Experts of the Auto Market Research Institute analyzed the statistics of registration actions with used passenger cars in 2023, and determined the most popular brands and models among those imported and sold domestically, as well as the distribution of the market by fuel and average age for each group.

In 2023, the total volume of the secondary market of passenger cars amounted to 1,177 thousand. units, which is 5.5% more compared to 2022. The difference in monthly total volumes last year was smaller, there was no "wave" in February-April, which was recorded in 2022 in connection with the beginning of a full-scale Russian attack on Ukraine. Then, in the first days of the introduction of martial law, firstly, citizens did not want to buy cars (at least with official re-registration), and secondly, the service centers of the Ministry of Internal Affairs stopped working. After the resumption of their work, there was a noticeable increase in the number of sales agreements and first registrations, which were postponed due to the circumstances just mentioned.

In the domestic market, 955,600 purchase and sale agreements were concluded in 2023, which is significantly more, by 34.3%, than in 2022, which ended with a total of 711,200 resales within the country.

Last year , 220,900 first registrations of passenger cars with mileage were recorded, which is almost twice less ( by 45.3% ) than in 2022, when 403,900 cars were imported. This is because in May-July 2022, the Ukrainian authorities introduced benefits for the import of motor vehicles, the so-called "zero customs clearance", which gave this significant boost to the import segment.

No legislative or other changes to import regulations were introduced this year, so the overall market picture looks much more equal in terms of proportion and total quantity than the year before.

It is worth noting that during the past year there was a gradual increase in interest in imported cars: their share in January-2023 was 16.3%, in December it was already 23.6%. The average value for the year is 18.8%. At the same time, the demand for "freshly driven" cars was not completely satisfied — the need for imported used cars is at least twice as large as the current indicators, but the development of this segment is restrained by the war, restrictions on traveling abroad for men, in certain periods — the blocking of border checkpoints so so-called "activists", who first called themselves "carriers", then, having changed "trucks" to tractors, "agrarians".

- You can order a turnkey car from Europe at West Auto Hub, a reliable partner of IDA

The average age of the active part of the market, i.e. cars that were sold and bought in 2023, was 15.7 years in the domestic market, and 11.1 years for cars that were first registered in Ukraine after customs clearance.

