This is the second part of the car market study, dedicated to motor vehicle imports from China, which will cover new cars and motorcycles. The IDA specialists reviewed the used car market earlier — the results of the study are available at this link .

The main task of both studies is to demonstrate the actual volume of the market and the place (share) of Chinese products in it, so that all market participants have reference data that will allow to fully understand the state of affairs with imports from China, without generalized evaluative judgments and guesswork.

So — new vehicles made in China. They are produced and selected according to the relevant WMI (World Manufacturer Identifier) index, without distribution to local car factories and licensed (joint) enterprises. Therefore, in the lists or on the diagrams, you will be able to find the names of famous European, American or Japanese manufacturers, which will stand next to local Chinese brands.

In order to make it easier to compare both segments (new and used vehicles), the structure of the studies will be similar, as well as the diagrams used in them.

Letʼs start by looking for an answer to the question " how many and what kind of new vehicles arrived this year (in 7 months) to Ukraine from China"?

In contrast to the segment of used vehicles, motorcycles have a quantitative advantage among new ones, and it is very noticeable. A total of 16,600 two-wheelers arrived in 7 months of 2024, 6,400 passenger cars. Compared to the two just mentioned, the other segments have an extremely small share (and quantitative presence) to talk about them separately.

Considering the fact that the segment of motorcycles was recently studied by us, you can familiarize yourself with the rating of new "bikes" by clicking on this link.

And when all the main things have been said about motorcycles, it remains to stop at the passenger car segment, which we will do now .

What is the share of new Chinese-made passenger cars in the total volume of imports?

