Today, the Verkhovna Rada will consider bills on preferential customs clearance of "Eurobills" № 4643-d and № 4644-d. Experts of the Institute of Car Market Research discussed the features of the new rules live. Be the first to know who will be able to take advantage of the benefits, how the law will work in practice and how much it will cost to clear customs "Europlates". We present the main theses of the discussion.

Обговорення проєктів законів №4643-д та №4644-д щодо пільгового розмитнення так званих “євроблях”Проєкти законів №4643-д та №4644-д щодо пільгового розмитнення так званих “євроблях” мають всі шанси стати законами. Профільний комітет Верховної Ради рекомендував їх до прийняття в цілому.Про це і не тільки говоритимуть експерти Інституту досліджень автомобільного ринку під час ZOOM-дискусії у четвер, 15 квітня.

Posted by Інститут досліджень авторинку on Thursday, April 15, 2021

To begin with, it should be noted that "Europlates" are cars with foreign registration, temporarily imported into Ukraine without payment of customs duties and subsequent registration. Used cars from Europe or America, officially imported and cleared through customs, are not "Eurocars". The bills currently on the agenda apply only to "Eurobills" and not to all used cars from abroad.

CONDITIONS OF APPLICATION OF NEW RULES

1. Applies exclusively to previously imported "Eurobills", which as of 31.12.2020 were on the territory of Ukraine in transit or temporary importation

Cars that were abroad or were imported later on this date are not eligible for preferential terms.

2. Only for cars and trucks with a gross weight of up to 3.5 tons

Which correspond to the UKT FEA codes 8703 and 8704. It will be impossible to clear other categories of cars at customs at reduced rates.

3. One car per person

During the law, on preferential terms, one person will be able to clear customs only one car "Euro" and one truck with foreign registration weighing up to 3.5 tons.

4. The minimum environmental standard — "Euro-2" for cars and "Euro-5" for trucks

In practice, this means the possibility of customs clearance of passenger cars "Europlates" from 1996 and 2009 — trucks weighing up to 3.5 tons.

6. Only cars over 5 years old

We are talking about "Eurobonds", more than 5 years have passed since the year of issue. Practically — from 1996 to 2015 of the calendar year of production inclusive for cars and from 2009 to 2015 for trucks weighing up to 3.5 tons.

7. Entry into force — one month after the publication of the law

The new rules will take effect a month after entry into force, ie publication in an official publication. During this time, you can prepare the necessary documents, deregister the car abroad and get certified.

8. Only 150 days for "preferential" customs clearance

The wording of the bills, approved at a meeting of the profile committee before adoption as a whole, provides for benefits for "Eurobills" for 180 days from the date of entry into force. However, the law comes into force in a month. Therefore, in fact, there are 150 days left for "preferential" customs clearance.

9. Participants in hostilities — 90 days more

For participants in hostilities who will be on the territory of the Environmental Protection Agency for more than 90 days from the date of entry into force of the law, the rules will apply for 270 days. Taking into account the month for the law to come into force, there are actually 240 days left to clear the "Euro tank" through customs.

DOUBTS

1. You need to confirm ownership of the car

The current rules stipulate that you can clear customs only those cars that belong to you. The bills do not provide for any exceptions for "Eurobills". The document confirming the right of ownership may be, in particular, a contract of sale, invoice, invoice.

The problem is that many users of "Eurobills" do not have a connection with the legal owner of the car — a foreigner or a foreign company.

2. The car must be deregistered abroad

Another requirement of the current legislation: only those vehicles that have been deregistered in the relevant authorities of foreign countries are allowed to be cleared through customs. The bills also do not provide for any exceptions for "Eurobills".

The problem is that there is no remote deregistration: someone needs to be physically present at the registration authorities abroad. And when in the case of Poland and Lithuania the availability of a car is not mandatory, in the Czech Republic and Slovakia cars will not be removed without inspection by a local expert.

3. A large number of "problematic" documents

A significant number of "Eurobills" have problems with documents: insufficient number of them, forgeries, illegal records, etc. In order to restore these documents officially, it takes time and additional costs. In some cases, this is not possible at all.

