January 2026 was the moment of truth for the Ukrainian electric vehicle market. While the segment of “fresh” imports is painfully getting used to VAT, the domestic secondary market is demonstrating amazing resilience. This is no longer just chaotic sales, but a formed ecosystem that is able to maintain a high pace even under adverse external conditions.

- Check the history of a car by VIN code before buying with CEBIA!

In January 2026, 3,553 used electric vehicle purchase and sale agreements were concluded within the country.

- MM dynamics (relative to December): -17.0% decrease. This is a completely expected seasonal reaction after the peak December (4,281 transactions), when the market was "overheated" by the general excitement.

- YY dynamics (relative to January 2025): growth of +105.0%, and although formally the number of resales doubled over the year, in fact this is the difference between the period when SCs did not register vehicles for several weeks due to a failure in the electronic vehicle registration system.

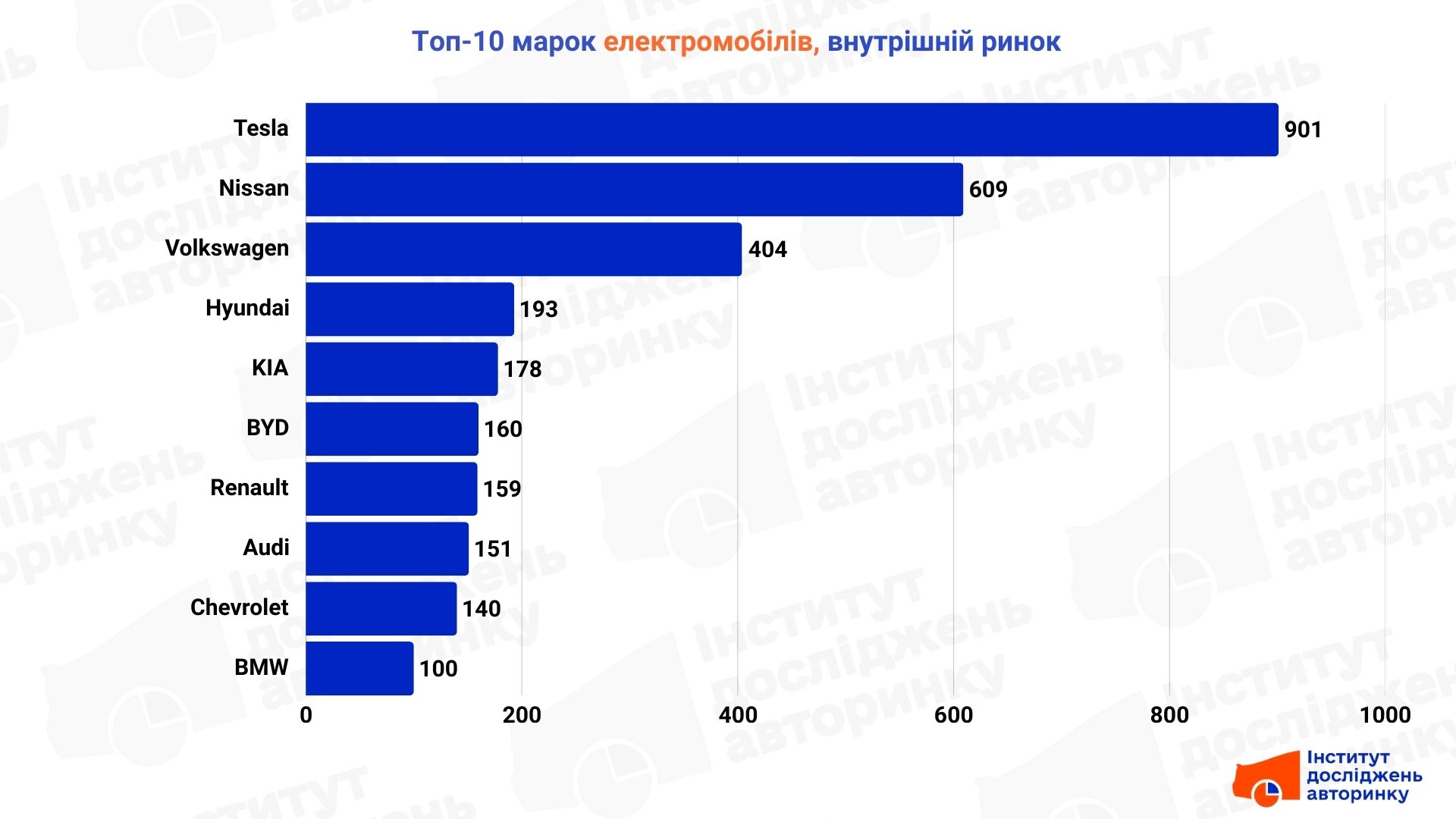

Brands. What is chosen more often?

In the scoreboard, there is a clear gap between the leader and everyone else:

- Tesla (901 units) firmly holds the lead. Every fourth transaction on the domestic market is a Tesla. It has long ceased to be exotic, but the most liquid asset in the segment.

- Nissan (609 units) consistently ranks second thanks to its large fleet of Leafs.

- Volkswagen (404 units) closes the top three, having significantly broken away from the peloton.

Also in the Top 10, we see a tight struggle between the Koreans ( Hyundai, KIA ) and the Chinese BYD, which is gradually flowing into the secondary market after the boom in new car sales last year.

