Fuel and car market, results of 2023. Have gas station prices affected the priorities of car buyers?

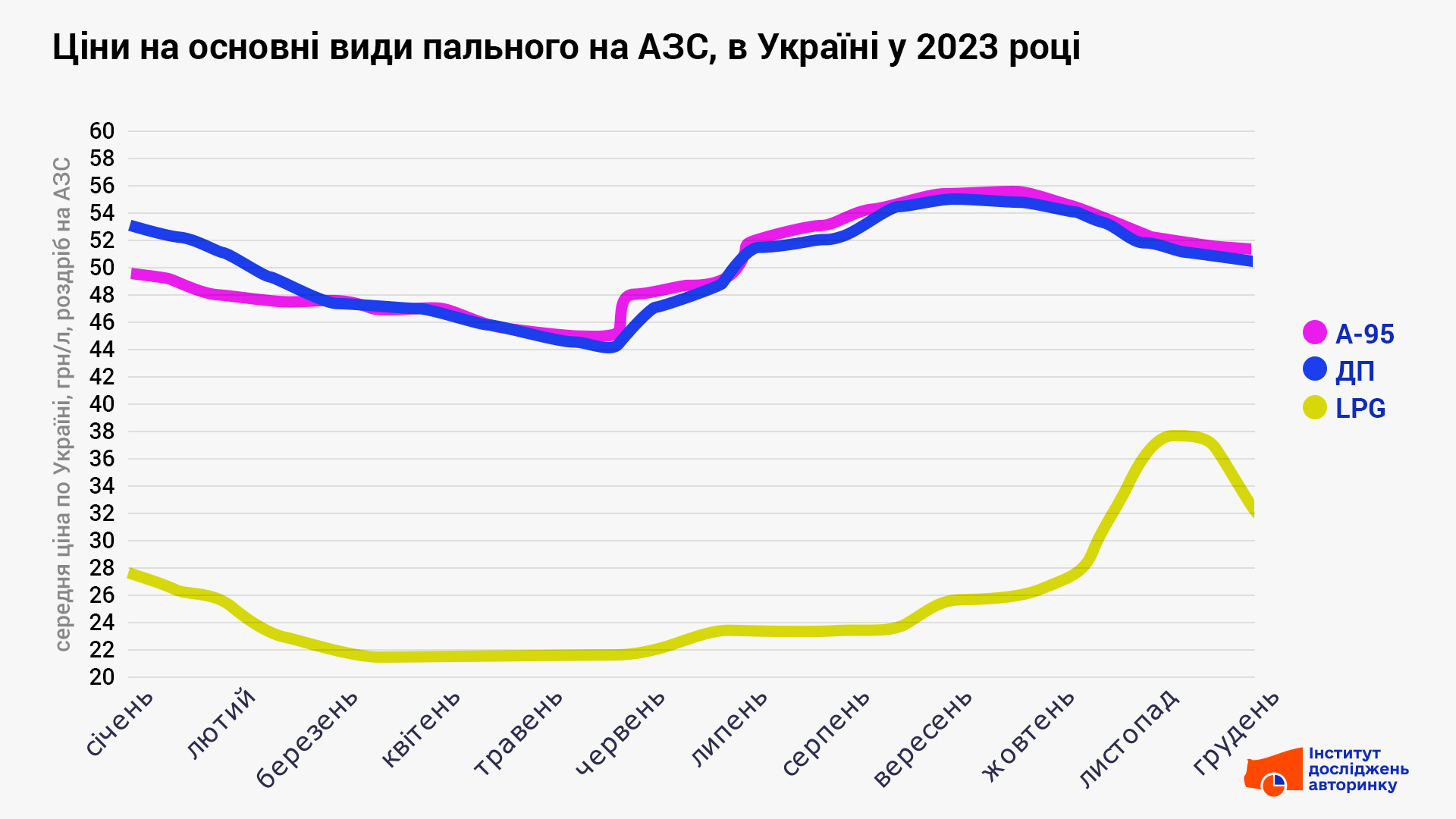

Over the past year, retail prices for the main types of automotive fuel fluctuated significantly. A-95 gasoline on average in Ukraine cost from 44 to 55 hryvnias/l, diesel — from 43 to 55 hryvnias/l, the largest delta in liquefied propane-butane mixture (LPG) — from 21 to 37 hryvnias/l. The lowest prices were observed in the summer, the peak of price increases fell on the autumn months. By the end of the year, prices decreased somewhat, but remained at a higher level than at the beginning of the year.