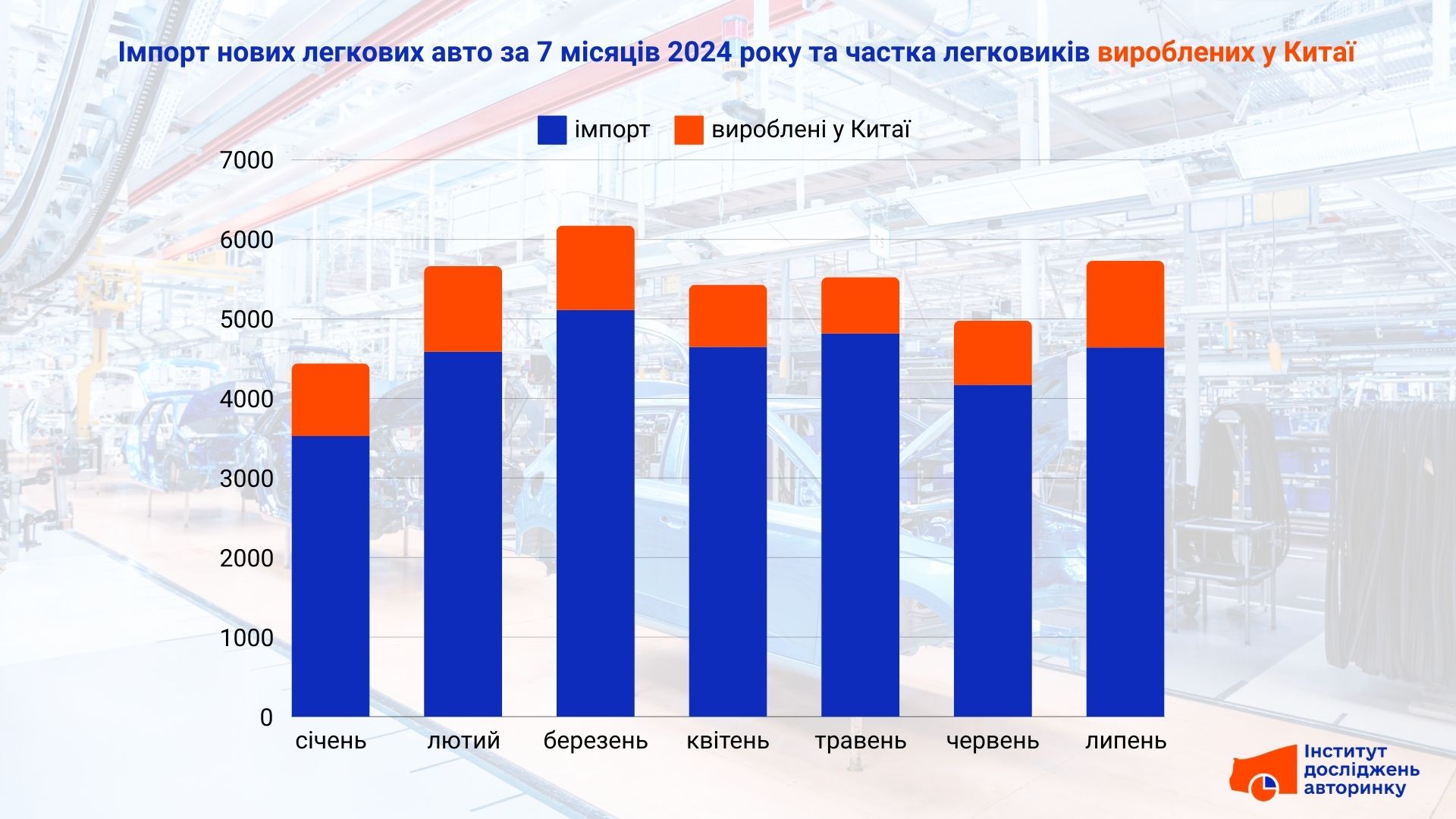

We will remind that for used cars, the share of Chinese products was from 1% to 3% of the total volume of passenger car imports. Which in quantitative terms was from two to five hundred a month. In the new segment, the numbers are completely different: the share is (depending on the month) from 13% to 21%, or from 707 to 1,088 cars submitted for first registration within one calendar month. Much more than in the secondary market.

