The combination of two useful properties in one thing rarely happens. For example, if a gasoline car is powerful and dynamic, then it, as a rule, cannot be economical. Or if there is dynamics and relative economy at the same time, then some other side effect appears — for example, a long charging time in electric cars.

Probably, with the intention of bypassing established engineering postulates, the enthusiasts who were the first to combine internal combustion engines and electric traction in a passenger car were guided by similar thoughts. Combine the strengths of both technologies, and do it so that there are as few "side effects" as possible. And fuel prices, which were constantly rising, and, of course, "greens", that is, those who fought for the improvement of ecology on the planet, usually first of all "fighting" with cars, added their own.

Without going into the deep history and the first experimental developments, the model that is of actual importance for the modern market and which became a true pioneer of the topic is the Toyota Prius. Almost everything was great about it, except for the somewhat specific interior design, which should have emphasized the futuristic technology used by the Japanese in the HSD (Hybrid Synergy Drive) drive, and the same quirky design of the car in general.

However, the fascination of Hollywood stars with saving polar bears made this not too ostentatious hatchback popular in the USA — for its low level of emissions and the fact that it is Eco-Friendly, ecological, which means that owning a cramped and not very comfortable Prius allegedly contributed to saving the planetʼs ecosystem.

- Do you need a car in stock or "turnkey" from Europe? — West Auto Hub will help with this !

Of course, Ukrainian buyers have a more rational attitude to issues of ecology and caring for the North Poleʼs animal world — local motorists are more interested in fuel consumption, that is, it is also close to "eco", but eco -nomic.

Then the management of the car plants decided that it was worth trying to make "hybrids" with a conventional design — without adding the "element of donation to the owner" that was present in the Prius — and then there was an interesting line of different variations from Ford, one of the best "hybrids» — Chevrolet Volt (Opel Ampera), and the same Toyota began to install HSD drives in regular models — Camry, RAV4 and even the small Aqua. This was the right step, because most buyers are not so concerned about the threat of extinction of "red book" animals, and of the two "eco", as already mentioned, the one that improves your life by reducing fuel costs is more important, and the bears should somehow be left alone.

There are also not very correct solutions. That is, not entirely honest — the release of so-called MHEV cars, "soft hybrids". We will not consider these options here, due to their minimal effectiveness, but maximum value for product advertising.

But another right step was the release of PHEV passenger cars — those with an increased traction battery, the charge of which can be recharged (just like in an electric car) from an outlet or a charging station. And it is the plug-in hybrids, with all their obvious advantages, that should become the market leaders, pushing classic variants with internal combustion engines, and even electric cars with their limitations, to the bottom of all ratings. But...