In contrast to 2022, in 2023 there was actually no shortage of fuel at gas stations — both large network complexes and smaller gas stations did without posting "no fuel" signs.

How is the fuel market related to the automobile market? After all, more than a million buyers (so many new and used passenger cars were bought last year) had to make a decision about the type of engine, taking into account the prices at which they will have to refuel the purchased car. To do this, we will consider how the shares of each type of fuel (or power) power plant changed during the year by individual segments (new cars, import of used cars and the domestic market of passenger cars with mileage).

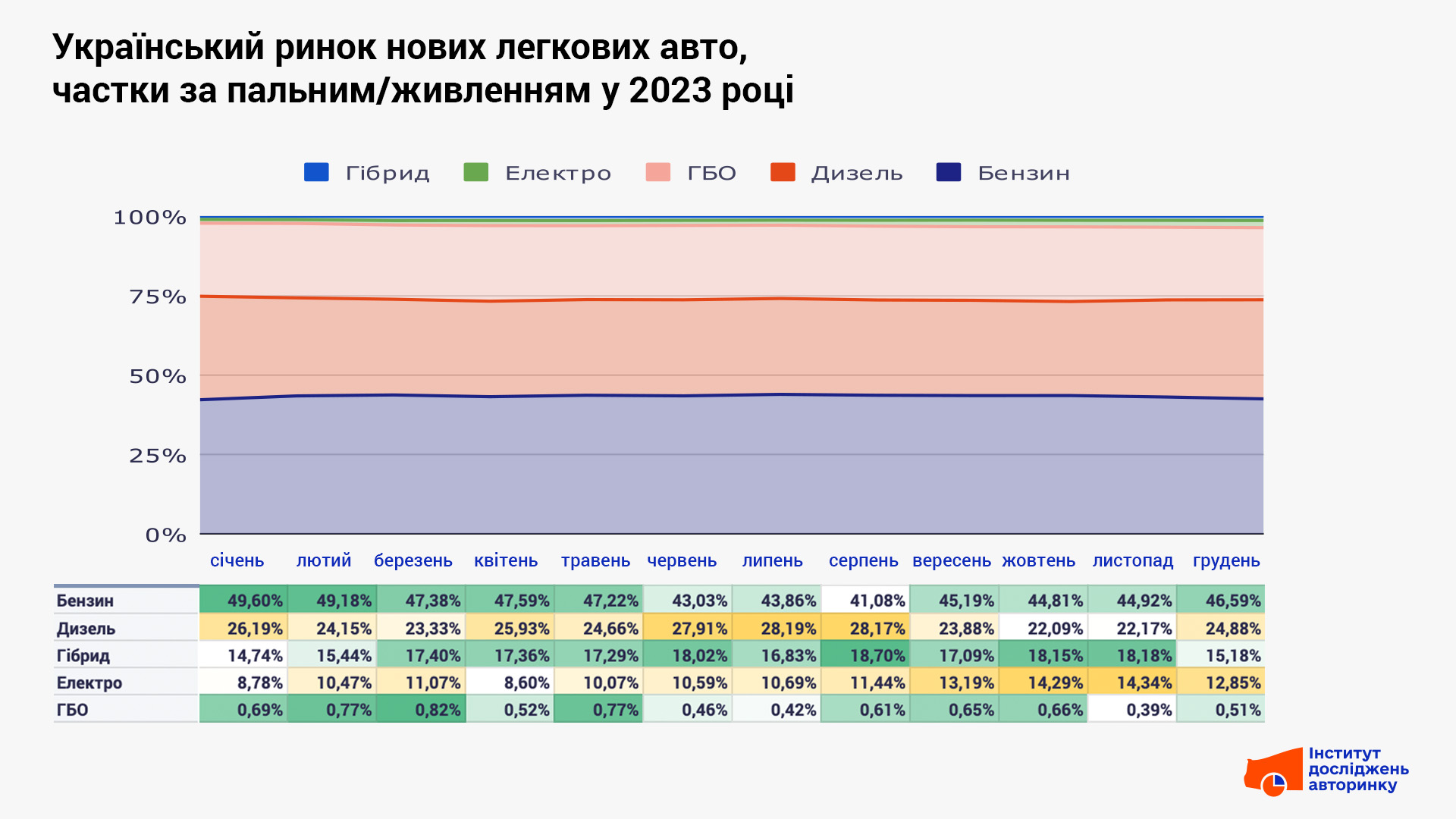

New cars

Gasoline versions dominate in this segment, almost half of which: 49.6% at the beginning of the year, 46.6% at the end. The minimum share of such was 41% in August, the maximum was 49.6% in January. Diesels occupied from 22% to 28%, the peak of conditional (whatʼs more) popularity fell on August. In contrast to the secondary market, there are many new cars with hybrid power plants — during the year, the share of "hybrids" ranged from 14.7% to 18.7%, also with a peak in August.