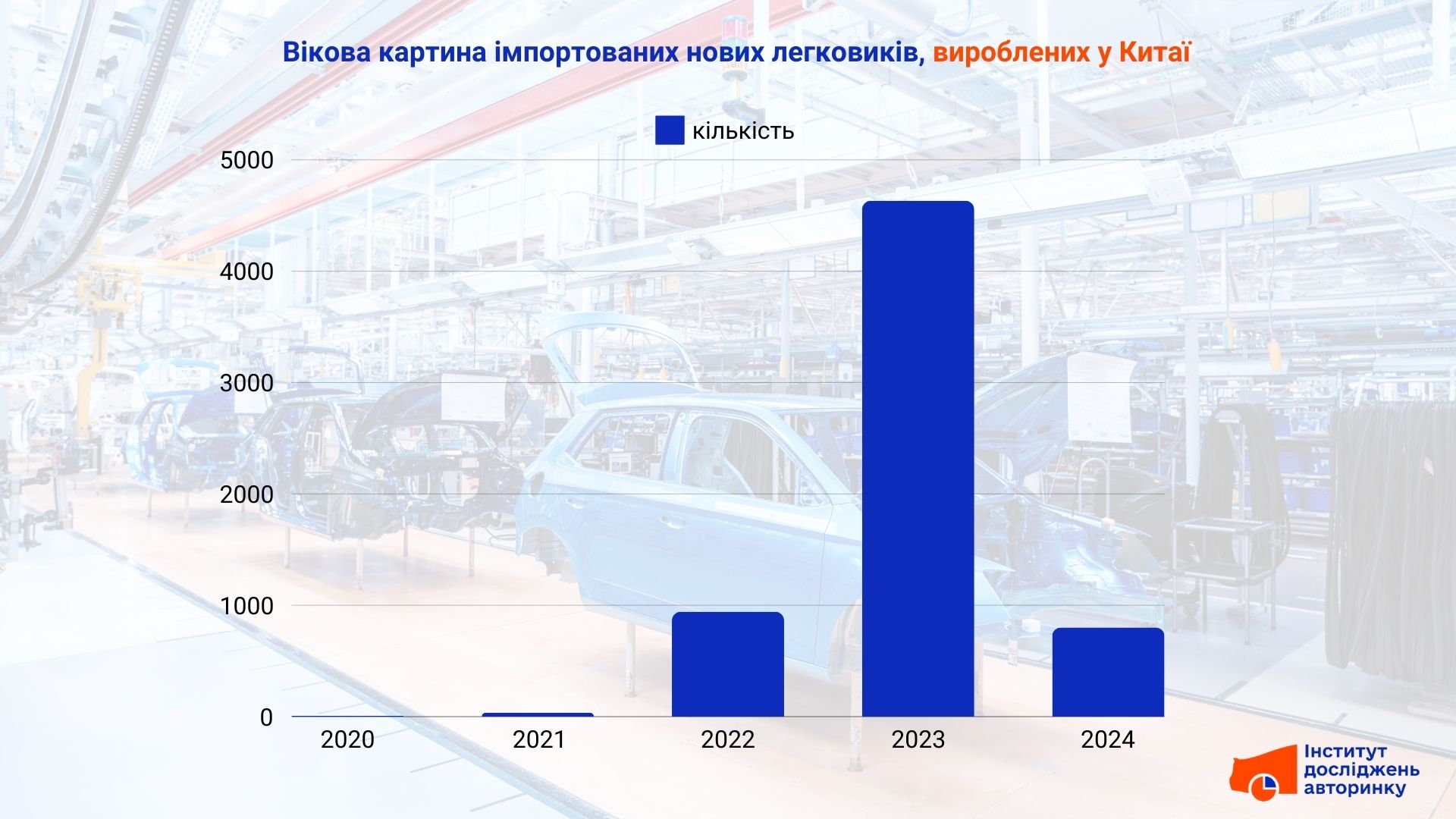

For used cars, we determined the age pattern — there the largest number of cars had the year of production in 2023, in general, the base of the "enforcement" is in the range from 2021 to 2023. Considering the considerable distance to China and the long time required to deliver cars from there, it is worth examining the age picture for new cars that were first registered in this status for the first time in 7 months of the current year.

As a result, we get a picture very similar to the segment of used cars: the quantitative maximum has the year of production in 2023, and the presence of cars of 2024 and 2022 years of production is noticeably smaller.

This leads to a conclusion that should rather be addressed to a preliminary study: in the status of used, independent dealers import, letʼs call them, "almost new" cars. That is, in the end, if we were to consider both segments together, we would actually be talking about the same market sector, with a similar set of brands and models. However, without dividing these segments (which is exactly how it is established in research), we would not have received the basis for making the conclusion just voiced.