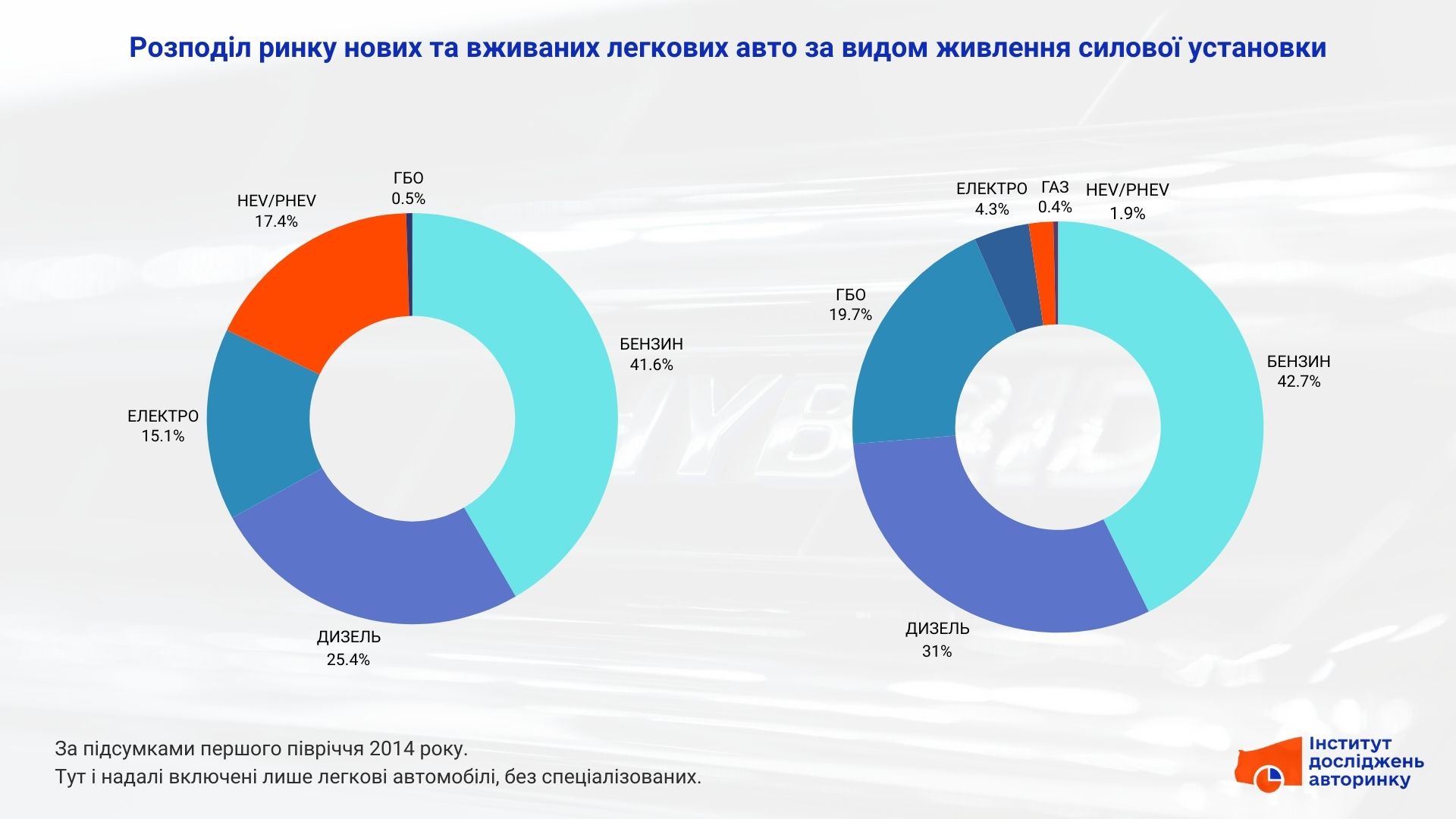

Distribution of the market by fuel now

According to the results of the first half of 2024, passenger cars with hybrid power plants took a share of 17.4% in the new car market, and a barely noticeable 1.9% in the secondary market. Small.

How then was our car fleet replenished with "hybrids" in the past years — perhaps their time has not yet come? Although, considering the fact that the first Prius appeared back in 1997, there was more than enough time.

In the "secondary market", the share of cars with hybrid power plants is barely noticeable, and although it is growing slowly, less than 2% is more like the level of monthly fluctuations in the dominant segments than a significant value. Itʼs a different matter with the new ones — we see a steady increase in the share of "hybrids." Although in fact it contradicts logic: after all, most manufacturers have already abandoned hybrid technologies in favor of electric cars, while leaving "running" models with internal combustion engines. That is, everything should be the other way around. Letʼs unravel this tangle of contradictions further.

