The light commercial vehicle (LCV) segment is a golden mean for the city and business. They are more economical than large trucks, so they allow you to reduce fuel and maintenance costs. Thanks to their compact dimensions, they easily maneuver in city traffic, and despite this, they are able to transport considerable loads — an ideal choice for small and medium-sized businesses. And if you take the cargo-passenger versions, you get even more versatility, with which you can transport goods or tools on weekdays, and take a trip with the family on weekends.

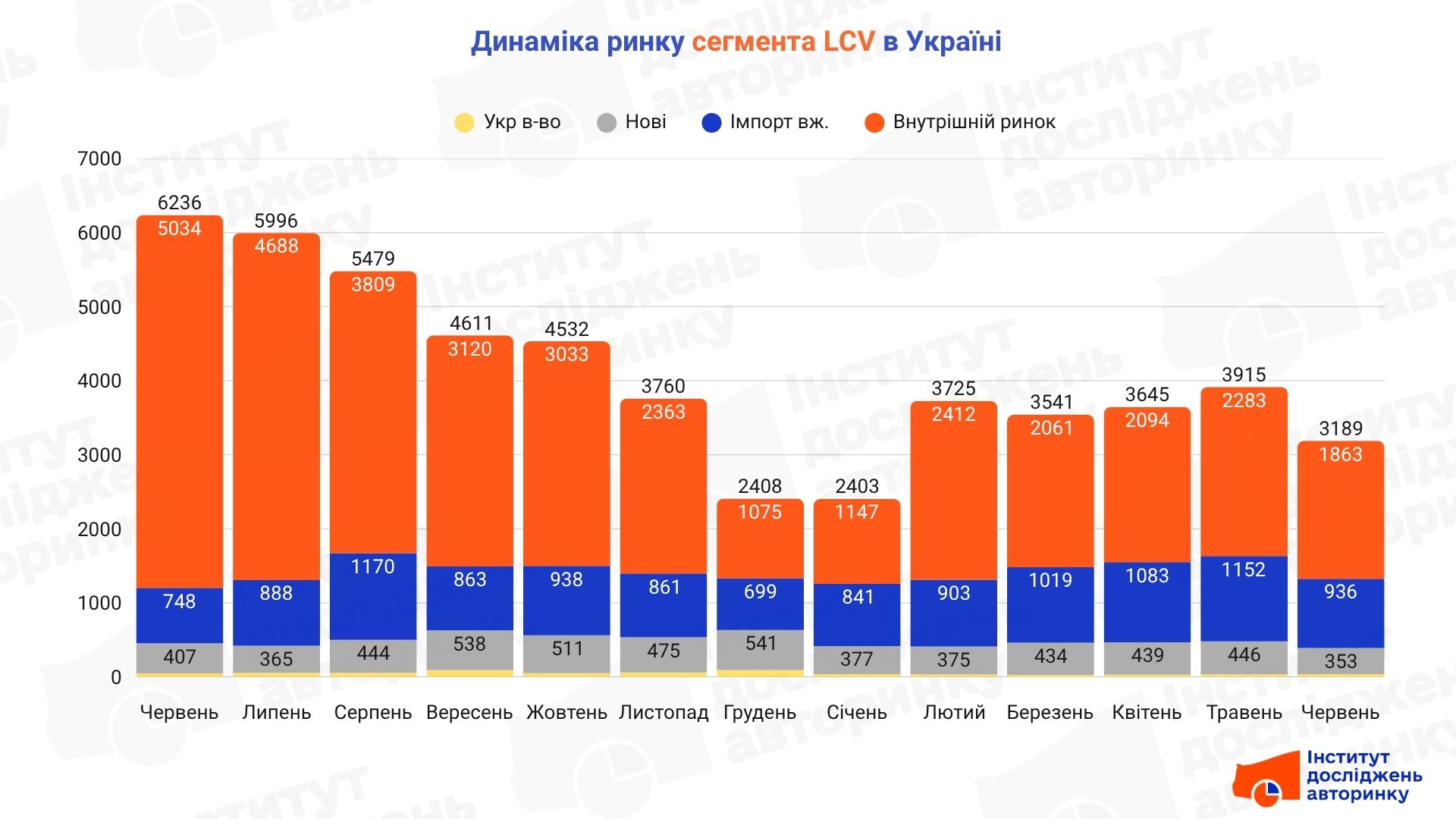

Specialists of the Institute of Car Market Research have determined the dynamics of trading in this segment, as well as the most popular types and models for each of the groups. Letʼs start with the total trading volumes. During June 2025, a total of 3.2 thousand cars of the LCV group were purchased. Compared to June 2024, this is a significant 48.9% less. Compared to May of this year, there is also a decrease in volumes, by 18.5%. When it seemed that the practically possible lowest trading rhythm in the LCV segment, which would be stable, had been achieved, the volumes fell again.

Here are the dynamics by subsegments of the LCV market:

- Domestic resales: −18.4% MM, −63.0% YY

- Used imports: −18.8% MM, +25.1% YY

- New imports: −20.9% MM, −13.3% YY

- Made in Ukraine: +8.8% MM, −21.3% YY

The segment structure is as follows: the largest share, 58.4% — in domestic resales; 29.4% were imported used light trucks, 11.1% — new imported, 1.2% — produced or re-equipped in Ukraine. The total share of new cars — 12.2%. Based on the share of each of the subsegments, we will consider them in more detail in the same order.

