From the beginning of October of this year, when selling those vehicles from which a tax is levied upon alienation, a document with an estimate of the value of such a vehicle, issued by the expert service of the Ministry of Internal Affairs or an entity that has the right to evaluate vehicles, should be provided. These changes are provided for by the relevant resolution of the Cabinet of Ministers.

Vehicles, the sale of which is subject to taxation (for individuals, Article 173 of the Code of Civil Procedure ) — the second car, moped or motorcycle sold in the year (rate 5% of the value of the vehicle), as well as the third and all subsequent such vehicles (rate 18%). The military tax is added every time, the size of which is 1.5%, but in the event of the entry into force of draft law 11416-d, which was adopted by the Parliament, but immediately blocked by a series of resolutions, the size of the military tax will increase to 5%.

A tax is also collected from the sale of the first and second truck, bus, trailer or special equipment at a rate of 5%, and for the third and subsequent similar vehicles, the rate increases to 18%. And again plus the military fee.

That is, in practice, there have been no actual changes to taxation rules or fee rates — they have been prescribed for a long time. The only thing that has changed is that the value of the vehicle will not be entered into the sales contract based on the words of the seller, but on the basis of a document issued by official appraisers (or taken from the website of the Ministry of Economy, where there is a special vehicle valuation calculator, which, however, does not cover a significant part of the market even for the most popular models such as Volkswagen Passat, Renault Megane, Ford Focus, etc.).

Why these changes? According to Deputy Minister of Internal Affairs Bohdan Drapyaty, " If a person sells a second car in a year, then with a certificate of average market value, it will be valued at UAH 450,000, and the 5% tax will amount to UAH 22,500." Instead, the trading organization estimates not on the basis of an official document, but "from the words of the seller", for example, 15 thousand UAH, and pays a tax of 750 UAH. Moreover, the price of a premium class car for 15,000 UAH is not an allegory, but a reality. Unfortunately. For example, a 2022 Tesla Model 3 car was recently registered for UAH 10,000. At the same time, the real average market value of such a car is UAH 917,083.