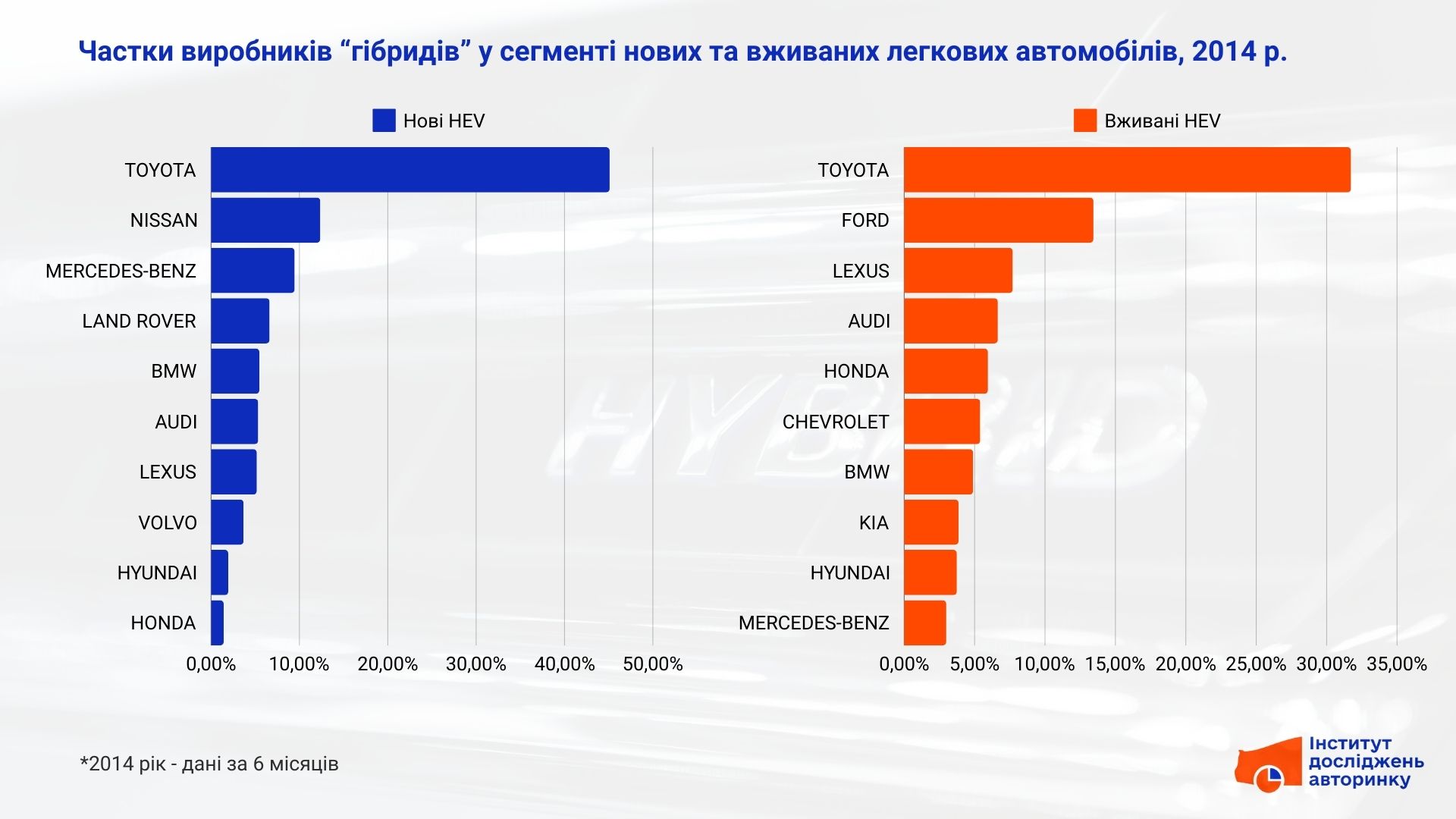

What brands offer "hybrids" now?

More precisely, this title should be formulated as follows: "which manufacturers of passenger cars with hybrid power plants are currently available on the primary and secondary car markets in Ukraine." However, since such an option takes up almost an entire paragraph, we decided to prefer brevity, and then clarify what is meant. And the idea will become even more clear after reading the following slide:

In both parts of the market, both new and used cars, Toyota leads. Now only Nissan has more than 10% of new ones, while Ford "hybrid" cars take second place in the secondary market. Others are again in the minority.

