diagram showing the saturation of the market with offers of various price groups does not show any radical changes. However, if you look at the data in more detail, you can see that the number of overpriced offers with a price of up to $2,000 has increased, while the presence of cars with a price of over $20,000 has decreased.

The closest explanation for such processes is the purchasing power of citizens, which is constantly decreasing due to the war.

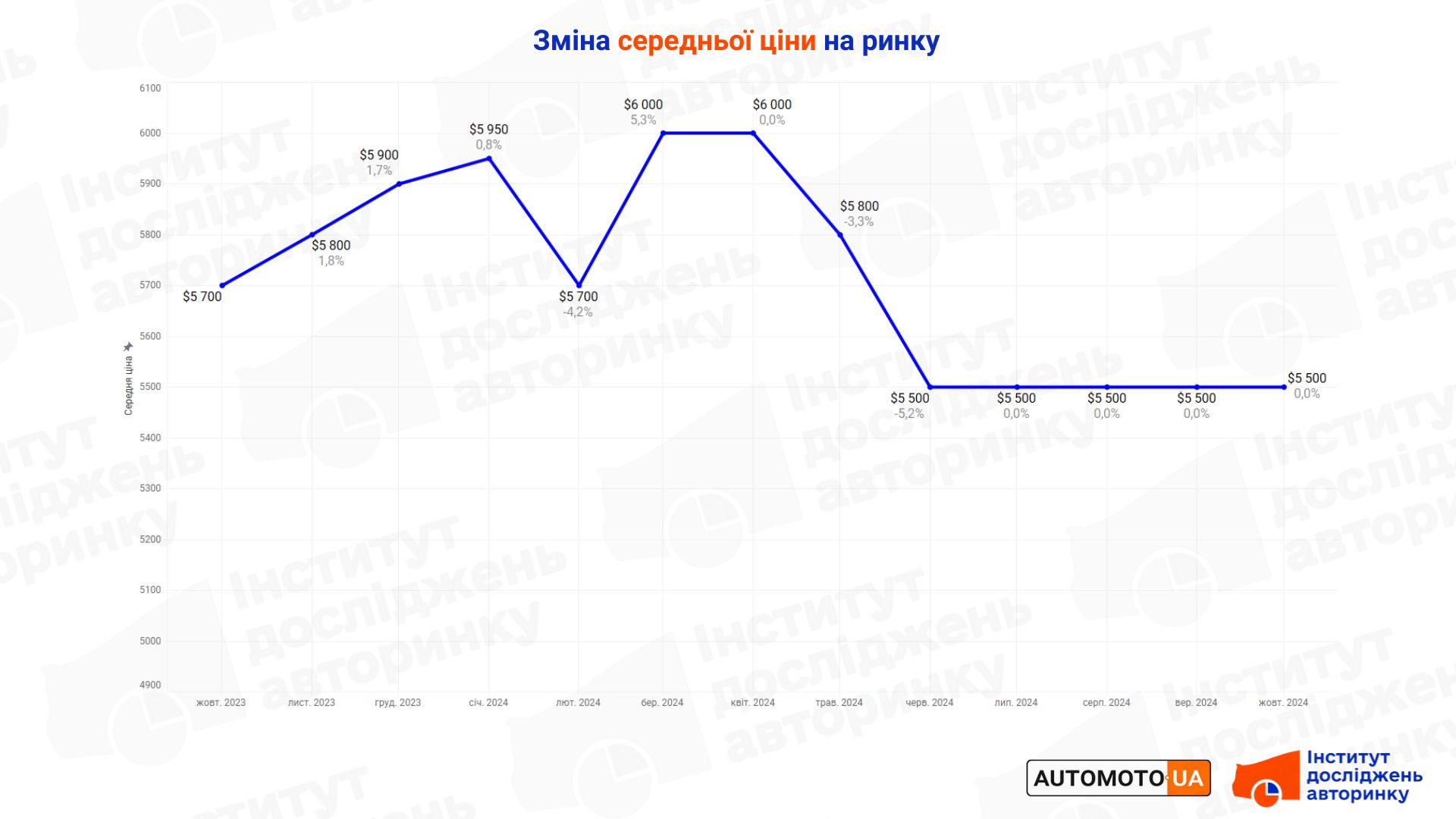

Average bid price: no movement

Despite some spillover between price segments, which was mentioned in the previous section, the overall average value of the price in the secondary market remains unchanged for the fifth month in a row at the level of $5,500.