4. High risk of fraud

There are many ads of obscure people who promise to solve all the above problems. In many cases, all "help" is the artisanal production of forged documents. Do not trust questionable services!

5. Liability for false information

Liability is provided for false information in the customs declaration and submission of forged documents. For example, there is a criminal article for a forged registration certificate. And in court it will still be necessary to prove that you are the injured party, instead of did it intentionally. Customs may be fined for a counterfeit purchase agreement.

6. You need to be certified

At the time of customs clearance it is necessary to confirm the environmental standard "Euro-2" for cars and "Euro-5" for trucks, during registration — compliance with the standards. The production of a certificate of conformity is mandatory for all those who want to clear the "Euro tank".

7. Corruption risks

There is a risk of receiving illegal benefits by customs officers and further modification of the date of entry of the car "retrospectively" for preferential customs clearance.

8. Risk of fines

The draft laws provide for exemption from liability for violations provided for by three specific articles of the Customs Code — 470, 481 and 485, in the case of payment of a "voluntary contribution" of UAH 8,500. However, the threat of a fine of 34 thousand hryvnias from customs under Article 469. Of the Customs code on the person who temporarily imported a car, and also 8500-17 000 UAH from police on 121 Art. КУпАП — remain. Nobody canceled them.

Each of these "pitfalls" will complicate the customs clearance procedure "Eurobills". Solving some problems will take more time, others — financial costs, and some will cause the inability to "legalize" their "Eurobond". This situation will reduce the number of potentially cleared "Euros".

COST OF CUSTOMS CLEARANCE IN EUROS

To begin with, it should be understood that a "voluntary" contribution of UAH 8,500 is in fact mandatory. Otherwise, a fine of 170 thousand hryvnias is threatened. Customs clearance of any "Eurobill" begins with the payment of this fee.