LCV — domestic market

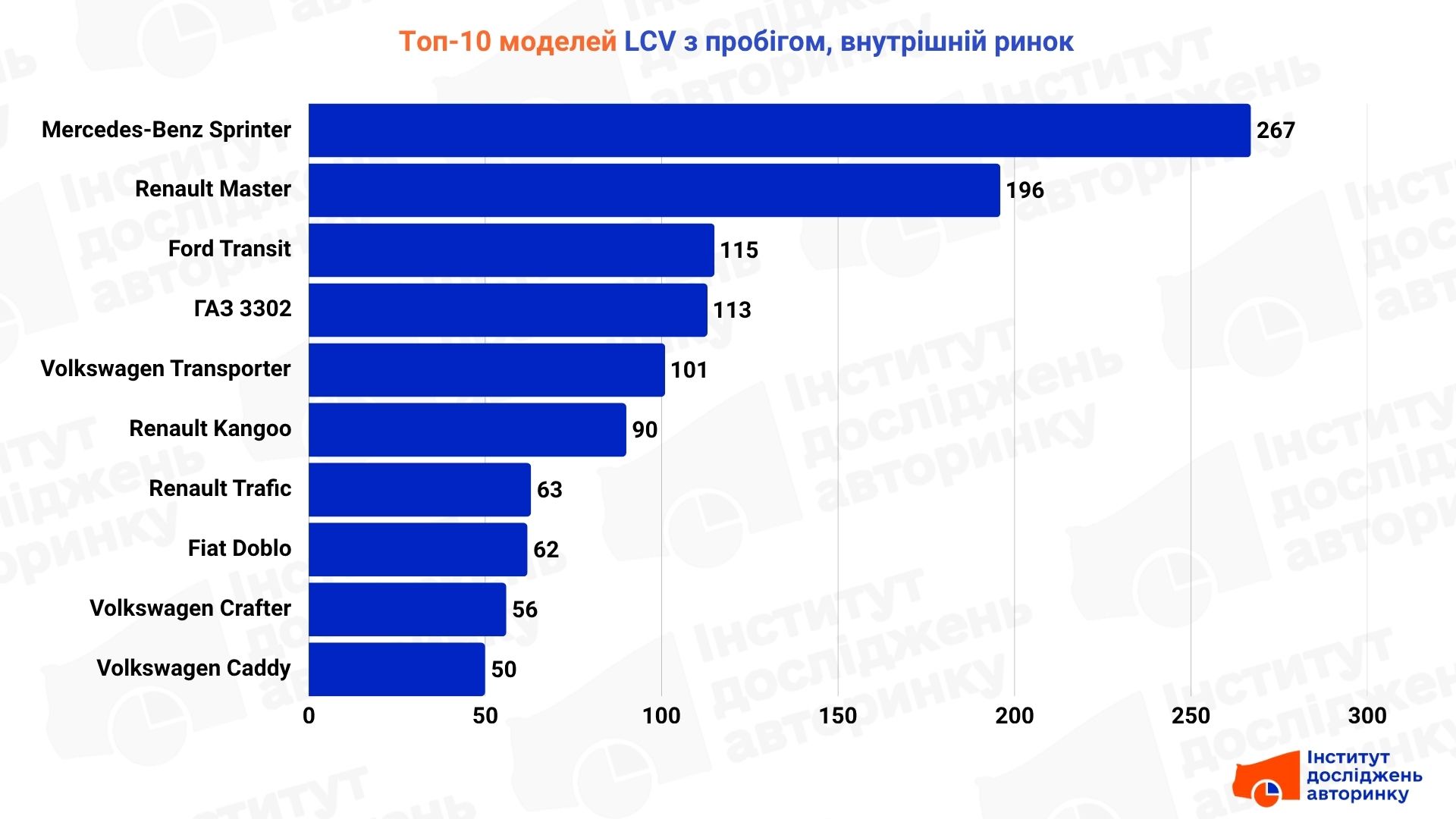

In this part, cargo vans, which form the basis of the segment, were the most popular. Cargo-passenger versions and pickups were purchased less frequently.

In the domestic market, the leadership is steadily held by the Mercedes-Benz Sprinter — a universal "workhorse" that is respected in all circles of carriers. It is closely followed by the Renault Master, which in recent years has become a favorite of small businesses due to its good balance of price and volume. The Ford Transit and the GAZ 3302 (Gazelle) also maintain their positions — the first as a time-tested van, the second as a legacy of a bygone era that is still actively "running" around the regions.

Popular and more compact models: Renault Kangoo, Fiat Doblo, Volkswagen Caddy — convenient in the city, economical and often used in service or courier services. And Transporter, Trafic and Crafter remain favorites among those looking for something more, but not yet a truck.

LCV — used import

In June 2025, our fleet was replenished with 936 LCV family vehicles. Similar to the previous subsegment, here buyers most often chose "fitted" cargo vans, somewhat less often refrigerated vans and flatbed versions.

The market for imported used LCVs maintains a familiar pattern: the Renault Master and Mercedes-Benz Sprinter go almost toe-to-toe, remaining the main "workhorses" for business. Behind them are the Trafic, Crafter, Kangoo and others, less spacious but convenient for urban and regional transportation.

LCV — new sales

In April 2025, 390 new light trucks entered Ukrainian roads for the first time. Of these, 353 were imported, 37 were registered as manufactured (or converted in factory conditions) in Ukraine.

Despite the overall dominance of imports, the segment of new light commercial vehicles also shows stable demand. The leader is the Toyota Hilux, a pickup truck that is increasingly chosen as a versatile tool for business and agriculture. In second place is the Renault Express, a compact and economical option for urban deliveries.

The top ten also includes Fiat Ducato, Volkswagen Crafter, Peugeot Partner, Citroën Berlingo and other familiar players. This cross-section well illustrates the diversification of demand — from classic vans to pickup trucks capable of operating both in the city and off-road.

The average age in the secondary market as of June for LCVs was 16.2 years for domestic resales, and 6 years for "freshly driven" cars.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.