Customs clearance of the car in "Action", depending on the age of the car, its power, fuel type and engine capacity. Fixed formula without customs value and human factor. Such a proposal from the Office of Simple Decisions was presented today at a meeting of the National Reform Council. However, the "simple", at first glance, the solution contains both advantages and disadvantages. Analysis of the proposal from the experts of the Institute of Car Market Research.

At customs clearance of a car the Office of simple decisions offers to leave two payments: the excise duty which has to be calculated according to the fixed formula; as well as VAT in the amount of 20%, which will be charged on the amount of this excise tax. The duty, respectively, will be 0%. The cost of customs clearance should be gradually reduced over the next five years. According to representatives of the organization, as a result, this will reduce the cost of customs clearance by 30%. At the same time, losses of budget revenues are expected. We checked to see if this was really the case.

The calculation mechanism is offered

Excise duty = base rate depending on the age of the car * engine capacity * fuel type factor * power factor * exclusivity factor

VAT = 20% of the amount of excise duty determined by the formula above.

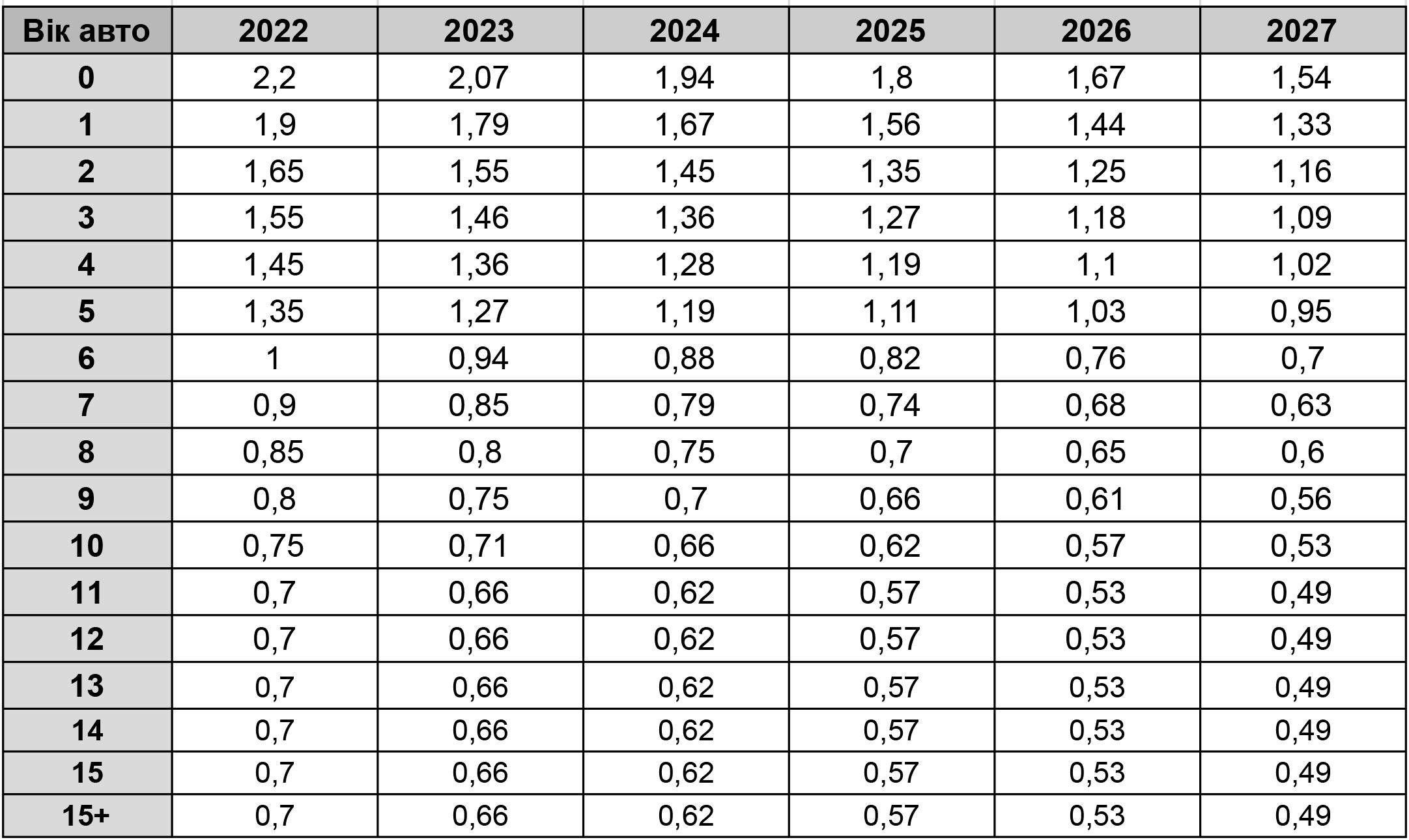

The proposal provides for a transition period. The base rate will be gradually reduced each year, from 2022 to 2027, according to the table:

Other indicators of the formula will be determined by the following principle:

The cost of customs clearance

We selected the most popular cars of different classes and conducted a comparative analysis. If the new mechanism works, then in 2022 the main reduction in the cost of customs clearance will occur in the segment of expensive and luxury cars. For example, customs clearance of the elite Lamborghini Urus (price abroad from 220 thousand euros) will cost 29,760 euros instead of 71,840; for Rollse Royse Cullinian (cost in Europe 390,000 euros)will have to pay 53,064 euros instead of 126,400. By 2027, the cost of customs clearance of such cars will decrease even more: you will have to pay 70% cheaper than now. This will happen due to a new approach to VAT accrual: not from the customs value, but according to the "tabular" value determined by the formula.

