The following calculations are based on an analysis of the real sector of the car market. The team analyzed almost 3 million records of the aggregator Automoto.ua about the announcement of the sale of cars from all (about 100) car websites of Ukraine.

Given the fact that prices in advertisements are directly dependent on the principle of market equilibrium (that is, when the sellerʼs request must meet the buyerʼs expectations, so that the goods are sold in a reasonable time), as well as the fact that these same prices are formed under the influence of a number of external factors, they can use for market analysis as indicator values that demonstrate or explain the state of affairs at a given moment in time, or explain the influence of external factors on the market. Possession of such information allows business analysts to determine tendencies (trends) and forecast the state of the market for the future, to plan activities taking into account historical and current information for future periods.

Volumes of the online market of passenger cars with mileage

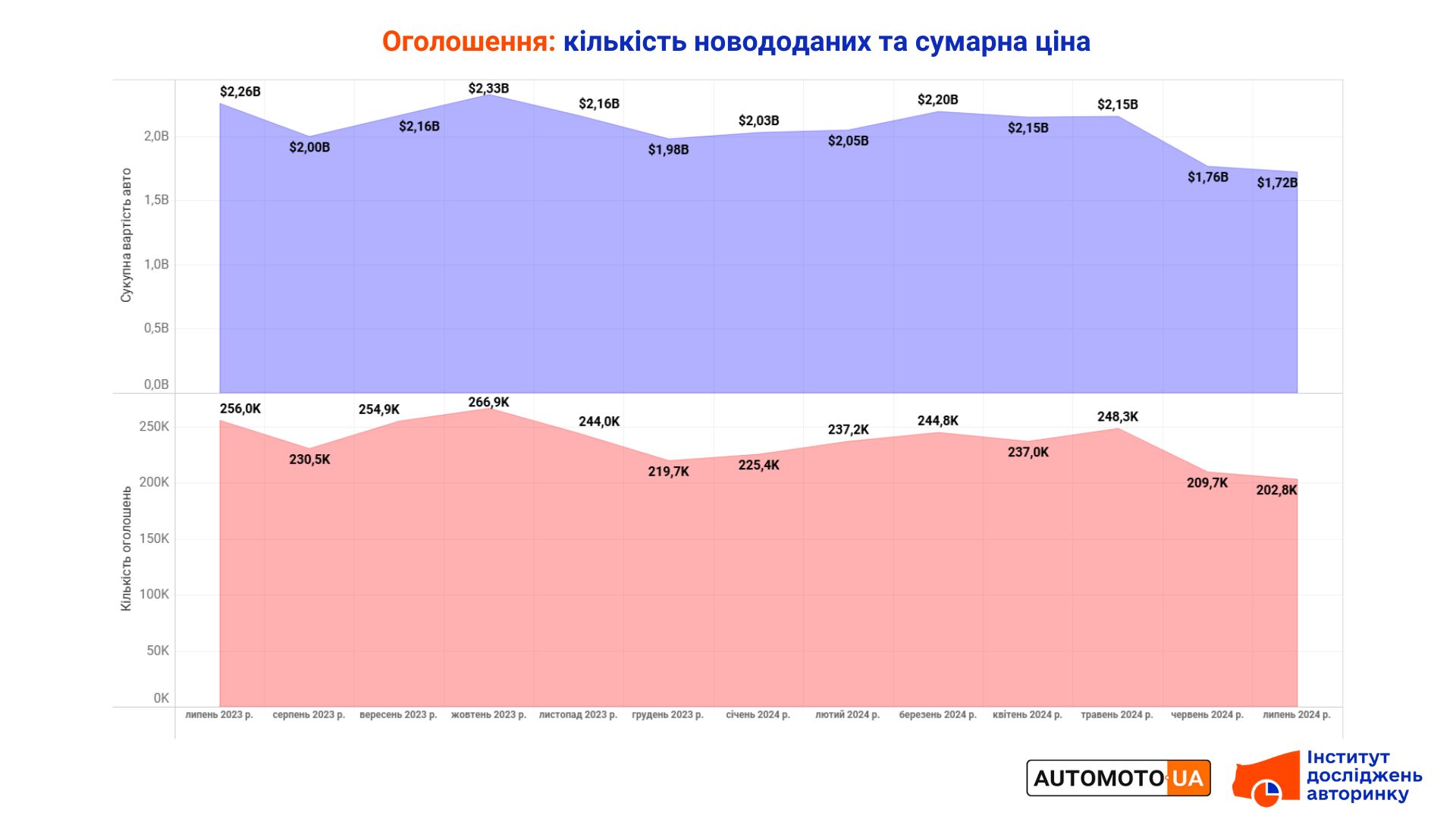

Over the past 12 months , 2.8 million offers for the sale of used cars were placed on Ukrainian Internet sites for posting advertisements for the sale of motor vehicles. This number includes only newly added ads, excluding duplicates that may occur on multiple bulletin boards.

The highest activity of sellers during the mentioned period was observed in October 2023, when 266.8 thousand ads were placed. The lowest activity was recorded in June and July 2024, 209.7 thousand and 202.8 thousand ads, respectively.

At the same time, if you compare the number of newly created ads on the marketplaces with the number of registration operations in the service centers of the Ministry of Internal Affairs, you can confirm the previously expressed hypothesis: the abnormal increase in re-registrations in April-May 2024 was not a real activation of the market. There was no peak in online car auctions, and in June and July there is a trend of decreasing activity, says Stanislav Buchatskyi, co-founder and CEO of the Institute of Car Market Research.

The impact of the news about a possible additional 15% military levy during the first registration of a car is also not yet visible — however, for final conclusions, it is worth waiting for the results of August.

As Automoto.ua CEO Mykhailo Glushko explains, the decrease in the number of ads on marketplaces over the past two months can be caused by several factors. But, in addition to the decrease in purchasing power and the slowdown in economic activity due to the war, there is another interesting trend: the flow of online ads from classic sales sites to social networks and messengers.

The potential financial value of all cars offered (or offered) for sale in the past 12 months was almost $27 billion. The maximum and minimum bid saturation in monetary terms is fully correlated with the number of ads mentioned above, which is also visible in the chart. On average, Ukrainians offer $2.1 billion worth of used cars for sale on the Internet every month.