The domestic market is the most popular manufacturers

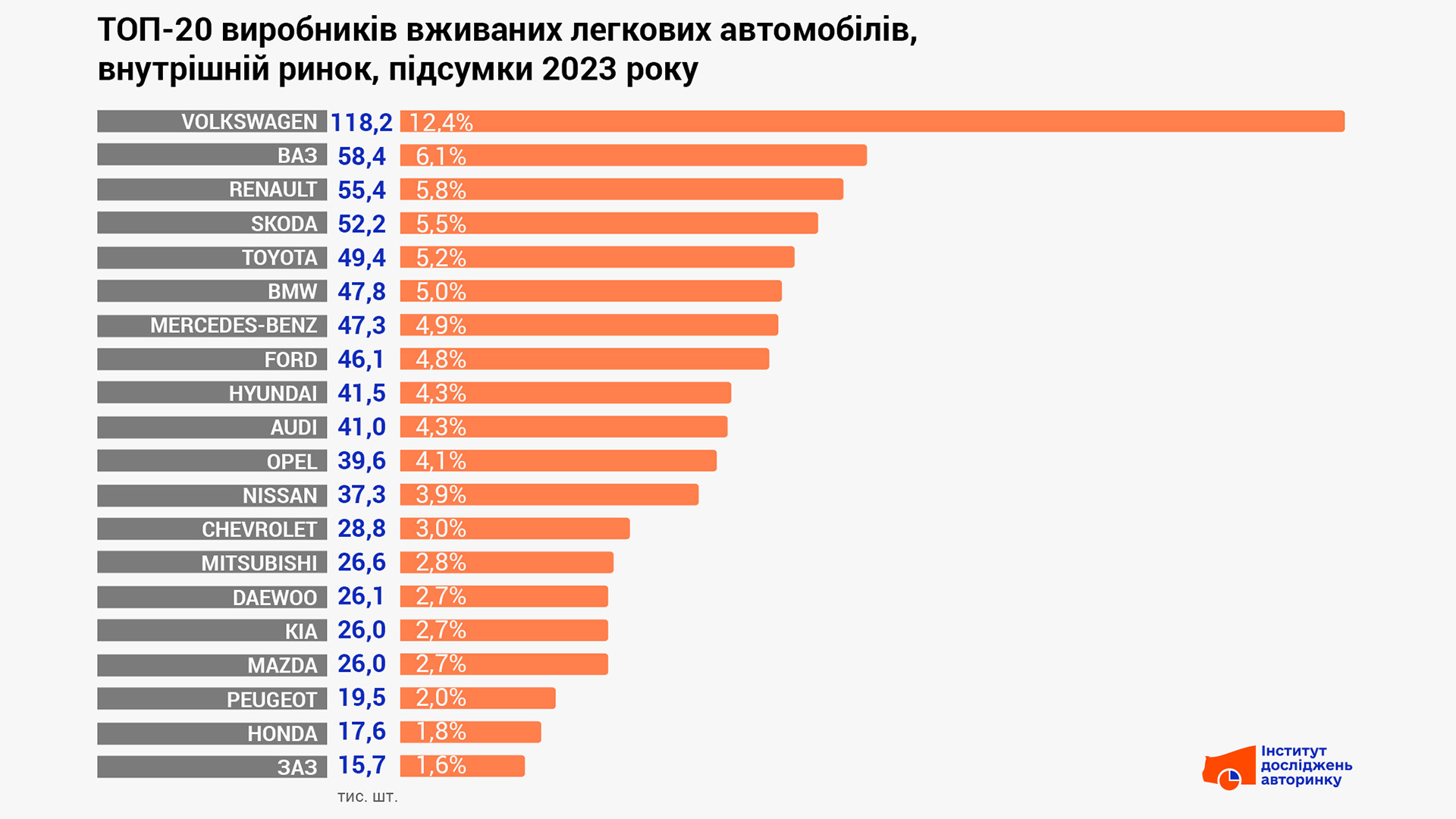

For several years in a row, the leadership in domestic resales belongs to the German brand Volkswagen, the share of which cars according to the results of 2023 amounted to 12.4% — twice as much as the brand that took second place, VAZ, and which for several decades had a de facto monopoly position in Ukraine and and a number of countries occupied by Russia in the format of the "Soviet Union". Gradually, these morally and physically outdated vehicles are being phased out, Ukrainian buyers prefer cars from well-known global manufacturers — because a number of important factors, such as safety, reliability, comfort, prestige of the car, economy, dynamic characteristics, etc., cannot be erased from the perspective of buyers only low price

Therefore, the list of the most popular brands is followed by Renault with a share of 5.8%, Skoda (5.5%), and Toyota with 5.2%, which rounds out the top five.

- Volkswagen — 118,200 units.

- VAZ — 58,400 units.

- Renault — 55,400 units.

- Škoda — 52,200 units.

- Toyota — 49,400 units.

- BMW — 47,800 units.

- Mercedes-Benz — 47,300 units.

- Ford — 46,100 units.

- Hyundai — 41,500 units.

- Audi — 41,000 units.

- Opel — 39,600 units.

- Nissan — 37,300 units.

- Chevrolet — 28,800 units.

- Mitsubishi — 26,600 units.

- Daewoo — 26,100 units.

- KIA — 26,000 units.

- Mazda — 26,000 units.

- Peugeot — 19,500 units.

- Honda — 17,600 units.

- ZAZ — 15.7 thousand pcs.

Domestic market — the most popular models

In the Top-20 models, the long-time leader of the Ukrainian secondary market, Volkswagen Passat, did not give up its first place to anyone, followed by Daewoo Lanos (including derivative models), which at one time in "greenhouse conditions" and once again in quotation marks "almost" shows signs of life several private businesses voluntarily" (i.e., without alternative) saturated the market, presenting their work as the activity of a "national producer".

Very close in terms of the number of cars bought in third place is the Skoda Octavia, a model that really successfully combines price and capabilities, followed by the Volkswagen Golf, which also has something to brag about when it comes to world sales records. Rounding out the top five in the rating of secondary market models of the 2023 model year is the Renault Megane.

- Volkswagen Passat — 34,500 units.

- Daewoo Lanos — 31,800 units.

- Skoda Octavia — 29,600 units.

- Volkswagen Golf — 27,100 units.

- Renault Megane — 17,000 units.

- Ford Focus — 14,600 units.

- BMW 5 Series — 13,500 units.

- Skoda Fabia — 13,000 units.

- Chevrolet Aveo — 12,700 units.

- Opel Astra — 12,600 units.

- BMW 3 Series — 12,500 units.

- Toyota Camry — 12,200 units.

- Audi A6 — 11.8 thousand units.

- Mercedes-Benz E-Class — 11,000 units.

- Audi A4 — 10,400 units.

- BMW X5 — 9.3 thousand units.

- Renault Scenic — 8,900 units.

- Volkswagen Jetta — 8,600 units.

- Volkswagen Transporter — 8,400 units.

- Mitsubishi Lancer — 8,400 units.