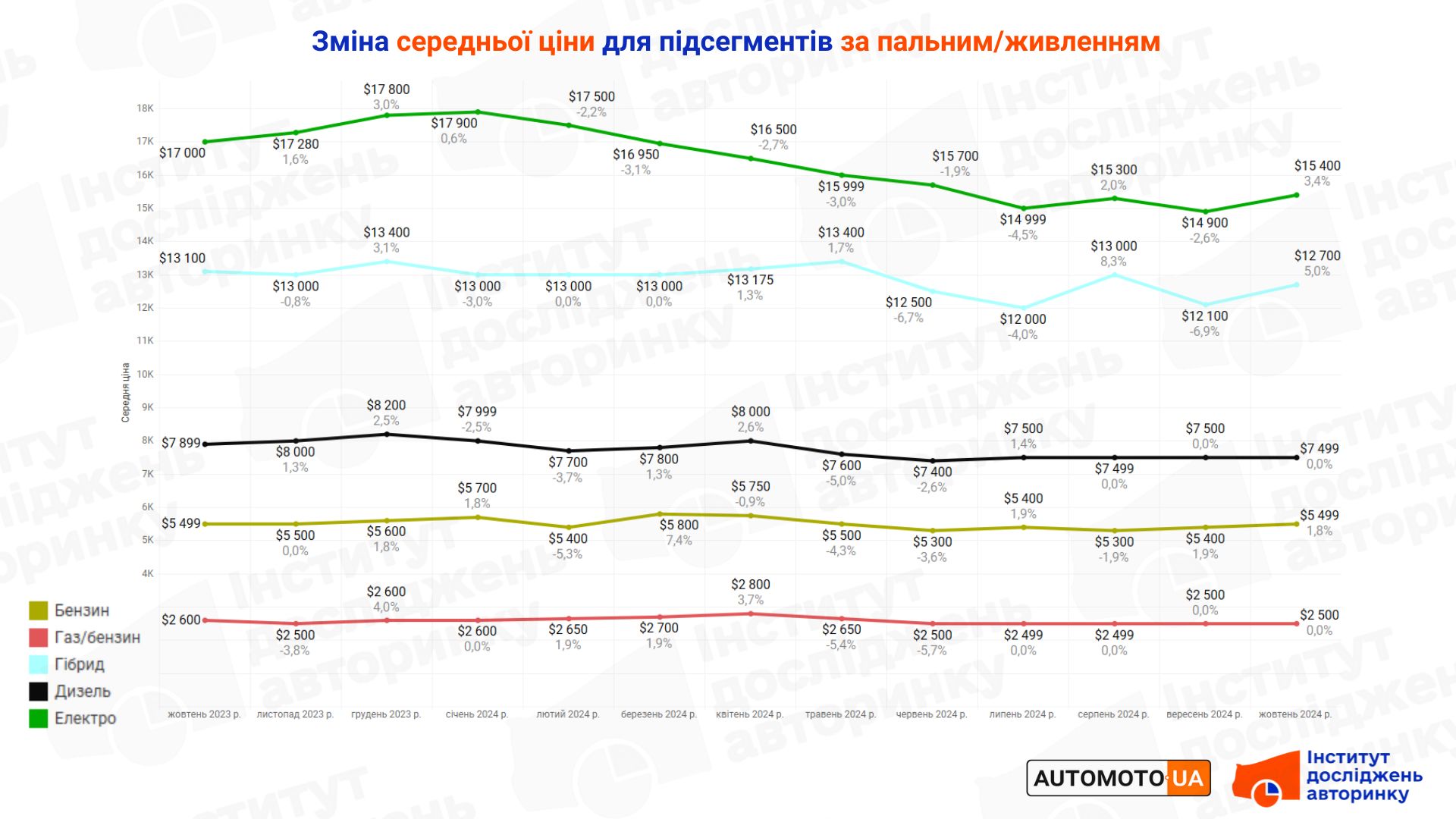

Changes in prices by segment (based on fuel/power)

In the section of individual segments, with distribution by type of power plant, the lowest average price, which according to the results of September is $2,500, is for passenger cars with gas cylinder equipment. It is worth noting that this segment may soon undergo significant changes — more details on this in a separate article related to the fuel market. Over the past 12 months, the average price in this segment has not changed, although some minor fluctuations have been observed.

The most popular segment on the market is gasoline cars, occupying an intermediate position between the just described cars with HBO and diesel cars. The current average price of all offers here is $5,499, actually up $100 from a month ago, but overall, despite the slight fluctuations over the past periods, the average price here remains relatively stable.

Diesel passenger cars with mileage are currently asking $7,499 on average, about the same as in the previous 12 months included in this review. All three segments just described (which at the same time are the most massive in the secondary market) were quite stable in terms of average price indicators from October 2023 to October of the current year.

The segment of cars with hybrid power plants (in total, all subtypes such as MHEV/HEV/PHEV), unlike the previous ones, continues to fluctuate, even in a fairly noticeable range. The current value of the average price of "hybrids" with mileage is now $12,700, which is 6 hundred "conditional" more than a month earlier. However, this is less than a year ago, when this value was more than $13 thousand. The main reason for such jumps in the average price in this segment is the small number of ads for the sale of cars with hybrid power plants.

And about the segment of electric cars: the long-term decrease in the average price for this group changed to a noticeable increase — up to $15,400, i.e., plus $500 compared to September. What can be evidence of the high level of interest of buyers in the BEV car group, which is facilitated by the increase in the price of autogas, consistently high prices for gasoline and diesel fuel, as well as the absence of hourly schedules for power outages.

- Need more information? Send us a request , and the IDA team will make every effort to provide you with all the necessary data that will help your business grow!

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without ads or spam.