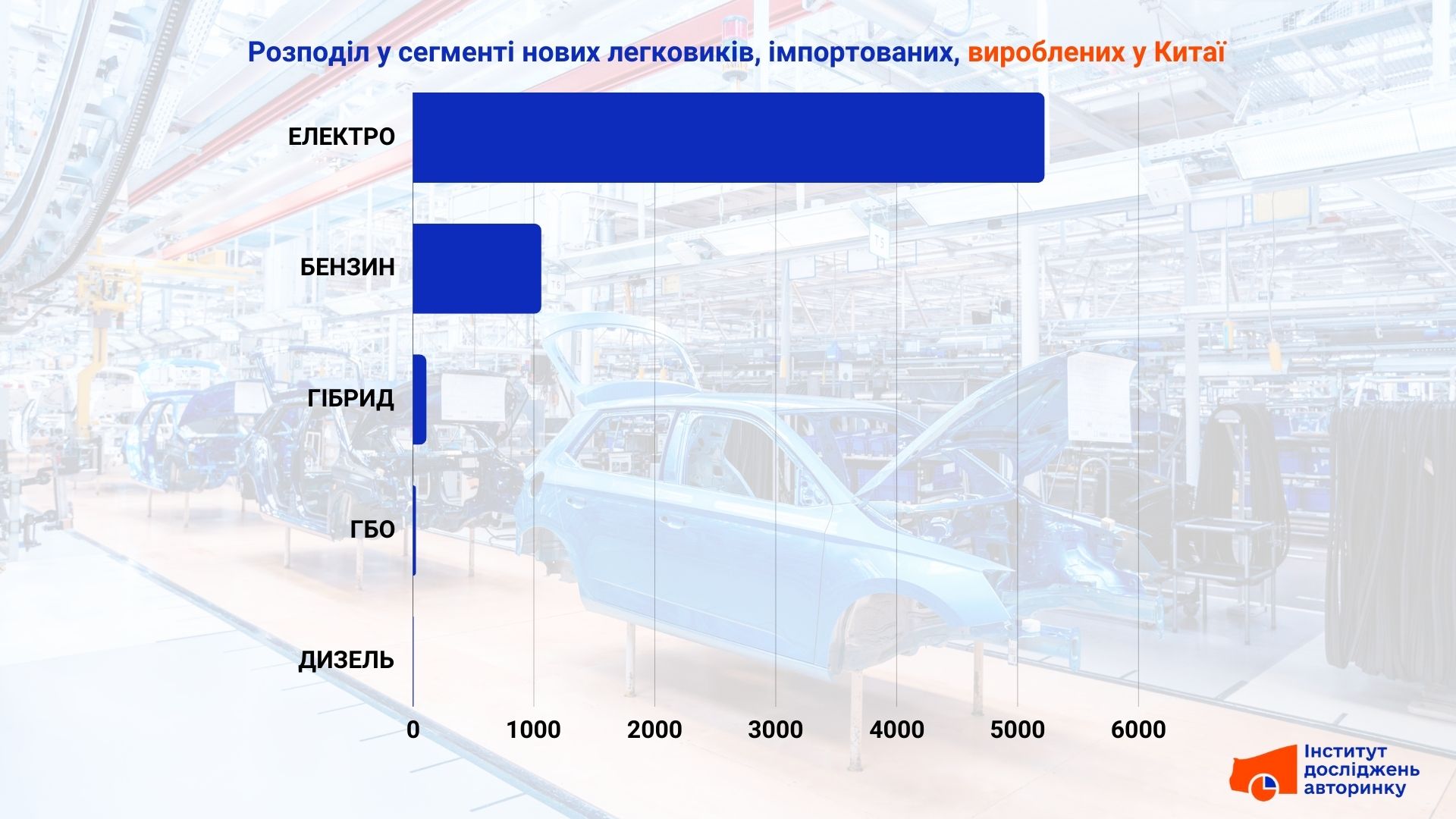

The next step is to consider whether there are differences between "almost new" and new cars in terms of distribution by fuel, as well as whether there are many electric cars, which is what the Chinese car industry is especially famous for.

Among the new passenger cars with the Made in China label, electric cars dominate in both segments. Gasoline versions are also arriving — but they are significantly fewer than battery-powered cars.

Next, we will determine which brands of new cars produced in China were most often submitted for first registration in the mentioned period.

Similar to the same list of used cars (more precisely, which mostly have this status legally, in fact "almost new" cars), Volkswagen, Honda and Nissan are at the top of the rating, with the local BYD sandwiched between them. In general, of the twenty brands listed on the slide, only ten belong to local Chinese businesses, the others have long been known to the world automotive community.

After twenty of the most popular brands, we will move on to the same number of new models with the greatest demand in Ukraine.

The article about the segment of used Chinese cars began with a mention of the Baader-Meinhof effect, or the illusion of frequency. That is, when one gets the impression that (in our case) it seems as if there are more and more "Chinese" on the roads, especially electric ones, and this impression becomes stronger almost every day. And what do the numbers say about this? Taking into account the fleet of electric cars, which recently crossed the mark of 100,000 units, and taking into account the share of Chinese-made cars in it, which is no more than 15%, and even taking into account the products that are already sold in our country with the logos of well-known global manufacturers, in fact, there are still too few electric cars from China to claim that "they will soon fill all the roads and parking lots."

Rather, we are dealing with the fact that among the models that a Ukrainian is used to, something new (sometimes unknown), seen for the first time, arouses much more interest than, say, twenty Renault "Megans" that passed by. That is why there is a desire to learn more about these cars, about their capabilities, the technological innovations used, and, of course, the price. As for prices, they are usually about the same as for cars from other, non-Chinese manufacturers. Availability is now not their main advantage. What if we touch on the segment of electric cars separately — but this is a topic for a separate conversation, for which we are already preparing excerpts and creating slides. So, to find out what is profitable to buy now, use the advice below.

Subscribe to the IDA Telegram channel to be among the first to know about the release of the next review!