Price structure: the peak of the mass market has shifted to cheaper cars

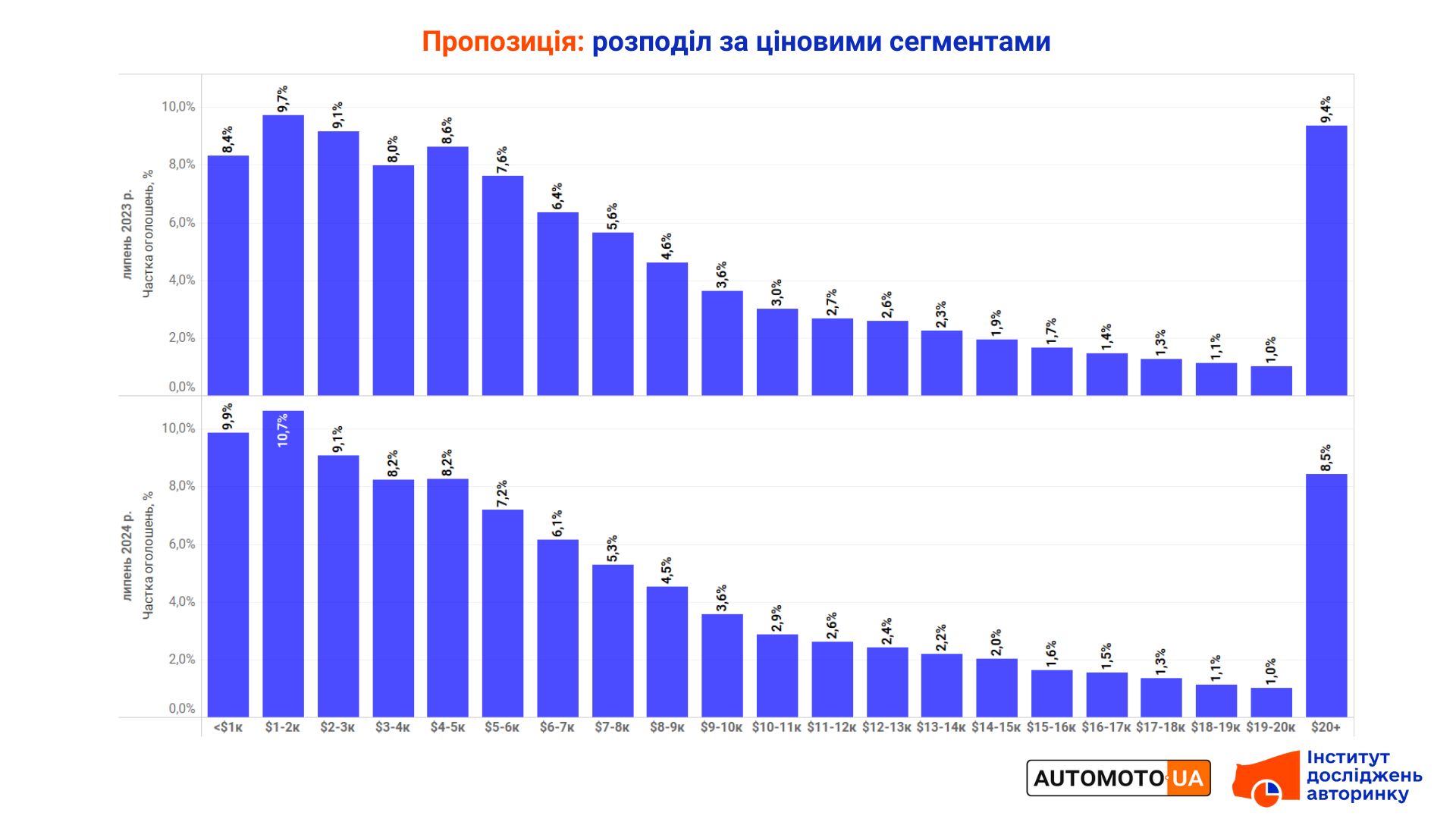

At first glance, the overall “quantity-price” picture looks normal: the absolute majority ( 64.7% ) of the Ukrainian car market consists of offers for the sale of cars worth up to $8,000. A year ago, this figure was slightly lower: 63.4%.

If we go into details, we can state that the "bottom of the market" (in the range of up to $3,000) increased by 2.5 percentage points (p.p.) over the year, to 29.7%. Instead, by 0.5 p.p. the share of the price group $3-6 thousand decreased, in which the most noticeable (by 0.4 pp) subsidence of the $5-6 thousand range

Cars costing $10-20 thousand reduced their share from 15.1% in 2023 to 11.4% in 2024. Cars costing more than $20 thousand also decreased: 8.5% in July 2024 compared to 9.4 % in July 2023.

That is, cheap cars have increased on the market, and expensive cars have decreased accordingly.

