In January 2026, the Ukrainian car market demonstrated paradoxical dynamics. According to the company Automoto.ua, which aggregates data from all popular marketplaces, the number of newly added ads fell to the lowest level in the last 13 months.

Market capacity: where have the billions gone?

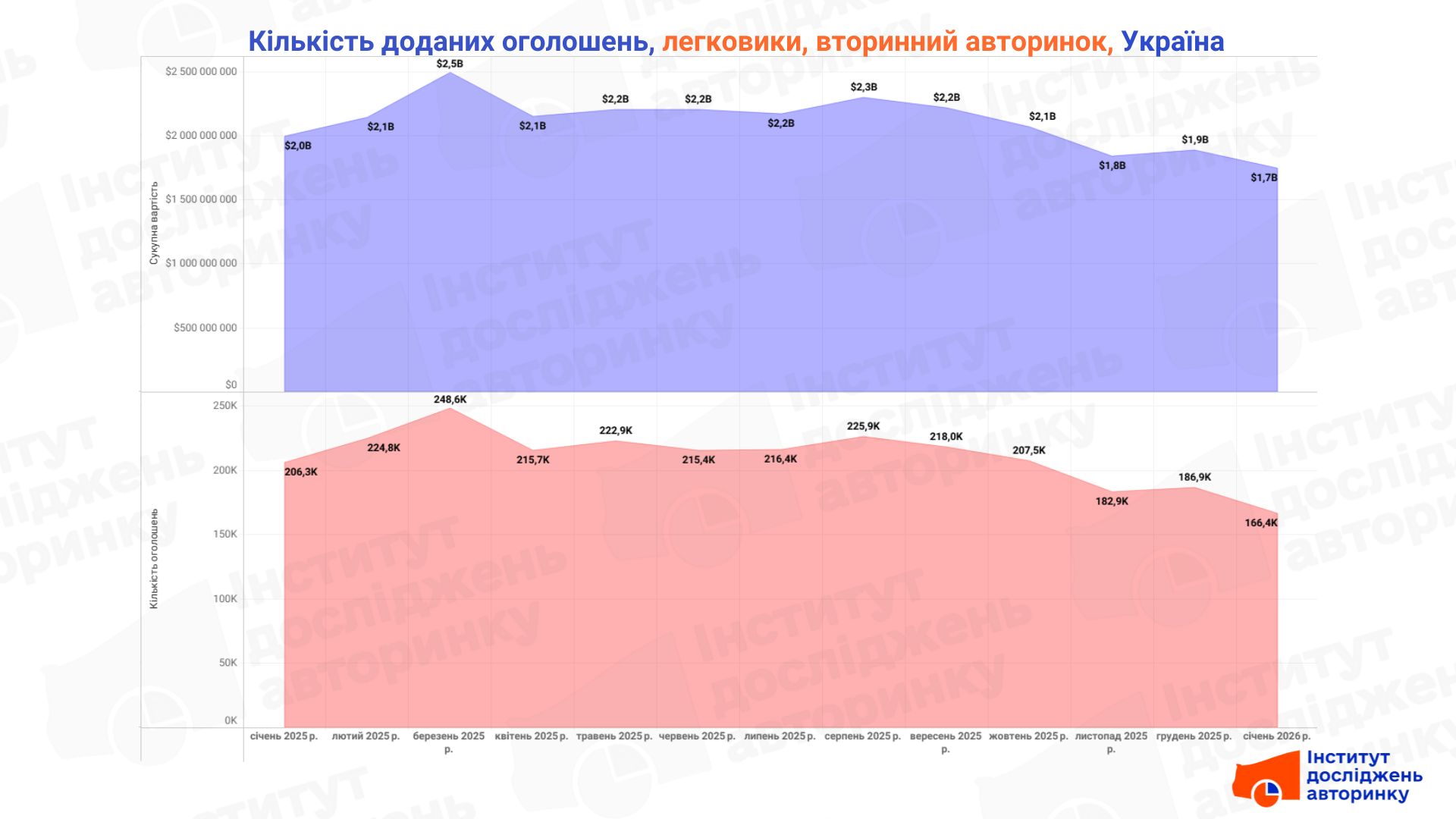

If in March 2025 the total value of all cars on sale reached $2.5 billion, then as of January 2026 this figure dropped to $1.7 billion. The number of new offers decreased from 248 thousand to 166 thousand per month.

The reason is not a shortage of cars, but the speed at which they are sold. Since previous lots "hang" longer, dealers and private sellers are in no hurry to publish new ads, trying to sell off their existing stock.