The share of electric cars gradually increased, from 8.7% in January to 14.3% in November, and slightly decreased in December, to 12.8%. The highest demand for electric vehicles was observed during the autumn months.

Very few new cars equipped with gas cylinder equipment (HBO) are sold — no more than 50 units per month, with a share of less than 1%, so they should not be taken into account in this segment.

The part of the slide, where the higher values of the particles are highlighted by color saturation, for new passenger cars has the appearance of a "checkerboard", that is, there are no trends that could be attributed to those that had a connection with external factors. Except for some increase in the shares of hybrids and electric cars in the autumn months, when fuel was the most expensive. In general, this is because now most dealers of new cars sell their goods "from wheels" (that is, without accumulating in warehouses), and queues have formed for individual models. Therefore, buyers often have to choose from the available options, agreeing to certain compromises, including the type of engine.

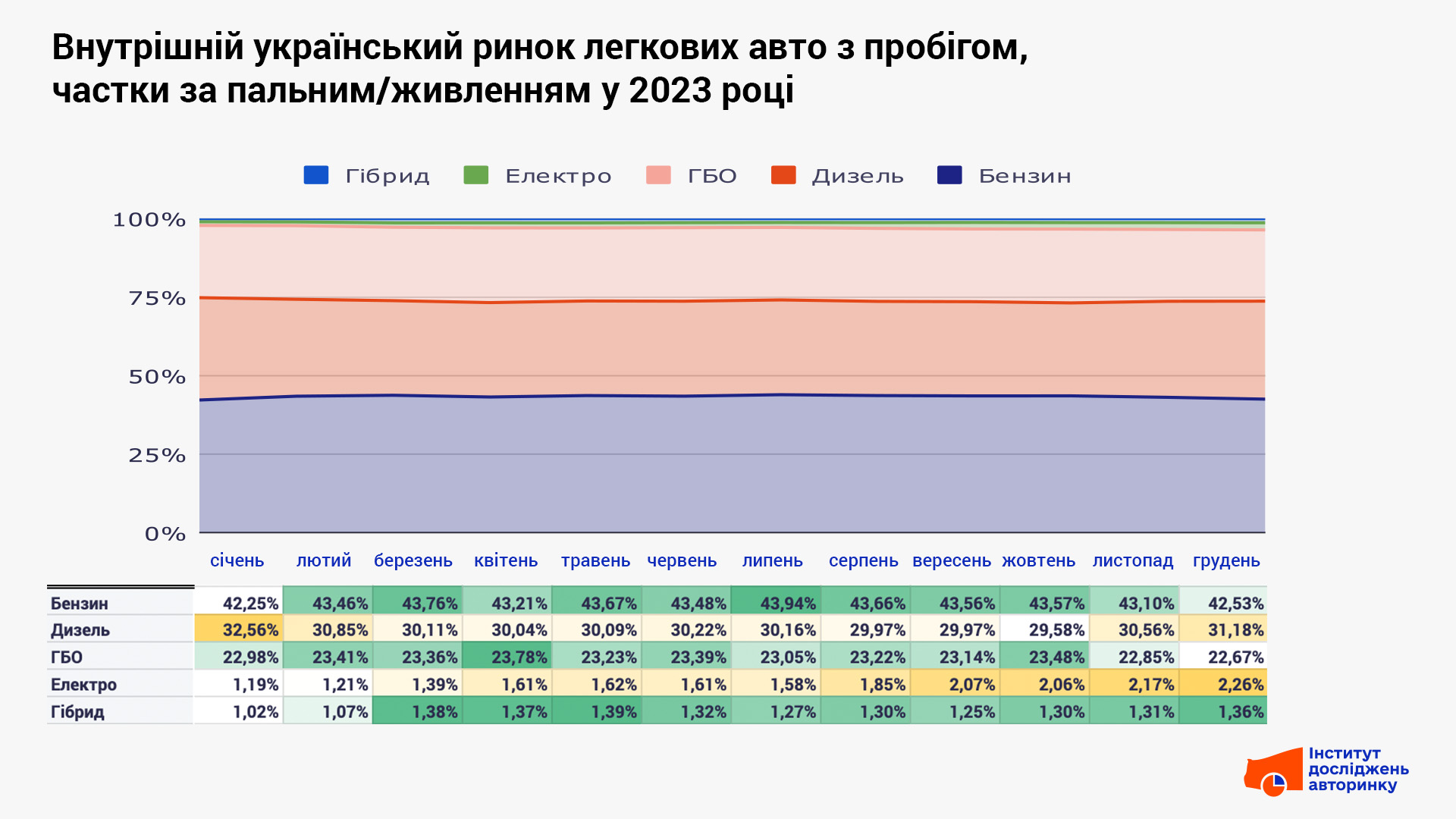

Domestic market of passenger cars with mileage

Similar to other segments, gasoline versions prevail here, the share of which fluctuated from 42.2% to 44% during the year, and in general it can be considered stable. The demand for diesel cars changed more noticeably: from 29.6% to 32.6%. The largest number of first registrations of diesel engines was submitted in January, then interest in them decreased, reaching a minimum value just in autumn, after which, at the end of the year, the share of diesel cars began to grow somewhat.

Cars with HBO had the largest share in April (23.8%) and October (23.5%), the smallest — in December, 22.7%. At the same time, despite the fact that the price of propane-butane mixture changed the most among all types of fuel, this was directly reflected in the market, the difference between the maximum and minimum value of the share for cars with HBO during the year is insignificant.

A slight increase in the share of cars with hybrid power plants is noticeable, from 1.2% to 1.4%, in the amount of about a thousand purchased every month — too few for the possibility of establishing clear conclusions. Electric cars are also bought relatively few domestically, but since this segment is growing (primarily in imports), the share of such cars is also increasing: from 1.2% at the beginning of the year to 2.3% at the end of the year, with the highest share values in the fall period. That is, it was on electric cars that a certain influence of the "price peak" at gas stations could have an effect, as well as on cars with HBO, but with the opposite meaning of the dynamics.

