Gasoline or electric? With which types of engines were passenger cars sold more often in Ukraine in January?

Analysts of the Institute of Car Market Research processed data provided by the aggregator Automoto.ua, which collects information from all sites containing advertisements for the sale of vehicles, and determined the overall picture by fuel/power share, as well as separately for 15 car brands that are most frequently listed in offers for sale. Only newly created advertisements without duplicates in January 2025 were taken into account.

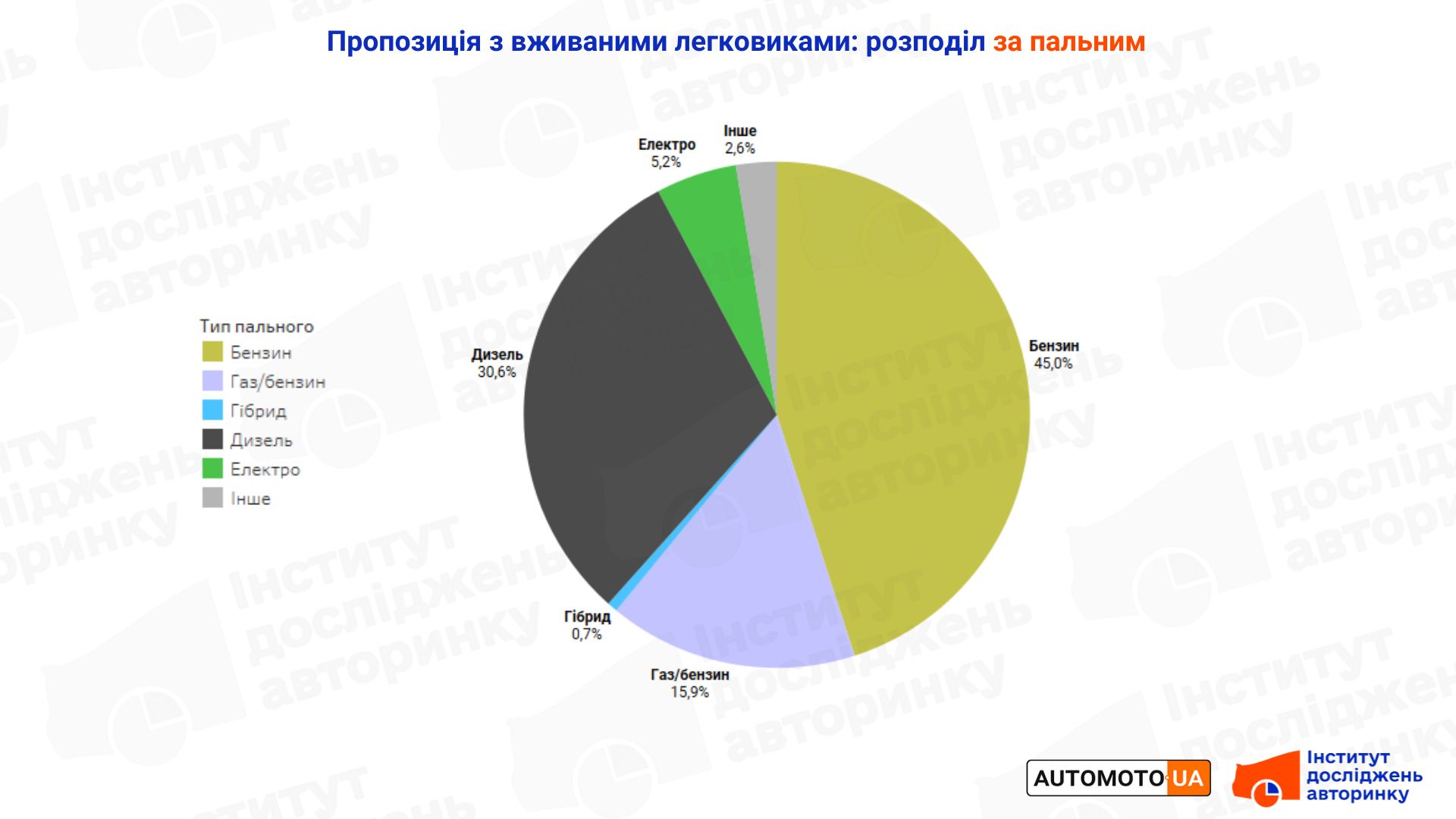

The overall picture resembles a similar one for the secondary market: gasoline versions prevail, their share among all offers is 45%. Diesel cars are the second most numerous, their number is over 30%. A separate category is dual-fuel passenger cars with gas cylinder equipment (GBO), which occupy almost 16% of the mass of ads.

There are 5.2% of offers for electric cars, which is slightly more than their share among those actually purchased, but since this segment is gradually expanding, this state of affairs can be considered quite natural at this stage. However, cars with hybrid power plants, which are quite popular in Europe, could not even reach 1% of offers for sale in Ukraine, despite all their advantages.