According to the type of power plant, gasoline passenger cars dominated the domestic market in 2023, the share of which was 43.2%. The second most popular are diesel with 30.2% of the market. Despite the temporary increase in the price of liquefied gas, which occurred in the second half of 2023, cars with gas cylinder equipment (HBO), which were bought by 23.1%, did not lose their attractiveness in the eyes of buyers. Electric cars got 1.7% of the market, passenger cars with hybrid power plants — 1.3%, another 0.4% was occupied by cars whose engines run only on a gas mixture.

Imports are the most popular manufacturers

Volkswagen, like in the domestic market, ranks first in the ranking of cars that were first registered in Ukraine after customs clearance in 2023. The share of cars with the "VW" logo was almost 19%. With a double quantitative difference in second place is Renault, whose cars covered 10% of the import segment. Skoda is in third place with a share of 7.2%, followed by Nissan (7.1%) with a slight lag. Rounding out the top five is Audi, a manufacturer of the "premium" group, with a share of 15.4%.

- Volkswagen — 41,700 units.

- Renault — 22,000 units.

- Škoda — 16,000 units.

- Nissan — 15,800 units.

- Audi — 15,400 units.

- Ford — 13.7 thousand units.

- BMW — 9,600 units.

- Opel — 8,600 units.

- Tesla — 7,600 units.

- Hyundai — 7 thousand pcs.

- Mazda — 5,700 units.

- Mercedes-Benz — 5,300 units.

- KIA — 4.9 thousand units.

- Jeep — 4,800 pcs.

- Peugeot — 4,600 units.

- Toyota — 4,500 units.

- Honda — 4,100 units.

- Volvo — 4 thousand pcs.

- Dacia — 3.5 thousand units.

- Mitsubishi — 3,300 units.

Imports are the most popular models

According to the results of 2023, in the import segment, the championship was won by the Volkswagen Golf, whose success was facilitated by the presence of the electric version of the e-Golf, included in the total number, since it is not a separate model, but only a version of the power plant, in fact, in the same body with the name, to which one was added letter However, even without taking into account electric cars, of which 3.3 thousand were imported, "Golf" would somehow become the winner of this rating.

- "Freshly driven" cars from Europe are available in Ukraine from West Auto Hub

Also, among the "freshly driven" last year, there was a high demand for Skoda Octavia, Renault Megane, Volkswagen Passat and Renault Scenic minivan, the number of which is indicated for the basic version, excluding the extended Grand.

In the list of models that replenished the Ukrainian car fleet last year, in addition to the mentioned VW e-Golf (and, in part, the Ford Focus Electric, which are also included with the "basic" model), there are several electric cars developed from the beginning: Nissan Leaf (sixth place), Tesla Model 3 (No. 12 on the list), and Model Y (No. 19).

- Volkswagen Golf — 15,000 units.

- Skoda Octavia — 10,300 units.

- Renault Megane — 8,900 units.

- Volkswagen Passat — 8,600 units.

- Renault Scenic — 6,400 units.

- Nissan Leaf — 5,200 units.

- Volkswagen Touran — 4,200 units.

- Volkswagen Tiguan — 4,100 units.

- Ford Focus — 4,100 units.

- Audi A4 — 3.8 thousand units.

- Audi Q5 — 3,300 units.

- Tesla Model 3 — 3,300 units.

- Skoda Fabia — 3,300 units.

- Nissan Qashqai — 3,200 units.

- Opel Astra — 3,100 units.

- Opel Zafira — 2.8 thousand units.

- Mazda CX-5 — 2.6 thousand units.

- Nissan Rogue — 2.5 thousand units.

- Tesla Model Y — 2,200 units.

- Audi A6 — 2,200 units.

The distribution of this segment by fuel looks like this: 43.9% — cars with gasoline engines. 34.3% — diesels, heavy 13.6% — electric cars. Passenger cars with HBO were imported relatively few — 4.9%, an even smaller share of "hybrids" — 2.9%, and cars with an engine power system (exclusively with it) liquefied gas — 0.4% almost disappear.

What is the potential of importing cars to Ukraine?

To estimate the potential (so-called pent-up demand) of importing passenger cars to Ukraine, letʼs use the annual total from Poland, a country with a population similar to ours. So, 737,000 used cars were imported to Poland last year, and local analysts call this result "relatively small." We will remind that in Ukraine, the year 2023 ended for the import segment with a total of 221,000 units, which is 3.3 times less than that of our neighbors. At the same time, the average age of passenger cars imported to Poland is even higher than the figure for Ukraine: 13 years versus 11.1 years. This means that conditional average checks (cost of imported used cars) are similar. It is clear that the state of Polandʼs economy, as well as the general economic well-being of the population there, is higher than in Ukraine, and there are no active hostilities. However, even taking into account these features, the potential capacity of Ukrainian imports is at least twice as high as it is now.

Subscribe to the Telegram channel of the Auto Market Research Institute to be the first to receive information without advertising or spam.