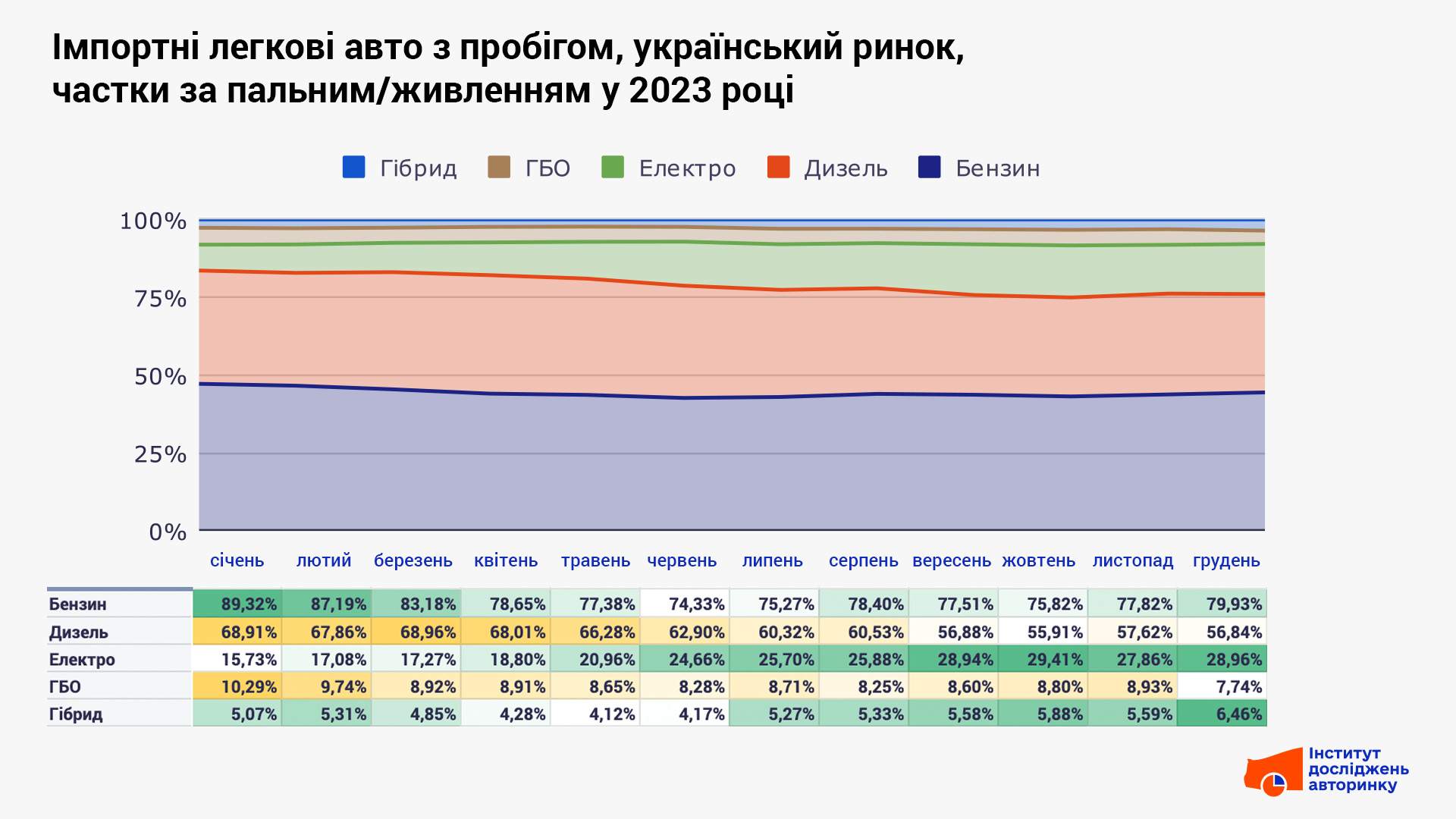

The first registrations of passenger cars with mileage

The share of gasoline cars among "freshly driven" passenger cars is the largest — last year it ranged from 74.3% to 89.3%. Higher values were observed at the beginning of the year. Diesel options seem to be losing their appeal in the eyes of potential buyers: last year their share was from 55.9% to 69%, and it is clear that it has a tendency to decrease.

Briefly about hybrid passenger cars: their share was in the range of 4.1%...6.5%, with a tendency towards some growth closer to autumn and the end of the year. Passenger cars with HBO had a share from 7.7% to 10.3%, and showed a tendency for it to decrease somewhat in the second half of last year.

The most noticeable increase in the share of electric cars among imported cars last year: from 15.7% in January to 29.4% in October, with a slight decrease in November and December, but even there the values are considerable — 27.9% and 29%. One of the factors that could contribute to such an active import of electric cars could well be the high autumn prices at gas stations.

Conclusions

- So, the change in retail fuel prices had a certain impact on certain sub-segments of the Ukrainian passenger car market. It is most noticeable in the import sector, where buyers and dealers react most quickly to external circumstances and make appropriate decisions (in addition, having a considerable selection of cars abroad).

- The domestic market turned out to be almost "stationary" — here they mostly choose for the price and technical condition (taking into account the age and fullness of the Ukrainian car fleet), and among the engines, they tend to prefer "reliable", which is often determined by the recommendations of local "experts", and then by type fuel

- As for new cars, it is difficult to talk about the trends of choosing such cars, due to the shortage of cars at certain dealers, which forces buyers to make certain compromises, rather than choosing a car on the open market without any conditions and restrictions.

What are the forecasts for fuel prices and availability?

Oleksandr Sirenko, an expert of the NaftoRynok analytical agency, commented on this issue for the Institute of Car Market Research .

"In the current conditions, making a forecast more than 2 weeks in advance is a difficult and even ungrateful task. There are many factors that can change quickly, including:

- quotes of oil and oil products in Europe

- currency

- market (supply and demand)

Quotations are always a lottery, oil reacts to any event in the world, and, accordingly, there is an impact on the price for Ukrainian importers. We also have no influence on the exchange rate. So far, it can be stated that when it was released into "free swimming", it increased in price only in the third month (now it is stabilizing).

The market works normally, now is the season of low consumption, farmers buy fuel for work at a relatively low price. In general, the price at gas stations has not yet fallen to possible low positions, given the drop in wholesale prices in December. Exactly until February, retail prices will decrease for A-95 by UAH 2...3/l, for DP — by UAH 1.0...1.5/l, and for propane-butane mixture — up to UAH 2/l."

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without advertising or spam.