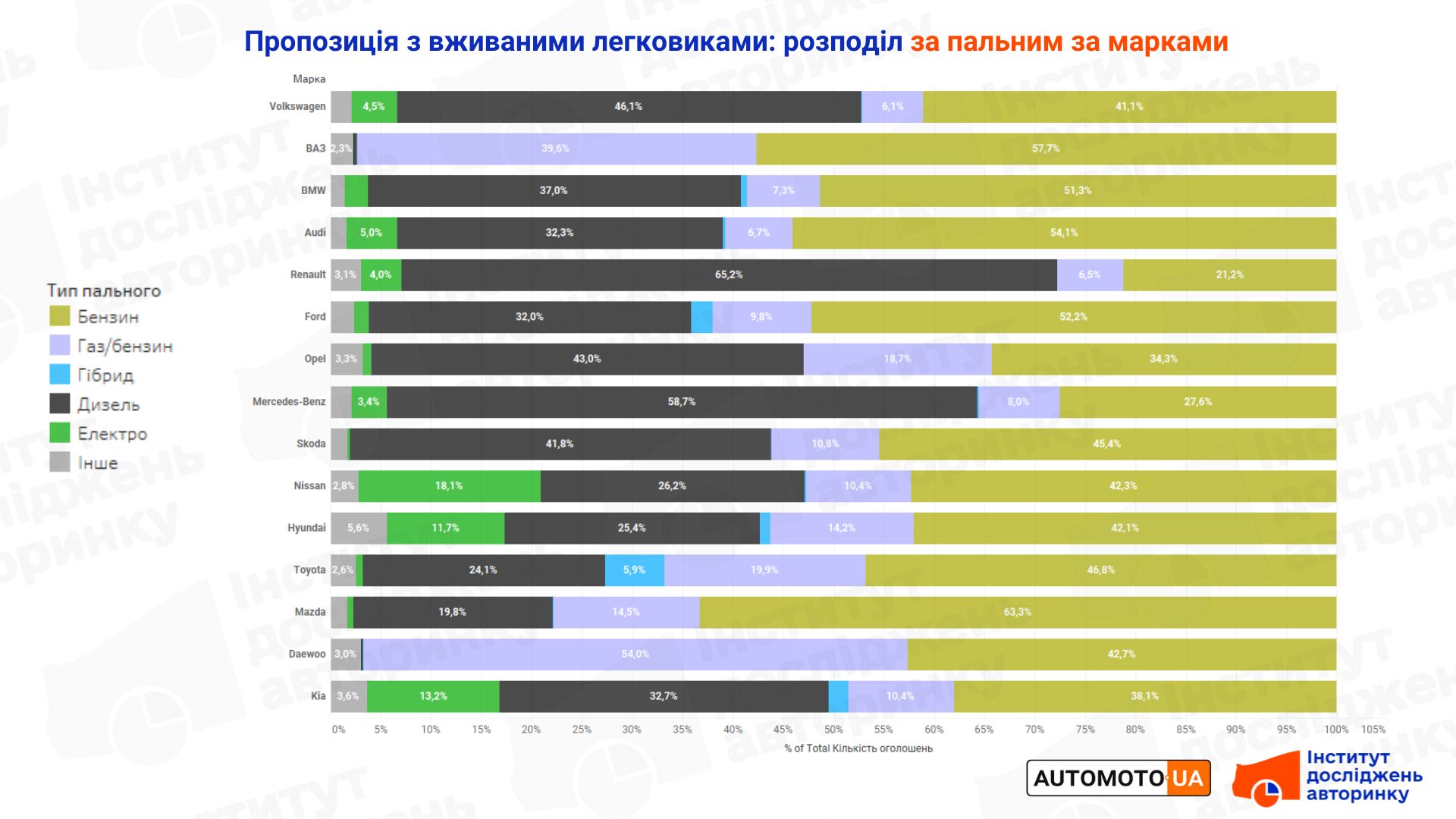

For individual brands, in particular among the 15 with the most ads, the picture is heterogeneous, which is due to the historical features of the arrival of a particular brand on our market, as well as its average age.

For example, Volkswagen offers almost equal numbers of both gasoline and diesel engines, with a few percent advantage for the latter. A small share of versions with LPG, and 4.5% electric, most of which are e-Golf hatchbacks and ID.4 crossovers.

VAZ, which is the second in terms of the number of ads, since it was not offered with diesel engines, is mainly sold with gasoline engines, and the diagram also shows a fairly significant array of versions with LPG. For such cars, converting to “gas” is almost the only way to maintain their economic feasibility. A similar picture (and also the history of their appearance on our market) is observed in Daewoo, only Korean cars have a slightly lower average age compared to VAZ products.

The largest number of diesel variants can be found in the Renault (65.2%) and Mercedes-Benz (58.7%) ad sections. In general, if you “take out” Soviet and Korean-Ukrainian products, the difference in engine types will not be as contrasting as with their presence.

As for cars with hybrid drive, most of them are found among Toyota and Ford, less often (but more often than others) "hybrids" are found on cars from Hyundai and KIA.

The green sector, which is marked by electric cars, is the largest in Nissan — 18.1%. It is clear that this is due to the popularity of the Leaf hatchback, which occupies almost a quarter of the entire fleet of BEV cars in Ukraine. There are also many "electric cars" offered under the KIA (13.2%) and Hyundai (11.7% of ads).

The presence of the "other" sector is explained by incorrectly specified or missing information from sellers about the type of power plant in the car.

- Subscribe to the Telegram channel of the Auto Market Research Institute to receive information first, without advertising and spam.