The $6,200 Phenomenon and Pricing Structure

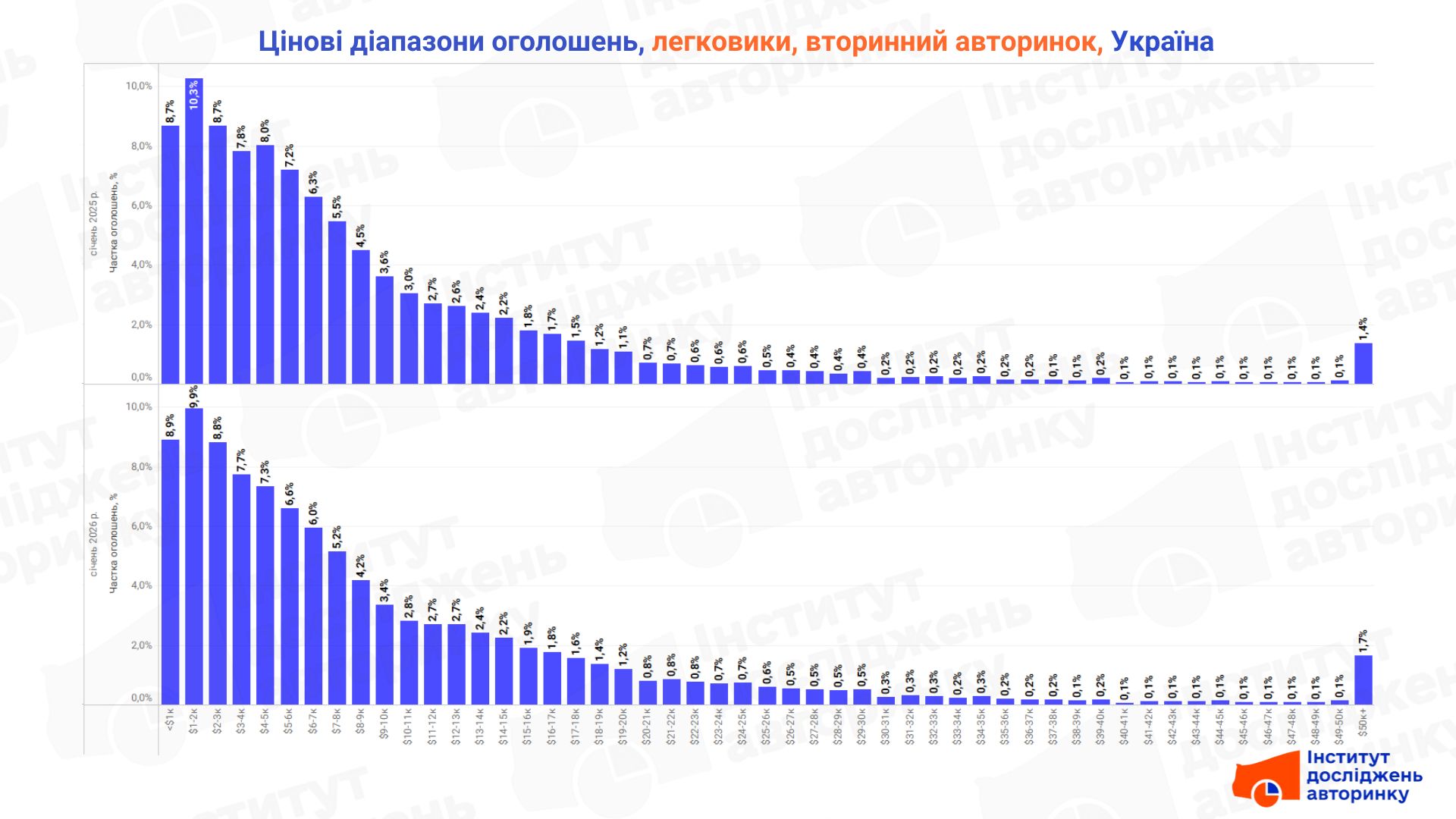

The median price of a used car in Ukraine has increased by $200 compared to last year and is $6,200. This may seem strange against the background of falling purchasing power, but the secret lies in the structure of offers:

- The "super-low-cost" segment ($1,000 — $2,000) is shrinking.

- The premium segment ($50,000+) shows a share increase from 1.4% to 1.7%.

- 80% of the market is a stable zone from $1,000 to $10,000. This is the real financial capacity of the average Ukrainian.