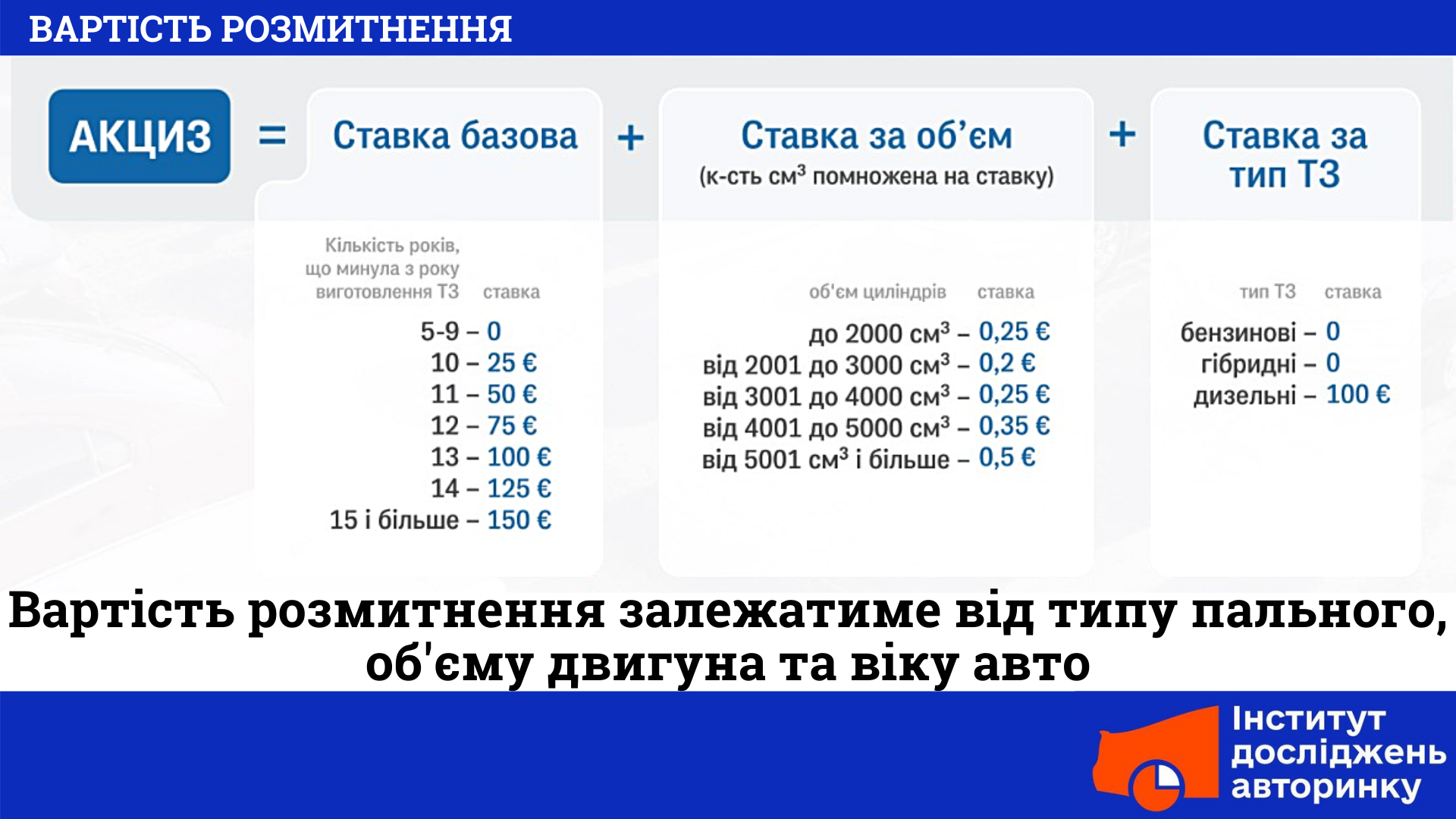

The excise duty on customs clearance of "Europlates" will depend on the type of fuel, engine capacity and age of the car. The duty will be zero. 20% VAT will be charged not on the customs value, but on the excise tax.

We must not forget that during the first state registration in the Service Center of the Ministry of Internal Affairs you need to pay an additional fee to the Pension Fund: from 3% to 5% of the customs value of the car.