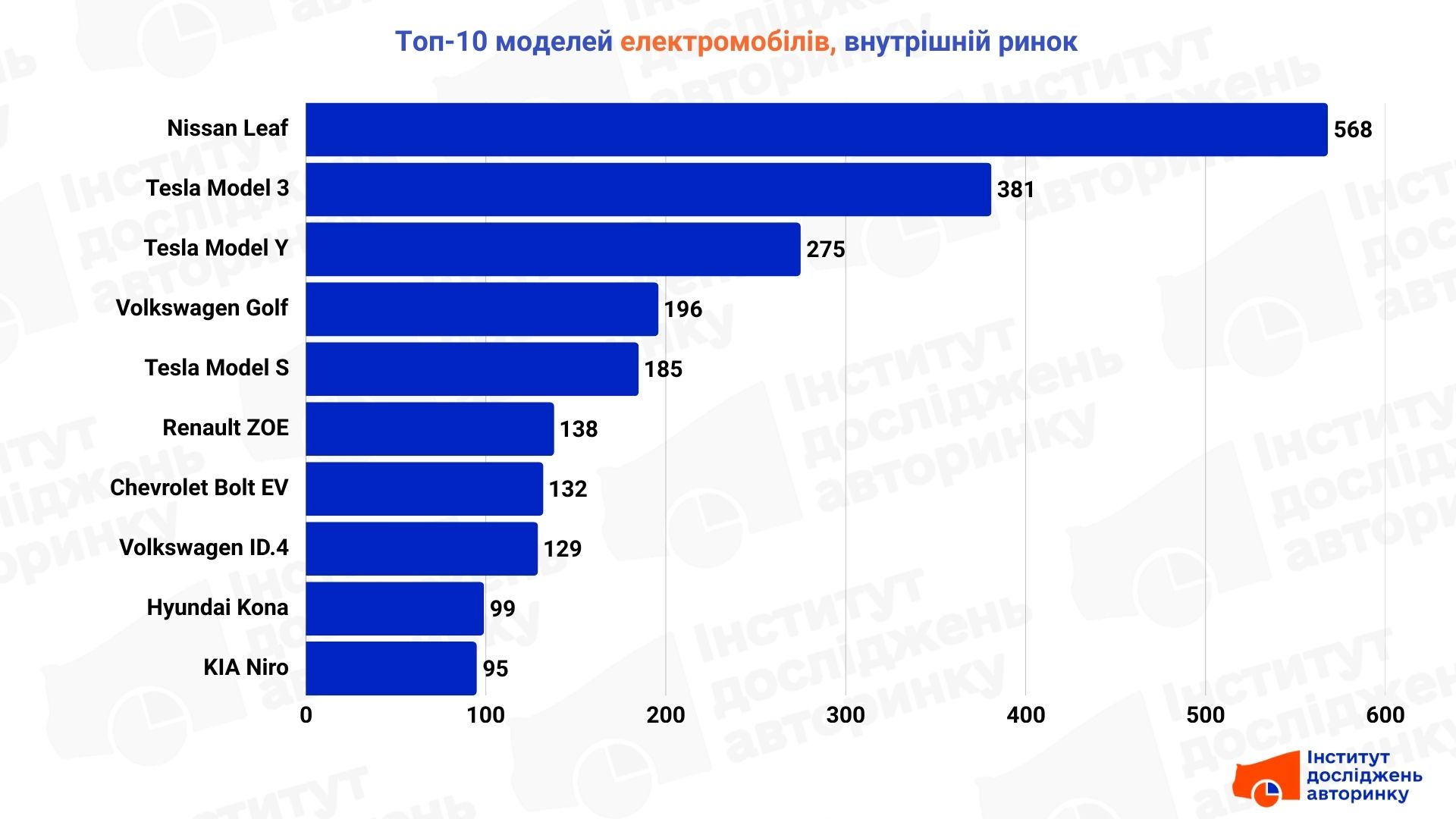

Models

Nissan Leaf (568 units) remains the “entry ticket” to the world of electric vehicles. It leads by a wide margin, being the most straightforward and affordable option.

Tesla Model 3 (381 units) and Model Y (275 units) are the main drivers of growth. These are the models that are currently changing owners most often, migrating between regions.

The Volkswagen Golf (196 units) and Tesla Model S (185 units) hold high positions, rounding out the top five.

Volkswagen ID.4 (129 units) — it is noteworthy that this model already confidently occupies eighth place in domestic resales. This means that the “fresh” Chinese ID.4s imported earlier have already started to look for second-hand ones, forming a new layer of the secondary market.

Expert opinion

Ostap Novitsky , car market analyst (IDA):

"The secondary market is generated by the import of used cars and sales of new ones. January statistics clearly show: we already have a stable flow from these two segments to the domestic market. There is already a regular buyer here, and this is for a long time."

The most important thing is that even despite all the "horror stories" with the VAT refund on imports, domestic resales have hardly changed their trajectory. This indicates the immunity of the segment to customs vicissitudes. We can confidently predict: in the future, the secondary market will only grow, becoming more stable both in terms of volumes and in the range of models. The secondary market for electric vehicles has matured, and now it is the main insurance for Ukrainian electrification.

- Need more data — contact IDA!