The calculations below are based on an analysis of the real sector of the car market. The team of the Car Market Research Institute analyzed almost 3 million records of the aggregator Automoto.ua about car sales announcements from all (about 100) Ukrainian car sites.

Prices in ads directly depend on market equilibrium: the seller sets the exact amount that he believes the buyer is willing to pay. In order to sell a car in a reasonable time, the price must meet market expectations. At the same time, price benchmarks are also influenced by external factors — from the economic situation to changes in legislation or exchange rates. That is why prices from ads can be used as an analytical indicator: they not only reflect the real state of the market at a particular moment, but also help explain how certain events affect the behavior of sellers and buyers. For business analysts, such information is the key to identifying trends, building forecasts, and planning decisions based on both current and historical data.

- You can find out about the European price index at this link

Online market for used cars: fewer ads

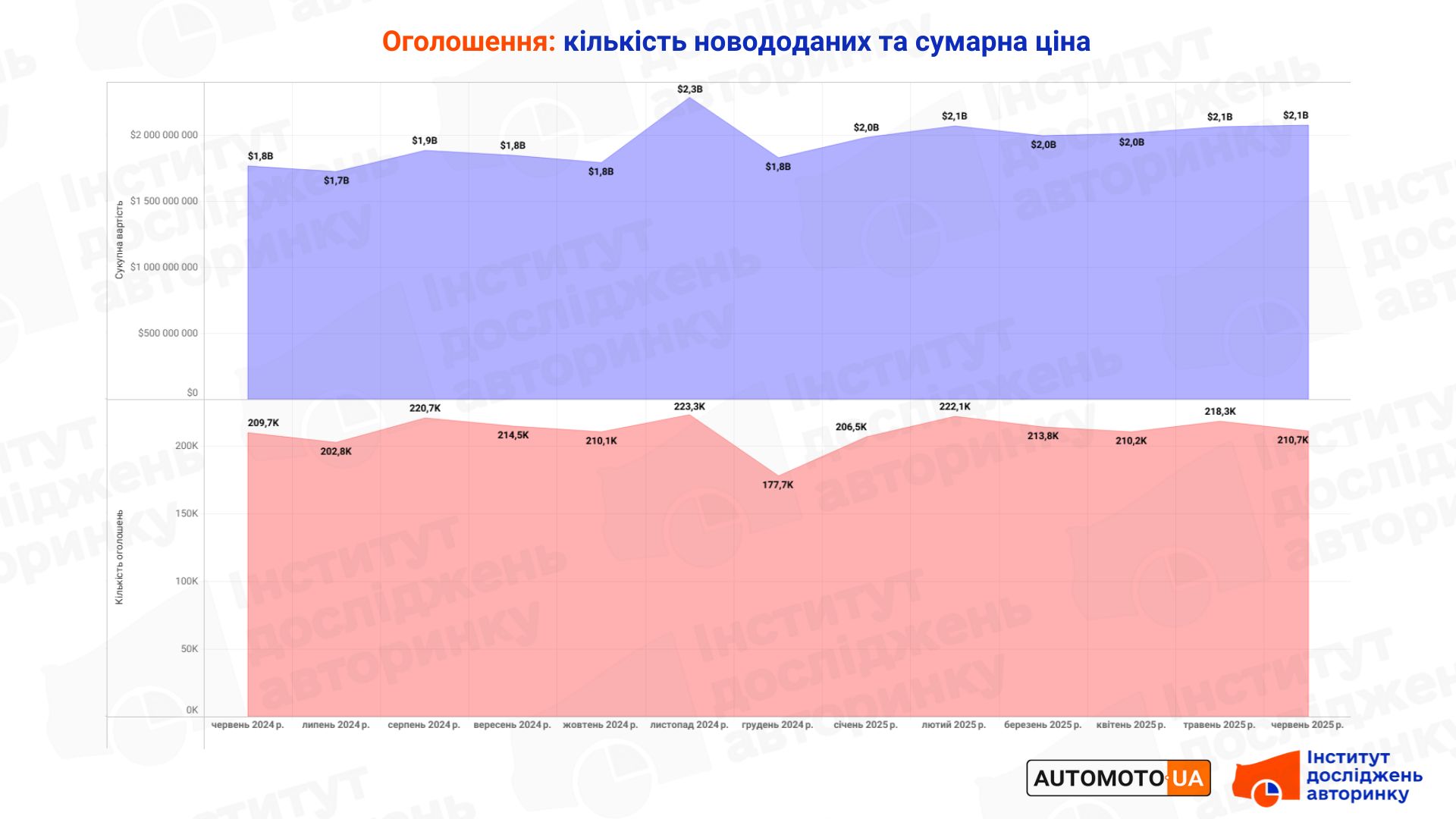

Over the past 12 months, about 2.5 million offers for the sale of used cars were posted on Ukrainian online vehicle classifieds. This number includes only newly added ads, excluding duplicates that may appear on multiple bulletin boards.

The highest seller activity during the mentioned period was recorded in November 2024, when 223.3 thousand ads were placed. The lowest activity during this period was observed in December of last year — 177.7 thousand ads.

The number of newly created ads has decreased :from 218.3 thousand in May to 210.7 thousand in June (-3.5%). In a year-on-year comparison, the picture is as follows: in June 2024, online platforms published 209.7 thousand fresh offers, so they are now offering 0.5% more.

The potential financial value of all cars offered (or being offered) for sale in June was $2.1 billion, which is close to the average value.

The maximum and minimum volume of offers in monetary terms is largely correlated with the number of ads indicated above, which is visible in the diagram. On average, Ukrainians offer $2 billion worth of used cars for sale online every month.

- Order a turnkey car from Europe from West Auto Hub !