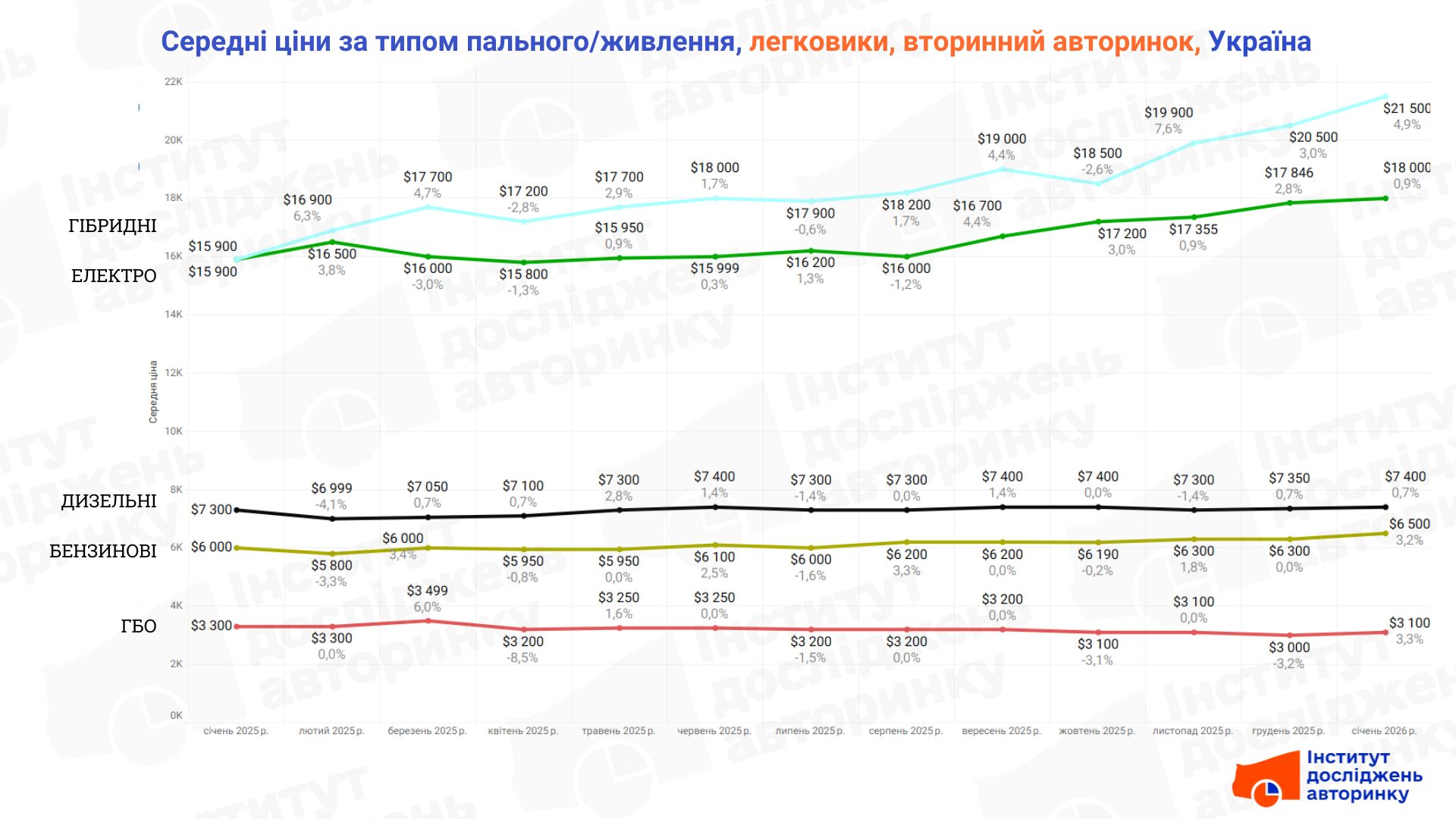

Market and fuel: Hybrids and electric vehicles are becoming more expensive, diesels and LPG are stagnating

The biggest shock of January was the prices of hybrids. Over the year, the average price in this segment soared from $15,900 to $21,500. Such a jump (+ $6,000!) is explained not so much by hype as by a change in the model range: fresh Toyota RAV4 and Camry entered the secondary market en masse, which "beat" the price of old Priuses and Ford Fusions.

Diesel cars remain stable ($7,300), despite the fact that Ukraine still remains a “tractor state.” Buyers continue to believe in the mythical “5 liters per hundred,” ignoring the high cost of maintaining modern environmental systems (particulate filters, injectors).

LPG (gas) is finally becoming a segment for those who are "finishing off" their old fleet. The average price here is $3,000, and the financial motivation to install new equipment at the current excise tax on gas is practically zero.

Video version of the analytics:

For those who prefer a lively discussion with details and irony, watch the full market analysis from Stanislav Buchatsky and Ostap Novytsky :

Conclusions for business

The market is slowing down, and thatʼs a fact. Today, the winner is not the one who has a "sense", but the one who works with data. If you sell cars, be prepared for the fact that the exposure period of the lot will increase. Narrow niches (hybrids, fresh "Americans") give a higher margin, but require accurate calculation.

Need detailed analytics for your region or segment? Contact the Auto Market Research Institute — we turn arrays of numbers into management decisions.