The average price of offers

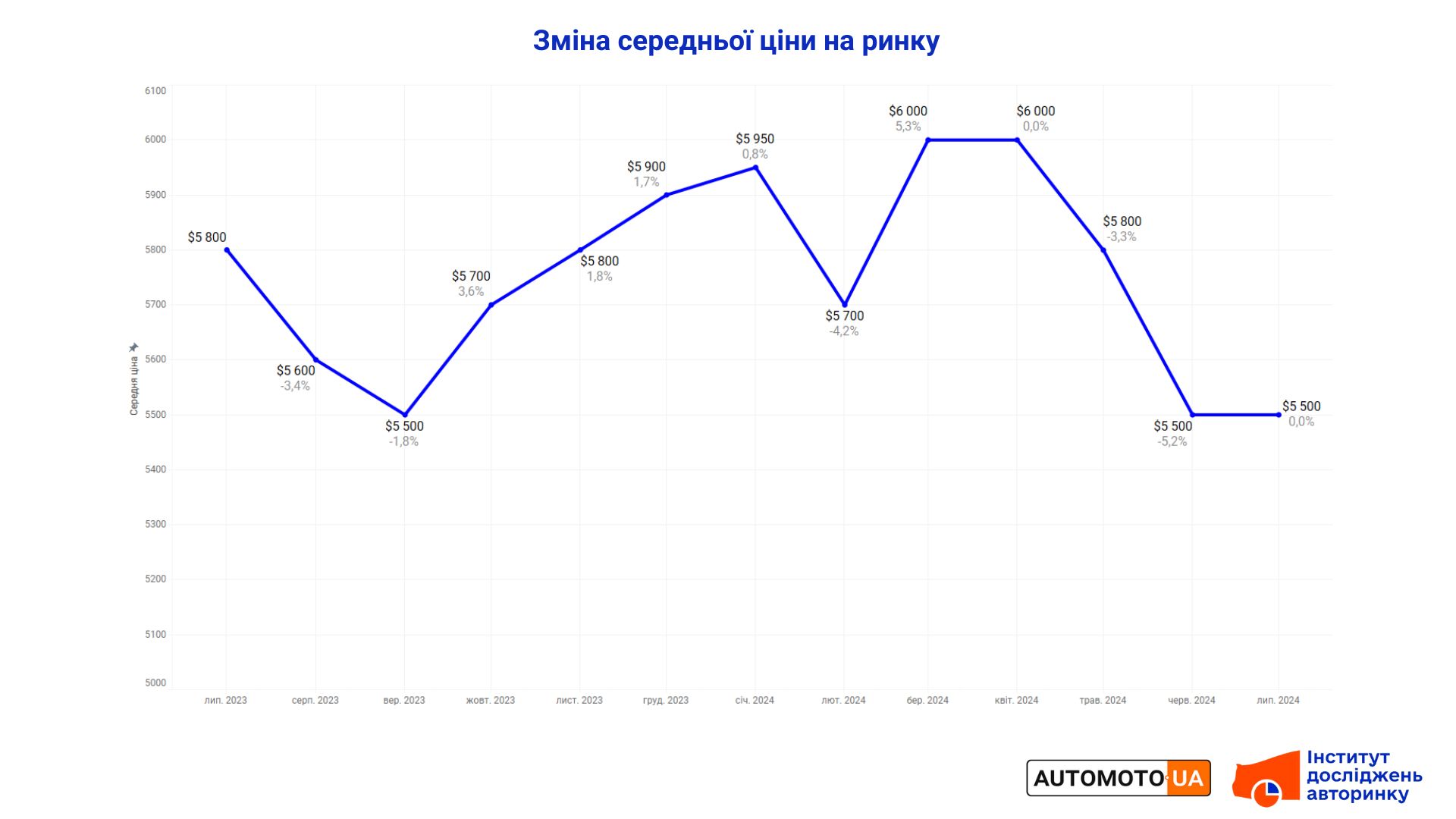

Over the past 12 months, the average (median) asking price for sellers in classified ads has ranged from $5,500 to $6,000. The highest (which usually happens when there is sufficient demand) seller requests were in March and April of the current year 2024. The lowest, which usually indicates a certain decrease in the pace of sales and an increase in the average waiting time of the buyer, was last year in September, as well as in June and July of this year.