It seems that if Toyota were to be removed from the market, the actual share of hybrid cars would become so small that it would be difficult to notice it among all the others, and it would lose the sense to distinguish this segment as an independent one.

How many "hybrid" models are currently on the market?

Itʼs a fair question, because the more values we measure, the more accurate conclusions weʼll get about the state of this market segment. Letʼs go from the shares of brands to the number of models.

The rounded number of available models (all, for the first half of 2024) is about 480 options. Of them, 120 are "hybrid". There are more than 2,000 different models on the secondary market, of which 230 cars have hybrid power plants.

At the same time, it is worth noting that quantitative presence is not the same as qualitative presence — any of the models may be represented by several cars, and not necessarily in proper technical condition or at an acceptable price. That is, the actual choice, especially among cars with mileage, is even smaller.

Conclusion time

The creation of cars of the HEV group, and even more so PHEV, was not without the emergence of weaknesses of these technologies. This is what led to a relatively small coverage of our market by passenger cars with hybrid power plants.

Price: one of the most popular crossovers in the segment of new cars, the Toyota RAV4, with a gasoline engine now costs from $30,000. For the HEV version, you will have to pay another $5,500, or, if you translate it into liters of gasoline, it is more than 4,000. liters of A-95. What with an average statistical mileage of 15,000 km per year and an average (rounded and approximated to the real) consumption of 10 l/100 km will be enough for 2.7 years.

And if you take into account that the "hybrid" also needs fuel, let it be half as much, 5 l/100 km, then the payback time of the additional price increases, accordingly, by two times, to more than 5 years, which is longer than the warranty period and the average time the car stays in hands first owner Of course, the price of the "hybrid" on the secondary market will also be higher, but when you put everything in numbers, the savings are not so impressive.

On the "secondary" side, the situation is as follows: passenger cars of the HEV group are more expensive than similar gasoline versions by about 30%, plug-in PHEVs by 50%. You can also calculate the potential savings and determine the payback time, but it is already clear that not everything is as economical as it would be in theory.