Price structure: the share of more expensive cars continues to grow

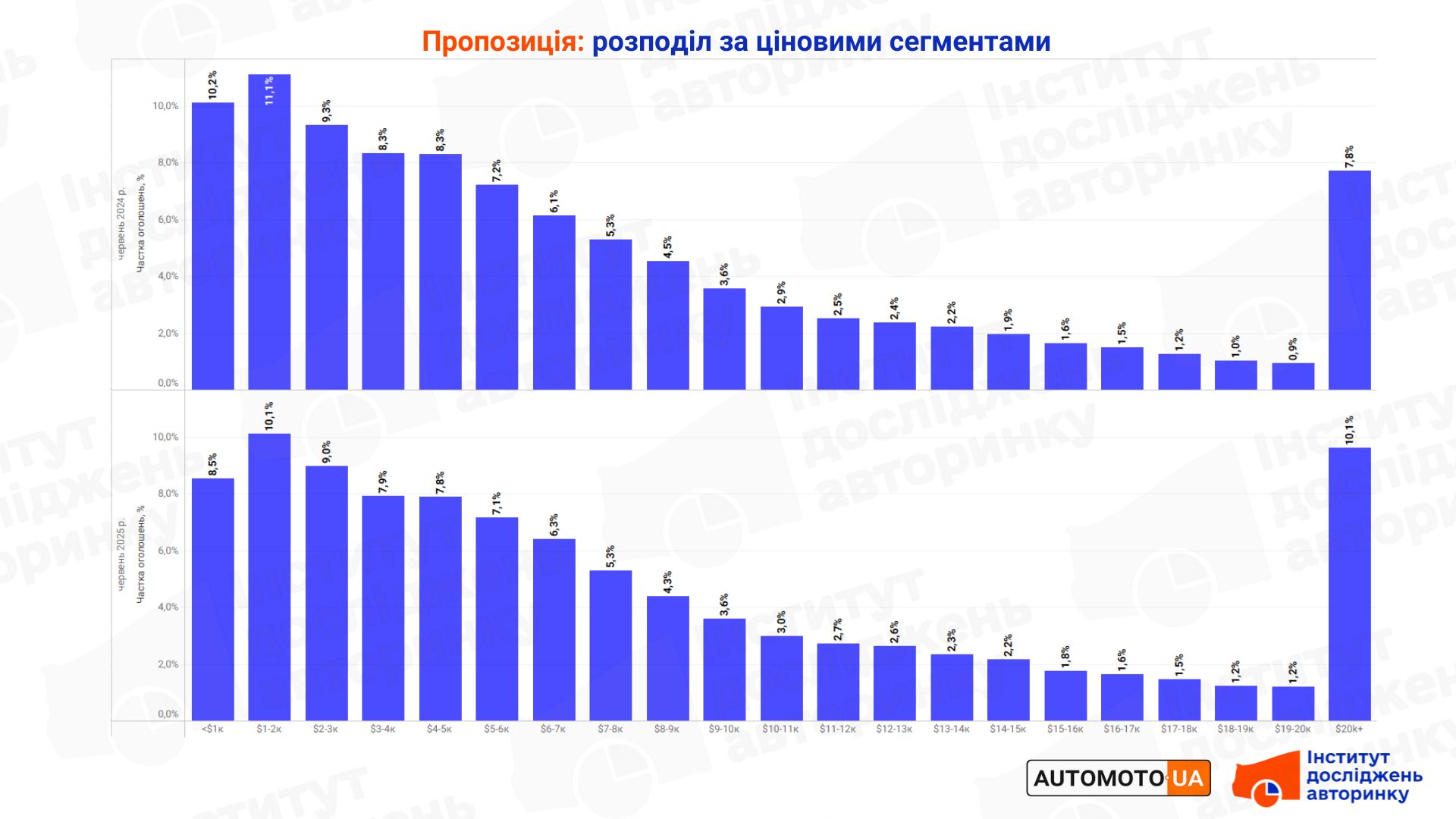

A comparison of the structure of ads for the sale of used cars in June 2024 and 2025 indicates a shift in the price distribution — but not due to an increase in purchasing power, but on the contrary, due to its decrease.

In June 2025, the share of ads in the cheapest segments — < $1 thousand (from 10.2% to 8.5%) and $1–2 thousand (from 11.1% to 10.1%) — decreased. However, this does not mean that there are fewer such cars overall — they are simply bought more quickly, because this is the most affordable category, where demand is consistently high.

Instead, segments with a price of over $10,000 showed stability or even an increase in the share in the structure — for example, in the range of $20,000+ it increased from 7.8% to 10.1%. This is not a signal of an increase in supply following demand, but on the contrary — an accumulation of goods that do not find a buyer. Such cars “hang” in the databases longer, forming a higher share of ads.

The middle segment ($5–9 thousand) remains stable, although small shifts are visible here.

Average price in segments (by fuel/food)