Instead, customs clearance of the budget 10-year-old Dacia Sandero 1.0 (cost in the EU 2000 euros)in 2022will fall in price only by 340 euros: 899 against 1239, in 2027 for customs clearance of such a car will have to pay 635 euros.

Customs clearance of some cars is becoming more expensive. For example, for the popular 5-year-old Nissan Rogue 2.5 (price in the US $ 7000) will have to pay 35% more: 4030 euros instead of 2986. Also more expensive new cars.

Some examples:

- Now: 1239

- Proposed in 2022: 899e

- At the end of the transition period in 2027: 635e

- Now: 2143

- Proposed in 2022: 1683

- At the end of the transition period in 2027: 1178e

- Now: 1916

- Proposed in 2022: 1258e

- At the end of the transition period in 2027: 880e

- Now: 2986

- Proposed in 2022: 4030e

- At the end of the transition period in 2027: 2836e

- Now: 4113

- Proposed in 2022: 2300e

- At the end of the transition period in 2027: 1610e

- Now: 71,840

- Proposed in 2022: 29,760

- At the end of the transition period in 2027: 20,928e

- Now: 126,400

- Proposed in 2022: 53,064

- At the end of the transition period in 2027: 37,305

You can compare the current cost of customs clearance and the proposed rates in 2022 and 2027 for some other car models at this link .

Revenues to the budget

For a deeper analysis of possible losses or revenues to the budget, we analyzed the customs statistics for 2020, namely the Information on vehicles and their owners, published by the Ministry of Internal Affairs on the web resource "Open Data Portal", as well as data on the web resource of the State Customs Service of Ukraine "Indicators of foreign trade of Ukraine".

In the table published at this link you can see how much the introduction of the new rules will change the average tax burden per car, depending on the type of fuel and engine capacity, both for new and used cars. On average, compared to 2020, budget revenues from customs clearance of cars in 2022 will increase by UAH 6.2 billion.

As can be seen from the table, in 2022 the most expensive customs clearance of new cars: all categories of new passenger vehicles according to UKT FEA, except for two — petrol with a volume of 2.2-3 l and diesel with a volume of more than 2.5 l. By 2027, the situation will change: all categories will become cheaper, except for two: gasoline up to 1 liter and diesel up to 1.5 liters.

As for used cars, in 2022 the customs clearance of petrol cars with an engine capacity of more than 2.2 liters will increase significantly (by 30-40%), and the customs clearance of diesel cars with an engine capacity of up to 1.5 liters will become 4% more expensive. By 2027, the total cost of customs clearance will decrease for all categories of passenger vehicles, but customs clearance of these two categories will be more expensive than today.

In general, if a new customs clearance mechanism is adopted, in 2022, compared to 2020, the average cost of customs clearance will increase by 5.6%. In 2027, it will decrease, but only by 5.8%. At the same time, there will be a redistribution of taxes from expensive and elite used cars to new and used middle-class cars.

Advantages of the proposed mechanism

- The proposed changes apply to all, in contrast to the temporary solution for certain categories of the population, as in the bill passed in the first reading on the legalization of the so-called "Eurobills".

- An attempt to solve the problem of manipulation and corruption in car customs clearance.

- An attempt to reduce the impact of the human factor in the customs clearance of cars and increase the level of service by developing the appropriate functionality in the application "Action".

- The final cost of the car in Ukraine after customs clearance is clearly predicted.

- The age factor, in contrast to the current system, is lower for older cars and higher for new ones.

- Twice the ratio for "hybrid" cars.

- Not only the volume but also the power of the car is taken into account when determining the cost of customs clearance.

- Zero VAT for electric vehicles on a permanent basis.

The disadvantages of the proposed mechanism

- There will be a redistribution of taxes: in absolute terms (the number of taxes paid) the customs clearance of expensive and luxury cars will decrease the most, the least — for budget. On some cars of the middle class customs clearance becomes more expensive.

- The decision to withdraw from the customs value of the car is contrary to international agreements. Article 85 of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax provides that the importation of any goods from abroad shall be based on customs value.

- The methods of determining the customs value in the European Union are uniform for all groups of goods, and are applied in all member states, and do not provide for its determination using tables or formulas. The Customs Code of Ukraine already takes into account the provisions necessary for European integration, namely 6 methods of determining the customs value. The problem is that it is not implemented due to the high level of corruption. However, the problem must be resolved without violating international agreements.

- When registering, namely the first state registration of a vehicle in the Service Centers of the Ministry of Internal Affairs, it is necessary to pay a fee to the pension fund — 3-5% of the customs value of the car. They forgot about it.

- The system will only work for cars. And changes are needed in the import of trucks, buses and special equipment.

- Customs clearance of the car in "Action" is a good idea, but will apply only to citizens. The main part of vehicles is imported by companies — legal entities. It is unknown whether there are any improvements to the operation of such a business.

- There are no changes in the certification procedure for used vehicles.

Conclusions of experts of the Institute of car market research

It is good that the discussion continues, and the issue went beyond customs clearance only in "Eurobills". The problem was mentioned at a meeting of the National Reform Council chaired by the President of Ukraine, so the need for a new customs clearance system is understood at the highest levels of government.

The offer contains both good and completely healthy ideas, as well as shortcomings and shortcomings. Some provisions need to be adjusted: it is necessary to reconsider what are the ways to move away from corruption in determining the customs value of cars; it is also necessary to review customs clearance rates; along with the improvement of the customs clearance system for individuals, we must not forget about business.

Obviously, these are just suggestions: before the system starts working, it is necessary to draft everything, pass discussions in the relevant committees of the Verkhovna Rada, and get a majority of votes during the voting in the Parliament hall. Therefore, now is a good time to unite experts to discuss proposals and work out a solution that will suit all parties: citizens, the state and business.