If we consider the regional aspect, the most expensive passenger cars with mileage were traditionally found in the Kyiv region and Kyiv ($7,999), Lviv Oblast ($7,700) and Volyn ($7,000). The cheapest are in the Kirovohrad ($3,800), Kherson ($3,000) and Donetsk ($2,900) regions.

Passenger cars rose in price the most over the year in Ivano-Frankivsk region — by 8.6% to $6,300, in Volyn (by 7.7%) and Kherson regions (by 7.2%). The average price decreased the most in Kharkiv (-12.2% to $4,300), Kirovohrad (-12.6% to $3,800) and Vinnytsia (-14.8% to $5,200).

Changes in prices by segment (based on fuel/power)

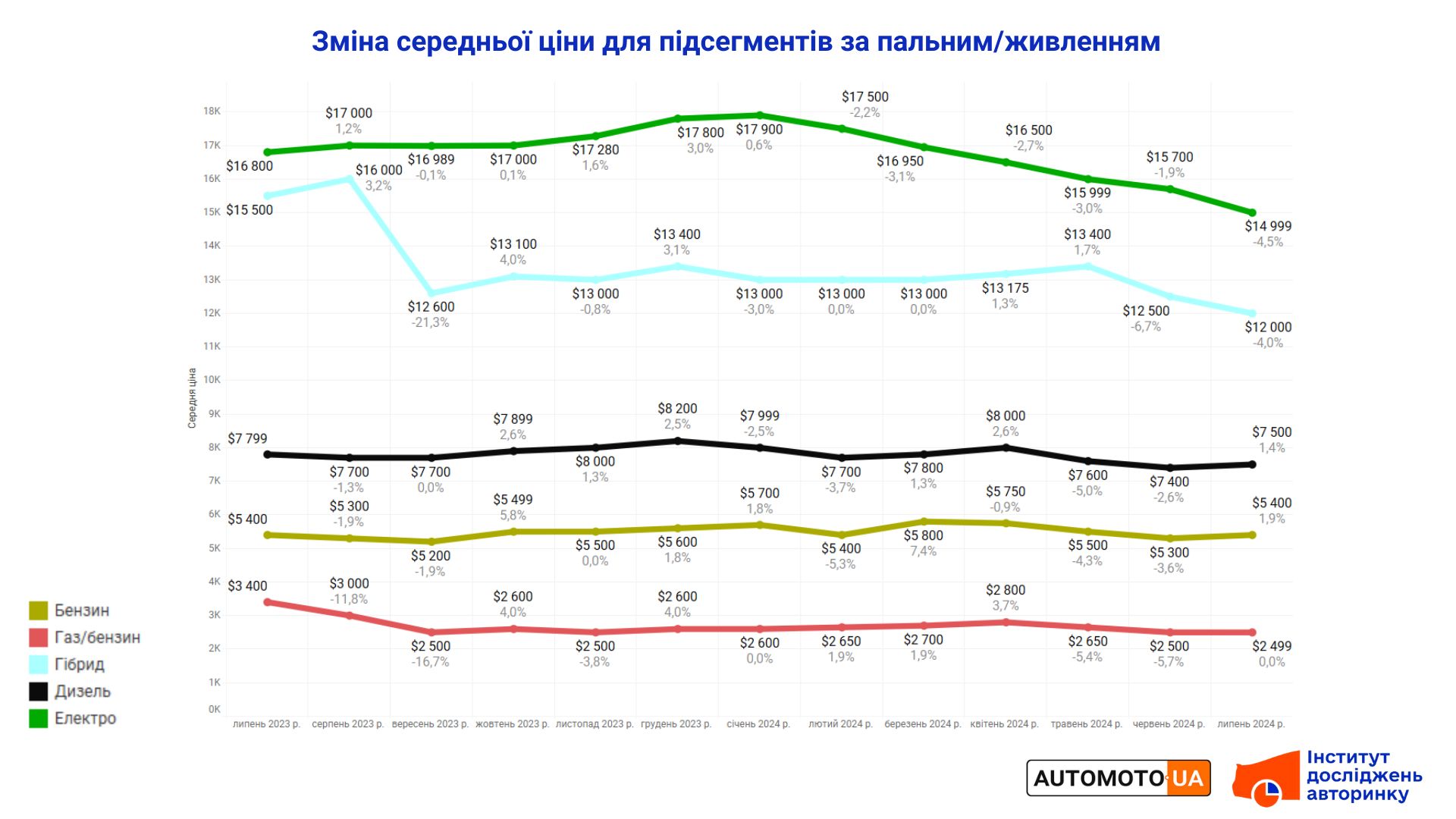

In the section of individual segments, with distribution by type of power plant, the lowest average price, which according to the results of July is $2,500, is for passenger cars with gas cylinder equipment. This is explained by the fact that the fleet of cars with HBO mostly consists of models over 20 years old, with relatively simple internal combustion engines, without direct gasoline injection, turbochargers, variable valve timing, etc. And although some imported cars from the USA with so-called "atmospheric" engines end up there, it did not have a significant effect on the increase of the average price in this segment. In addition, the average price here decreased from $3,400 to $2,500 over the course of a year.

The most popular segment is gasoline cars, occupying an intermediate position between the just described cars with HBO and diesel cars. The current average price of all offers here is $5,400, which, despite minor fluctuations over the past periods, has not changed.

Diesel passenger cars with mileage are now asking an average of $7,500, down slightly from $7,800 a year ago. All three segments just described (which at the same time are the most massive in the secondary market) were quite stable in terms of the average price from July 2023 to July of the current year.

A rather unusual jump in the average price was recorded in the segment of cars with hybrid power plants (which are not divided into subtypes such as MHEV/HEV/PHEV). However, considering that the share of "hybrids" in the market is only about 2%, a few dozen cars are enough to significantly change the price range. In general, if we exclude the period of anomalous "subsidence", the prices of "hybrids" are constantly fluctuating with a tendency to gradually decrease.