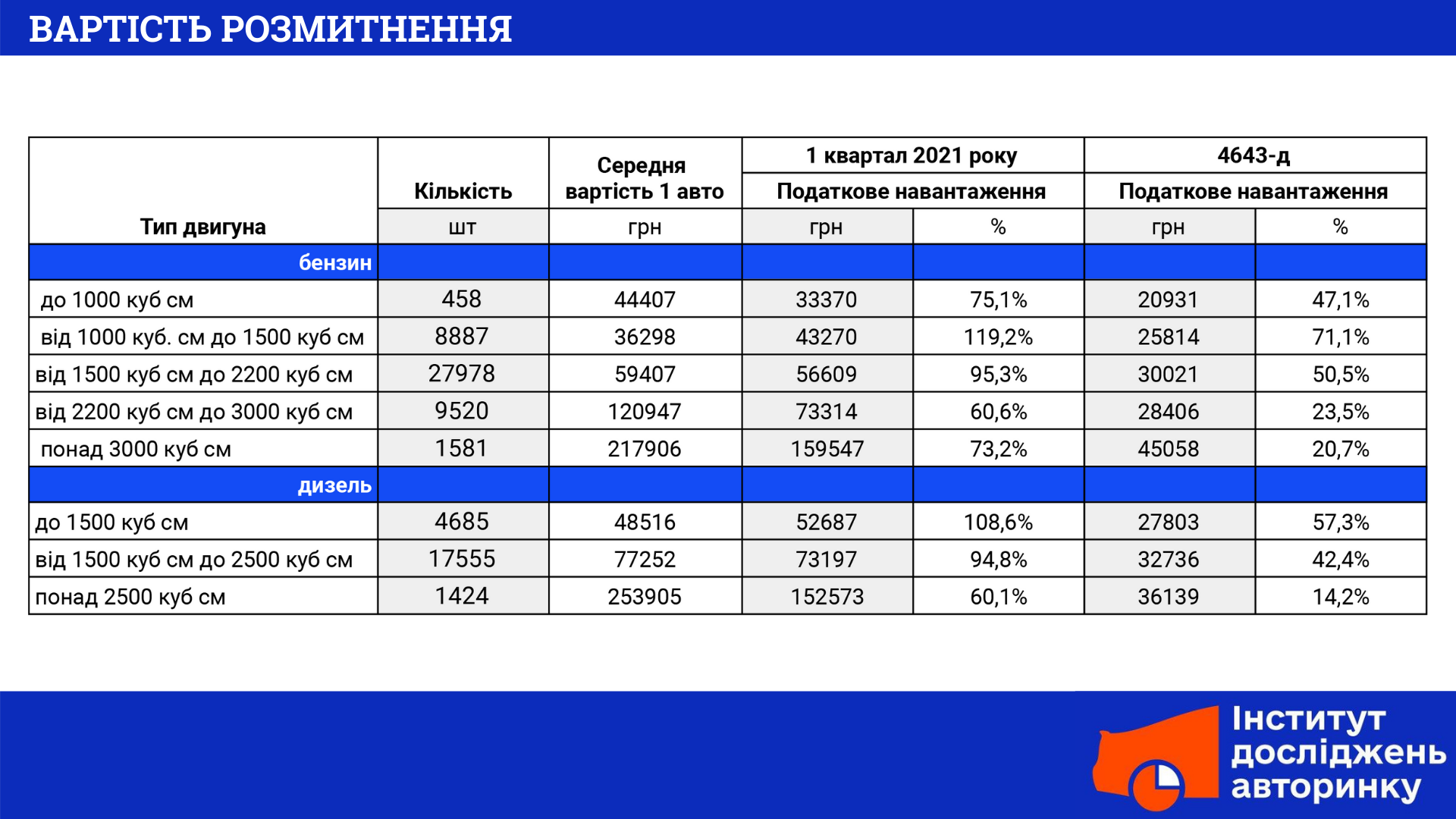

Experts from the Institute of Car Market Research have calculated how much customs clearance on Euros will cost on average compared to car customs clearance for all other Ukrainians on general terms.

From the table you can see that customs clearance will really decrease. However, the reduction will apply only to previously imported "Eurobills". Ukrainians who want to buy a car from abroad will have to pay for customs clearance on general terms. By the way, it will be most profitable to clear customs "Europlates" with a large engine capacity. The cost of customs clearance of such cars will be reduced several times.

And now — real examples: a comparison of the cost of customs clearance of the most popular cars from abroad in the first quarter of 2021 on a general basis, and at reduced rates for previously imported "Euros".

GASOLINE CARS

1. Toyota Aygo

2. Skoda Fabia

3. Skoda Octavia

4. Jeep Cherokee

5. Cadillac Escalade

DIESEL CARS

1. Renault Megane

2. Volkswagen Passat

3. Volkswagen Touareg

4. Land Rover Range Rover

Also do not forget about other potential associated costs — customs brokerage services, entrance fees to the customs terminal, car certification, registration.

Even if preferential customs clearance of a car with a foreign registration seems too expensive, the car can be taken abroad by paying UAH 8,500 in a "voluntary" fee. In this case, there will be no fine of 170 thousand UAH for the non-exported "Europlate". However, the car must be taken out by the person who imported the car. This rule is most relevant for those who once imported a car in transit in person, but to clear the car does not make economic sense.

CONCLUSIONS

Official payments for car customs clearance will indeed decrease. However — only for a certain group of people who previously imported "Europlates". Everyone else will pay for customs clearance of the car in full.

The number of cleared "Eurobills" on preferential terms will be small. This will be affected by a significant number of restrictions in the bills themselves, as well as problems with documents, corruption risks and the threat of being fined. Experts from the Institute of Car Market Research predict that a relatively small number of cars with foreign registration will take advantage of the preferential terms.

The impact on the car market from such a decision will be minimal, but it can be considered the final end of the era of "Eurobills" in Ukraine. At the end of the period of "legalization", the authorities promise to apply sanctions for the use of cars with foreign registration in full.

" Eurobonds " are only a consequence of deeper problems and an indicator of the need for change, not the root cause. It is necessary to comprehensively form a civilized car market, and not be satisfied with point and temporary solutions. Changes are needed not only in the passenger car segment, but also in trucks and buses. However, any change must affect everyone and act on an ongoing basis.