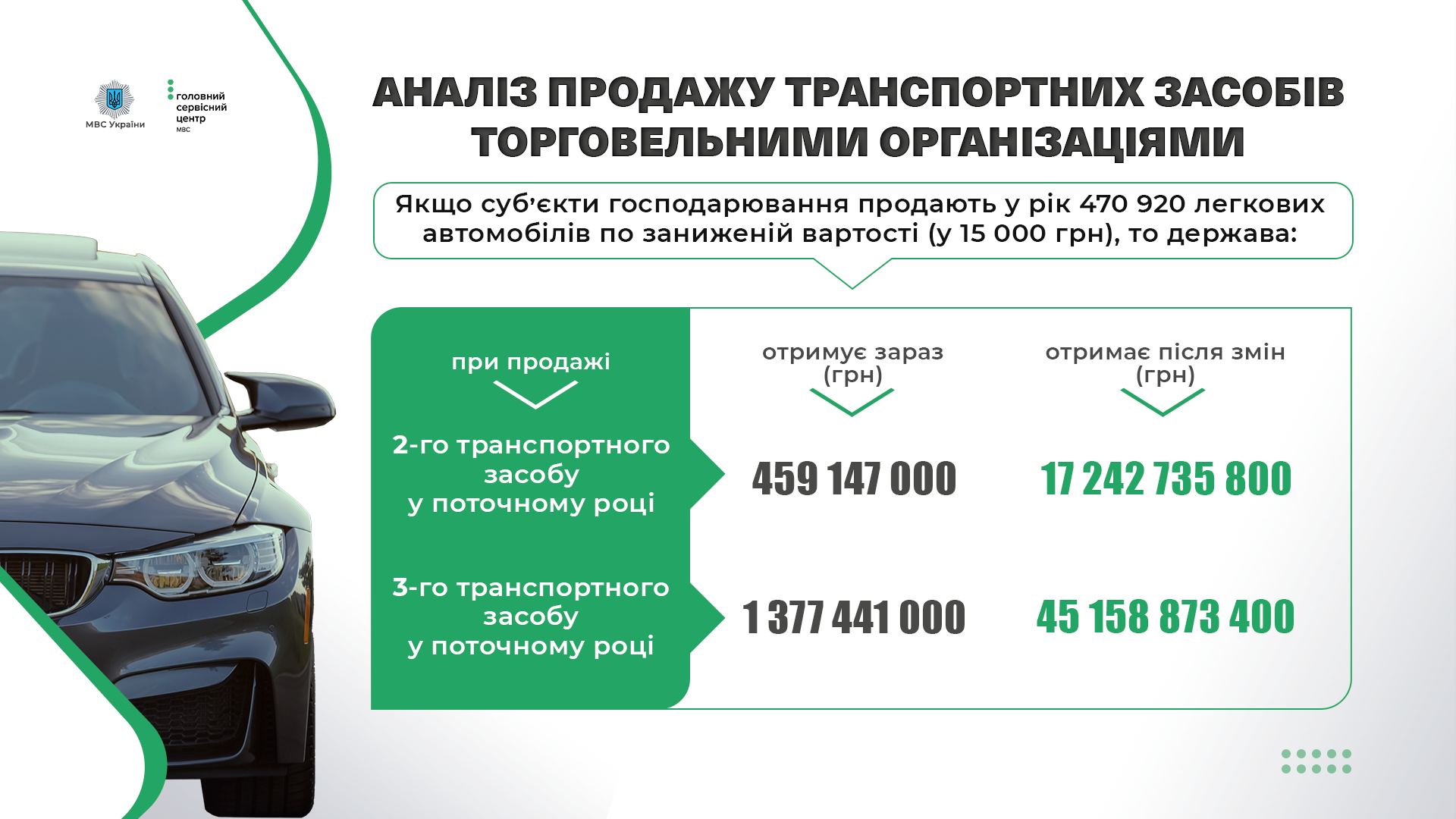

The main service center of the Ministry of Internal Affairs has even prepared an infographic on how this innovation will affect revenues to the state treasury from taxing the sale of vehicles. Currently, the total annual amount of 471,000 taxed motor vehicles is 1 billion 837 million UAH. The introduction of the official certificate of value should already bring 62.4 billion UAH — approximately 60 billion UAH more.

Returning to the total number of sales contracts (sales contracts) from the infographic, where, unfortunately, they are not divided into those concluded for the second or third TK in the year, we will determine the average value of the tax burden for one TK that is subject to taxation. So, now this amount is UAH 3,900 (or almost $100). According to the new assessment principles, the size of the load, as predicted by the authors of this initiative, will increase to UAH 132,510 (or about $3,200). It is not known if these numbers include the military tax (at the current or proposed increased rate), but it is already clear that the average sales tax for a car is about $3,200, for a market where 40% of all cars are priced under $3,200, and the average price for of the entire market is $5,500 — this is quite a challenge for sellers and buyers, that is, for the car market as a whole.

For reference: the total number of resales within the country for all types of vehicles in 2023 amounted to almost 1.1 million. In the above calculations, only those DCPs that (according to the title of the slide) are concluded in trade organizations are taken into account. Accordingly, it follows that the full (not understated) prices of vehicles were indicated in the DCPs concluded in the SC of the Ministry of Internal Affairs and before the changes, and trade organizations (where registration of DCPs are paid) were mostly addressed by those who encountered the "second" or "third" sale of vehicles in the year

At the same time, we will independently determine the amount of tax for an average passenger car at a price of $5,500, provided that its full value is indicated in the DKP. So, if this is the second sale, at a rate of 5+1.5%, the amount of the fee will be $358. If the third sale is 18+1.5%, the payment will increase to $1073. Five times less for the first case, and three times less than the example from the slide for the second. It appears that the slide shows overly optimistic numbers that currently do not correlate with actual market performance and opportunities.

At the same time, taking into account the lack of publicly available data on the official average market value of the majority of vehicles, and the limited availability of the "Bulletin of a car expert", on the basis of which experts will provide their own assessment, only practice will show what amounts will be indicated in the references, and how close or distant they will be from market realities.

- Need more information about the Ukrainian car market? — Contact the Institute of Car Market Research!

It is also worth mentioning that this year, in the period from April and during the next few months, the so-called "re-registration boom" of motor vehicles, caused by the change in the rules for the mobilization of motor vehicles, continued. Owners urgently got rid of or "transferred" cars to relatives in various ways, so that no more than one remained in their possession, because otherwise "extra" cars may be seized for defense purposes under the new rules.

It makes no sense to determine the exact number of "rewritten" and donated vehicles — because all those (or most of them) who owned two or more vehicles already have only one, so they are out of the scope of the new rules, at least when selling cars

In addition, based on the experience of the past, when even before the SC of the Ministry of Internal Affairs there were MREVs, and their services were difficult to access or available only "to the chosen ones", most "sales" took place with the help of notarized powers of attorney, which were "re-assigned" several times in order to not to encounter the then system of registration of transport. This option is still available, and there are even simpler ones — the transfer of a registration certificate (sometimes with registration in the Act of the proper user), which does not even require a visit to a notary.

Practice will show whether Ukrainian car sellers will return to these or similar "circumvent" options. But even now, according to preliminary calculations, it becomes clear that the expected $3,200 from one car is an overly optimistic forecast, since for this it is necessary that each car (at the second sale, 5 + 1.5%) is worth $50,000 (or $16,500 at the third sale at the rate of 18+1.5%), and there are very few of them on our market : in the passenger car segment, there are less than 1% of vehicles whose price is over $50,000, and 5% of those whose price is higher than $16,000.

Are there alternative solutions? More weighted and realistic calculations were given by IDA experts last year, including the potential of revenues to the state budget from the legalization of Trade-in. But for this, several steps should be taken, the first of which have already been taken this year. You can learn more about the "legalization of Trade-in" in this article.

- Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without ads or spam.