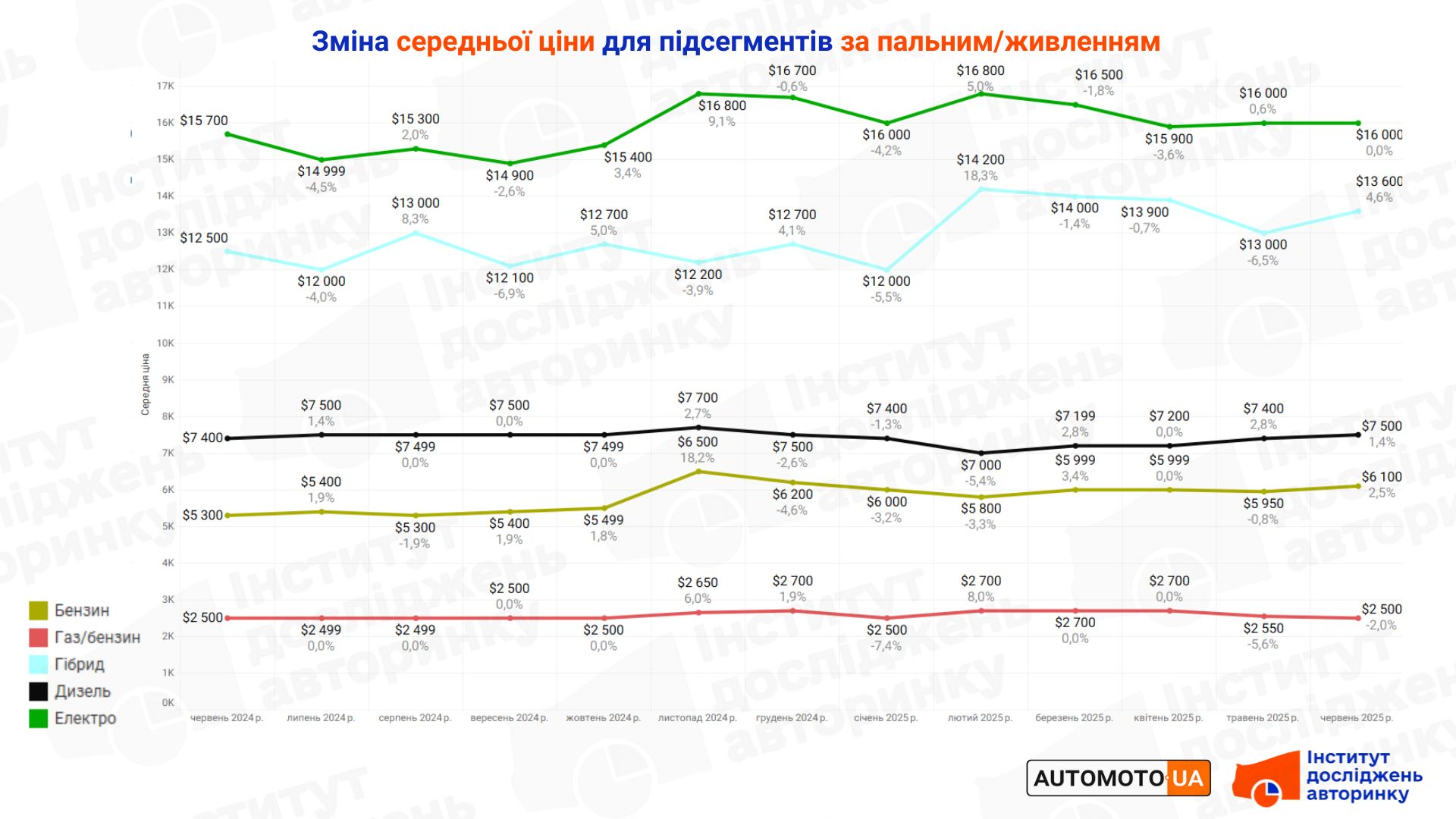

In terms of individual segments, with a breakdown by type of power plant, the lowest average price, which according to the results of June is $2,500 (-$50), is for cars with gas-powered equipment.

The most popular segment on the market is gasoline cars, occupying a middle position between the just described cars with LPG and diesel cars. The current average price of all offers here is $6,100, $50 more than it was a month earlier.

Used diesel cars are currently asking an average of $7,500, $100 more than a month earlier. It is worth noting that the average price here has been steadily increasing since the beginning of the year.

The volatile segment of cars with hybrid powertrains (all subtypes such as MHEV/HEV/PHEV) was recorded at $13,600 in June, which is $600 more than it was previously. It should be remembered that the share of "hybrids" in the secondary market is relatively small (about 1.2%), so prices here fluctuate much more noticeably than elsewhere.

About the electric vehicle segment: the final price value for used cars in sales offers is now $16,000, the same as in the previous cut. It is worth considering that in addition to the approaching date of VAT refund for customs clearance of BEV cars, another incentive has appeared — the increase in prices for gasoline and diesel. But the price of electricity, both "home" and at public EV charging stations, has not changed.

In order to get a more accurate idea of the average prices by segment, we add information about the average age of each of them on our secondary market. So:

- Gasoline cars — 14.5 p.

- Hybrid — 6.4 years.

- Equipped with HBO — 18.3 years.

- Diesel — 14.9 p.

- Electric cars — 5.6 years.

Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.