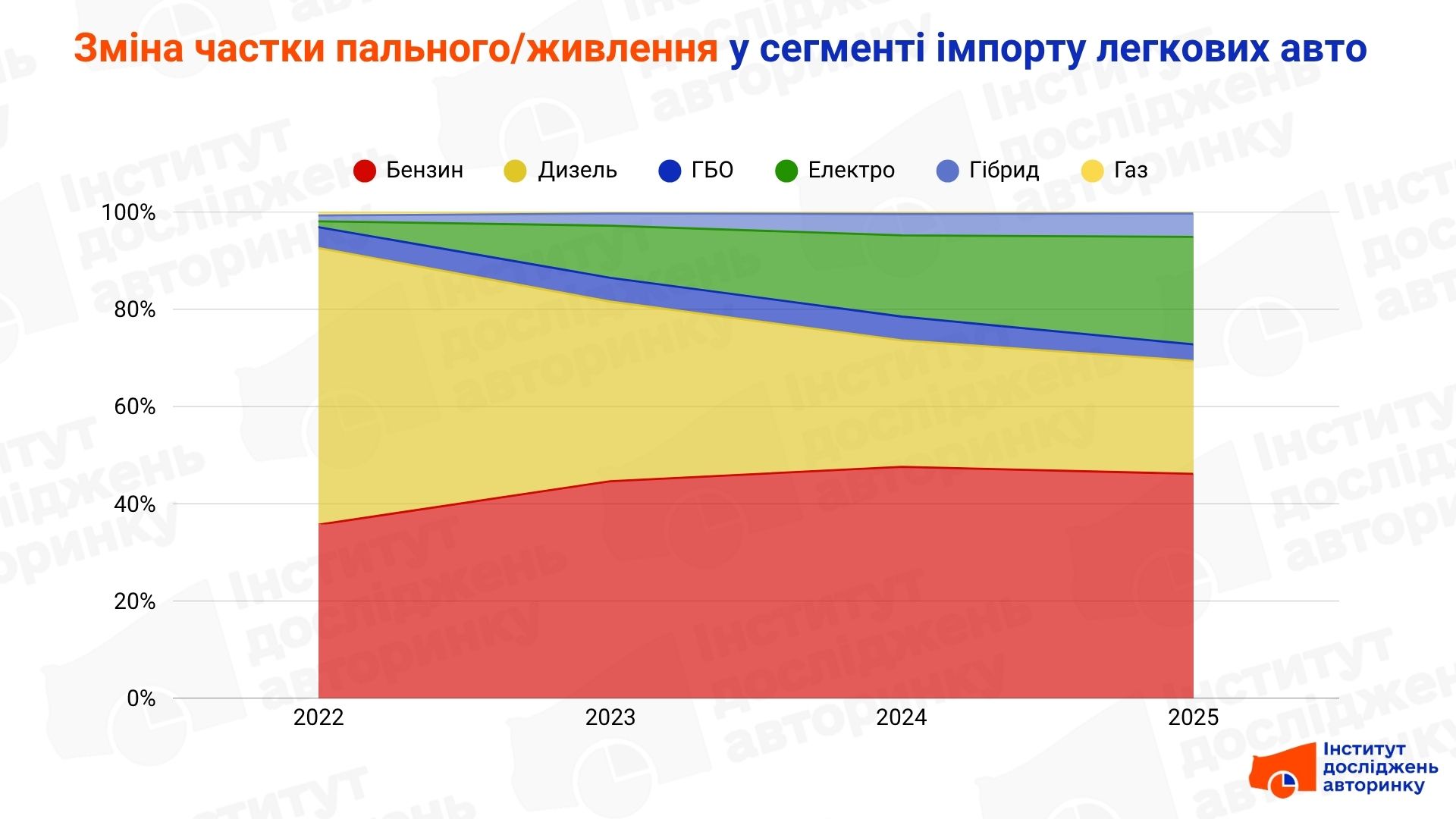

The picture of car selection by fuel type (or power supply — if we talk about electric cars) has changed noticeably. Until relatively recently, diesel was the favorite for most buyers of used cars from abroad, but today this type has been confidently replaced by electric cars and gasoline cars. Specialists of the Institute for Car Market Research analyzed how the structure of primary registrations of imported used passenger cars by fuel type changed in the first half of 2022–2025 — and here are the trends they found.

Gasoline is a stable classic

Despite the development of electric vehicles, gasoline cars remain the most popular choice. In the first half of 2025, they captured 46.1% of the market, only slightly inferior to the result of the previous year (47.6%). Demand is maintained by:

- a wide selection of models in Europe,

- imports from the USA where virtually all passenger cars are gasoline-powered,

- relatively simpler and cheaper maintenance,

- some options allow conversion to HBO.

Diesel — a precipitous fall from the top

In 2022, diesel had a 56.9% share of the imported used car market. In 2025, it was only 23.2%. The reasons for this collapse:

- tightening restrictions on diesel in Europe (ecozones, taxes),

- lack of demand for used diesel cars in Europe itself, recycling programs,

- the lack of diesels in the USA,

- A change in understanding: diesel is no longer “economical and reliable,” but “expensive and risky.”

Electric vehicles — explosive growth

The growth of the share of electric vehicles is one of the most noticeable trends:

1.2% → 10.7% → 16.7% → 22.1% (2022 → 2025).

What has changed:

- charging infrastructure in Ukraine no longer causes panic,

- cars from China, the USA, and Korea have become more affordable,

- early Tesla and Leaf owners became the best advertising agents,

- more models with "interregional" range (60+ kWh batteries)

- fuel savings are relevant again (price increases at gas stations).

In addition, this year, buyers will be further stimulated by the approaching VAT exemption for electric vehicles from 2026, which will increase the total cost of the same models on the market by a quarter, or even a third.

- Order a turnkey car from Europe from West Auto Hub !

Hybrids — grow, but slowly

Passenger cars with hybrid power plants will have a share of 4.8% in 2025. This is not much, but the trend is positive. Compared to 2022, the share has increased 4 times. Reasons:

- more and more hybrid Toyota, Ford, KIA, Honda and others are becoming available,

- real savings in the urban cycle without interfering with the design of the car (compared to HBO).

The development of the segment is hampered by a limited selection of models, higher prices, and in some cases, the specifics of servicing “two-in-one” machines.

HBO — consistently low

The share of passenger cars that use gasoline and/or a gas mixture as fuel, i.e. have on-board gas cylinder equipment (GBO) as an additional system, is small — from 3.4% to 4.9%, with no tendency to increase or decrease. A similar picture is with "pure gas" cars, mostly Korean, which belong to the LPI group — after a wave of popularity (if you can call the share among imported cars of 0.7% in 2022), the number of registrations of such cars decreased to 0.3% in 2025.

For both groups, the explanation for such a small presence is simple: there are few such cars in Europe and even less so in the USA, the Korean market is specific, so few of them are "imported".

So, over the past 4 years, Ukrainians have become less inclined to buy "freshly made" diesel engines, instead their share is occupied by gasoline versions, and even more so by electric ones. Passenger cars with hybrid power plants, even despite a certain statistical increase in their share, do not occupy a significant place in the import segment. The picture is similar with cars whose engines are capable of running on a gas mixture — they are in the minority and do not show signs of increasing their share in the market.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.