The biggest change occurred in the electric vehicle segment: the current value of the average asking price of sellers is $15,000. Which is significantly lower ($1,800) than a year ago in July 2023, and significantly lower ($2,900) than the peak value of $17,900 that was recorded in January 2024. The general trend in the segment of electric cars is a sure decrease in average prices, and the higher the price of a particular model, the faster it falls. On the other hand, in the segment up to $10,000, this phenomenon is reproduced much less.

According to the co-founder of the Car Market Research Institute , Ostap Novytskyi, this state of affairs regarding electric cars is caused by the action of several factors. One of them is that electric cars have lost their special status as a novelty on the market, and have become ordinary everyday vehicles. After all, this is what one of the pioneers of the electric car movement — Elon Musk, who in 2014 stated in an interview with the publication "Rolling Stone" that the goal of Tesla is to make electric cars mass and affordable, so that they become as common as gasoline cars. It seems that in 10 years he has dealt with it.

The next factor (related to the previous one) is the reduction of prices at American insurance auctions, which in turn allows importing and selling many electric cars in Ukraine also cheaper.

Among the local factors, two are worth noting: the saturation of the market with electric cars (or, in other words, the number of buyers who have access to their own charging point is over). Emergency power outages also have their episodic impact, which prompt some electric car owners to urgently look for alternatives with internal combustion engines, getting rid of battery-powered cars with significant discounts.

According to Stanislav Buchatskyi, the stability of the prices of gasoline, diesel, and HBO-equipped cars will be observed in the following periods as well. These segments make up the main part of the market, and the majority of Ukrainians, in turn, tend to buy "traditional" cars with internal combustion engines. This will maintain the balance of supply and demand, provided there are no other "stressful" factors on the car market, the expert explains.

- Need more information? Send us a request , and the IDA team will make every effort to provide you with all the necessary data that will help your business grow!

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without advertising or spam.