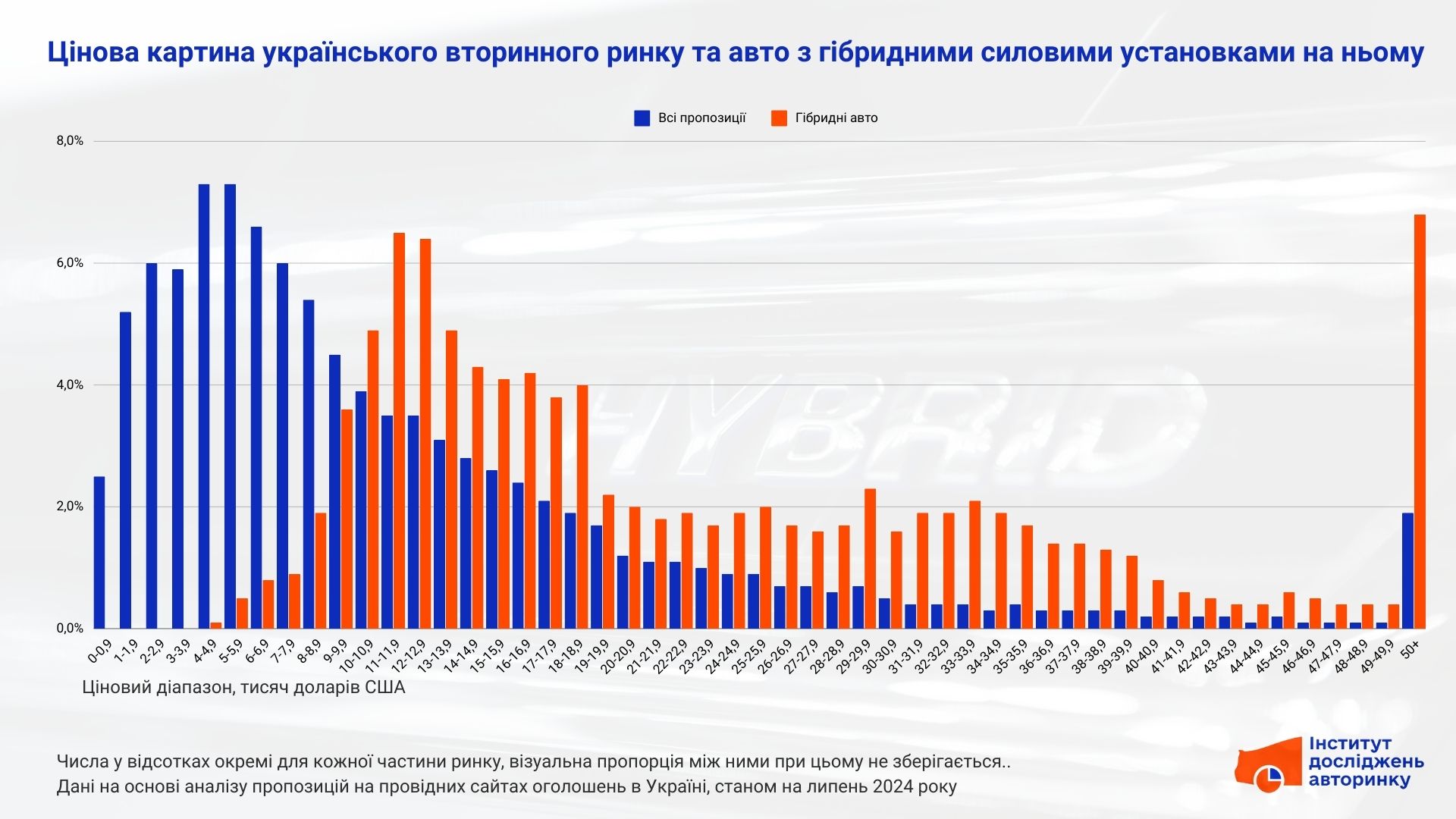

The third question regarding the price will concern the purchasing power of Ukrainians. In the following diagram (without preserving the proportion with respect to the actual quantity — because otherwise the columns with "hybrids" become invisible) it can be seen that the mass market of the secondary market is in the range from $2 to $9 thousand, and just at the upper limit of the mass market, the offer begins with hybrid used cars. Add here the "time-fuel economy" calculation, and it becomes clearer why the share of gasoline or diesel cars prevails.

Once again, we mention the predominant presence of Toyota brand products in the "hybrid" segment, without which this segment would look statistically much more modest, the higher complexity and price of servicing "hybrids", and the smaller selection of models on the market.

We add that most manufacturers abandoned HEV/PHEV options in favor of "pure" electric vehicles in the future, and the use of successful models with internal combustion engines in their product lines.

And finally we get an answer regarding the prospects of passenger cars with hybrid power plants on the Ukrainian market. The segment of new cars is actually based on cars with the Toyota logo, which forces other brands to offer similar options to stay in the competitive environment. Most likely, if Toyota abandons the further use of HSD technology, the presence of "hybrids" in the segment of new cars will decrease dramatically.

Over time, "hybrids" that were sold new will become a commodity on the secondary market. This will be the determining factor regarding its replenishment with newly arrived "hybrids". But considering that the entire new market is ten times smaller than the used car market, this replenishment will be barely noticeable. Similarly, HEV/PHEV stocks in Europe and the USA are running out, so there is no significant future potential for a significant increase in the share of this type of car in our secondary market.

In the end, the interesting and promising (at first glance) technology turned out to be a bit complicated, somewhat expensive, and not readily available, so at the moment, taking into account all the realities, we should not expect an increase in the presence of "hybrids" on the Ukrainian car market.

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without advertising or spam.